Tuesday, March 31, 2020

Monday, March 30, 2020

Oil Tanks Are So Full That Traders May Stow It on Pipe Networks

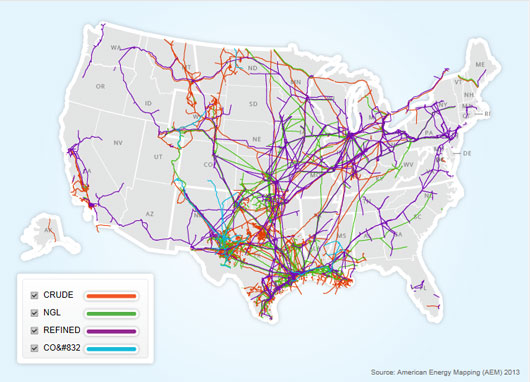

More than 190,000 miles of liquid petroleum pipelines traverse the

United States. They connect producing areas to refineries and chemical

plants while delivering the products American consumers and businesses

need. Pipelines are safe, efficient and, because most are buried,

largely unseen. They move crude oil from oil fields on land and offshore

to refineries where it is turned into fuels and other products, then

from the refineries to terminals where fuels are trucked to retail

outlets. Pipelines operate 24 hours a day, seven days a week.

The glut of U.S. oil is growing so fast that at least one pipeline owner is concerned wily traders may try to stow away crude on its network until prices improve.

Plains All American Pipeline LP is requiring customers to prove they

have a buyer or place to offload crude they’re shipping through the

company’s pipes, according to people familiar with the matter. The idea

is to prevent anyone from using Plains’s network to park oil in lieu of

higher prices.

With the key storage hub in Cushing, Oklahoma, already more than half full, concern is rising among investors and oil producers that the surfeit of American crude may overwhelm storage capacity and force companies to shut down wells. Shale explorers are dialing back drilling but it won’t have a meaningful impact on overall crude supplies any time soon.

With the key storage hub in Cushing, Oklahoma, already more than half full, concern is rising among investors and oil producers that the surfeit of American crude may overwhelm storage capacity and force companies to shut down wells. Shale explorers are dialing back drilling but it won’t have a meaningful impact on overall crude supplies any time soon.

Similar anxieties are wracking the fuel markets as the Covid-19

outbreak saps demand and foreign producers swamp global markets with

oil. Colonial Pipeline Co., operator of the busiest U.S. fuels conduit,

last week warned clients that any gasoline or diesel on their system

that had no end-user or storage reservation would be sold off to the

highest bidder.

Sunday, March 29, 2020

Tullow Terminates Maersk Venturer drilling contract for Ghana program

https://www.petroleumafrica.com/tullow-terminates-maersk-venturer-drilling-contract-for-ghana-program/

Maersk Drilling announced that it has received notice from Tullow Oil

that it would be terminating its contract for services related to its

drilling program offshore Ghana which was to utilize the Maersk Venturer drillship.

Since February 2018, Maersk Venturer has worked for Tullow

offshore Ghana with an expected end of contract in February 2022. The

rig is now expected to end the contract in June 2020. As a consequence

of the termination, Maersk Drilling’s revenue contract backlog is

reduced by USD 175m covering the period from the end of the contract to

February 2022.

Subject to commercial prospects, Maersk Drilling will take measures to reduce Maersk Venturer’s operating costs following the end of the contract.

Maersk Drilling maintains the profitability guidance for 2020 of

EBITDA before special items of USD 325-375m as announced on 20 March

2020.

Friday, March 27, 2020

U.S. indicts Venezuela’s Maduro on narcoterrorism charges, offers $15 million reward for his capture

Venezuelan President Nicolás Maduro speaks during a news conference this

month at the Miraflores presidential palace in Caracas. (Manaure

Quintero/Reuters)

https://www.washingtonpost.com/world/the_americas/the-united-states-indicts-venezuelas-maduro-on-narco-terrorism-charges/2020/03/26/a5a64122-6f68-11ea-a156-0048b62cdb51_story.html

March 26, 2020 at 5:42 p.m. EDT

Attorney General William P. Barr announced the indictments of Maduro and other current and former Venezuelan officials

on charges including money laundering, drug trafficking and

narcoterrorism. Barr and other U.S. officials alleged a detailed

conspiracy headed by Maduro that worked with Colombian guerrillas to

transform Venezuela into a transshipment point for moving massive

amounts of cocaine to the United States.

The

action, rumored for years, comes as the U.S.-backed opposition movement

to oust Maduro has struggled to maintain momentum. The coronavirus has effectively halted the opposition rallies that have been a signature of the movement.

On Thursday, Barr accused Maduro of “deploying cocaine as a weapon” to undermine the United States.

“Maduro

and the other defendants expressly intended to flood the United States

with cocaine in order to undermine the health and well-being of our

nation,” Barr said during a news conference in Washington.

The

charges against Maduro, brought in indictments in New York and Florida,

carry a mandatory minimum sentence of 50 years in prison and a maximum

of life. The U.S. Attorney in Manhattan, Geoff Berman, seemed to concede

that U.S. authorities could not arrest Maduro in Venezuela, but noted

that the leader might travel outside his country.

The charges, described as “a decade” in the making, recalled the

U.S. indictment of Panamanian strongman Manuel Antonio Noriega in 1988.

In that case, President George H.W. Bush eventually ordered U.S. forces

to invade and capture Noriega. But Venezuela’s far better-equipped

military and Russian support for Maduro would complicate any attempt by

the U.S. to take him into custody the same way.

The Trump administration broke diplomatic relations with Maduro last year and recognized National Assembly leader Juan Guaidó

as Venezuela’s legitimate president. Barr said officials expect to

arrest Maduro, but declined to say whether the administration would

entertain a military option, as it did in Panama.

“We’re

going to explore all options for getting custody,” Barr said.

“Hopefully, the Venezuelan people will see what’s going on and will

eventually regain control of their country.”

Also

charged were the head of Venezuela’s National Constituent Assembly, a

former director of military intelligence, a former high-ranking general,

the defense minister and the chief justice of the Supreme Court. Some

of the indicted officials — notably Defense Minister Vladimir Padrino

López and Chief Justice Maikel Moreno — were involved in plotting a military uprising against Maduro

last spring, but failed to live up to secret pledges to move against

the president. The charges suggest the Justice Department was pursuing

their alleged links to narcotrafficking even as U.S. officials endorsed

and encouraged the efforts of the Venezuelan opposition to solicit their

participation in that plot.

The indictments are a sharp escalation in tactics that officials have

gradually ramped up against Maduro since President Trump entered the

White House. A campaign that started with targeted sanctions on

individual Venezuelan officials broadened to measures that have locked the government out of the U.S. financial system. A U.S. oil embargo imposed last year has denied Caracas its single largest source of hard currency.

Maduro rejected the U.S. charges Thursday.

