Monday, April 29, 2024

China's Oil Buyers to Weather Tighter US Sanctions on Iran

China’s private oil refiners could seek to buy more cargoes whose origin has been obscured as they prepare for fresh US sanctions on Iranian exports, ensuring crude continues to flow to the world’s top importer.

The US House of Representatives passed tougher measures against Iran over the weekend in response to an attack on Israel, promising to broaden the scope of restrictions with a series of measures targeting the country’s exports that could become law as soon as this week. The Senate voted in favor on Tuesday night of sending the legislative package for President Joe Biden’s sign-off.

China has long been wary of being caught up in the US sanctions net and the latest steps extend to foreign ports, vessels, and refineries that knowingly engage in the Iranian oil trade. Still, Iran’s exports to China are not expected to fall away.

So-called teapot refiners — private outfits clustered in Shandong province and the leading beneficiaries of US sanctions on Iranian exports — are already bracing for the increased scrutiny. According to refinery executives and traders supplying them, that will likely include buying oil that has been manipulated en route, usually via ship-to-ship transfers around Malaysia and Singapore, or near Fujairah in the Gulf of Oman.

Some may temporarily back away as a precaution, but pressure on profits is already high with margins barely at breakeven levels, traders say. Buyers may instead seek better terms as the hurdles accumulate for Iranian exporters, even sidestepping middlemen in order to lower prices.

Teapot refiners have become all but reliant on less expensive crude from sanctioned regimes in recent years, emerging in particular as the most important buyers of Iranian oil. That’s been possible thanks to sidestepping measures including the use of yuan transactions, a domestic clearing and settlement system — known as CIPS — and local financial institutions isolated from large commercial players, such as Bank of Kunlun.

Still, US officials can trace at least some physical shipments of Iranian oil with the help of ship-tracking and satellite data, and identify the entities aiding in these flows. The bigger question is whether Washington is willing to enforce the sanctions and live with the consequences, including higher gasoline and diesel prices in an election year.

Added Risk

The additional measures certainly add a “new element of risk” at a time when crude is pricier and gasoline prices are up almost 30% year to date, oil analysis firm Rapidan Energy Group wrote. Others, including consultant Energy Aspects Ltd., question whether Washington will actually move ahead and tighten its grip, risking fuel inflation and disgruntled voters.

According to official Chinese customs data, no Iranian oil has been imported by China since mid-2022.

In reality, China has taken an average of 1.2 million barrels a day of crude from Iran since the beginning of 2023, according to data compiled by Kpler. Much of these flows are passed off as cargoes of other origins, such as Malaysia, where these shipments are typically transferred from one tanker to another, allowing vessels to shuttle back to Iran for more crude.

Any new restrictions, if introduced, would affect exports amounting to between 200,000 and 500,000 barrels a day, Amrita Sen, co-founder and director of research at Energy Aspects, told Bloomberg Television earlier this week. Iranian crude and condensate exports stood at 1.5 million barrels a day in March, based on Bloomberg ship-tracking data.

No major supply disruption is expected from the US bill, Goldman Sachs Group Inc. said in a note, adding that “Iran is already facing the toughest sanctions in its history, and the effect of the broader sanctions will mostly depend on their execution.”

Oklahoma Oil Hub Getting Bigger with New Pipelines

New pipeline projects are expanding the size of an Oklahoma crude oil hub that is already one of the most important oil storage facilities in the world.

One new pipeline is in operation at the hub in Cushing, another is almost complete and a new project was announced earlier this month when Tulsa-based NGL Energy Partners revealed plans for the Grand Mesa Pipeline, a joint venture with Rimrock Midstream LLC, the Tulsa World reported Saturday.

Grand Mesa, which will be open to oil producer commitments starting next week, will be a 550-mile system from Colorado to Cushing. Once completed, the pipeline could move more than 130,000 barrels per day from production.

“The pipeline not only supports the continued growth and production in the area, but does so in a cost-effective and environmentally responsible way by reducing the current utilization of rail and truck and transportation,” according to a statement from NGL.

The Grand Mesa, if it gains sufficient commitments to be built, will be the third major pipeline connecting to the already busy Cushing hub. Enbridge is putting the finishing touches on its Flanagan South project from the Chicago area to Cushing, while Tulsa-based SemGroup completed its White Cliffs II earlier this summer.

“The additional pipeline capacity being added to deliver crude into Cushing underscores the critical role Cushing plays as a major crude oil logistics interchange and marketing hub,” Carlin Conner, CEO for both SemGroup and Rose Rock, said in a statement.

Cushing is the pricing settlement point for West Texas Intermediate crude on the New York Mercantile Exchange. The tank farms there hold more than 70 million barrels and include terminals for Rose Rock, Enbridge, Plains All-American Pipeline, Magellan Midstream Partners and others.

Flanagan South, once operational in the coming weeks, will run 600 miles and carry up to 600,000 barrels per day. The new pipeline runs nearly along the same route as Enbridge’s existing Spearhead system from the Flanagan, Illinois, terminal to Cushing.

Friday, April 26, 2024

Thursday, April 25, 2024

Wednesday, April 24, 2024

Tuesday, April 23, 2024

Monday, April 22, 2024

Judge Approves Trump’s $175 Million Bond With New Restrictions in New York Civil Case

Former President Donald Trump and New York Attorney General Letitia James reached an agreement on April 22 regarding his $175 million bond in his New York civil case, imposing additional restrictions while resolving concerns about the funds’ security.

The attorney general argued that Knight Specialty Insurance Company (KSIC) lacked a “certificate of qualification,” and that President Trump still had access to the Charles Schwab account pledged to the insurer as collateral.

