https://www.russell-clark.com/p/after-lme-lch-addendum?s=r

I have been thinking about clearinghouses for well over four years now, and build a mental model for trying to understand how they get in trouble (see the early clearinghouse posts). Whenever I talk to someone about their actually experience with LCH, they tend to be very positive, and usually assure me it reduces risk, and is far better managed than LME. The problem is why did major banks, which are major customers and potential beneficiaries have such a problem with the clearinghouses? The clunk title below is basically code for the banks to say they want CCPs to hold more capital and to be put into bankruptcy if needed.

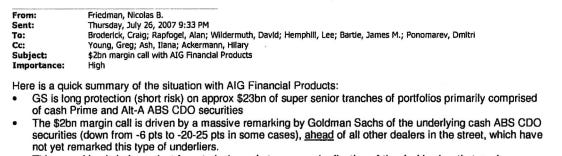

The author for Goldman Sachs is a Nicholas Friedman, who was involved in the margin call on AIG that began the GFC. If he is worried about clearinghouses, then I am worried about clearinghouses.

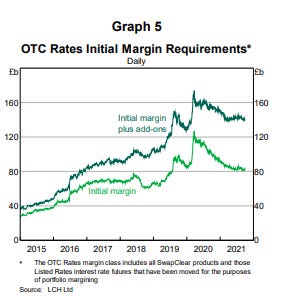

So I started asking myself, what do the banks see that the rest of the market not see? The clearinghouse offer copious information via CMPI IOSCO disclosures, but in such a way as to make it very hard to extract meaningful information. So far the best source of analysis on LCH I have found comes from the Reserve Bank of Australia’s Assessment of LCH SwapClear Service. One useful graph is the amount of initial margin held at LCH for OTC rate trades.

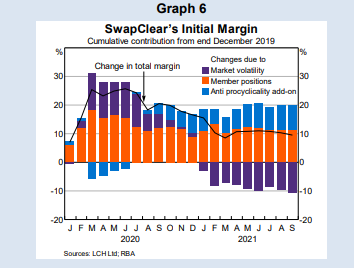

RBA also provide a useful graph on how initial margins have changed during Covid. With an initial spike dues to changes in market prices, which has fallen off, to be replaced with a some pro-cyclical charges.

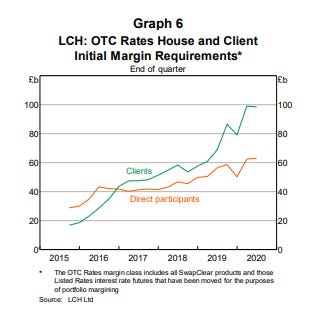

None of the above graphs provide a good reason to understand why banks are worried about clearinghouses. However, in an assessment from 2020, we find a graph that may explain banks concerns better. Banks, which are direct participants, provide far less initial margin than clients (that is clients of members), which is in stark contrast to 2015. In essence, non members are bigger players in clearinghouses than members. As a bank, you are now forced to hope that the other members have done the correct due diligence on their clients, in particular their ability to meet margin calls.

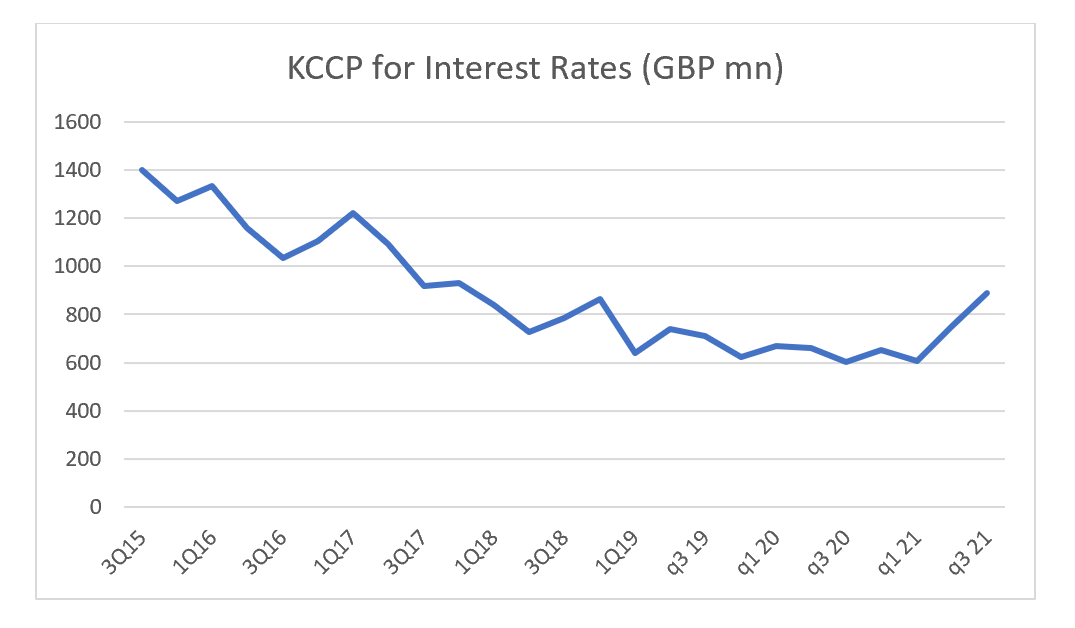

As highlighted in previous posts, I believe more “speculative” clients, and aggressive compression makes me think that clearinghouses are becoming more risky, not less risky. One way risk is priced for clearinghouses is a measure called KCCP. This quantifies the amount of capital that must be held against default fund contributions. The lower this amount, the less capital that must be held. As you can see below, from 2015 until beginning of 2021, this measure was falling. The most recent disclosure has it rising.

A universal financial truth is that risk does not disappear, but it can be moved to those best placed to bear that risk. This is a positive feature of financial markets. But another universal truth, is that complicated financial systems can often obfuscate who is really taking the risk, which leads to mispricing and a boom and eventual bust. Clearinghouses look to have moved into the latter category for me.

No comments:

Post a Comment