“There’s

a conspiracy from the United States and Colombia and they’ve given the

order of filling Venezuela with violence,” he said on Twitter. “As head

of state I’m obliged to defend peace and stability for all the

motherland, under any circumstances.”

Maduro is scrambling to cope with an outbreak of the coronavirus as Venezuela’s broken hospitals

reel from chronic shortages of medicines, dilapidated equipment and

unsanitary conditions. Barr suggested the pandemic had delayed

Thursday’s announcement, but he said the time was right because

Venezuela’s “people are suffering.”

“They

need an effective government that cares about the people,” Barr said.

“We think that the best way to support the Venezuelan people during this

period is to do all we can to rid the country of this corrupt cabal.”

In a January interview with The Washington Post,

Maduro scoffed at allegations that his government had established

agreements with Colombian guerrillas engaged in narcotrafficking and

kidnapping on the Venezuelan-Colombian border.

“It makes me laugh,” he said.

Prosecutors allege that Maduro and other Venezuelan officials have operated the Cartel do los Soles,

or Cartel of the Suns, since at least 1999, corrupting Venezuela’s

government institutions so they could flood the U.S. with hundreds of

tons of cocaine. They say the cartel worked with the Revolutionary Armed

Forces of Colombia, or FARC, to ship the drug by air and sea through

the Caribbean and Central America to the United States. (The FARC, a

Marxist guerrilla movement that engaged in a decades-long war against

the Colombian government, officially disbanded with the Colombian peace

accord of 2016, but more than 2,500 dissident members remain active.)

Prosecutors allege that Maduro led the operation, negotiating shipment

quantities, directing the cartel to provide military-grade weapons to

the FARC and coordinating with officials in other countries to

facilitate the drug trafficking.

Barr said the Maduro government is “awash in corruption and criminality.”

“While

the Venezuelan people suffer, this cabal lines their pockets with drug

money and the proceeds of their corruption,” Barr said.

Venezuela’s

broken health system is uniquely vulnerable to coronavirus. Neighbors

are afraid the country will hemorrhage infected migrants.

U.S.

authorities charged myriad Venezuelan officials in separate drug and

money laundering cases in federal courts in New York, Florida and

Washington.

In

one case, prosecutors alleged Padrino López took bribes to allow drug

traffickers to fly planes in his country’s airspace without fear of

being shot down. In another, they said Moreno fixed criminal and civil

court cases in exchange for kickbacks — including dismissing a fraud

case against the state oil company and authorizing the sale of a $100

million General Motors plant in exchange for a cut of the proceeds.

U.S.

officials and Venezuelan opposition leaders have sought dialogue with

members of Maduro’s inner circle in an attempt to strip away or at least

weaken his internal support. By targeting several members of his inner

circle, the administration could push them to close ranks around Maduro,

complicating efforts to isolate him.

The indictments appear to conflict with long-standing administration

policy toward Maduro. For most of the last year, administration

officials repeatedly emphasized their desire for Maduro to leave

Venezuela for exile, where they pledged not to pursue him. “This is not

about revenge,” one senior official said last year. “We would be happy

to pay the airfare.”

By

reducing the likelihood of a negotiated settlement, they could be

putting Maduro in a position where he has little left to lose — and

could increase pressure on Guaidó, who has enjoyed a level of protection

under U.S. patronage.

In

what appeared to be a retaliatory move, Maduro’s attorney general on

Thursday announced an investigation into Guaidó and others for allegedly

plotting a “coup.”

U.S.

officials who deal with Venezuela policy say that the charges announced

Thursday had more to do with Justice Department investigations — and

the timing of grand juries weighing the matter in New York and Florida —

than any change of position within the administration.

“This was

not a policy move,” said one official, who spoke on the condition of

anonymity because the official was not authorized to speak publicly on

the matter.

Venezuela’s

opposition embraced the charges. Iván Simonovis, Guaidó’s security

commissioner, called the $15 million reward for Maduro’s capture and

conviction, and $10 million for others, powerful incentive for other

government officials to turn against them.

“There is a price for each one of them,” he told The Post. “You never know what could happen with that.”

Trump

administration officials have given strong support to Guaidó, notably

in his military uprising last April 30. That effort quickly petered out,

and is increasingly being viewed as Venezuela’s Bay of Pigs — a lost

opportunity to oust Maduro that might not come again.

One

of the Venezuelans charged, retired Gen. Cliver Alcalá Cordones, posted

video clips on Twitter proclaiming his innocence. He said he was living

in Barranquilla, Colombia, with the full knowledge of the Colombian

government, and had been cooperating for some time with both Guaidó and

American officials.

“I'm at my home,” he said. “I'm not running.”

Last

year, Maduro’s former spy chief, Gen. Manuel Ricardo Cristopher

Figuera, told The Washington Post that he had provided details on

locations and activities of Colombian drug cartels and criminal gangs operating on Venezuelan soil directly to Maduro, but Maduro declined to act.

“I

gave him a folder with this and told him, ‘Look, this is the situation

with the guerrillas,’” said Figuera, who turned against Maduro last year

and is now in the United States.

“They never took action,” he said. “You could say that Maduro is a friend of the guerrillas.”

Analysts see differences between going after Maduro now and Noriega in the 1980s.

Maduro

maintains a firmer grip on the Venezuelan military than Noriega had,

and its officers have been less influenced by contact and cooperation

with the U.S. military than were Panama’s. Venezuela’s military is

better equipped with more sophisticated Russian weaponry.

Maduro’s

government also has more international support. The Russians and

Cubans, and to a lesser extent, the Chinese, have stood behind him, and

Moscow has turned the shipment of Venezuelan oil to circumvent U.S. sanctions into a cash cow.

Perhaps

the biggest difference is that Maduro, although broadly unpopular, is

still seen by some in Venezuela as the anointed successor of Hugo

Chávez, the father of the socialist state, who died of cancer in 2013.

Maduro’s inner circle maintains control of the Venezuelan socialist

movement, known as Chavismo, a still-formidable apparatus.

“You

can lob a cruise missile and take him out, but you don’t take out

Chavismo,” said Eric Farnsworth, vice president of the Council of the

Americas and the Americas Society. “You don’t really take out the regime

unless the military lays down its weapons and says we’re going to

support the Americans. I don’t see that happening.”

Ana Vanessa Herrero in Caracas contributed to this report.

Thursday, March 26, 2020

History’s largest oil glut months away from topping world storage while tanker freight rates explode

The

largest oil supply surplus the world has ever seen in a single quarter

is about to hit the global market from April, creating an imbalance of

around 10 million barrels per day (bpd).

An exclusive Rystad Energy analysis shows global storage infrastructure

is in trouble and will be unable to take more crude and products in

just a few months.

Our current liquid balances show supply surpassing oil demand by an

average of nearly 6 million bpd in 2020, resulting in an accumulated

implied storage build of 2.0 billion barrels this year.