Judge Arthur Engoron accepted the April 22 agreement, which gave KSIC exclusive control over the account. The state made the offer after Chris Kise, President Trump’s attorney, provided oral argument.

The attorney general established five bond conditions this morning that allow former President Trump to use a non-New York company as a traditional license surety to cover the $175 million he was ordered to pay.

KSIC is unauthorized by the New York Department of Financial Services, which bond experts see as a victory for Mr. Trump.

“[The company] is probably charging Trump less and they accepted a pledge rather than actually receiving $175 million in cash,” said Bruce Lederman, a commercial and real estate litigator who has dealt in bonds for more than 40 years.

All of Mr. Trump’s attorneys agreed to the settlement stipulations, which are expected to be memorialized by the end of the week.

The five bond conditions include retaining the collateral in a Schwab account and restricting KSIC from trading or withdrawing any of the funds for anything other than payment of the bond.

“The state was not looking to be vindictive,” Mr. Lederman told The Epoch Times. “They are looking simply to be guaranteed that they are geting paid if they win the appeal and they were sufficiently satisfied that if these five conditions were met, they would get paid.”

Another settlement condition is that KSIC must provide the state with monthly statements and the pledge agreement cannot be amended without court approval.

James’ Criticism

The bond issued by KSIC is meant to secure President Trump’s compliance with a $454.2 million judgment won by Ms. James.Ms. James had challenged the sufficiency of President Trump’s bond and cast doubt on the stability of the insurance company.

Amit Shah, president of the insurance company, demanded the court compel the attorney general to show cause, or prove the allegation that the insurance company is not sufficient.

Mr. Shah submitted a sworn affidavit explaining that KSIC now has control over a bank account of President Trump’s that will maintain $175 million cash for the duration of the appeal. The insurance company entered into a collateral agreement with the Donald J. Trump Revocable Trust. Mr. Shah submitted documents establishing that his company is in “good standing” and was approved for excess line eligibility in New York in June 2021.

KSIC is under The Hankey Group of financial companies, which includes the affiliate Westlake Financial Services LLC. The attorney general argued that Westlake was found to have “violated numerous federal laws by pressuring borrowers through the use of illegal debt collection tactics, including using phony caller ID information, falsely threatening to refer borrowers for investigation or criminal prosecution” in 2015 by the U.S. Consumer Financial Protection Bureau. The company was fined and provided $44 million in restitution to consumers.

President Trump defended the bond outside the courtroom at his criminal trial.

“We put up cash and the number is 175,” President Trump said. “She shouldn’t be complaining about the bonding company. The bonding company would be good for it because I put up the money. I have plenty of money to put up.”

Iron ore price weakens amid waning China stimulus hopes, high portside stocks

Iron ore futures prices ticked lower on Monday, weighed down by diminishing hopes of more stimulus in top consumer China, high portside stocks, and risks of possible government intervention after a price rally last week.

The most-traded September iron ore contract on China’s Dalian Commodity Exchange (DCE) ended daytime trade 0.06% lower at 866.5 yuan ($119.63) a metric ton, following a rise of more than 5% last week.

Sign Up for the Iron Ore Digest

The benchmark May iron ore on the Singapore Exchange was 0.34% lower at $116.05 a ton, as of 0705 GMT.

Iron ore prices will likely consolidate in the near term as uncertainty lingers on how much hot metal output can rise further, analysts at Everbright Futures said in a note.

“The main driving force behind a price rebound last week was the macroeconomic factor and marginally improved fundamentals,” they said, referring to improved steel margins and market confidence and continuous destocking of steel products, among others.

China left benchmark lending rates unchanged at a monthly fixing, in line with market expectations, as better-than-expected first-quarter economic data removed the urgency for Beijing to unveil fresh monetary stimulus to aid the economic recovery.

Iron ore stocks at major ports surveyed climbed by 0.5% week-on-week to 145.59 million tons as of April 19, data from consultancy Mysteel showed.

Read More: Column: China’s strong iron ore imports diverge from weak steel output

Other steelmaking ingredients on the DCE also retreated, with coking coal and coke down 0.86% and 0.73%, respectively.

Steel benchmarks on the Shanghai Futures Exchange were mostly lower. Rebar dipped 0.22%, hot-rolled coil shed 0.65%, wire rod fell 0.83%, and stainless steel edged down 0.21%.

Analysts at Guotai Junan Securities expect China’s crude steel output in 2024 to be lower than the 2023 level and steel consumption to fall further, dragged down further by the struggling property sector.

($1 = 7.2431 Chinese yuan)

(Reporting by Amy Lv and Mei Mei Chu; Editing by Subhranshu Sahu)

Friday, April 19, 2024

Thursday, April 18, 2024

Aframax rates could face further weakening in Q2 2024

https://www.vortexa.com/insights/freight/aframax-rates-could-face-further-weakening-in-q2-2024/

rude tanker rates have remained quite healthy for owners in the last couple of years, especially post the Russian invasion and the changes to trade flow and fleet behaviour patterns that followed suit.

However, seasonal and regulatory downside risks could be on the cards in the months to follow for Aframax tankers with rates currently hovering below 2023 averages, according to Vortexa Tanker Basket composed from Baltic Exchanges freight assessments.

Vortexa Crude Tanker Basket vs 2023 averages (Basket = 100 @ Feb 2021), Source: Baltic Exchange

The bedrock of Aframax employment has mainly been the transatlantic US Gulf-to-Europe crude trade. In March 2024, Aframax utilisation on this route recorded the lowest point since June 2023, a 10-month low. The return of US refineries from turnaround aligned with the start of maintenance in Europe, as well as the pickup of crude supplies sourced from the Middle East Gulf on Suezmaxes, all led to a reduction in transatlantic crude flows to Europe.

