/https://public-media.si-cdn.com/filer/20120723113006afghanistan-map.jpg)

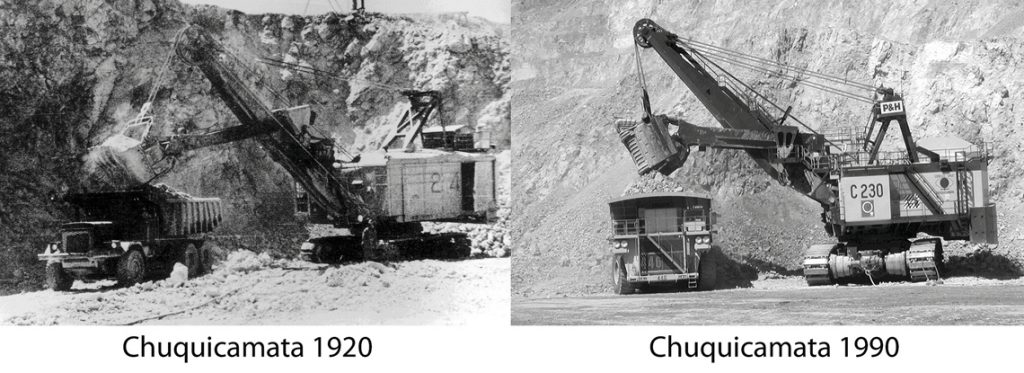

A map of Afghanistan’s resources

(USGS)

https://www.mining.com/how-afghanistans-1-trillion-mining-wealth-sold-the-war/?utm_source=Daily_Digest&utm_medium=email&utm_campaign=MNG-DIGESTS&utm_content=how-afghanistans-1-trillion-mining-wealth-sold-the-war

After

the fall of Kabul, US media regurgitates a 2010 New York Times

frontpage story on Afghanistan’s mineral riches based on a secret

Pentagon memo and a 1977 Soviet geologic map.

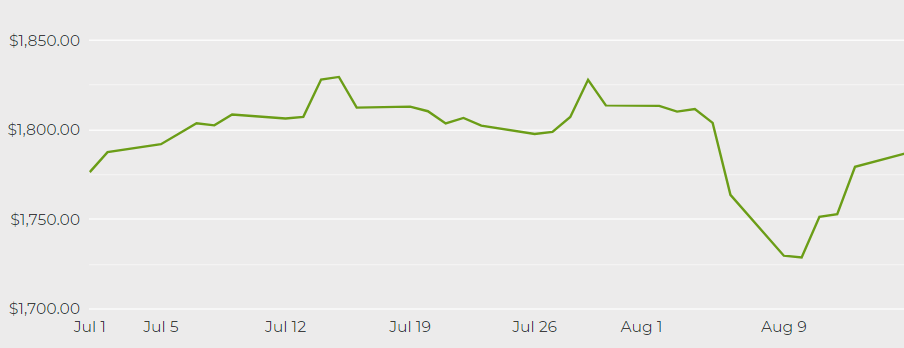

All the one trillion dollar articles are derived from a breathless June 2010 New York Times front-page story and

interview with General David H Petraeus during which the commander of

US forces in Afghanistan referenced a US Dept of Defense “internal

memo”.

The story of how “the vast scale of Afghanistan’s mineral wealth was

discovered by a small team of Pentagon officials and American

geologists” by the Pulitzer prize-winning journalist James Risen’s opens

with a bang (emphasis added):

“The United States has discovered nearly $1 trillion in untapped mineral deposits in Afghanistan, far beyond any previously known reserves and enough to fundamentally alter the Afghan economy and perhaps the Afghan war itself, according to senior American government officials.”

“The previously unknown deposits including huge veins of iron, copper, cobalt, gold and critical industrial metals like lithium are so big and include so many minerals that are essential to modern industry that Afghanistan could eventually be transformed into one of the most important mining centers in the world, the United States officials believe.”

The tale of the $1 trillion treasure trove – which has more than a

whiff of Indiana Jones about it as told by the New York Times – begins

three years after the US invaded Afghanistan:

“In 2004, American geologists,

sent to Afghanistan as part of a broader reconstruction effort, stumbled

across an intriguing series of old charts and data at the library of

the Afghan [sic] Geological Survey in Kabul that hinted at major mineral

deposits in the country.”

“Technoexport”

At first the American geologists only found hints of these huge big

veins, but “they soon learned that the data had been collected by Soviet

mining experts during the Soviet occupation in the 1980s.”