Based on our rigorous analysis, we find that the world currently has

around 7.2 billion barrels crude and products in storage, including 1.3

billion to 1.4 billion barrels currently onboard oil tankers at sea. We

estimate that, on average, 76% of the world’s oil storage capacity is

already full.

There is essentially no idle storage capacity available on tankers, as

Saudi Arabia and other producers might have already wiped out the

available population of Very Large Crude Carriers (VLCC) for March and

April 2020.

Our data shows that the theoretical available storage capacity at

present is just 1.7 billion barrels onshore for crude and products

combined. Using our estimate of an average of 6.0 million bpd of implied

oil stock builds for 2020, in theory, it would take nine months to fill

all onshore tanks. However, in practice we will hit the ceiling within a

few months due to operational constraints.

“The current average filling rates indicated by our balances are

unsustainable. At the current storage filling rate, prices are destined

to follow the same fate as they did in 1998, when Brent fell to an

all-time low of less than $10 per barrel,” says Paola Rodriguez-Masiu,

Rystad Energy’s Senior Oil Markets analyst.

Learn more in Rystad Energy’s OilMarketCube.

Floating storage normally uses VLCCs, which can carry about 2.0 million

barrels. We estimate that there are about 802 VLCCs active globally

with a combined capacity of 250 million deadweight tonnage (dwt),

capable of collectively storing 1.8 billion barrels. The entire global

fleet, including smaller Suezmax and Aframax vessels, is estimated to

have a combined capacity of 630 million dwt or 4.6 billion barrels.

However, to keep oil flowing between regions, a ballast of around 50%

is necessary as cargos often need to travel with no cargo to the

destinations where they pick up oil, meaning that at any given time

around half of the world's fleet is booked traveling to consumer

destinations, while the other half is empty on their way to pick up oil.

This reduces the number of available vessels to about 57.

In addition, the workable available capacity is significantly lower as

many of these vessels are under long-term charter deals or locked in

ownership agreements, such as COSCO vessels with PetroChina. Waiting

time at ports and repairs further shrinks the workable available

capacity.

Due to the above-mentioned factors, using supertankers to float oil

offshore might not be a viable option this time, as the planned OPEC+

output hike has not only limited the workable available vessels but also

caused a surge in tanker freight rates. The cost of renting a VLCC on

the spot market has risen from about $20,000 per day last month to

between $200,000 and $300,000, depending on destination.

“We find that liquid supply will have to be reduced by around 3.0

million to 4.0 million bpd compared to the current production planning

to bring the implied stocks builds closer to 2.0 million to 3.0 million

bpd for 2020, which is the level of implied stocks build that we find

sustainable in the short to medium term,“ Rodriguez-Masiu concludes.

Wednesday, March 25, 2020

US urges Saudi Arabia to ‘rise to the occasion’ and end its oil price war with Russia

US Secretary of State

Mike Pompeo (C-L) meets with Saudi Arabia’s Crown Prince Mohammed bin

Salman (C-R) at Irqah Palace in the capital Riyadh on February 20, 2020.

ANDREW CABALLERO-REYNOLDS | POOL | AFP via Getty Images

https://www.cnbc.com/2020/03/25/oil-prices-and-coronavirus-us-urges-saudi-arabia-to-end-russia-feud.html

- Oil prices have more than halved since climbing to a peak in January, with analysts warning crude futures could soon plunge into the teens over the coming weeks.

- It comes as the coronavirus pandemic continues to crush oil demand worldwide and with no end in sight to the ongoing price war between Riyadh and Moscow.

The U.S. has called on OPEC kingpin Saudi Arabia to put a stop to its ongoing oil price war with non-OPEC leader Russia.

In a statement released by the U.S. State Department Wednesday, a spokesperson confirmed that Secretary Mike Pompeo had spoken with Saudi Crown Prince Mohammed bin Salman on Tuesday.

“Secretary Pompeo and the Crown Prince focused on the need to maintain stability in global energy markets amid the worldwide response,” the statement said.

“The Secretary stressed that as a leader of the G-20 and an important energy leader, Saudi Arabia has a real opportunity to rise to the occasion and reassure global energy and financial markets when the world faces serious economic uncertainty,” it added.

Pompeo and bin Salman expressed their “deep concern” over the coronavirus pandemic and underlined the need for all countries to work together to contain the outbreak, according to the statement.

International benchmark Brent crude traded at $26.46 a barrel Wednesday afternoon, down 2.5%, while U.S. West Texas Intermediate (WTI) stood at $23.47, more than 2.2% lower.

Oil prices have more than halved since climbing to a peak in January, with analysts warning crude futures could soon plunge into the teens over the coming weeks.

It comes as the coronavirus pandemic continues to crush oil demand worldwide and with no end in sight to the ongoing price war between Riyadh and Moscow.

Earlier this month, the OPEC group of oil producers and its non-OPEC allies — sometimes referred to as OPEC+ — failed to agree on extending oil supply cuts beyond March 31.

This has led to heightened concerns of a supply surge from April 1, with Saudi Arabia and the United Arab Emirates both pledging to ramp up production.

In a statement released by the U.S. State Department Wednesday, a spokesperson confirmed that Secretary Mike Pompeo had spoken with Saudi Crown Prince Mohammed bin Salman on Tuesday.

“Secretary Pompeo and the Crown Prince focused on the need to maintain stability in global energy markets amid the worldwide response,” the statement said.

“The Secretary stressed that as a leader of the G-20 and an important energy leader, Saudi Arabia has a real opportunity to rise to the occasion and reassure global energy and financial markets when the world faces serious economic uncertainty,” it added.

Pompeo and bin Salman expressed their “deep concern” over the coronavirus pandemic and underlined the need for all countries to work together to contain the outbreak, according to the statement.

International benchmark Brent crude traded at $26.46 a barrel Wednesday afternoon, down 2.5%, while U.S. West Texas Intermediate (WTI) stood at $23.47, more than 2.2% lower.

Oil prices have more than halved since climbing to a peak in January, with analysts warning crude futures could soon plunge into the teens over the coming weeks.

It comes as the coronavirus pandemic continues to crush oil demand worldwide and with no end in sight to the ongoing price war between Riyadh and Moscow.

Earlier this month, the OPEC group of oil producers and its non-OPEC allies — sometimes referred to as OPEC+ — failed to agree on extending oil supply cuts beyond March 31.

This has led to heightened concerns of a supply surge from April 1, with Saudi Arabia and the United Arab Emirates both pledging to ramp up production.