Crude MEG arrivals in Europe by vessel class (LHS, mbd) vs. US Gulf-to-Europe Aframax utilisation (RHS, no. of vessels)

The restart of European refineries from May onwards could provide some support for transatlantic flows but the already high crude inventories in Europe will likely not leave room for a considerable improvement. Moreover, the current widening of the Aframax/Suezmax freight spread for the US Gulf-to-Europe route will prompt charterers to fix on Aframax’s bigger counterparts that provide more economically lucrative opportunities.

The introduction of Russian sanctions by the West led to the development of a multi-tier fleet system that helped alleviate Aframax competition for mainstream trades. However the current increased sanctioning activity has sparked the return of Western operators to these non-Russian trades gradually increasing the competition once again.

This type of behaviour could be repeated out of Venezuela. Crude tanker voyages out of Venezuela reached an 11-month high, but fears of the re-imposition of sanctions post-18th April are looming. The share of the low-risk vessels (i.e “mainstream” fleet) operating in the trade have increased from 5% by the end of 2022 to a staggering 80% in March 2024. The increase of the mainstream fleet employment is predominantly materialised on Aframaxes (19 out of the 25 voyages), heading towards the US or performing STS operations offshore Venezuela for cargoes headed towards India and China.

Voyages out of Venezuela (no. of vessels)

Prospective US sanctions on Venezuela, especially if the initial waivers to US cease to exist, will mean that the high-risk vessels/dark fleet would once again raise their share in the Venezuelan trade – predominantly on VLCCs – at the expense of mainstream Aframax operators that will likely seek new opportunities elsewhere.

A complete “ousting” of the mainstream Aframax from the Venezuelan and Russian trade will also hamper the mainstream fleet voyage mileage. Looking from the start of 2023, when Venezuela waivers and the EU ban on Russian crude were primarily introduced, the transportation of the respective grades on Aframaxes has added on average 25% on global voyage mileage.

Aframax laden voyage mileage: global & excl. Venezuela and Russian grades vs. % difference (RHS)

Although the majority of signals point towards the continuation of a downwards trend for Aframax tankers, there might be a silver lining in terms of employment boost. The Venezuela sanction re-introduction will naturally increase demand for the dark fleet, potentially attracting tonnage that is currently utilised in Russia. This could pave the way for mainstream operators to raise exposure in the Russian trade under the price cap, shall the sanctioning activity led by the US and the UK, which is gradually eliminating non-Western linked shipowners to transport Russian oil to countries like India, continues to take place.

Wednesday, April 17, 2024

Maine Governor Allows National Popular Vote Legislation to Become Law

Maine Gov. Janet Mills said she will allow a narrowly passed bill that would award the state’s four electoral college votes to go toward the winner of the National Popular Vote to become law, as opposed to the current system where the votes go either to the winner of the state’s popular vote or according to the results in each of congressional district—as is the case in Maine.

A group known as the National Popular Vote (NPV) is behind a push for states to enter into a “National Popular Vote Interstate Compact” that would hand the presidency to whoever gets the greatest number of popular votes at the national level.

Rather than abolishing the Electoral College, this would require presidential electors in the states and the District of Columbia to vote for the candidate who gets the most popular votes overall, which would see the outcome of the election decided by the views of those living in major population centers like Los Angeles and Houston instead of by entire swing states.

Maine’s legislation passed the State House of Representatives on April 2 by a slim 73 to 72 margin. It cleared the Senate the following day by an 18 to 12 vote.

She opted to give her approval to the bill without a signature. Maine’s Constitution gives governors three options to legislation that arrives at their desk: to sign a bill into law, veto it, or allow it to become law without their signature.

Supporters of the legislation argue that electing a president based on who has more support among voters in a state but not nationwide doesn’t make sense, and that the new system under the “National Popular Vote Interstate Compact” would make everyone’s vote count the same, no matter where they live.

Critics of the compact argue that the legislation is a shortcut to bypass the U.S. Constitution because such a change in the way the president is elected should involve a constitutional amendment. A constitutional amendment must be passed by a two-thirds majority in the U.S. Congress and ratified by three-quarters of the states.

They also warn it would ultimately stifle the voices of voters in smaller, rural states like Maine.

“I struggle to reconcile the fact that a candidate who has fewer actual votes than their opponent can still become President of the United States,” she said.

“Absent a ranked-choice voting circumstance, it seems to me that the person who wins the most votes should become the President. To do otherwise seemingly runs counter to the democratic foundations of our country,” Ms. Mills added.

Currently, under the electoral college system, delegates are assigned to states based on how residents are represented in Congress. States with bigger populations get more representatives in the House. But each state—no matter its population—also gets two senators to represent its interests. Electoral college delegates for most states—except Maine—have voted under a state-wide “winner-takes-all” system, where they put their vote behind the presidential candidate who wins the popular votes in their state.

The National Popular Vote Interstate Compact would change this to a “winner-takes-all” system based on the national popular vote, which needs the support of 270 delegates for participating states to determine who to send straight to the White House.

Currently, the pact’s members collectively control 205 electoral votes—65 votes short of what it needs to be effective.

Ms. Mills said that the bill that passed the Legislature in Maine is not irreversible.

“Still, recognizing that there is merit to both sides of the argument and recognizing that this measure has been the subject of public discussion several times before in Maine, I would like this important nationwide debate to continue. And so I will allow this bill to become law without my signature,” she said.

Maine has now joined 15 other states and the District of Columbia to adopt the compact. California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, Massachusetts, New Jersey, New Mexico, New York, Oregon, Rhode Island, Vermont, and Washington have all passed similar legislation.