How soon did the American geologists learn it was a Soviet study?

Perhaps when they looked at the author page of the intriguing charts and

data and saw this:

Abdullah, Sh., Chmyriov, V.M., Stazhilo-Alekseev, K.F, Dronov, V.I.,

Gannon, P.J., Lubemov, B.K., Kafarskiy, A.Kh. and Malyarov, E.P., 1977,

Mineral resources of Afghanistan (2 ed.) 419 p. and Abdullah, Sh.,

Chmyriov, V.M. Map of mineral resources of Afghanistan V/O

“Technoexport” USSR, scale: 1:500,000.

Contrary to the article, it was two years before the Soviet army

invaded (hmm… what did Breshnev know about Afghan minerals and when did

he know it?) and it was done under the auspices of the United Nations

Development Programme (AFG/74/12).

Details. Let’s not get sidetracked.

Risen, also the recipient of the 2015 Ridenhour Courage Prize, continues:

“Armed with the old Russian

charts, the United States Geological Survey began a series of aerial

surveys of Afghanistan’s mineral resources in 2006 using advanced

gravity and magnetic measuring equipment attached to an old Navy Orion

P-3 aircraft that flew over about 70 percent of the country.”

The legend

If you have such advanced tech (Shuttle Radar Topography Mission,

SRTM, digital elevation model, DEM) why would you need Mineral resources

of Afghanistan 2nd ed., and Technoexport?

The reason is printed on the legend of the map the USGS produced after the SRTM DEM survey:

“The geologic and mineral resource

information shown on this map is derived from digitization of the

original data from Abdullah and Chmyriov (1977) and Abdullah and others

(1977).

“The classification of mineral

deposit types is based on the authors’ interpretation of existing

descriptive information (Abdullah and others, 1977) […] and on limited

field investigations by the authors.”

Promising before, astonishing ASTER

“The data from those flights was so promising that in 2007, the

geologists returned for an even more sophisticated study” the article

continues:

“The handful of American geologists who pored over the new data said the results were astonishing.”

This even more sophisticated study

used Advanced Spaceborne Thermal Emission and Reflection Radiometer

(ASTER) data from Nasa’s flagship Terra satellite and the astonishing

results are summarized in the USGS-Afghanistan Ministry of Mines Joint

Mineral Resource Assessment Team Preliminary Assessment of Non-Fuel

Mineral Resources of Afghanistan prepared in cooperation with the

Afghanistan Geological Survey under the auspices of the US Agency for

International Development, October 2007. (Download here)

One can understand that the New York Times would not want to confuse

readers with mining jargon but what the paper calls “untapped mineral

deposits far beyond any previously known reserves” the USGS report defines as “mean expected values of quantitative probabilistic estimates of undiscovered deposits”.

Close enough, it’s the New York Times.

Abdullah et al

That said, there were some pretty mean expected values gleaned from

the ASTER and SRTM DEM non-discoveries and the report (the full 810 page study

– Open-File Report 2007–1214 available on 1 CD-ROM and 1 DVD – appears

now to be off limits to the public) outlines 34 orebodies across 27

metals and minerals.

However, of the 34 deposits outlined in the three-page summary, only

four were newly identified: mercury, potash, asbestos and rare earth.

A further four were revised (upwards).

That is, revised from Abdullah, Sh., Chmyriov and others. Mineral resources of Afghanistan (2 ed.) 1977.

The 26 deposit estimates from the Soviet scientists were simply copied over and “further study recommended”.

Astonished but ignored

At this point in the article Risen injects some tension into the story:

“The results gathered dust for two more years, ignored by officials in both the American and Afghan governments.”

But the story doesn’t end in a dusty library in Kabul or the CD-ROM/DVD storeroom of the USGS:

“In 2009, a Pentagon task force

that had created business development programs in Iraq was transferred

to Afghanistan, and came upon the geological data.”

“Until then, no one besides the

geologists had bothered to look at the information and no one had sought

to translate the technical data to measure the potential economic value

of the mineral deposits.”

“Soon, the Pentagon business

development task force brought in teams of American mining experts to

validate the survey’s findings, and then briefed Defense Secretary

Robert M. Gates and Mr. Karzai.”

In these three truly stupefying paragraphs Risen makes it sound that

if it was not for the task force coming upon the data after they were

transferred (no access to the USGS website from Iraq?) and more

importantly, bothered, the world would never have found out about the

value of Afghanistan’s mineral wealth.

Send in the Excel cavalry

The only reason the geologists – on who The New York Times heaps so

much responsibility to give the article a patina of science – did not

bother is because that’s not how mining works.

