Closeup of construction site in China. Stock image.

https://www.mining.com/web/chinas-property-pain-deflates-overhyped-iron-ore-market/

After a bullish start to 2023, iron ore is struggling with the reality that China’s property sector — the steelmaking material’s largest demand driver for two decades — is still far from a robust recovery.

President Xi Jinping’s flagship campaign to squeeze debt from the real estate sector has stifled commodities demand, as developers focus on completing existing projects with few new ones in the pipeline. That’s crimped the appetite for iron ore and metals during a period when building sites should be buzzing.

“Developers are very reluctant to start new projects outside of the top-tier cities, and that’s where the bulk of steel demand used to come from,” said Tomas Gutierrez, an analyst at Kallanish Commodities Ltd. Iron ore was “overhyped” as the price rallied late last year into March, he added.

China’s steelmakers are already losing money and cutting output in an ominous sign for global miners. Prices for iron ore to copper — and the fortunes of major producers such as BHP Group and Rio Tinto Group — have been tied to the nation’s property booms and slowdowns since 2000.

Chinese mills monitored by the country’s statistic bureau made a first-quarter loss for the first time in more than a decade, according to data from the National Bureau of Statistics released Thursday.

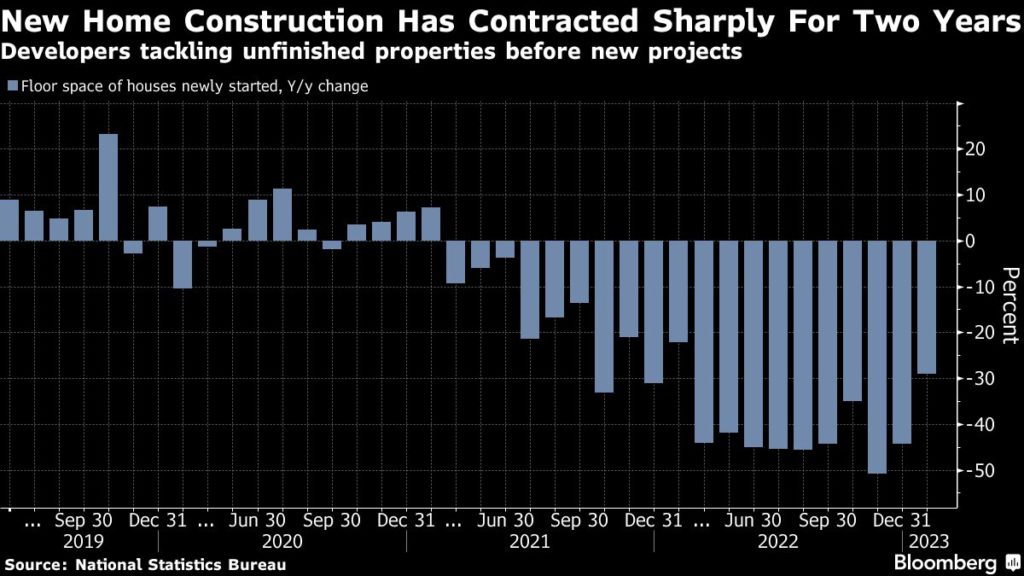

Still shrinking

China’s economy grew at the fastest pace in a year during the first quarter, and several banks recently raised growth forecasts, but the rebound has been patchy. The recovery has been led by consumer sectors, with the government so far reluctant to unleash major stimulus.

While real estate has turned a corner in terms of prices and sales this year, fresh investment is still falling. Property starts will decline 12.5% in 2023, according to Hong Kong-based consultancy Real Estate Foresight. Citigroup Inc. is even more pessimistic, with a forecast for a 40% contraction.

“China’s property sector is not completely out of the woods and steel consumption from the sector is unlikely to see a meaningful turnaround this year,” Citi analysts including Max Layton wrote in a note this week.

Iron ore slipped to $99.90 a ton on Wednesday in Singapore before rebounding, and was down 0.7% at $104.40 as of 3 p.m. local time Thursday. Prices are down around 16% in April, heading for the biggest monthly drop since October, after surging above $132 in mid-March.

‘Missed expectations’

The property sector typically accounts for between a third and half of metals use in China, and the construction malaise has fed into base metals. Copper fell to the lowest level in a month on the London Metal Exchange this week, while aluminum was down for a sixth session on Thursday.

“Chinese copper demand has missed expectations,” Ni Hongyan, the vice president of trading firm Eagle Metal International Pte Ltd. told an industry conference this week in Shandong province. She expects prices to go even lower, under pressure also from US monetary tightening and financial stress.

Copper and aluminum are used more in the later stages of construction and are less exposed to the slump in new housing starts. The price of steel rebar, used to reinforce concrete buildings, has collapsed close to the lowest since early November, a bleak period when China’s Covid curbs were wreaking havoc across the economy.

Infrastructure spending

The prospect of more global supply and warnings from Beijing about cracking down on speculation have also been weighing on iron ore of late. China is also planning to cap steel output this year, which would theoretically limit iron ore buying and spur a partial switch to scrap steel.

The demand outlook is not universally gloomy, however, notably for infrastructure, with Chinese provinces planning to boost spending on major construction projects by almost a fifth this year. Fixed-asset investment rose modestly in the first quarter and economists expect that to accelerate as the year goes on.

“We think stimulus policies gave a boost to the strong infrastructure demand at the beginning of the year, and expect infrastructure investment to stay resilient in 2023,” said Chaohui Guo, a commodity analyst at China International Capital Corp. Still, a smooth recovery in other sectors of the economy will reduce the need for a steel-intensive infrastructure splurge, they said.

For now, China’s steel industry sounds increasingly pessimistic, with the major industry association warning this week that prices would remain weak and volatile for the rest of this year. Mills need to save cash and exert caution on inventories and production in the face of “severe challenges,” the China Iron & Steel Association said.

(With assistance from Winnie Zhu, Tom Hancock and Fran Wang)