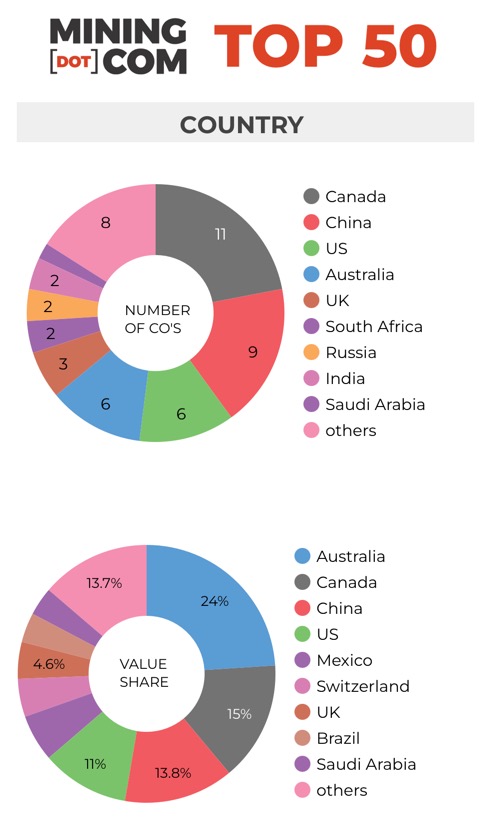

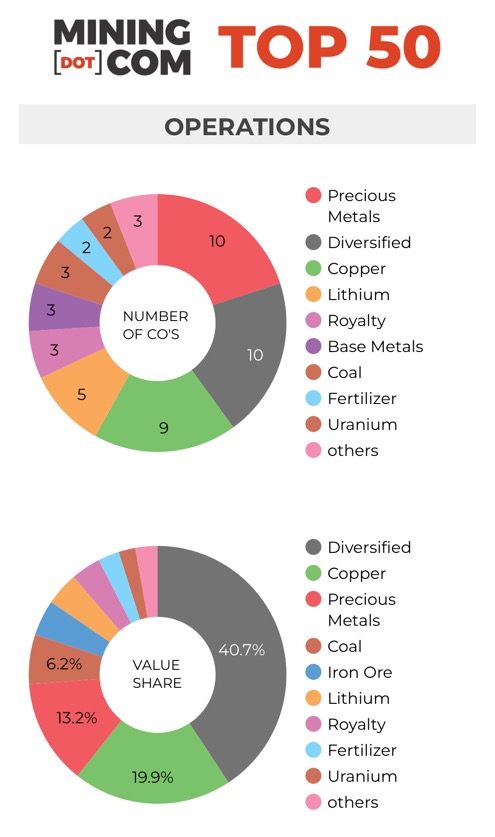

Big 5 diversified mining companies are having a rough 2024

https://www.mining.com/big-5-diversified-mining-companies-are-having-a-rough-2024/

At the end of the first quarter 2024, the MINING.COM TOP 50* ranking of the world’s most valuable miners had a combined market capitalization of a shade under $1.4 trillion, down $13 billion since the start of the year.

The historic gold run and copper’s comeback, up 14% and 12% so far in 2024, only kicked into a higher gear after the end of the March quarter, but copper and gold counters nevertheless dominate the best performer list for Q1.

Sign Up for the Battery Metals Digest

The lacklustre combined performance of the sector’s majors came despite the revival in the bellwether metals, but the broader market has been a mixed bag in 2024.

Aluminium is trading not far off 52-week highs, but zinc seems unlikely to breach $3,000 a tonne any time soon and cobalt is bobbing along historic lows below $30,000 a tonne.

Nickel has been bumped up after lows in the mid-$15,000s last year, but remains firmly stuck in bear territory and lithium’s 2024 good fortune also looks in danger of petering out.

Sentiment towards PGMs has hardly improved with both platinum and palladium drifting lower in 2024. Even iron ore prices back above $100 a tonne – the bread and butter of the diversified majors – was not enough for investors to jump back into the sector.

Gold, copper boost

First Quantum Minerals with market valuation up 58% in US dollar terms, made a welcome return at position 44 after dropping out at the end of last year following the closure of its Cobre Panama mine.

Amman Mineral continued its astounding run – the Indonesian copper and gold miner has added 380% in value since its July listing and could soon vie for a place in the top 10.

Lundin Mining joins the top 50 for the first time, jumping five places to 48 and is already climbing thanks to the red metal approaching 14-month highs. Lundin’s 25% rise in 2024 also restores Vancouver as the number one location among top 50 headquarters after Pilbara Minerals’ exit this quarter.

Anglogold Ashanti’s re-entry boosts the number of precious metals miners in the top tier to 10 and their collective value to $183 billion.

China’s Yintai Gold, which in February picked up Canada’s Osino Resources, could also challenge for a position in the upper echelon from its current 54th position should gold continue to rally, but long term top 50 participant KGHM has a hill to climb to make it back despite shares in the Polish mining company rising 15% year to date.

Pan American Silver, like its primary metal, could ride gold’s coattails to become the only silver-focused miner in the top 50 following Fresnillo’s exit more than a year ago. Silver is now the best performing metal year to date, up more than 18%.

Diversified drubbing

While the top 50 mining companies as a whole drifted sideways during the quarter, the largest diversified companies faced headwinds going into 2024, and uncharacteristically some of the biggest names in mining feature on the worst performers list for the quarter.

The only $100bn companies in the ranking – BHP and Rio Tinto – were both down by double digits at the end of Q1 and Glencore’s rerating over the past couple of years went into reverse with declines of 9% in 2024.