Not that it’s much of a bother to multiply tonnes and ounces of “probabilistic estimates of undiscovered deposits” with prices.

To the Abdullah et al copper deposits, the USGS report added 32

million contained tonnes (nice!) to bring overall Cu resources in the

country to 60 million tonnes. That’s $453 billion right there at the

average price for copper of $7,562/tonne in 2010.

Some 600,000 tonnes of cobalt ($27 billion at 2010 prices) and

724,000 tonnes of molybdenum ($18 billion) were also put in the copper

basket and the 27 million tonnes of potash would’ve fetched just under

$10 billion at 2010’s average price.

Rare earth as seen from space

The global trade in rare earths was before the WTO for arbitration in

2010 and not only were prices volatile (dysprosium went up 12-fold

between 2008 and 2011), the 17 elements also trade at very different

price points – samarium could be had for $3.40/kg in 2009 but europium

would set you back $492/kg that year.

That would have made it more difficult to assign a dollar value to

the 1.4 million tonnes of rare earths as seen from space. Although the

Pentagon task force probably found a way.

The sulfur tonnage was upwardly adjusted to 5.5 million tonnes, but

at a ruling price of some $50 a tonne it doesn’t really smell like

money. Neither does the newly non-discovered graphite deposit – not too

flaky at 1.05 million tonnes but worth only a billion in 2010.

SRTM DEM and ASTER also zoomed in on 13.4 million tonnes of Afghan

asbestos. Asbestos fibre remains a thriving global trade and if you need

to get to 12 zeros you can’t just leave it in the ground. At ruling

prices of around $1,500 a tonne, that’s $20 billion someone other than

the Afghans would have to cough up.

The world in a grain of sand

Only 2.7 tonnes or 86,743 troy ounces of gold were identified in

1977. The USGS recommended further study of the primary gold deposits

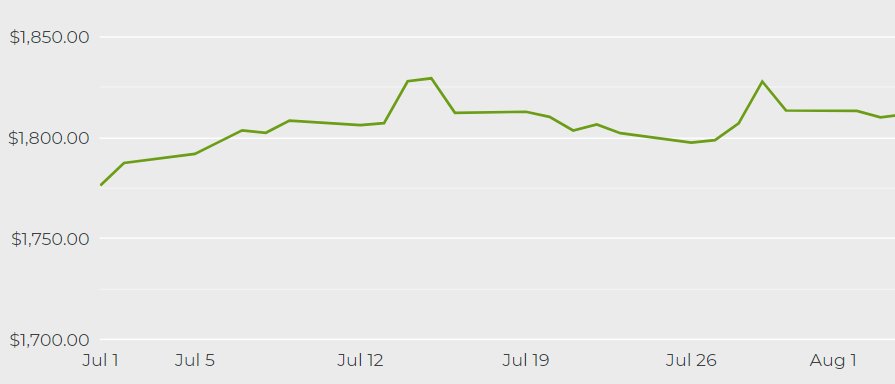

but did associate 682 tonnes gold ($26.8 billion at the average 2010

gold price of $1,226 per troy ounce) and 9,067 tonnes of silver ($5.9

billion) with the igneous copper deposits.

If the gold non-discoveries seem like an underestimation consider

that neither SRTM or ASTER added to the 36 million cubic metres of sand

in the Soviet data. Sand is the world’s number one mining endeavour as per Yale School of the Environment and prices have long been on an upward trajectory.

Who knows? The task force probably found more sand, but the Pentagon

would’ve realized the jokes write themselves if the New York Times

article proclaimed that the US military – ten years into the

occupation – discovered vast reserves of sand in Afghanistan.

Don’t be fooled by the rocks that I got

Afghanistan’s endowment of lead, zinc, tin, tungsten, barite, talc,

lazurite, fluorite, halite and celestite et cetera were not estimated by

the USGS, and since the task force data is secret, only the Pentagon

could put a price on those. Whether the task force incorporated the

32,000 tonnes of hot spring mercury in the $1 trillion would also remain

a mystery.

Not that those treasures are needed – with iron ore 12 zeroes is more than doable.

The 2007 study did not add rocks to the 2.438 billion tonnes Abdullah

et al found thirty years earlier, it didn’t have to – 62% Fe ore was

trading at $120 in 2010 putting a price of $292 billion on Afghan

steelmaking stuff.

Lithium nirvana

The task force did find ways to warm up the Soviet studies, which

likely ignored lithium because commercialisation of the lithium-ion

battery only happened more than a decade later. The 2007 USGS report

also glossed over the world’s softest metal.

