Friday, September 30, 2022

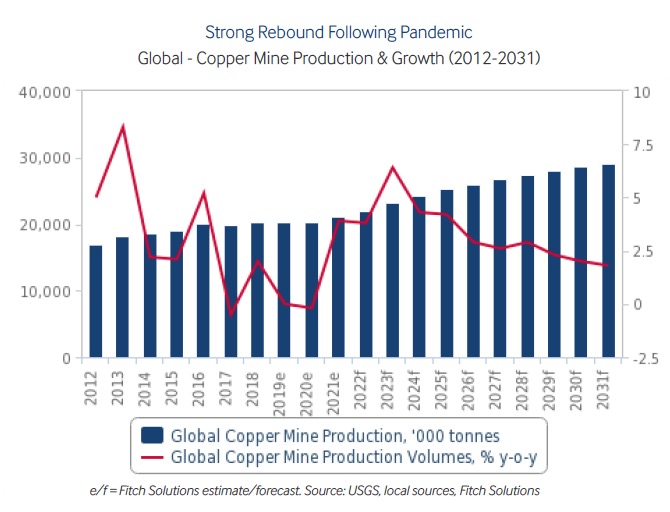

Copper production to show “strong and consistent” growth for next decade

https://www.mining.com/copper-production-to-show-strong-and-consistent-growth-for-next-decade/

A new study by Fitch Solutions Country Risk and Industry Research forecasts 7.3 million tonnes will be added to global copper production through 2031 as a raft of projects in Chile, China and Congo come online.

Sign Up for the Copper Digest

Chile

The market researcher says top producer Chile will show a slight decline in the short term due to ongoing drought affecting mines such as Anglo American’s Los Bronces and Antofagasta’s Los Pelambres operations, labour action at state-owned Codelco and unforeseen maintenance at Vale’s mines.

However, longer term the country, which is responsible for a quarter of global production, will experience strong growth led by large scale miners. BHP is adding substantially to Escondida’s output following the end of covid restrictions, Teck Resources’ Quebrada Blanca Phase 2 project is expected to complete construction around the end of 2022, while Codelco is undertaking a $1.6 billion project to overhaul its Salvadore mine and add 47 years to its mine life.

“Downside risks to long-term production stem from the possibility of a mining sector tax, which President Gabriel Boric is pursuing. Nevertheless, given significant opposition in Congress to the original proposals, we expect the impact on output to be limited,” says Fitch.

China

Fitch expects Chinese copper mine production growth to slow sharply from an average growth rate of 6.9% over the past decade to 1.0% through 2031 due to the shutdown of low grade mines and delayed capacity expansions.

Ramp ups at new projects, including Yunnan Copper’s Pulang mine and Zijin Mining’s Qulong complex will offset declines elsewhere.

Peru

Fitch expects Peruvian output growth to slow dramatically in the near term from its earlier estimates due to community protests affecting key mines including MMG’s Las Bambas and Southern Copper Corp’s Cuajone mines. The authors of the report do not anticipate that annual production will reach pre-covid levels until 2024.

China will play an increasingly important role in Peru’s copper sector, says Fitch, pointing to the country’s Ministry of Energy and Mines forecast of a total of $10.2 billion to be invested by Chinese firms in five mining projects over the next 10 years.

DRC

The Democratic Republic of the Congo, thanks mainly to Ivanhoe Mines and Zijin Mining’s giant Kamoa-Kakula mine expansion, will exceed annual production of 2 million tonnes for the first time next year and reach nearly 3 million tonnes in 2031.

Glencore’s restart of the Mutanda copper-cobalt mine and China Minmetals’ Deziwa project, held with state-owned Gecamines will further add to the central African nation’s strong growth.

Price slump

The copper price has been in retreat since hitting all-time highs in March and was last trading at $3.28 a pound ($7,230 a tonne) in New York, a 10-week low.

Fitch expects prices to average $8,400 a tonne in 2023 and $11,500 a tonne by 2031 as a long-term structural deficit emerges due to the very strong long-term demand outlook.