Vale’s pullback from its valuation at the end of 2023 places the stock firmly in bear territory with losses of nearly 24% in US dollar terms. The Brazilian giant sold 13% of its base metals unit for $3.4bn to amongst others, the Saudi Arabia’s sovereign wealth fund, but given the performance of nickel a separate listing seems off the table for now.

Anglo American stock had a fairly uneventful Q1 2024 after the sharp H2 2023 sell-off sparked by copper guidance, PGM and South African power woes, and despite the bad news from its Woodsmith fertiliser project in England.

Nevertheless, the counter has dropped below a $30 billion market cap for the first time since the outset of the pandemic and losses for the past 12 months top 30%. Rumours that Glencore may be interested after the Swiss behemoth’s bid for all of Teck Resources fell through have died down, probably for the right reasons.

The ranking remains top heavy, but as a group the historic top five diversified mining companies’ share of the MINING.COM Top 50’s overall valuation fell to a new low of 29%, down from 36% at the end of 2022.

China cheer

The historic top 5 diversifieds should in fairness be expanded to seven and include Saudi Arabia’s Ma’aden and Zijin Mining, the highly acquisitive Chinese firm is up over 30% so far this year and appears to be well ensconced in the top 10.

Xiamen-based Zijing at the end of Q1 fell just short of a $60bn market worth (indeed gold and copper’s run in the first week of Q2 has now lifted the stock above that milestone).

On the best performer list for the quarter, Zijin sits just behind CMOC Group, formerly China Molybdenum and for years before being overtaken by Zijin the most valuable middle kingdom mining stock, and ahead of Jiangxi Copper, which jumps 9 places to 41 in Q1.

The 10 Chinese companies in the ranking collectively are worth $192bn or 14% of the overall value, up from 8 companies valued at $115bn and 9% of three years ago.

Lithium loss

Three counters dropped out of the top 50 during the first quarter. Brazil’s CSN Mineração, an iron ore miner, China’s Huayou Cobalt and Australian lithium producer Pilbara Minerals.

Pilbara Minerals only just lost out to Kinross Gold for the last spot as at end-March and lithium prices have recovered somewhat this year, but probably not enough for the lithium sector to outperform gold stocks in Q2.

The merger of Livent and Allkem to form Arcadium Lithium also did not result in an increase in lithium mining’s representation in the ranking. Arcadium Lithium has been hammered down to below a $5bn valuation this year.

From its height of a collective $119bn valuation at the end of the second quarter of 2022, the combined value of the lithium stocks in the top 50 has now fallen to $59 billion.

Click on the table below for a full-size image.

*NOTES:

Source: MINING.COM, GoogleFinance, stock exchange data, company reports. Share data from primary-listed exchange at March 28, 2024 – March 29, 2024 close of trading converted to US$ at cross-rates March 29, 2024.

Percentage change based on US$ market cap difference, not share price change on exchange in local currency.

As with any ranking, criteria for inclusion are contentious. We decided to exclude unlisted and state-owned enterprises at the outset due to a lack of information. That, of course, excludes giants like Chile’s Codelco, Uzbekistan’s Navoi Mining, which owns the world’s largest gold mine, Eurochem, a major potash firm, and a number of entities in China and developing countries around the world.

Another central criterion was the depth of involvement in the industry before an enterprise can rightfully be called a mining company.

For instance, should smelter companies or commodity traders that own minority stakes in mining assets be included, especially if these investments have no operational component or warrant a seat on the board?

This is a common structure in Asia and excluding these types of companies removed well-known names like Japan’s Marubeni and Mitsui, Korea Zinc and Chile’s Copec.

Levels of operational or strategic involvement and size of shareholding were other central considerations. Do streaming and royalty companies that receive metals from mining operations without shareholding qualify or are they just specialised financing vehicles? We included Franco Nevada, Royal Gold and Wheaton Precious Metals on the basis of their deep involvement in the industry.

Vertically integrated concerns like Alcoa and energy companies such as Shenhua Energy or Bayan Resources where power, ports and railways make up a large portion of revenues pose a problem. The revenue mix also tends to change alongside volatile coal prices. Same goes for battery makers like CATL which is increasingly moving upstream, but where mining still makes up a small portion of its valuation.

Another consideration is diversified companies such as Anglo American with separately listed majority-owned subsidiaries. We’ve included Angloplat in the ranking but excluded Kumba Iron Ore in which Anglo has a 70% stake to avoid double counting. Similarly we excluded Hindustan Zinc which is listed separately but majority owned by Vedanta.

Many steelmakers own and often operate iron ore and other metal mines, but in the interest of balance and diversity we excluded the steel industry, and with that many companies that have substantial mining assets including giants like ArcelorMittal, Magnitogorsk, Ternium, Baosteel and many others.

Head office refers to operational headquarters wherever applicable, for example BHP and Rio Tinto are shown as Melbourne, Australia, but Antofagasta is the exception that proves the rule. We consider the company’s HQ to be in London, where it has been listed since the late 1800s.

Please let us know of any errors, omissions, deletions or additions to the ranking or suggest a different methodology.

Vale operations in Brazil now 100% renewable energy-powered

https://www.mining.com/vale-operations-in-brazil-now-100-renewable-energy-powered/

Vale (NYSE: VALE) announced Monday it had achieved its goal of running all of its Brazilian operations based on renewable energy sources, two years earlier than the scheduled target of 2025.

The Rio de Janeiro-based top iron and nickel producer said that 100% of the electricity used in its local operations last year came from green sources, such as hydroelectric, wind and solar power plants.

