Edward Chang

Security, Middle East

The risk of miscalculation is now significantly higher.

The Real Threat to America: Iran May Close the Strait of Hormuz

President of Iran Hassan Rouhani threatened

to close the Strait of Hormuz in response to potential sanctions that

could be levied upon Iranian oil exports, threats which were echoed by

the Islamic Revolutionary Guard Corps (IRGC). President Donald Trump has

given countries until November 4, 2018, to stop importing petroleum

from Iran. This wide-scale ban is part of a new campaign of

confrontation and pressure against the Islamic Republic. This demand

comes on the heels of the U.S. departure from the Joint Comprehensive

Plan of Action (JCPOA), also known as the Iran nuclear deal, which was

signed in 2015.

During

negotiations, the JCPOA was marketed as the only option for curtailing

Iran’s nuclear program short of war. Supporters of the deal routinely

cited an increased risk of war in their arguments against exiting the

deal and Rouhani’s statement, on the surface, appears to confirm such

concerns. But how seriously should these threats be taken?

We’ve Been Here Before

Iran threatening to close the Strait of Hormuz is nothing new. In fact, as recently as 2012, the Obama administration

had its own confrontation with Iran over the latter’s nuclear program.

Iran threatened to close the Strait and carried out military exercises

in the area, drawing a major United States, British, and French

deployment in response. But a year later, both sides resorted to

negotiations that led to the JCPOA.

In

2008, citing fears of a U.S. or Israeli attack, the commander of the

IRGC, Mohammad Ali Jafari, threatened to close the Strait of Hormuz in

retaliation. During the 1980–88 Iran-Iraq War, both sides targeted one

another’s shipping as part of a total war effort, raising fears that

Iran might attempt to make the Strait of Hormuz unpassable. Iran used

mines as part of its strategy, eliciting an operation to safeguard

Kuwaiti shipping, codenamed Operation Earnest Will. Beginning in summer

1987, it lasted over a year-and-a-half and involved increasingly direct

combat between the United States and Iran, culminating in Operation

Praying Mantis in spring 1988. In the one-day air/naval battle, the

United States scored a decisive victory, with Iran losing several

warships during the exchange, while inflicting no losses in return.

Apart

from the events that took place from 1987–88, none of these incidents

resulted in open warfare. This is nothing short of remarkable, given the

unrelenting level of hostility exhibited on both sides since the

November 4, 1979, seizure of the U.S. embassy in Tehran. While the lack

of actual fighting can be attributed to restraint and professional

crisis management skills on the part of the United States, it can also

be attributed to the fact that Iranian behavior and rhetoric regarding

the Strait primarily serves as a means of crisis-management (albeit a

dangerous one) and a political purpose.

Threatening Closure Is More Useful than Executing One

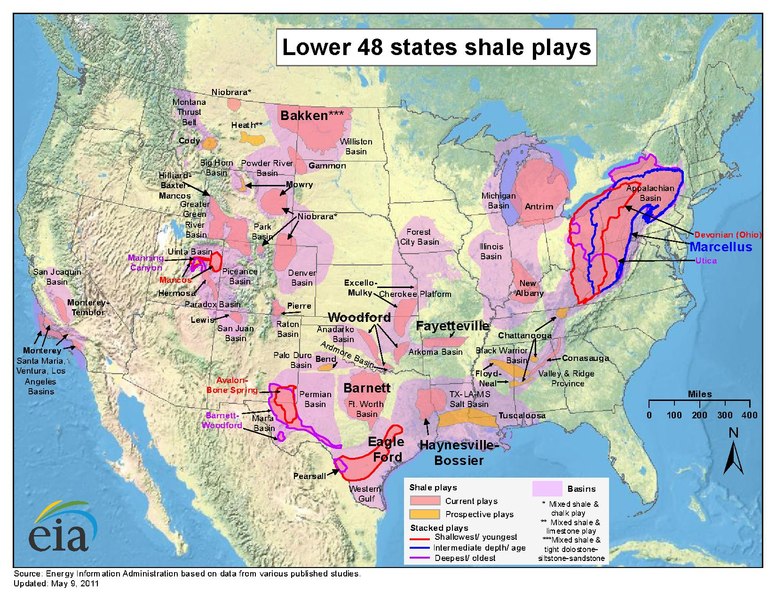

Eighty-five

percent of Iran’s imports come through the strait, and the oil exports

so crucial to the Iranian government’s solvency mostly flow out of it.