Tankers to discharge Iranian crude, condensate at Venezuela's main port

https://www.tankeroperator.com/ViewNews.aspx?NewsID=13298

HOUSTON, Sept 26 (Reuters) - Tankers carrying about 1.22 million barrels of Iranian crude and 2 million barrels of condensate are scheduled to discharge at Venezuela's Jose terminal in the coming days, according to a document from state oil company PDVSA.

Thursday, September 29, 2022

Gold price rallies as dollar pulls back

https://www.mining.com/gold-price-rallies-to-weekly-high-as-dollar-pulls-back/

Gold rose by nearly 2% on Wednesday as a slight retreat in the dollar rekindled some of its safe-haven appeal, although prospects of sharp rate hikes are still keeping the precious metal near a 2-1/2-year trough.

Sign Up for the Precious Metals Digest

[Click here for an interactive chart of gold prices]

Meanwhile, the US dollar retreated after scaling a new two-decade high, making bullion less expensive for overseas buyers. Treasury yields also eased, adding more appeal to the non-yielding bullion.

A pullback in the dollar and yields have “seen gold move off those lows,” said David Meger, director of metals trading at High Ridge Futures, in a Reuters report.

“The factors in regards to Russia and the discussion of annexation… that probably gave a bid to the (gold) market from a safe-haven perspective,” Meger added.

Moscow was poised on Wednesday to annex a swath of Ukraine, releasing what it called vote tallies showing support in four partially occupied provinces to join Russia, after what Kyiv and the West denounced as illegal sham referendums held at gunpoint.

Moreover, “gold is seeing some relief as the UK’s plan to buy long-end Gilts sees yields weaken,” TD Securities said in a note. Still, bullion has failed to benefit from the recent rout in equities and faces headwinds from looming rate hikes, which would raise the opportunity cost of holding the metal.

“It’s all tied together — the same factors that have been weighing on gold have been weighing on equities,” Meger said.

(With files from Reuters)

Tuesday, September 27, 2022

Monday, September 26, 2022

Thursday, September 22, 2022

Wednesday, September 21, 2022

Tuesday, September 20, 2022

Monday, September 19, 2022

Friday, September 16, 2022

Thursday, September 15, 2022

Wednesday, September 14, 2022

Tuesday, September 13, 2022

Monday, September 12, 2022

No Enemies

Alas! my friend, the boast is poor;

He who has mingled in the fray

Of duty, that the brave endure,

Must have made foes! If you have none,

Small is the work that you have done.

You've hit no traitor on the hip,

You've dashed no cup from perjured lip,

You've never turned the wrong to right,

You've been a coward in the fight.

China National Offshore Oil Corporation (CNOOC) on Wednesday announced the completion of the roofs of three 270,000 cubic meters LNG storage tanks designed and built solely by China in Yancheng City, east China’s Jiangsu Province.

Yokohama Japan

https://www.reddit.com/r/megalophobia/comments/6sxsq3/the_inside_of_the_worlds_largest_liquefied/

Capable of holding the world’s largest volume of 270,000 cubic meters each, the three storage tanks are part of the CNOOC Yancheng “Green Energy Port” project, which involves the construction of 10 large-scale LNG storage tanks: four completed ones of 220,000 cubic meters and six to-be-completed ones of 270,000 cubic meters.

High-tech oriented project

Raising the roof is the most difficult phase of the construction process. The 1,200-tonne part of the roof structure needs to be lifted to a height of 60 meters. This is done with air pressure devices and requires about 500,000 cubic meters of air.

Li Deqiang, deputy commander-in-chief of the “Green Energy Port” roof construction project, told China Media Group (CMG) that “through balanced guidance, storage tank sealing, lifting power and smart monitoring, we precisely controlled the air pressure, speed and deviation ratio and other parameters of the storage tank during roof construction, so as to ensure the security and stability of the pressure lift comprehensively.”

Upon completion, each storage tank will be 60 meters high, equivalent to the

height of the National Stadium or the Bird’s Nest and will be able to accommodate three Boeing 747 simultaneously.