Sign Up for the Energy Digest

With this milestone, Vale has eliminated its indirect CO2 emissions in Brazil, corresponding to scope 2. The company still faces the challenge of reaching 100% renewable energy consumption in its global operations by 2030. Currently, this figure stands at 88.5%.

Vale’s decarbonization strategy aims to reduce its scope 1 and 2 carbon emissions (direct and indirect) by 33% by 2030 and to become net-zero by 2050.

“As we are progressing on our targets, we are helping to make Brazil’s energy matrix even cleaner, contributing to society’s fight against climate change,” Vale’s director of Energy and Decarbonization, Ludmila Nascimento, said in the statement.

Vale said starting up the Sol do Cerrado solar complex in November 2022 was key to achieving the target two years ahead of schedule.

Located in the state of Minas Gerais, this complex represented an investment of $590 million and it is considered one of the largest solar energy parks in Latin America.

While it has an installed capacity is of 766 Megawatts-peak, equivalent to the consumption of a city of 800,000 inhabitants, the complex has the potential of contributing to around 16% of all the electricity consumed by Vale in Brazil, the company said.

Three decades long journey

Vale began its journey towards 100% renewable energy consumption in the 1990s with the acquisition of its first hydroelectric plants.

The company’s activities are now powered by a renewable energy portfolio with an installed capacity of 2.6 GW, equivalent to the energy consumption of over 3 million people.

The company holds 14 assets through direct and indirect participation, including ten hydroelectric plants, three wind farms, and Sol do Cerrado. If it functioned as a power generator, Vale would rank as the 15th largest in the country.

On a global scale, the mining giant is investing in joint venture partnerships, renewable generation certificates in contracts (PPAs), and innovation initiatives to enhance battery efficiency.

Vale is also focused on reducing its direct Scope 1 emissions. In the mining and railroad sectors, where diesel (a fossil fuel) is currently heavily used, the company is exploring the adoption of alternative fuels, such as ethanol for trucks and green ammonia for locomotives. Additionally, in the pelletizing furnaces, the plan is to substitute anthracite, a type of mineral coal, with zero-emission biocarbon produced from the carbonization of biomass.

Vale inked a deal with Wabtec in 2023 for the provision of three electric locomotives and initiated studies on the development of a green ammonia-powered locomotive engine.

It also successfully produced pellets using 100% biocarbon for the first time in an industrial test last year. Pellets production accounts for 30% of the firm’s direct emissions.

China’s March iron ore imports edge up, steel exports near 8-year high

https://www.mining.com/web/chinas-march-iron-ore-imports-edge-up-steel-exports-near-8-year-high/

China’s iron ore imports in March rose about 0.5% from a year earlier, customs data showed on Friday, amid expectations that demand will pick up after the Lunar New Year holiday break as steelmakers typically ramp up production.

The world’s largest iron ore consumer brought in 100.72 million metric tons of the key steelmaking ingredient last month, data from the General Administration of Customs showed.

Sign Up for the Iron Ore Digest

That compares with 97.51 million tons imported in February and 100.23 million tons in March 2023.

The relatively high level of imports were probably driven by expectations steel mills would resume production in March, which would then push up ore demand, said Chu Xinli, a Shanghai-based analyst at China Futures.

But demand was much weaker-than-expected last month, which together with the high imports contributed to a pick-up in portside stocks and a steep drop in prices.

Iron ore inventories at major Chinese ports rose 5.3% to 142.1 million tons by the end of March, the highest since late February 2023, while ore prices tumbled over 13%, data from consultancy Steelhome showed.

China’s iron ore imports in the first quarter of 2024 totalled 310.13 million tons, up 5.5% from a year earlier, customs data showed.

“Fewer weather-related disruptions on shipments from major suppliers Australia and Brazil also played a role in high imports,” Pei Hao, a Shanghai-based analyst at international brokerage FIS, said.

Imports in April will likely rise further on a monthly and an annual basis, Pei added.

“Seaborne cargoes in late March and the first half of April remained at a relatively high level, and this may mean that it’s hard to see a big reduction in import volumes this month.”

Steel trade

With domestic demand not recovering as much as expected, China’s exports of steel products rose by 25.35% in March year on year to 9.89 million tons, the highest since July 2016.

The March volume brings the total in the first quarter to 25.8 million tons, the highest for the period since 2016 and a rise of 30.7% year on year, customs data showed.

China’s imports of steel products in March declined by 9.26% to 617,000 tons, with the total for January-March falling 8.6% year-on-year to 1.75 million tons.

(By Amy Lv and Andrew Hayley; Editing by Himani Sarkar and Kim Coghill)

US Steel shareholders approve Nippon Steel’s $14.1 billion takeover offer

https://www.mining.com/web/us-steel-shareholders-approve-nippon-steels-14-1-billion-takeover-offer/

United States Steel Corp. shareholders voted in favor of a $14.1 billion takeover offer

by Nippon Steel Corp., leaving the fate of the deal for the iconic

American steelmaker to the realm of US regulators and politics.![]()

Investors of US Steel endorsed the Japanese steelmaker’s $55-a-share offer at a special shareholders’ vote Friday with more than 98% approval, the company said in a statement. The vote was widely expected to pass. Attention now shifts to a pending US regulatory review for an offer that has become mired in a political firestorm in a US presidential election year.

Sign Up for the Iron Ore Digest

Shares of Pittsburgh-based US Steel fell 2.6% to $41.13 at 1:52 p.m. in New York.

Nippon Steel agreed in December to buy US Steel at a significant premium, but the deal was quickly met with pushback from union workers who operate most of the US steelmaker’s plants and influential politicians who voiced concerns about foreign ownership. President Joe Biden and presumptive Republican presidential nominee Donald Trump both oppose the deal as they vie for blue-collar votes in key swing states ahead of November’s election.

