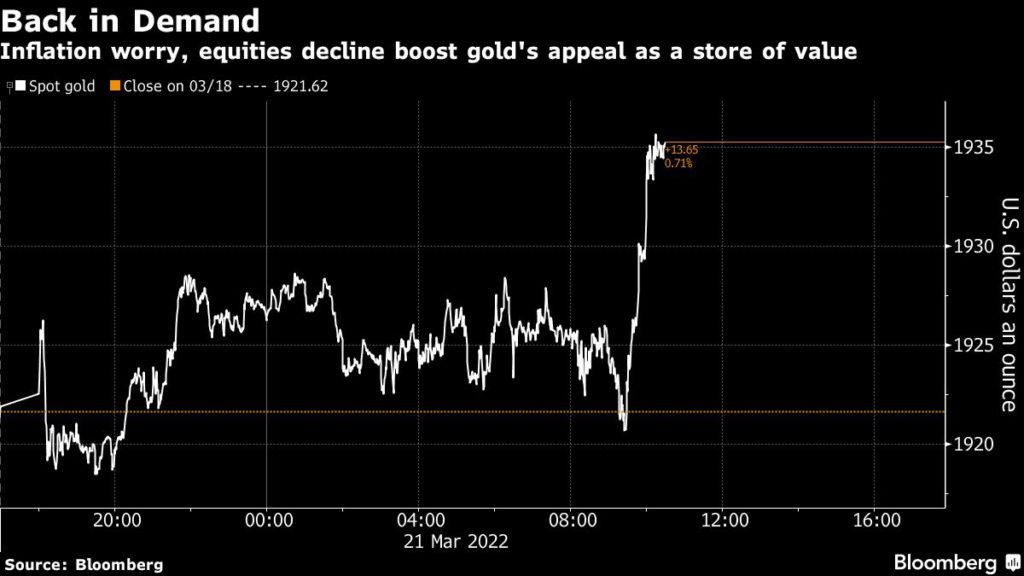

Gold rebounded from its biggest weekly drop since June as the war in Ukraine continued to push oil prices higher, adding more fuel to global inflation fears and boosting the demand for safe havens.

[Click here for an interactive chart of gold prices]

Meanwhile, both the S&P 500 and Nasdaq 100 fell after posting their best five-day streak since November 2020. West Texas Intermediate oil rose above $110 a barrel as investors assessed the war in Ukraine and Middle East tensions.

Rising commodities prices are helping underpin bullion’s appeal as an inflation hedge. Former US Treasury Secretary Lawrence Summers said last week that the Fed will need to raise borrowing costs higher than officials are currently projecting if it’s to wrestle inflation back under control.

On Monday, Atlanta Federal Reserve Bank President Raphael Bostic said he was open to more aggressive policy tightening, while pencilling in six rate hikes for 2022.

“The main fundamental driver that is still supporting gold prices to potentially trade higher in the medium term continues to be the stagflation risk,” Kelvin Wong, an analyst at CMC Markets in Singapore, told Bloomberg. “The Fed has so far failed to cool down future inflationary expectations.”

“Another escalation around Ukraine will drive significant safe haven flows to gold, even inflation hedge moves if we see sanctions that trigger another commodity surge,” Craig Erlam, senior market analyst at OANDA, said in a Reuters report.

“As real interest rates creep up, appetite for gold as an inflation hedge could diminish,” analysts at Heraeus precious metals warned.

“However, even if the Fed’s upper estimates of rate raises become reality, inflation will still be ahead, and real interest rates negative, maintaining a positive environment for gold in the medium term,” Heraeus analysts added.

(With files from Bloomberg and Reuters)

No comments:

Post a Comment