Tuesday, March 24, 2020

Curacao seeks $162 million from PDVSA for refinery operations

![Curacao oil refinery takeover: Good for jobs, bad for climate? The Isla oil refinery in Curacao, as seen from the cemetery west of the complex towards which pollutants have been emitted for decades [Ben Piven/Al Jazeera]](https://www.aljazeera.com/mritems/imagecache/mbdxxlarge/mritems/Images/2019/12/27/fa7b1c850d514d799b13ddb15929254e_18.jpg)

The Isla oil refinery in Curacao, as seen from the cemetery west of the

complex towards which pollutants have been emitted for decades [Ben

Piven/Al Jazeera]

https://www.reuters.com/article/us-venezuela-pdvsa-curacao/curacao-seeks-162-million-from-pdvsa-for-refinery-operations-idUSKBN21A3M5

(Reuters) - Curacao is pursuing a $162 million arbitration claim

against Venezuela’s state-run PDVSA oil firm over its management of the

island’s oil refinery, an executive of Refineria di Korsou said on

Monday.

The Dutch Caribbean island last week seized a PDVSA-owned

oil storage terminal in neighboring Bonaire to enforce claims for

overdue payments, maintenance costs and environmental damage at RdK,

Marcelino de Lannoy, RdK’s interim managing director, said in an

interview.

Curacao separately expects a contract with commodities

firm Klesch Group to operate the 335,000-barrel-per-day Isla refinery

and its storage facilities will be delayed. Klesch is committed to the

deal but any agreement may be delayed until May or June because of

travel restrictions due to the coronavirus pandemic, de Lannoy said.

Globally, demand for oil and petroleum products have fallen due to

the pandemic, slashing prices and profit margins for many refineries.

But the sharp price has lifted demand for storage space, including at

the island’s Bullenbay oil terminal, with its 17.75 million barrels of

storage and blending capacity.

PDVSA ran RdK’s Isla refinery on

Curacao for about 34 years through last year. U.S. sanctions against

Venezuela led to a halt of operations. PDVSA failed to make lease

payments, did not meet take or pay agreements with RdK or fulfill

maintenance requirements, de Lannoy said.

Neither PDVSA or the Venezuelan oil ministry immediately responded to requests for comment.

RdK’s claim was filed earlier this month at the International Centre

for Dispute Resolution, an arbitration group in New York, de Lannoy

said. An ICDR spokesman said the group does not comment on its work.

A

Dutch court in Curacao authorized a legal attachment of the Bonaire

Petroleum Corp site. De Lannoy said Curacao would seek to auction the

site if it wins the arbitration case.

PDVSA and the Venezuelan

government have missed billions of dollars in payments to creditors in

recent years as the once prosperous OPEC nation’s economy unraveled,

putting many of its overseas assets at risk of seizure.

Reporting by Gary McWilliams in Houston and Luc Cohen in New York; Editing by David Gregorio

Our Standards:The Thomson Reuters Trust Principles.

Monday, March 23, 2020

US Energy Department Requests Purchase of Up to 30 million Barrels of US Crude

Crude oil storage tanks are seen from above at the Cushing oil hub, in

Cushing, Oklahoma, U.S., on March 24, 2016. (Nick Oxford/Reuters)

DOE wants to buy crude from small to midsize US producers. Deliveries may start in April, will run through June. Unclear if Congress will fund another 47 million barrel buy.

The US Energy Department on Thursday formally requested to buy up to 30 million barrels of sweet and sour crude from US producers for the Strategic Petroleum Reserve, the initial step in the Trump administration’s plan to lessen the impact of low oil prices on domestic operators by filling government stocks to capacity.Deliveries of the crude were expected to begin as soon as April and will likely run through June, DOE said.

The department plans to eventually purchase a total of 77 million barrels of US crude to fill the SPR’s four storage sites along the US Gulf Coast.

Energy Secretary Dan Brouillette said the Trump administration is asking Congress for $3 billion in funding for the total purchases, with a solicitation for the remaining 47 million barrels expected in 60-90 days.

“We’re seeing that there’s really broad support for that all

across the Congress,” Brouillette told reporters. “I think it’s largely

because the Congress fully recognizes the importance of the energy

industry to the rest of the economy.”

Once the crude is purchased, the SPR could receive up to 650,000 b/d

of crude to its caverns in Texas and Louisiana, according to Steven

Winberg, the DOE’s assistant secretary for fossil energy.

“With its extensive storage, pipeline, and marine infrastructure

along the Gulf Coast, the SPR will help relieve oil-related disruptions

to our economy,” Winberg said in a statement.

Analysts, however, believe the reserve’s fill capacity is likely below 500,000 b/d and could be as low as 200,000 b/d.

Small, Midsize Producers

In a solicitation released Thursday, the department said its initial,

30 million-barrel purchase will focus on small to midsize US oil

producers. Proposals to sell crude to the US government are due March

26.

In a statement, Mark Menezes, DOE’s under secretary for energy, said small to midsize producers have been “particularly hard hit”

by the collapse of oil prices. Front-month Brent crude slid 13.4% on

Wednesday to its lowest since May 2003, while prompt WTI futures were

down more than 24% from Tuesday and were last lower in early February

2002.

At 1714 GMT, NYMEX front-month crude was trading around $24.90/b, up

$4.53 on the day, while ICE front-month Brent was trading $3.37 higher

at $28.25/b.

DOE said the solicitation Thursday was the “first step” in

filling the SPR to its maximum capacity. US President Donald Trump on

Friday called on DOE to begin buying crude for the SPR and to “fill it

right to the top.”

The SPR has a 713.5 million-barrel storage capacity and, as of

Friday, held 635 million barrels of crude, including 250.3 million

barrels of sweet crude and 384.7 million barrels of sour crude.

Congressional Funding?

Funding for SPR purchases could present a major obstacle for the Trump administration.

“We continue to see political headwinds,” analysts with

ClearView Energy Partners said in a recent note, writing that it would

be problematic for House Democrats to approve a plan depicted by Trump

as “saving” the US oil industry.

Glenn Schwartz, director of energy policy at Rapidan Energy Group,

said the Democrat-controlled House of Representatives would be unlikely

to go along with any plan to bailout domestic fossil fuel producers

without significant trade-offs, such a tax breaks for renewables or

federal incentives for electric vehicles.

Trump would likely find such concession unpalatable, Schwartz said.

Trump’s plan is a stark departure from May 2017, when his

administration proposed selling off half the SPR, which was roughly 270

million barrels of crude oil at the time, shut two of four SPR storage

sites on the Gulf Coast and sell its 1 million-barrel gasoline reserve

in the Northeast. That proposal was forecast to raise about $16.6

billion over a decade, but it was never taken up by Congress.

DOE is still under a statutory requirement by Congress to sell a

certain amount of SPR crude, but Brouillette said the administration is

urging lawmakers to delay any sales beyond this fiscal year.

Saturday, March 21, 2020

Oil Companies Seeing Detrimental Impacts of COVID-19 and Oil Price Drop

https://www.petroleumafrica.com/oil-companies-seeing-detrimental-impacts-of-covid-19-and-oil-price-drop/

The global Corona Virus pandemic coupled with low oil prices as a

result of he Saudi-Russia production showdown are hitting oil companies

hard. Share prices have plummeted and operations in some quarters are

being stymied as these companies try to comply with best practices in

social distancing to help stop the spread.