Iran would be cutting off its own lifeline if it closed the strait, and

it would have to live on its already dwindling currency reserves. Iran

would also be inviting attacks on its own oil facilities by vengeful

neighbors, and it would isolate itself internationally.

So,

in contemplating any Strait of Hormuz closure scenario, it should

immediately be noted such a move by Iran amounts to one of desperation,

employed only in a situation in which Tehran sees no other way out of

its predicament. Therefore, a Strait closure is unlikely, the United

States is well-aware of this, and the Iranian leadership probably

realizes Washington can call its bluff any time. So why does Tehran

continue to make such threats?

By

threatening to close the vital waterway linking the oil-rich Persian

Gulf with the world, through which approximately a third of the world’s

petroleum is ferried, Iran stokes fears of war and economic crisis. This

not only raises gas prices in anticipation of supply disruptions, but

it also influences world opinion towards the direction of de-escalation,

which would pressure the United States to back away from its own red

lines. Given the number of countries that rely on Middle Eastern oil,

including that of Iran, Tehran can craft a damning narrative that shows

that the United States is generating a crisis to the world’s detriment.

These

narratives work well at home, too. Like most autocracies, the Islamic

regime regularly employs crises to establish political dominance and

domestic order. The sights and sounds of Iranian naval forces

challenging and harassing U.S. warships serves powerfully as propaganda,

encouraging unity against the “Great Satan” that is America.

And

while the United States has the capability to prevent a closure or

re-open the Strait, the physical and political costs of such an

undertaking are considerable. Assuming Iran would attempt a closure only

when it feels it has no other recourse, it would then have little to

lose from doing so, while the United States and the world would bear

costs not easily recouped nor as readily borne in comparison.

What If Iran Were to Attempt a Strait Closure?

Iran’s

closure of the Strait would not involve employing its naval forces to

physically occupy the waterways in a conventional sense. Rather, it

would make the Strait impassable utilizing an Anti-Access/Area-Denial strategy

(A2/AD) strategy. For Iran, mines would form the centerpiece of this

strategy to turn the choke point into a no-go zone. Afterwards, it can

use land-based anti-ship missiles (ASMs) to prevent clearance operations

or to directly target enemy warships and civilian shipping. Should

Iranian leadership deem it necessary to deploy naval forces, the IRGC

possesses a large fleet of small fast-attack craft. Though lightly

armed, the craft can prove a menace to conventional warships, via the

use of “swarming” tactics to overwhelm adversaries and employ

“hit-and-run” attacks that are notoriously difficult to counter. On a

higher level, Iran could target United States and allied military

facilities in the region or even civilian population centers with

ballistic missiles as a means of deterrence.

The

ability of the United States and its allies to re-open the Strait of

Hormuz comes down to preparation. Should advance warning be received of

an impending closure attempt, the forces of Central Command (CENTCOM)

would mobilize and naval forces, particularly one or more aircraft

carrier strike groups would be rushed to region to force Iran to alter

its calculations or to intervene before it makes much progress in making

the waterways impassible. Should the United States and its allies be

caught off-guard, then the costs of re-opening the Strait could be

exorbitant.

For

example, Gay and Kemp estimated the cost of a Hormuz mine-clearance

operation to be $230.1 million. Even something as routine as maintaining

two carrier strike groups (CSGs) on-station for a week was estimated to

be $106 million. In the event of a more serious military confrontation,

a 2017 RAND report

calls for the deployment of, among other things, twenty-one Air Force

fighter squadrons and four CSGs. It is more difficult to estimate human

casualties, but these numbers make clear there are prohibitive up-front

costs to a crisis in the Strait of Hormuz, whether a full-blown shooting

war erupts or not.

However,

for reasons outlined earlier, the likelihood of a surprise closure is

remarkably low. The United States and its allies are well-aware of such a

possibility and have been, for decades, well-prepared for the scenario.