Pursuit of clean energy

To be put into full operation by the end of 2023, the project, with an annual LNG processing capacity of 6 million tonnes (equivalent to 8.5 billion cubic meters of natural gas), will meet the natural gas demand of all residents in Jiangsu Province within 28 months.

It will offset carbon dioxide by 28.5 million tonnes and nitrogen oxide emission by 232,500 tonnes, providing greater impetus for the green development of China’s Yangtze River Economic Belt and further boosting clean energy supply capacity to achieve China’s carbon peak and neutrality targets.

Next, CNOOC is mapping out the second phase of the Yancheng “Green Energy Port” project, aiming for another 10 LNG storage tanks of 270,000 cubic meters to increase the annual LNG receiving capacity to 10 million tonnes.

Friday, September 9, 2022

Thursday, September 8, 2022

Wednesday, September 7, 2022

Copper price: Chile, Codelco face another lost decade of output growth

Tunnel vision. Chuquicamata mine, Chile. Credit: Codelco.

After an early jobs-report bump on Friday in New York, the copper market turned negative by lunchtime, marking its sixth straight session of losses. December contracts for the orange metal are now trading down 8% for the week.

Disappointing manufacturing data in China was behind the recent pullback after PMIs from the country, responsible for 55% of global copper consumption, unexpectedly slipped into contractionary territory.

But worries about global growth, inflation and interest rates, and an energy crisis in Europe have been hounding the metal for months. The copper price has now fallen by one third since hitting all-time highs early in March above $5 per pound.

No fun in fundamentals

Amid all the economic gloom and doom, a bombshell announcement this week by the world’s number one copper producer appears to have gone largely unnoticed or ignored by large-scale speculators on futures markets who’ve been net short on copper for the last seven weeks.

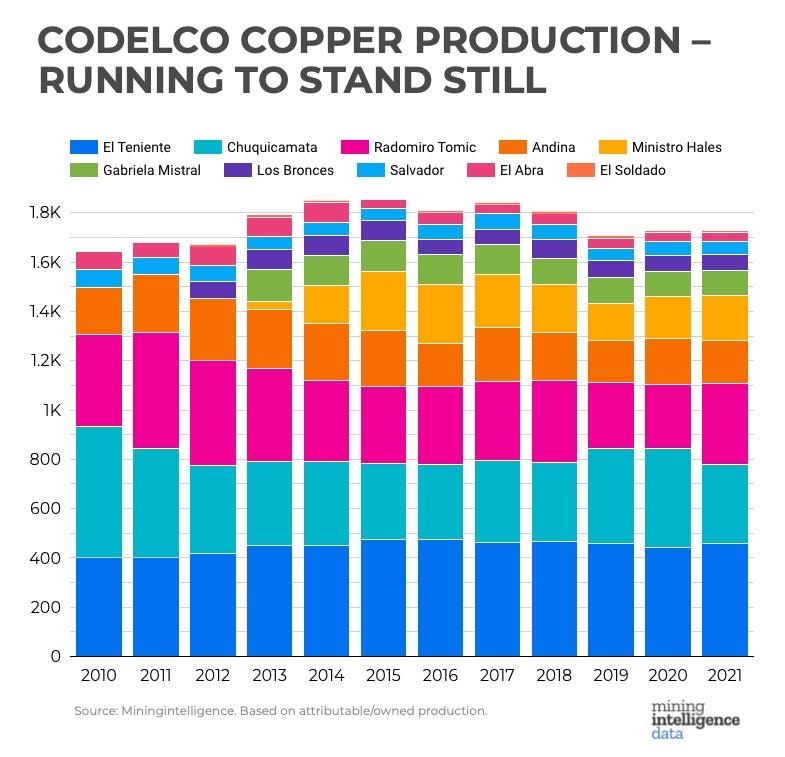

Chile’s state-owned Codelco last week said it expects output to reach between 1.49 million and 1.51 million tonnes this year, down from a previous forecast of 1.61 million tonnes.

On Wednesday, Codelco chairman Maximo Pacheco told a newspaper 2023 guidance is 1.45m tonnes, but significantly, there is no prospect of an improvement.