Biden has called for domestic ownership and announced his support for US workers, raising doubts on whether Nippon Steel can succeed in closing the transaction.

“Irrespective of the shareholder vote, we continue to expect this ultimately is decided by the White House,” Timna Tanners, an analyst at Wolfe Research, said in an interview.

Nippon Steel’s all-cash offer carries a 142% premium to US Steel’s share price on the last day of trading before the US company announced a strategic review.

Beyond politics, the takeover must pass a review by the Committee on Foreign Investment in the United States, or CFIUS. The review is unlikely to conclude until late this year and may extend into 2025, people familiar with the matter said in January. Such a time frame — already much longer than what the companies signaled — thrusts the takeover into the middle of the US election campaign.

US Steel and Nippon Steel are mulling a decision to formally push back the time frame they expect to close the deal.

(By Joe Deaux)

Iron ore climbs to multi-week high on lower shipments, hopes of China stimulus

Iron ore futures prices extended their rise to hit the highest level in multiple weeks on Monday, bolstered by an obvious reduction in shipments and hopes that top consumer China will roll out more stimulus to prop up its economy.

The most-traded September iron ore contract on China’s Dalian Commodity Exchange (DCE) ended daytime trade 2.18% higher at 845.5 yuan ($116.80) a metric ton, the highest since Mar. 26.

Sign Up for the Iron Ore Digest

The benchmark May iron ore on the Singapore Exchange was 1.31% higher at $112.5 a ton, as of 0720 GMT, the highest since Mar. 11.

Dalian iron ore rose for a sixth straight trading session, while the Singapore contract rose for a third straight session.

Iron ore shipments from top suppliers Australia and Brazil tumbled by 28.8% week-on-week to 19.19 million tons in the week of Apr.8-14, data from consultancy Mysteel showed.

China’s economy is expected to have slowed in the first quarter as a protracted property downturn and weak private-sector confidence weighed on demand, maintaining pressures on policymakers to unveil more stimulus measures.

Also, new-bank lending in China rose less than expected in March from the previous month, while broad credit growth hit a record low and property woes lingered.

State-backed Chinese real estate developer Vanke said it is facing short-term liquidity pressures and operational difficulties but has prepared “a basket of plans” to stabilize its business and cut debt.

Other steelmaking ingredients on the DCE recorded gains, with coking coal and coke up 3.97% and 2.92%, respectively.

Steel benchmarks on the Shanghai Futures Exchange were mixed.

Rebar was little moved, wire rod declined 0.99%, while stainless steel added 1.2% and hot-rolled coil ticked up 0.32%.

“Given the remaining high steel stocks, a further increase in hot metal output might not be conducive to the sustainability of a price rebound,” analysts at First Futures said in a note.

China is due to release a slew of key data, including output of key commodities, property investment, and the economic growth for the first quarter, on Tuesday.

($1 = 7.2386 Chinese yuan)

(By Amy Lv and Andrew Hayley; Editing by Savio D’Souza and Janane Venkatraman)

TikTok’s Campaign of Using Influencers to Target Lawmakers Could Backfire

WASHINGTON—Key congress members and their aides say they’ve been besieged by phone calls triggered by a campaign sent out by Chinese social media giant TikTok.

Some of their constituents were delivered full-screen notifications on TikTok.

“Tell your Senator how important TikTok is to you. Ask them to vote no on the TikTok ban,” the notification said.

“Now, if the Senate votes, the future of creativity and communities you love on TikTok could be shut down.”

The notification then urged users to enter their zip code to locate their senator’s phone number.

“Okay, listen, if you ban TikTok, I will find you and shoot you,“ one female caller says as others giggle in the background. ”That’s people’s job, and that’s my only entertainment. And people make money off there, too, you know. I’m trying to get rich like that. Anyways, I’ll shoot you and find you and cut you into pieces. Bye!”

The campaign began targeting members of the House ahead of a vote by the House Energy and Commerce Committee to move the bill to the House floor without giving the normally required week’s notice. After the legislation passed the House on March 13 in a 352–65 vote, senators began receiving the same calls.

It is too early to say whether TikTok’s mobilization campaign will bear fruit. It could just as easily scare lawmakers into action against the company rather than for it.

Sen. Marsha Blackburn (R-Tenn.) is one of many in the Senate who say that TikTok’s lobbying campaign is all the more reason to swiftly sever ties between the company and China.

TikTok’s parent company, ByteDance, is headquartered in Beijing, and both companies have a dubious history of suppressing content the Chinese Communist Party (CCP) finds displeasing.

“If TikTok wants to stay in the U.S. marketplace, they need to separate from the CCP’s control—plain and simple,” Ms. Blackburn told The Epoch Times.

“The Senate should take this issue up swiftly to protect our national security interests, and we should declassify the information given to Congress so that the American public can understand the exact threat we’re facing.”

TikTok is among the world’s most popular social media platforms, with more than 150 million users in the United States, many of whom get their news primarily from the platform.

That popularity, combined with the possibility that the platform could receive editorial direction from the CCP, creates an imminent threat, according to Ms. Blackburn and others in Congress.

It is unclear how much indirect control the CCP retains over ByteDance and TikTok. However, the regime purchased a “golden share” in ByteDance’s Chinese subsidiary in 2019, which could allow it to influence how the company’s board votes on key decisions. A golden share is usually a small amount of shares, but the stake gives the owner special voting powers, including veto power.

There are also growing indicators that some influencers on the platform are coordinating with the regime, according to Chihhao Yu, co-director of the Taiwan Information Environment Research Center.

Pro-CCP propaganda is now beginning to appear on TikTok in some instances before being published on Douyin, the version of the app available in China.