This pandemic and oil production war have hit share prices hard and

some independent companies may have difficulty surviving the ongoing

situation. Just a few examples of the share price crash from those firms

operating in Africa are particularly concerning. Below we have listed

an example of those companies operating in the African continent, listed

on different global exchanges:

Panoro Energy – 52 week high 2.49 EUR – March 17 2020 0.47 EUR

Kosmos Energy – 52 week high 7.55 USD – March 17 2020 0.69 USD

Aminex plc – 52 week high 1.65 GBP – March 17 2020 0.45 GBP

Africa Oil Corp – 52 week high 1.66 CAD – March 17 2020 0.82 CAD

FAR Ltd – 52 week high 0.081 AUD – March 17 2020 0.013 AUD

Petroleum Africa will continue to monitor the markets and

provide pertinent updates during this challenging period. We welcome

industry insights and you are welcome to contact us at info@petroleumafrica.com.

Friday, March 20, 2020

Filling Up: The World Has an Oil Storage Problem

The oil market could see a record supply surplus in April as

coronavirus wipes out demand and big producers pump more, creating a

global glut that threatens to overwhelm storage capacity within months

and force widespread industry shutdowns, analysts said on Wednesday.Crude is already gushing into storage at land and sea worldwide as

countries curb travel and economic activity falls due to coronavirus.

Storage levels are rising even before a wave of supply hits the market

from Saudi Arabia, Russia and other producers who are gearing up to

fight a price war for market share.

US benchmark crude fell to its lowest since April 2002 at $US22.60 a barrel on Wednesday, and is down more than 60 per cent since the start of the year. Brent crude prices have fallen almost 45 per cent in March alone, following the most pronounced demand destruction since the financial and economic crisis of 2008.

As storage reaches capacity, a slide toward $US10 per barrel is possible, according to some investors and analysts. That last happened during the 1998 glut before both oil companies and oil producing nations curbed supply.

Some Canadian crude is already trading not far off $US10 per barrel because of steep price discounts to US benchmark WTI crude.

“We believe we have not seen the worst of the price rout yet, as the market will soon come to realize that it may be facing one of the largest supply surpluses in modern oil market history in April,” said Rystad Energy’s Head of Oil Markets Bjornar Tonhaguen.

IHS Market analysts estimated the global oil supply surplus on a

monthly basis to range between 4 million barrels per day (bpd) and 10

million bpd from February to May 2020 – equal to 4-10 per cent of global

demand.

Standard Chartered Bank expected an “extreme” global surplus

of 12.9 million bpd in the second quarter – 13 per cent of global

demand – and a cumulative surplus exceeding 2.1 billion barrels by the

end of the year – well above the annual output of OPEC’s second largest

producer Iraq.

“Does the world have enough storage capacity to handle it? … For

crude oil, we estimate total spare inventory capacity at 900 million

barrels,” BofA Global Research said.

Goldman Sachs sees over 1 billion barrels of unused storage still available and said while it does not expect the glut to lead to a breach in storage capacity, “it will likely lead to a breach in logistical capacity, meaning ships, pipelines, terminals and processing units.”

Goldman Sachs sees over 1 billion barrels of unused storage still available and said while it does not expect the glut to lead to a breach in storage capacity, “it will likely lead to a breach in logistical capacity, meaning ships, pipelines, terminals and processing units.”

Strategic Reserves

The Organization of the Petroleum Exporting Countries (OPEC) and

Russia failed to seal a deal to cut oil production earlier this month,

as they disagreed on how to respond to the impact on demand of

coronavirus. Since then, OPEC’s de facto leader Saudi Arabia has pledged

to flood the world with cheap oil.

Saudi Arabia now plans to boost its crude oil production to a record

high of 12.3 million bpd in April, and its crude oil exports to more

than 10 million bpd from May.

Some major oil consuming nations like the United States and India have tried to take advantage of low oil prices and bulk their its strategic stockpiles.

Some major oil consuming nations like the United States and India have tried to take advantage of low oil prices and bulk their its strategic stockpiles.

US President Donald Trump vowed to fill the country’s Strategic

Petroleum Reserve to the top. The US strategic reserve has the capacity

to take an additional 77 million barrels of crude, and will fill it over

several weeks.

That is a fraction of the expected global glut. Around 3.3 billion

barrels of oil is stored globally onshore, close to the peak of 3.4

billion barrels reached in early 2017, according to Kpler data. Another

91 million barrels is in floating storage – in vessels at sea. That is

not far off peaks reached in 2009.

The surplus will only get worse if producers continue their price war. It will be “intensified by the fact that other OPEC countries will likely do their utmost to boost exports as their fiscal budget is under pressure due to lower prices,” said Homayoun Falakshahi, senior analyst at Kpler.

The International Energy Agency said on March 9 it expected oil demand to be 99.9 million barrels per day (bpd) in 2020, lowering its annual forecast by almost 1 million bpd and signalling a contraction of 90,000 bpd, the first time demand will have fallen since 2009.

The surplus will only get worse if producers continue their price war. It will be “intensified by the fact that other OPEC countries will likely do their utmost to boost exports as their fiscal budget is under pressure due to lower prices,” said Homayoun Falakshahi, senior analyst at Kpler.

The International Energy Agency said on March 9 it expected oil demand to be 99.9 million barrels per day (bpd) in 2020, lowering its annual forecast by almost 1 million bpd and signalling a contraction of 90,000 bpd, the first time demand will have fallen since 2009.

The IEA said that in the first quarter alone, the virus wiped out 2.5 million bpd of demand or 2.5 per cent.

“We estimate OPEC+ spare capacity at 2 million bpd, and at 3 million bpd if Libya’s nearly 1 million bpd production comes back online. What we are seeing here is essentially the atomic bomb equivalent in the oil markets,” said Rystad Energy’s analyst Louise Dickson.

“We estimate OPEC+ spare capacity at 2 million bpd, and at 3 million bpd if Libya’s nearly 1 million bpd production comes back online. What we are seeing here is essentially the atomic bomb equivalent in the oil markets,” said Rystad Energy’s analyst Louise Dickson.

Thursday, March 19, 2020

Tanker market "strongest in decades" - Nordic American

http://www.tankeroperator.com/ViewNews.aspx?NewsID=11449

In a

letter to shareholders, Herbjørn Hansson, Chairman & CEO of Nordic

American Tankers, says that the tanker market is the "strongest we have

seen in decades".

"Increased exports from Saudi Arabia lead to extra demand for tonnage.

As an example, it has been indicated that one million barrels a day

extra from Saudi Arabia to the Far East create demand for about 45

suezmaxes.