“For the five-year period between 2023 and 2027, the best forecast we have is 1.5 million tonnes on average.

“Structural projects [to maintain output levels] are effectively behind schedule and over budget.”

The “best forecast” would constitute the lowest output in at least a decade and compares to average attributable output of 1.74m since 2010 according to data from sister company Miningintelligence.

Codelco’s output next year, would more than 400,000 tonnes below its 2015 peak. A 400ktpa mine would be the world’s fifth largest according to 2021 production tables.

Two lost decades

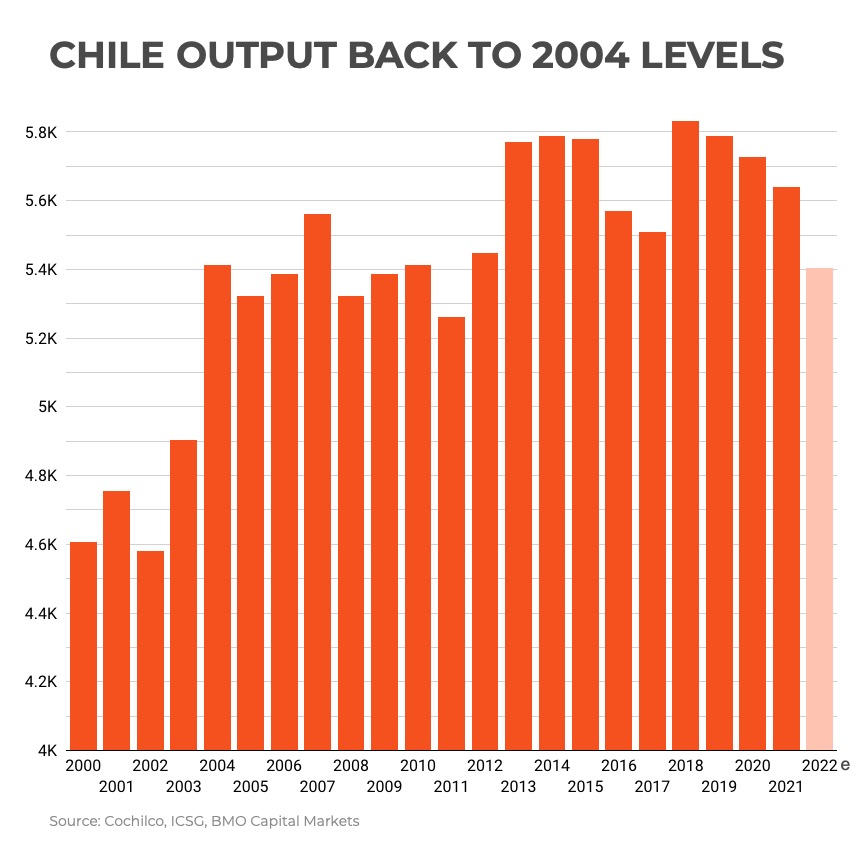

Codelco’s struggles are Chile’s struggles: water scarcity, declining grades, depletion rates, skinny project pipelines, industrial action, taxation increases and regulatory uncertainty and ever-expanding capex budgets.

In 2021 Chile produced a quarter of the world’s primary copper output of 21m tonnes, according to the US Geological Survey. On a proportional basis that makes Chile’s position in the world of copper on par not with Saudi Arabia’s in crude oil, but the combined output of the 13 members of Opec.

In a recent report, BMO Capital Markets says Chile is now heading towards two “lost decades” in terms of copper output growth:

“Following the steady ramp-up in the 1990s and early 2000s, output levels have stagnated, with the projections of 6Mtpa-plus of output never coming to pass.

“And this is not for a lack of investment, with a number of large new mines coming to market over this period. Rather, it is a function of decline at existing assets.”

BMO notes that in particular, SX-EW production in Chile “continues to trend inexorably lower” and is now roughly 500,000 tonnes below peak levels seen in 2009.

