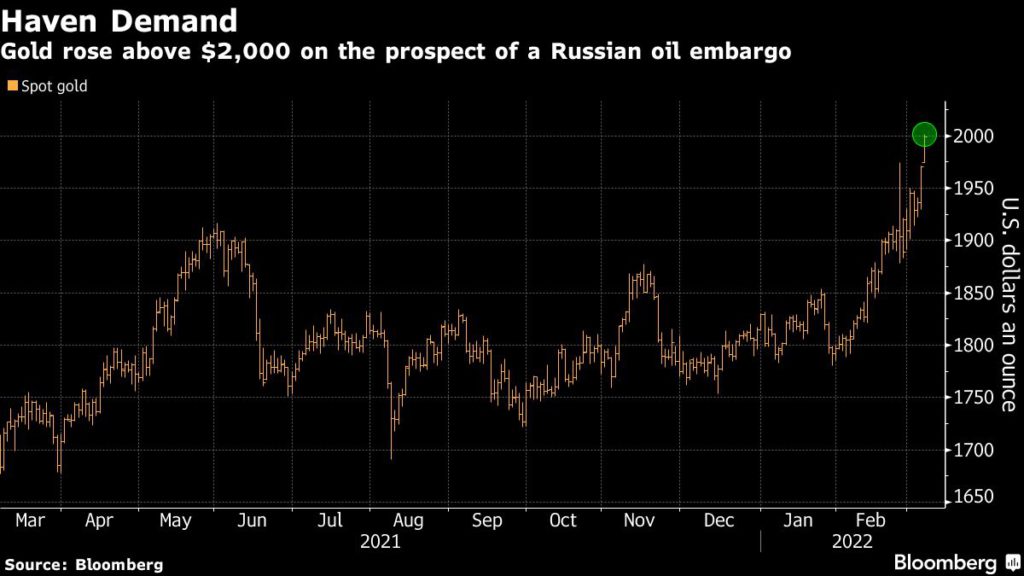

Gold extended its biggest weekly advance since July 2020 amid reports of the US and its allies contemplating an embargo of Russian oil, raising concerns about higher inflation and slowing economic growth.

Spot gold was up 0.3% by noon ET, trading at $1,982.16 an ounce after surpassing the $2,000 level for the first time in 18 months. US gold futures gained 0.8% to $1,982.60 an ounce.

[Click here for an interactive chart of gold prices]

Meanwhile, benchmark real Treasury yields have fallen deeper into negative territory in recent weeks, as expectations for higher inflation and lower growth are priced in, making non-interest bearing gold more attractive.

The precious metal has rallied even as the dollar rose to the highest since July 2020, a sign of its investment appeal as a haven.

Any escalation of the war “could push the world economy toward a stagflation scenario, which we see as very bullish for gold,” Carsten Menke, head of next generation research at Julius Baer Group, wrote in a Bloomberg note.

“Investors who see the potential for worsening could seek some protection in gold, but need to be aware that prices will likely retreat if their assumption does not hold true,” Menke added.

Investors in both exchange-traded funds and futures are now upping their bullish bets. Inflows into ETFs last week took holdings to the most in almost a year, while the net-long position of hedge funds trading the Comex are now the highest since August 2020.

(With files from Bloomberg)

No comments:

Post a Comment