The military superiority of the United States and its allies all but

ensures an overwhelming defeat for the Ayatollah’s warriors. Most

importantly, a surprise closure of the Strait acts to Iran’s detriment,

unless the strategic environment is such that Tehran feels its back is

against the wall and has little to lose from such desperation.

Threatening closure is more useful than attempting one, thus, absent

exigent circumstances, Iran’s leadership will always telegraph its

intentions, if only to avoid a situation where they must choose between

backing down and losing face or following through and hazard

overwhelming defeat.

Though risk of miscalculation remains, Iran has considerably dialed back

on its hostile behavior in the Strait, while increasing its aggressive

activities elsewhere. But if Tehran wants its threats to at least be

taken seriously, it may need to again resort to maritime provocations

against commercial shipping and the U.S. military. Iran’s de-emphasizing

of the Gulf in its strategy does not appear to be something that will

last much longer.

The Israeli Wild-Card

Some observers are predicting a cataclysmic war

between the Jewish state and Hezbollah in the near future. Given

Hezbollah serves as Iran’s most prominent proxy, there are concerns such

a conflict will draw Tehran in as well, risking a major regional

conflagration. Israel has, in fact, already clashed numerous times with

Iran-backed militias in Syria in

recent weeks and months, raising the likelihood of direct warfare between Jerusalem and Tehran.

Although

Washington does not possess a mutual-defense treaty with Jerusalem, the

former would still support the latter’s war effort through the

provision of armaments, logistics, intelligence support, among other

products. Furthermore, the United States currently has troops deployed

in Syria, Iraq, Jordan, and elsewhere throughout the region, along with

the ongoing air war against the Islamic State of Iraq and the Levant

(ISIL). In the event of a war between Israel and Hezbollah, potentially

including Iran, it would take incredible diplomatic and military

maneuvering to keep the United States directly out of the conflict.

The

true course of any conflict is difficult to predict, but Washington

should consider the possibility Iran may attempt to distract American

support for Israel by threatening to close the Strait of Hormuz. By

creating it crisis on the opposite end of the Middle East, Iran is not

so much banking on forcing the United States to reduce support for

Israel, but to overstretch its commitments, and create political and

strategic costs the American people may not be willing to bear, given

the generally controversial nature of the U.S.-Israeli relationship.

Once more, the importance of narratives emerges—threatening Strait

closure mounts pressure on the White House to find a diplomatic solution

to the conflict, due to the dread and uncertainty portending a

U.S.-Iran clash would conjure.

Once

again, however, blockading Hormuz proves an ineffective move if the

United States is willing to counter Iran’s provocations. This means Iran

is more likely to respond with low-intensity, deniable warfare by

utilizing cyberwarfare its deep roster of militias and terrorist groups.

Be it Lebanon’s Hezbollah, Gaza’s Hamas, or Iraq’s Popular Mobilization

Forces, the Ayatollah is likely to call upon these players long before

seriously considering closing the Strait of Hormuz. Hezbollah, in

particular, is among the most well-connected of terrorist groups in the

world, possessing links

with Central and South American drug cartels. A worst-case scenario

would involve Hezbollah exploiting these connections to carry out

terrorism on American soil. At the very least, it can be expected that

Iranian-backed militias like the PMU can be used to attack U.S. and

coalition forces in Iraq and Syria as the anti-ISIL campaign continues.

This would force the United States/coalition to contemplate escalating

their involvement in the multiple civil wars in the region, or, to their

obvious detriment, refrain from retaliation.

Conclusion

Barring

further developments, this latest threat from Tehran to close the

Strait of Hormuz will likely pass without incident. It will, however,

create the potential for close encounters between U.S. and Iranian naval

forces in the region, leaving open a window of heightened risk of

miscalculation. Furthermore, the likelihood of a war between Hezbollah

and possibly Iran continues to grow by the day. If or when that war

happens, the United States and the coalition will find it difficult to

stay out of the line of fire.

Edward Chang is a freelance defense, military, and foreign-policy writer. His writing has appeared in the National Interest and War Is Boring.