"It is simple: Increased demand leads to more transportation work for

our tankers. The last days we have entered into solid contracts for our

suezmax tankers in the region of $65,000 per day to more than $100,000

per day. Our operating costs are about $8,000 per day per vessel. NAT

has 23 suezmaxes which can load one mill barrels each."

Wednesday, March 18, 2020

Oil falls 19% in 3rd worst day on record, sinks to more than 18-year low

A floorhand works on an oil rig in the Bakken shale formation outside Watford City, North Dakota.

Getty Images

U.S. West Texas Intermediate crude fell 19.2%, or $5.19, to $21.76 per barrel, its lowest level in more than 18 years. WTI is on pace for its third worst day on record.

International benchmark Brent crude shed 11.6%, or $3.33, to trade at $25.40, its lowest level since 2003.

“The oil market is about to flood with surplus barrels,” Bank of America said in a note to clients Wednesday.

How low can prices go?

As

demand grinds to a halt, the OPEC+ production cuts currently in place

expire at the end of the month, meaning nations will soon be allowed to

pump as much as they please.

“With each day there seems to be yet another trapdoor lying beneath oil prices, and we expect to see prices continue to roil until a cost equilibrium is reached and production is shut in,” said Rystad Energy analyst Louise Dickson.

“This is the most dismal oil demand picture we have witnessed in a long time with a simultaneous collapse in jet fuel, gasoline, shipping fuel, petrochemicals, and oil used for power generation.”

WTI and Brent crude are on pace for their worst month ever, each down 45%.

“With each day there seems to be yet another trapdoor lying beneath oil prices, and we expect to see prices continue to roil until a cost equilibrium is reached and production is shut in,” said Rystad Energy analyst Louise Dickson.

“This is the most dismal oil demand picture we have witnessed in a long time with a simultaneous collapse in jet fuel, gasoline, shipping fuel, petrochemicals, and oil used for power generation.”

WTI and Brent crude are on pace for their worst month ever, each down 45%.

On Tuesday, Goldman Sachs slashed its oil forecast

for the second quarter, now seeing WTI and Brent averaging $20 per

barrel. The firm believes oil use has fallen by 8 million barrels per

day. “Demand losses across the complex are now unprecedented,” Jeffrey

Currie, the firm’s global head of commodities research, said in a note

to clients.

Unlike prior periods of economic turmoil, including the financial crisis in 2008, the long-term impact of coronavirus is still very much unknown. With more and more market watchers saying a recession looks likely, oil prices could have much further to fall.

“Looking ahead, the path of least resistance is decidedly lower right now and the lower-for-longer dynamic appears to be one that is here to stay for a while, given the clearly bearish fundamentals pointing to a likely longstanding surplus in the global oil markets,” said Tom Essaye, co-founder of The Sevens Report.

Unlike prior periods of economic turmoil, including the financial crisis in 2008, the long-term impact of coronavirus is still very much unknown. With more and more market watchers saying a recession looks likely, oil prices could have much further to fall.

“Looking ahead, the path of least resistance is decidedly lower right now and the lower-for-longer dynamic appears to be one that is here to stay for a while, given the clearly bearish fundamentals pointing to a likely longstanding surplus in the global oil markets,” said Tom Essaye, co-founder of The Sevens Report.

OPEC+ talks unwind

After

talks between OPEC and its allies, known as OPEC+, broke down earlier

this month, Saudi Arabia announced plans to increase its daily

production to a record 12.3 million bpd in April. By comparison, the

kingdom pumped roughly 9.7 million bpd in February. Russia is among the

other OPEC+ nations that has said it, too, could ramp up production.

“Saudi Arabia has become a market arsonist, adding as much fuel as possible to the selling fire, in the form of a maximized capacity output scheme,” Again Capital’s John Kilduff said. “Prices are attempting to find a clearing level or bottom, which I sense will be around the $18.00 per barrel level for WTI,” he added.

As oil prices continue to slide, OPEC-member Iraq on Tuesday urged the 14-member cartel and its allies to hold an emergency meeting, according to Reuters.

- CNBC’s Michael Bloom contributed reporting.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

“Saudi Arabia has become a market arsonist, adding as much fuel as possible to the selling fire, in the form of a maximized capacity output scheme,” Again Capital’s John Kilduff said. “Prices are attempting to find a clearing level or bottom, which I sense will be around the $18.00 per barrel level for WTI,” he added.

As oil prices continue to slide, OPEC-member Iraq on Tuesday urged the 14-member cartel and its allies to hold an emergency meeting, according to Reuters.

- CNBC’s Michael Bloom contributed reporting.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

Tuesday, March 17, 2020

Oil Refiners Face Grim Times Despite Collapse in Crude Costs

Oil refiners’ margins may draw some temporary benefits from the plunge in crude prices, but it won’t be enough to offset the coronavirus’ hit to fuel demand and new plants coming online.

Although crude prices have collapsed due to a price war between

Russia and Saudi Arabia, product prices will take longer to catch up.

For refiners, that creates a short-lived window where margins get a

boost from lower feedstock costs, without a commensurate drop in fuel

prices.

“Refiners will get temporary relief from the cheap crude, but any

sustained increase in runs will see a worsening oversupply situation in

the products markets beyond 2Q after peak turnaround season,” said

Sandra Octavia, an oil products analyst at Energy Aspects Ltd.

Almost every refining margin rose on Monday as crude futures tumbled,

according to data from Oil Analytics Ltd. on Bloomberg. That was to be

expected. Sharp moves in crude oil futures markets are rarely mirrored

immediately and fully by prices of petroleum products like gasoline,

diesel and jet fuel. A look at simple refining margins illustrates the

sudden change.

Although cheap oil usually stokes demand, any benefits this time are

likely to be outweighed by the coronavirus’ negative impact on

consumption as authorities around the world react to the virus’ spread.

Refiners in China and South Korea are cutting runs, while diesel

shipments from these countries to the storage hubs of Singapore and

Malaysia have risen sharply.

“Because of coronavirus, run rates at refineries are under threat,”

said Steve Sawyer, director of refining at Facts Global Energy.

Refiners are also facing an ever-more competitive market. More than a

million barrels a day of plant capacity is expected to be completed

this year, along with close to three million barrels a day next year,

according to BloombergNEF. That’s in addition to about 2.5 million

barrels a day that was commissioned last year.

Storage Access

For refiners looking to take advantage of the collapse in crude

values, much will depend on their access to storage facilities, whether

that’s for holding on to crude or having somewhere to put the fuels they

manufacture. The run cuts in China and South Korea are a result of

plants running out of storage space because demand has been so weak,

according to Sawyer.

India’s refineries, which are currently running at a relatively low

utilization rate, will be best placed to gain from the low crude price,

said David Doherty, downstream oil specialist at BloombergNEF.

