Two and a half years after the U.S. removed export restrictions on its crude oil, its exports hit 3 million bpd —the latest all-time high set in recent months.

The

volume of U.S. exports last week was higher than the individual country

exports of 12 out of 14 OPEC members. Only Saudi Arabia and Iraq export

more than 3 million bpd of crude oil to international markets.

The U.S. exports were also higher than the crude oil production of all but three OPEC members—Saudi Arabia, Iraq, and Iran.

The

rise in U.S. exports and the inevitable comparison with OPEC nations’

exports highlights the growing importance of U.S. oil on the

international market.

The 3-million-bpd export figure for one week

is unlikely to be sustainable just yet, analysts think. U.S. exports

fluctuate significantly week to week and face several obstacles to

keeping that 3-million-bpd level for longer than a week.

Still,

the trend line points toward higher exports, closer to the 2-million-bpd

weekly mark than the 1-million-bpd export volumes from last year. Related: Oil Investment In Canada To Drop Despite Rallying Prices

The

previous U.S. export record was 2.566 million bpd in the second week of

May 2018. U.S. exports exceeded 2 million bpd in just one week in 2017,

but this year they have done so eight times, including the

3-million-bpd record last week.

In the week to June 22, exports were 3 million bpd, compared to just 528,000 bpd

for the same week in 2017, the EIA’s data shows. The four-week average

to June 22 was 2.280 million bpd, versus a 581,000 bpd four-week average

for the same week last year.

In recent weeks, U.S. oil exports were supported by the wide discount, around $9 a barrel, of WTI Crude prices to Brent

prices. A spread of this size makes U.S. oil cheaper for buyers than

oil grades priced off the Brent benchmark, which has driven demand for

U.S. oil higher in Asia and Europe. Surging U.S. oil production—which

hit 10.9 million bpd this month—coupled with pipeline bottlenecks in the Permian—widened the WTI discount to Brent further.

Over the past week, however, the WTI-Brent spread has narrowed significantly,

also due to the outage at the 360,000-bpd Syncrude oil sands facility

in Fort McMurray, Alberta, which strained North American oil supplies.

Production at the Canadian oil sands facility is likely to remain offline at least through July, a spokeswoman for Suncor, the majority owner of the project, confirmed on Tuesday.

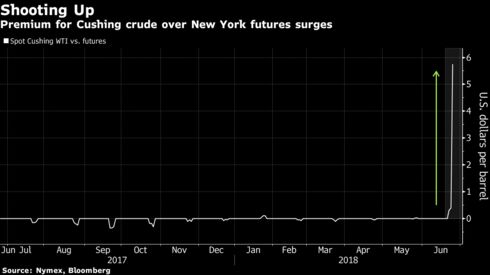

This

would drain more of the U.S. stockpiles in Cushing, Oklahoma, further

boosting WTI Crude prices, analysts say. The EIA’s latest inventory

report on Wednesday showed a massive 9.9 million bpd draw, much higher than expected.

It’s

not only the WTI-Brent spread that will determine the trend of U.S.

exports in the coming weeks and months. Takeaway capacity bottlenecks in

the Permian could constrain shipping from inland Texas to the Gulf

Coast. Related: The Saudis Won’t Prevent The Next Oil Shock

“The

fact is we’re loading crude oil for export across the Texas Gulf Coast.

The biggest issue that exporters are facing is getting oil from the

Permian basin to the Gulf Coast because of the lack of pipeline

capacity,” Andrew Lipow, president of Lipow Oil Associates, told CNBC.

Another U.S. export hurdle could be China slapping tariffs

on American energy imports amid the ongoing trade spat. Although this

is currently just in the realm of possibilities and speculation, a

25-percent tariff on U.S. oil would make it uncompetitive in China,

where American crude has already started to bite into the market shares

of OPEC and Russia.

The U.S. may be able to find other buyers for

its oil, but the rate of exports would depend more on the WTI-Brent

spread and the Permian’s takeaway capacity. In other words, on the price

of U.S. oil on the market, and on how fast and at what cost the oil can

be shipped from West Texas to the Gulf Coast ports.

By Tsvetana Paraskova for Oilprice.com