Iron ore price climbs after selloffs spurred by China covid woes

https://www.mining.com/web/iron-ore-price-climbs-after-selloffs-spurred-by-china-covid-woes/

Iron ore futures rebounded on Monday after last week’s selloffs, as traders bet the bottom has been reached despite lingering concerns about intensified covid-19 restrictions in top steel producer China.

Sign Up for the Energy Digest

On Friday, Dalian iron ore hit a five-week low of 652 yuan a tonne, while SGX iron ore slumped to a contract low of $92.75 a tonne amid mounting worries about demand as fresh covid-19 outbreaks prompted China to ramp up restrictions.

“Iron ore lacks short-term upward momentum, but the space below is also limited,” Zhongzhou Futures analysts said in a note.

Currently, 33 cities are under partial or full lockdowns, affecting more than 65 million residents, according to an estimate by Chinese financial magazine Caixin.

A property sector downturn in China and widespread lockdowns ahead of the ruling Communist Party’s once-every-five-years Congress starting on Oct. 16 are widely expected to dull domestic demand for iron ore and steel during the September-October peak construction season.

Offering some relief, a spokesperson for China’s central bank said on Friday there was room to adjust monetary policy as stimulus measures have been restrained while consumer inflation remains under control.

But for as long as China’s strict zero-covid policy exists, “any stimulus measures are unlikely to gain traction amid a challenging time for the Chinese property market and the economy in general,” said National Australia Bank economist Tapas Strickland.

Rebar contract on the Shanghai Futures Exchange rose 1.9%, while hot-rolled coil advanced 1.5%. Stainless steel gained 2%.

Other steelmaking inputs also rebounded, with Dalian coking coal up 3.1% and coke rising 2.4%.

(By Enrico Dela Cruz; Editing by Uttaresh.V and Rashmi Aich)

Tuesday, September 6, 2022

India coal baron becomes world’s third richest trailing only Musk, Bezos

https://www.mining.com/web/adani-becomes-worlds-third-richest-trailing-only-musk-bezos/

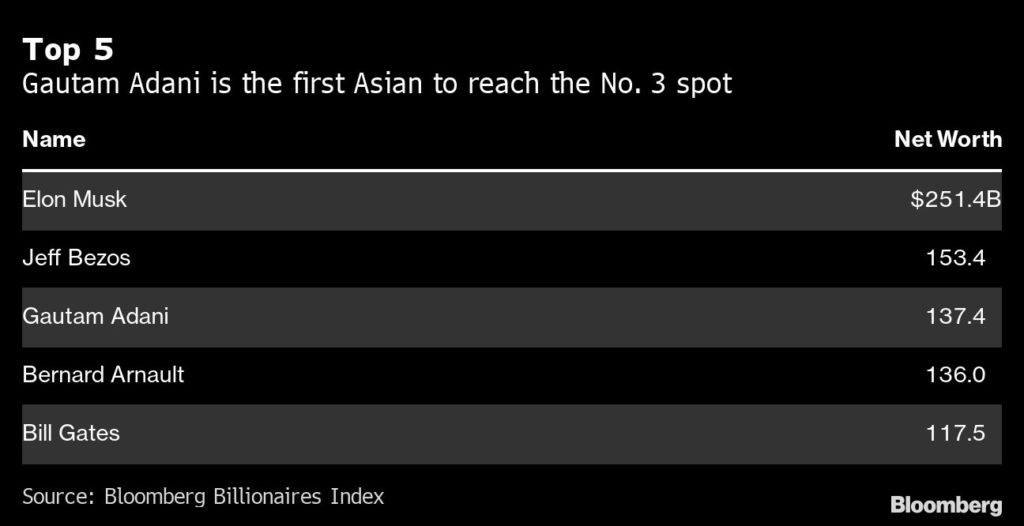

Few outside of India had heard of Gautam Adani just a few years ago. Now the Indian businessman, a college dropout who first tried his luck as a diamond trader before turning to coal, has become the world’s third-richest person.