The benefit, though, will be short-lived, he said. Indian refiners

export a lot of jet and diesel-type fuels to the European market, where

the coronavirus outbreak is increasingly cutting into oil demand,

particularly for those products.

Russia’s Rosneft PJSC isn’t likely to increase crude production until

April, while Saudi Arabia will probably do the same. As a result, there

won’t be an immediate change in refiners’ crude slates, Sawyer said.

Longer term, the combination of more medium sour crude from those

nations — along with potentially less light-sweet oil as U.S. tight oil

producers feel the pricing pressure — could result in more high-sulfur

fuel oil production.

There’s also perhaps a bright spot: recovery from the virus.

“The number of new coronavirus cases has slowed down in China, and

should the economy show signs of recovery it will support margins,” said

Victor Shum, vice president of energy consulting at IHS Markit in

Singapore.

Monday, March 16, 2020

Cheap Oil Doubles Americas VLCC Freight, Makes for Storage Play

Freight for east-facing VLCCs loading in the Americas soared 112%, or $7.4 million lump sum, this week and 75%, or $6 million lump sum, Wednesday, echoing a more than doubling of the cost of carrying 2 million barrel cargoes from the Arab Gulf to Northeast Asia.

“The Americas VLCC market is all being priced against West Africa-East and Persian Gulf-China freight,” a shipbroker said.

The sharp decline of oil prices after the 23-member alliance of OPEC+

failed to reach an agreement to extend or deepen oil production cuts of

1.7 million b/d that end in March and Saudi Arabia instead taking the

lead in flooding the oil markets with “cheap” barrels resulted in a bull

run on global VLCC tonnage either for single voyage charters or for

floating storage opportunities.

Around three dozen VLCCs were seen booked in the Arab Gulf in the

last 24 hours of the Asian trading day and levels on the VLCC Persian

Gulf-China route were seen trading at Worldscale 155 upon Wednesday’s

Americas market opening, up w40 from the Singapore market close.

Shipowners were looking toward ballasting economics from eastern

markets when offering on six first-half April loading cargoes on

USGC-East routes.

“The earnings equivalent of AG-China is $17 million plus,” a

shipowner said, looking toward last-done levels in the eastern markets.

“It takes $17.5 million for China to match the earnings of what is

currently being fixed in WAF.”

S&P Global Platts assessed the 260,000 mt WAF-Far East route at w120, or at $43.22/mt, Wednesday.

Yet Reliance managed to book the Astro Chloe for the East Coast

Mexico-West Coast India run at $12.5 million loading April 15, the

equivalent of $14 million on the benchmark VLCC USGC-China route, Platts

data showed.

Floating storage viable option for cheap oil

The initial Saudi-induced 30% decline in crude prices on the

Singapore market opening Monday prompted strong charterer inquiry for

floating storage opportunities both offshore Singapore and on the USGC.

Although the current crude price contango, coupled with recent gains

in long-haul freight, did not lend itself to storing oil longer term,

negotiations were heard for six-month time charter terms at

$35,000-$38,000/d ($3.20-$3.50/b) at the start of the week and closer to

$50,000-$60,000/d ($4.60-$5.50/b) mid-week, as major oil companies and

traders were heard willing to tug away comparatively cheap barrels that

seemingly defied crude contango economics.

“I am just watching Brent spreads tick lower and am guessing tank

farms are filling as fast as pipes allow,” a crude broker said Tuesday.

“Today might be $60,000/d and won’t happen anymore,” a shipbroker commented on storage economics Wednesday.

US crude cargoes sent to Singapore, or other Asian destinations known

to be storage hubs, could be positioned there in floating storage for a

possible recovery of Asia Pacific demand in the second quarter as

impacts of the coronavirus ease in the region.

US onshore storage demand spikes on contango economics

Storage economics typically improve during a contango market, when

prompt prices are lower than futures prices. NYMEX WTI settled Tuesday

with April $1.50/b lower than July futures. Further down the curve, in

September, the spread to front-month April steepened to $2.75/b.

Demand for storage onshore US has spiked in recent days as storage

brokers and companies that auction storage have seen an influx in

business and request to provide increased options.

“Storage costs for Cushing have increased from the 25 cents/b per

month to 40 cents/b per month based on the price action we witnessed on

Monday,” Ernie Barsamian, CEO of The Tank Tiger, a terminal storage

clearinghouse, wrote in a note this week. “[US Gulf Coast] export

storage is still in the high 60 cents/b per month range. Interestingly

enough, a big drop in the flat price, while helping the contango emerge,

may negatively impact export storage prices in the long run if US

production is curtailed.”

“In my 40 years, I’ve never seen anything like this. We are sitting

on top of a powder keg for oil,” said Richard Redoglia, CEO of Matrix

Global, which holds monthly crude oil storage auctions along the Gulf

Coast and in Cushing, Oklahoma. “It’s a supply shock on top of a demand

shock.

US crude trading declines as international crude floods in US crude cargo trading activity fell to a near standstill this week

as the international crude market has been flooded with supply and the

April/June Brent/WTI spread narrowed.

An April loading of West Texas Intermediate in Corpus Christi late

Tuesday was talked at a $3/b discount to June ICE Brent futures, the

equivalent of a 92-cent/b discount to Tuesday’s 15- to 45-day Dated

Brent strip. An April loading of WTI FOB in Corpus Christi was later

heard to trade early Wednesday at a $4.50/d discount to June ICE Brent.

Sunday, March 15, 2020

Aramco Slashes Spending as Coronavirus Erases Oil Demand Growth

-

Saudi oil giant cuts capex target by as much as 24% vs 2019

-

Profit slumped 21% in 2019 on lower oil prices and production

Saudi Aramco is slashing planned spending this year in the first sign

that plunging demand and the oil-price war the kingdom unleashed are

hitting home.

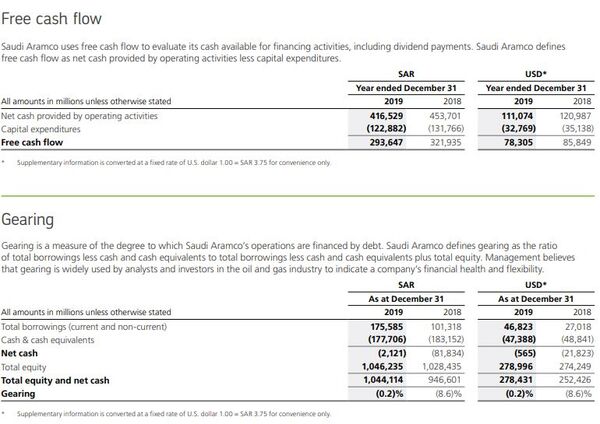

Capital expenditure will be between $25 billion and $30 billion

in 2020 and spending plans for next year and beyond are being reviewed,

Aramco said. The oil giant is lowering that range from the planned $35 billion to $40 billion announced in its IPO prospectus, and compares with $32.8 billion in 2019.