“Some of these TikTok videos are published before their Douyin counterparts by [Chinese] state media,” Mr. Yu said during an April 8 talk in Washington.

“So that’s an even stronger signal, indicating that these influencers on TikTok are having at least some kind of coordination with [Chinese] actors.”

Still, Mr. Yu said that the proliferation of misinformation and foreign influence operations online isn’t unique to TikTok. Instead, he said, it’s one problem among several.

“There are two more things: the top one is personal data security, and No. 2 is the addictiveness of the platform,” Mr. Yu said.

Data Security

Ms. Blackburn likewise believes that the foremost threat posed by TikTok is that ByteDance is required by law in China to provide any data it has to the CCP upon request, including whatever sensitive personal information it may have collected on Americans through TikTok.“TikTok’s parent company, ByteDance, is tied to the Chinese Communist Party by strict laws in Beijing that force companies to hand over users’ personal data,” Ms. Blackburn said.

Federal Communications Commission Commissioner Brendan Carr warned that TikTok is being used to collect troves of information on millions of American users, including “search and browsing history, keystroke patterns, biometrics, and location information.”

Indeed, the most recent version of the TikTok legislation was crafted in large part due to the threat posed by China’s security laws.

Rep. Mike Gallagher (R-Wis.), who chairs the influential House Select Committee on Strategic Competition with the CCP, said that’s why the bill includes language to force the divestiture of any social media company believed to be under the control of U.S. foes.

“This bill is squarely focused on preventing foreign adversaries—China, Russia, North Korea, and Iran—from controlling social media apps in the U.S.,” Mr. Gallagher told The Epoch Times.

“Under ByteDance’s ownership structure, the Chinese government not only has the ability to surveil Americans’ user data but also manipulate TikTok’s algorithm and conduct influence operations on Americans’ ‘For You’ pages,” he said.

“We simply cannot continue to allow an app controlled by our nation’s foremost adversary to take over the American media landscape.”

Opposition to TikTok Ban Grows

TikTok has painted the bill as a targeted ban on its operations and an assault on freedom of speech.“This bill is an outright ban of TikTok, no matter how much the authors try to disguise it,” a TikTok spokesperson told The Epoch Times in an email. “This legislation will trample the First Amendment rights of 170 million Americans and deprive 5 million small businesses of a platform they rely on to grow and create jobs.”

Opposition to the effort against TikTok is also growing in Congress, with a small but bipartisan minority in both chambers expressing numerous concerns about the legislation.

Speaking during the House vote on the legislation, Rep. Thomas Massie (R-Ky.) suggested that the bill could become a “Trojan horse” for perpetual overreach from the executive branch as it would empower the president to force the sale of social media companies deemed even indirectly influenced by foreign powers.

“I know the sponsors of this bill are sincere in their concerns and in their effort to protect Americans,” Mr. Massie said.

“[But] We don’t need to be protected by the government from information.”

There is also the question of whether the U.S. intelligence community has independently verified any of the claims that the CCP has directed the promotion or suppression of content on TikTok through ByteDance.

For this reason, Ms. Blackburn and many others in Congress have requested that their classified briefings on the subject be made public.

Some, however, have suggested that declassification wouldn’t unveil a unique threat.

Rep. Sara Jacobs (D-Calif.) said prior to the House vote that “not a single thing” Congress has heard in its classified security briefings is unique to TikTok, but pervades all social media.

Mr. Massie also highlighted numerous contentions about the bill’s premise and legality, including the fact that Bytedance is not actually owned by the CCP or even majority-owned by Chinese investors, that the bill has no sunset clause, and that the bill would require all appeals to be handled through the District of Columbia Court of Appeals rather than the states.

There is also the issue of whether the bill is lawful, given its reliance on presidential authority, an issue that several lawmakers, including Rep. Jim Himes (D-Conn.) and Sen. Rand Paul (R-Ky.), have spoken about.

That’s because the Cold War-era Berman Amendments revoked the Executive Office’s authority to ban or regulate the free flow of any “informational materials” to American citizens, including foreign propaganda.

“One of the key differences between us and those adversaries is the fact that they shut down newspapers, broadcast stations, and social media platforms. We do not,” Mr. Himes said.

What’s Next?

For now, the bill’s future remains uncertain, though it’s clear it won’t sail through the Senate with the speed that it did the House.During his last days in office, Mr. Gallagher is playing the role of an unofficial whip, urging the Senate to take up the legislation as quickly as possible for fear that the CCP could use TikTok to promote propaganda ahead of the U.S. election cycle.

“This bill passed in overwhelming fashion with 352 votes in the House of Representatives, which I have not seen on something this important in my eight years in Congress,” Mr. Gallagher said.

“This level of support makes it impossible for the Senate to ignore. The White House has signaled that they will sign the bill if and when it passes the Senate, and I know Leader Schumer is very concerned about the threat posed by the Chinese Communist Party,” he said.

Reflecting on Taiwan’s recent experience with CCP election interference, Mr. Yu acknowledged the threat posed by the regime’s influence on social media.

Noting his three major concerns—CCP influence, data security, and addictiveness—he concluded that the freedom to speak and share ideas should not be curbed. Instead, he said, the problem of CCP misinformation would be solved by encouraging the exchange of debate and ideas rather than eliminating it.

“I think we need to address all [the] three big problems of TikTok and maybe, by extension, all social media platforms and what all these tech tools are doing to our democratic processes,” Mr. Yu said.

“Freedom of speech is why we do this—because we want a healthy democracy. It’s not because we want to get rid of something when we don’t want something in our country. We want a healthy functional debate of our country’s direction.”