Sign Up for the Energy Digest

Adani, 60, has spent the past few years expanding his coal-to-ports conglomerate, venturing into everything from data centers to cement, media and alumina. The group now owns India’s largest private-sector port and airport operator, city-gas distributor and coal miner. While its Carmichael mine in Australia has been criticized by environmentalists, it pledged in November to invest $70 billion in green energy to become the world’s largest renewable-energy producer.

As his empire has expanded to one of the world’s largest conglomerates fueling the remarkable wealth gains, concerns have grown over the rapid growth. Adani’s deals spree has been predominantly funded with debt and his empire is “deeply over-leveraged,” CreditSights said in a report this month.

Some lawmakers and market watchers have also raised concerns over opaque shareholder structures and a lack of analyst coverage at Adani Group companies. Yet the shares have soared — some of them more than 1,000% since 2020, with valuations hitting 750 times earnings — as the tycoon focused on areas that Prime Minister Narendra Modi deems crucial to meeting India’s long-term goals.

Shares of Adani Enterprises Ltd., the group’s flagship, climbed 1.7% on Tuesday to close at a record high.

The pivot to green energy and infrastructure has won investments from firms including Warburg Pincus and TotalEnergies SE, helping Adani enter the echelons previously dominated by US tech moguls. The surge in coal in recent months has further turbocharged his ascent.

All told, Adani has added $60.9 billion to his fortune in 2022 alone, five times more than anyone else. He first overtook Ambani as the richest Asian in February, became a centibillionaire in April and surpassed Microsoft Corp.’s Bill Gates as the world’s fourth-richest person last month.

Adani was able to move past some of the world’s richest US billionaires partly because they’ve recently boosted their philanthropy. Gates said in July he was transferring $20 billion to the Bill & Melinda Gates Foundation, while Warren Buffett has already donated more than $35 billion to the charity.

The two, along with Gates’s ex-wife Melinda French Gates, started the Giving Pledge initiative in 2010, vowing to give away most of their fortunes in their lifetimes. The billions of dollars spent on philanthropy has pushed them lower on the Bloomberg wealth ranking. Gates is now fifth and Buffett is sixth.

Adani, too, has increased his charitable giving. He pledged in June to donate $7.7 billion for social causes to mark his 60th birthday.

(By Alexander Sazonov, with assistance from Pei Yi Mak)

Chilean market ends sharply higher after voters reject new constitution

BHP’s Escondida copper mine in Chile. (Image: Wikimedia Commons)

https://www.mining.com/web/chileans-rejecting-new-constitution-set-to-lift-markets-says-jpmorgan/

Chile’s stock market staged a strong rally before paring gains at the

close on Monday, a day after Chileans rejected a proposed new

constitution, while the top copper-producing nation’s peso firmed as its

government prepares to draft a likely more moderate text.![]()

Chileans voted overwhelmingly on Sunday to reject what would have been one of the world’s most progressive charters and a sharp shift from its market-friendly constitution dating back to the Augusto Pinochet dictatorship.

Sign Up for the Copper Digest

Chile’s peso rose more than 4% against the dollar as local markets opened to touch 838.20, a level last seen on June 10, Refinitiv pricing data showed, but it closed up 0.23% at 880.50.

“The outcome may force a more moderate and gradual reform impulse,” said JPMorgan’s Diego Pereira in a note to clients, adding that he expected positive market momentum, thanks to less uncertainty and lower risk premiums ahead.

“We believe both real and financial investors would prefer that if the current constitution has to be reformed, it’s done by the Congress or a committee of notables.”

Shares of London-listed miner Antofagasta rose 3.4% on Monday, outpacing gains in the STOXX Basic Resources Index, which was up 1%.

Chile is home to global copper giants including Codelco, BHP, Anglo American and Glencore as well as Antofagasta.

Chile’s peso has fallen some 3% since the start of the year, making it an outlier in the Latin America region, where currencies from Brazil’s real and Peru’s sol to Mexico’s peso have chalked up solid gains in 2022.

The referendum was also seen as an evaluation of the government, which is struggling with buoyant inflation, an economic slowdown and an internal security crisis, according to experts.