“That was the surprise,” Ahmed Hazem Maher, an analyst at EFG

Hermes in Cairo, said of the spending cut. “They’re adding production

in a low price environment so their cash flows could be impacted.”

Cutting investment could help absorb some of the impact of the drop in

oil prices, he said.

The oil-price war led by Saudi Arabia and Russia means more

pain for Aramco as producing nations prepare to boost supply. Discounted

pricing to markets already reeling from weak demand and crude that lost

roughly half its value since the beginning of the year is likely to hit

revenue further.

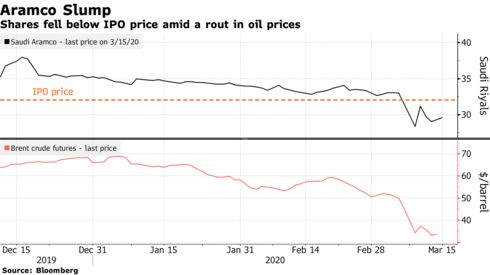

Aramco

shares fell as much as 1% on Sunday, extending the decline this year to

about 19%. Aramco’s market value has slumped from a peak of over $2 trillion in December to about $1.5 trillion. Aramco executives are set to brief financial analysts of the results at 3 p.m. Saudi time on Monday.

The

coronavirus’ blow to oil use has overwhelmed OPEC’s initial optimism

for demand this year, with analysts now expecting a drop in consumption.

The OPEC+ group’s failure on March 6 to agree on further cuts is only

exacerbating a glut as buyers search for storage tanks and vessels.

“We have already taken steps to rationalize our planned 2020

capital spending,” Chief Executive Officer Amin Nasser said. Given the

impact of the coronavirus pandemic on economic growth and demand, Aramco

is adopting “a flexible approach to capital allocation,” he said.

Saudi

Arabia, Russia and others intend to boost production once the current

accord to lower output expires in March. The kingdom pledged to supply

25% more oil in April than it produced last month, and Wednesday ordered

Aramco to boost output capacity by 1 million barrels a day.

Key 2019 numbers |

|---|

|

|

|

Oil

prices fell last year even as Saudi Arabia trimmed output as part of

efforts between OPEC and other producers to rein in production. Drone

and missile attacks on two of its biggest facilities in September

temporarily slashed production by more than half, but didn’t cause a big

surge in prices.

Aramco reiterated its plan to pay $75 billion

in dividends this year. The company needs to balance its pledge to pay

investors with spending on its upstream projects -- maintaining oil

production and expanding fields -- and boosting its global refining and

chemical operations -- the downstream segment of the business.

“Aramco

can restructure the strategy to concentrate more on the upstream

expansion rather than downstream,” said Mazen Al-Sudairi, head of

research at Al Rajhi Capital. “They can do it easily from their cash

flow. But it might affect the money transfer to the government for one

or two quarters.”

Brent crude averaged $64.12 a barrel in 2019 compared with $71.67

the previous year. Saudi production slipped to an average of 9.83

million barrels a day from 10.65 million in 2018, according to data

compiled by Bloomberg. Aramco restored output to pre-attack levels by

early October.

Aramco’s 2018 net of $111 billion

made it by far the world’s most profitable company, exceeding the

combined incomes of some of the world’s biggest companies including

Apple Inc., Samsung Electronics Co. and Alphabet Inc.

— With assistance by Verity Ratcliffe

Friday, March 13, 2020

Trump to buy oil for strategic reserve to aid energy industry: ‘We’re going to fill it’

https://www.cnbc.com/2020/03/13/trump-asks-energy-department-to-purchase-oil-for-the-strategic-petroleum-reserve.html

- President Donald Trump on Friday said he’s directed the U.S. Department of Energy to purchase crude oil for the Strategic Petroleum Reserve.

- The move was made in an effort to assist U.S. energy producers, which have been battered this week amid an oil price war between OPEC and Russia.

- “We’re going to fill [the strategic reserve] right up to the top, saving the American taxpayer billions and billions of dollars, helping our oil industry,” Trump said.

President Donald Trump

on Friday said he’s directed the U.S. Department of Energy to purchase

crude oil for the Strategic Petroleum Reserve in an effort to support

the battered energy sector.

“Based on the price of oil, I’ve also

instructed the Secretary of Energy to purchase at a very good price

large quantities of crude oil for storage in the U.S. strategic

reserve,” Trump said.

“We’re

going to fill it right up to the top, saving the American taxpayer

billions and billions of dollars, helping our oil industry [and

furthering] that wonderful goal — which we’ve achieved, which nobody

thought was possible — of energy independence,” he added.

The administration’s move to purchase oil comes after the worst week for crude since 2008

as investors worried over evaporating demand from the coronavirus

pandemic and a production ramp-up by top producers. The sell-off in

crude whacked the equity of the largest energy companies in the U.S.,

with Exxon Mobil and Chevron down 20% and 12% respectively over the week.

But following Trump’s announcement on Friday, crude futures jumped 5% following the president’s announcement.

“It

is a fantastic idea. The SPR is one of the few levers that the U.S. can

pull in times of oil market tumult,” said John Kilduff, founding

partner of Again Capital. “It has served the country well when supplies

get tight or otherwise become unavailable during times of natural

disasters or geopolitical turmoil. Releases of supplies have served to

short-circuit price rallies in the past, and this filling may well serve

to ebb the current sell-off.”

Cheap oil from Saudi Arabia, the

world’s largest exporter, and the United Arab Emirates is aggravating

the pressure on prices after talks to cut production with Russia soured

late last week. Russia, the world’s second-largest producer, does not

appear willing to return to its agreement with the Organization of the

Petroleum Exporting Countries (OPEC), which has kept oil in a range around $30 a barrel for much of the last week.

For the week, Brent is set to fall around 24%, the biggest weekly decline since December 2008, when it fell nearly 26%.

“As

of the latest data (March 6) the SPR was 92 million bbl short of

capacity. This is the perfect time to top it up: prices are low and

we’re engaged militarily in the Middle East. For once, Russia’s loss is

our gain,” said Scott Nations, chief investment officer

of NationsShares.

Oil and gas lobbyists met with White House policy staffers

Wednesday morning to discuss the administration’s response to the

economy, OPEC price war and the coronavirus, a representative for the

American Petroleum Institute told CNBC. Meanwhile, the Energy Department

had on Tuesday suspended the sale of crude oil from the Strategic

Petroleum Reserve that would have put more oil into the market.

The

move to purchase more oil for the U.S. reserve also came as part of the

administration’s response of supporting the American economy that’s

trying to determine to what extend the novel coronavirus will impact

growth. Trump declared a national state of emergency in his Friday speech from the Rose Garden.

— CNBC’s Pippa Stevens and Lauren Hirsch contributed reporting.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

Subscribe to:

Comments (Atom)