Gold prices dropped from their highest in over a year on Wednesday as risk sentiment was buoyed by reports that Russia is ready to hold a new round of talks with Ukraine.

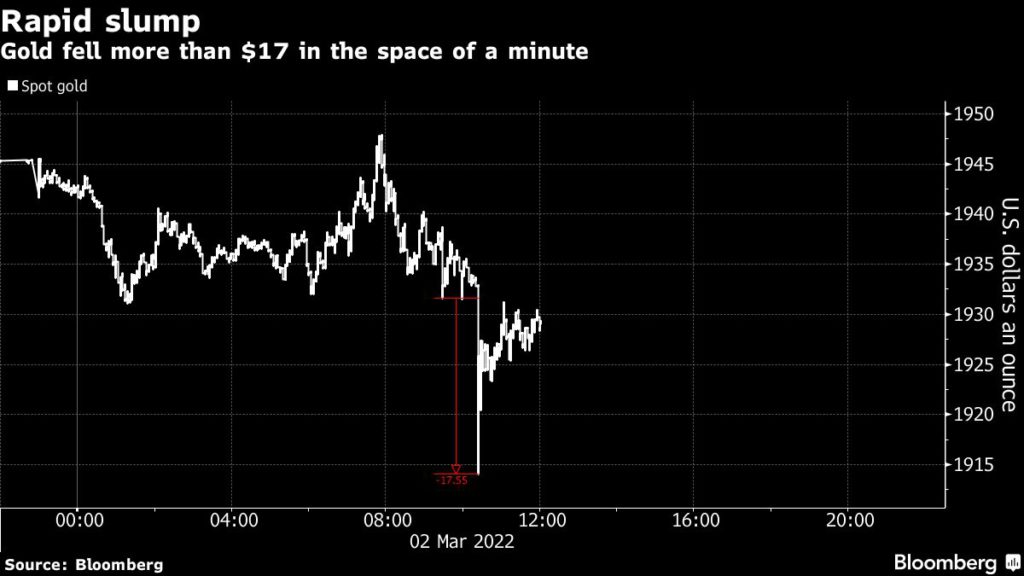

Spot gold declined 1.5% to $1,915.72/oz by 12:10 p.m. ET, still holding near a 13-month high. US gold futures fell 1.3% to $1,919.90/oz on the Comex, which saw a spike in trading volume that led to a $17 decrease within the span of a minute.

[Click here for an interactive chart of gold prices]

Meanwhile, US equities gained and bond yields edged higher after Federal Reserve Chair Jerome Powell signaled interest rate hikes could start this month despite uncertainties surrounding the military conflict in Ukraine.

Bullion is coming off its best monthly performance since May amid mounting concern that the raft of sanctions against Russia could dim the outlook for global growth and further stoke inflation. The metal has edged higher again so far in March, despite the latest blip.

Analysts told Reuters that gold’s moves may have been driven by a large sell order, though it was not clear who or what prompted the move.

Meanwhile, Commerzbank analyst Daniel Briesemann noted that gold prices could go up despite a US rate hike in March as “everything is dependent on how the Russia-Ukraine conflict develops.”

Gold-backed exchange-traded funds continued to increase their holdings over recent weeks, adding 14 tonnes on Tuesday in the biggest daily inflow in more than a month, according to an initial tally by Bloomberg.

Threats to supplies of grain, energy and metals are adding to price pressures, with a Bloomberg index of commodities jumping the most since 2009 to a record high. Gold is widely viewed as a hedge against inflation.

Traders are now dialing down rate-hike bets, including pricing out any risk of a half-point March liftoff by the Fed, according to the Bloomberg report.

(With files from Bloomberg and Reuters)

No comments:

Post a Comment