Experts say financial markets’ initial gains may not last as constitutional uncertainty remains a concern.

“As uncertainty hovers over the country, capital flows could slow and ratings downgrades should materialize,” said Brendan McKenna, a strategist at Wells Fargo.

“As those dynamics unfold, the Chilean peso should weaken over the longer term, ultimately getting up towards all-time lows against the dollar.”

Chile’s central bank is expected to raise the benchmark interest rate again this week in the face of persistent inflationary pressures.

After acknowledging defeat, President Gabriel Boric pledged to make adjustments in his government team and work with Congress to draft a new text. Center-left and right-wing parties have also agreed to negotiate.

(By Karin Strohecker, Alexander Villegas, Devik Jain, Valentine Hilaire and Sarah Morland; Editing by Matthew Lewis, Andrea Ricci and Richard Chang)

Thursday, September 1, 2022

Trump Was Right, World Leaders Were Wrong: Russia Just Cut Off Germany’s Fuel Supply. Who’s Laughing Now?

Jesco Denzel /Bundesregierung via Getty Images

As the Ukrainian war rages on, Europeans across the continent are appalled to discover that the man they found shockingly repulsive, Donald Trump, correctly warned that over-reliance on Russia’s energy would cripple their entire way of life.

On Wednesday, Russia announced that it would be cutting off Germany’s gas supply via Nord Stream 1 for the next three days. According to German officials, all they can do is “trust” that they can handle the decrease in natural gas.

“I assume that we will be able to cope with it,” Klaus Mueller, the president of Germany’s network regulator, told Reuters after the announcement. “I trust that Russia will return to 20% on Saturday, but no one can really say.”

If I’m a German and I’m hearing that, the first thing I’m doing is starting to knit an extra thick Wintermantel.

The second thing I’m doing is wondering why the German leaders didn’t heed Trump’s prophetic words.

German leaders in particular literally laughed out loud at America’s 45th president at the United Nations when he criticized their energy relationship with Russia, claiming that they were totally dependent four years ago.

Instead, Germany opted to listen to folks like Greta Thunberg — a teenager fully indoctrinated by climate change charlatans — and push green energy.

“Germany will become totally dependent on Russian energy if it does not immediately change course,” Trump said before the U.N. in 2018.

“Here in the Western Hemisphere, we are committed to maintaining our independence from the encroachment of expansionist foreign powers,” he added

The Left-leaning NowThis Twitter account claimed at the time that “Trump made some outrageous claims about German energy at the UN — and the German delegation’s reaction was priceless.”

Trump also stated that Germany was “totally controlled by Russia” because of its energy dependence.

Former German Chancellor Angela Merkel rebutted Trump, saying, “I wanted to say that, because of current events, I have witnessed this myself, that a part of Germany was controlled by the Soviet Union. And I am very happy that we are today unified in freedom as the Federal Republic of Germany.”

Merkel maintained that her nation was free, despite not having reliable forms of fuel.

At the same time, Merkel praised Thunberg for climate activism and encouraging kids to ditch school on Fridays. In 2020, Germany even began closing down its coal plants and instead promised to create a green energy utopia. In the interim, they would rely on Russia.

Germany was forced to reactivate coal plants in July 2022 precisely because they could not get green energy up to speed quickly enough.

Contrary to what the Left claimed, Trump’s U.N. claims were not outrageous. They were prescient.

As we speak, Germans are facing unprecedented energy prices before winter has even started.

“This is not normal at all. It’s incredibly volatile,” Fabian Rønningen, a senior analyst at Rystad Energy, said of high energy prices throughout Germany on Tuesday. “These prices are reaching levels now that we thought we would never see.”

The Europeans might not have seen those high prices coming, but those who believe in a true all-of-the-above energy solution that maximizes fossil fuels and clean energy, as well as energy independence, certainly predicted it.

For some reason, the Trump presidency made the entire world lose its mind. Leaders listened to children instead of taking an honest look at their vulnerabilities. Now, their people are paying the price.

The views expressed in this piece are the author’s own and do not necessarily represent those of The Daily Wire.