But the Pentagon and the New York Times saw an opportunity to show

Afghanistan’s potential in the age of the smart phone and the laptop

computer:

“An internal Pentagon memo, for

example, states that Afghanistan could become the “Saudi Arabia of

lithium,” a key raw material in the manufacture of batteries for laptops

and BlackBerrys.” (Blackberrys… chuckle – Ed.)

And the work was ongoing, according to the article:

“Just this month [June 2010],

American geologists working with the Pentagon team have been conducting

ground surveys on dry salt lakes in western Afghanistan where they

believe there are large deposits of lithium.

“Pentagon officials said that

their initial analysis at one location in Ghazni Province showed the

potential for lithium deposits as large of [sic] those of Bolivia, which

now has the world’s largest known lithium reserves.”

Finding lithium (15th most abundant element, although scarcer than

rare earth) in a dry salt lake as large as those of Bolivia which

measures 10,000 square kilometres? Maybe the Pentagon team just got

lucky.

Besides if you calculate the value of lithium reserves the way the task force did – and how Elon Musk does it – Nevada also has as much of the battery metal as Afghanistan and Bolivia.

Round up to the nearest trillion

The transcript of a Pentagon press briefing a few days later is not accessible due to website maintenance, but contemporaneous reporting suggests

the call did not add much besides clarifying that the $1 trillion was

actually $908 billion, but then adding that “a lot of people think that

is a conservative number”.

Officials also assured reporters that the task force (Task Force for Business and Stability Operations

to give its full name which was never mentioned in the article) just

used the USGS as a reference point to conduct more “detailed field work”

or as The New York Times described it:

“For the geologists who are now

scouring some of the most remote stretches of Afghanistan to complete

the technical studies necessary before the international bidding process

is begun, there is a growing sense that they are in the midst of one of

the great discoveries of their careers.”

What the detailed field work and scouring entailed is never stated

and once again the geologists are required to do all the heavy lifting

to get the article over the low bar of credibility Risen has set.

Whatever technical studies were completed were never considered in

any international bidding process and the “growing sense” of career

making discoveries Risen thought he detected among the geologists is,

not to put too fine a point on it, growing nonsense.

Scientific boots on the ground

The most well known copper deposit in Afghanistan is Mes Aynak, which

translates to “little source of copper” in Pashto/Persian. Copper

workings at Mes Aynak date back to the bronze age.

The scientists at the American Association for the Advancement of Science in Science magazine in 2014 in an article titled “Mother of all lodes”

wrote that after the USGS and the Pentagon “put scientific boots on the

ground“ in Afghanistan they found a “vivid panoply of nonferrous

mineral formations”.

Of these, Mes Aynak is surely the vividest.

Could Mes Aynak – which did go through a real world tender process –

prove that the Pentagon was right all along and $1 trillion – a sum even quoted by the World Bank, responsible for drafting Afghanistan’s mining laws – is on the money?

After a bidding process

that included Phelps Dodge (now part of Freeport McMoRan) and Canada’s

Hunter Dickinson, state-owned Metallurgical Corporation of China and its

minority partner Jiangxi Copper struck a $2.83 billion deal in 2007 for

a 30-year lease at Mes Aynak. (Only $997,170,000,000 to go – Ed.)

A stretch

The nine bidders, selected in November 2006, had to rely on a dusty

copy of Akocdzhanyan et al., 1974 V/O “Technoexport” Contract

55-184/17500 translated from the Russian.

In the tender information package

about Mes Aynak compiled by the Afghanistan and British Geological

Survey, the “systematic exploration” of the Soviet Geological Mission

“Technoexport” is praised as “exceedingly thorough and well documented”.

(Soviet geologist please let us know why it is called Technoexport – Ed.)

The work “included the drilling of several hundred exploration,

geotechnical and hydrogeological boreholes, nine underground adits, 70

trenches, and geophysical and topographic surveys.” It was also carried

out over 13 years and the geologists only pulled out when the Soviet

army did in 1989.

That’s in contrast to the work of “a small team of Pentagon officials

and American geologists”, who, according to New York Times’ timeline,

were busy for only about a year before the article, and were working in

the fields of 24 deposits scattered across the entire country.

Whether the task force scouring the “remote stretches” of Afghanistan

(Mes Aynak is only 30km (19mi) south of Kabul, btw) also included

drillholes, trenches and adits is impossible to say. Rather than

attracting international bidders and making careers, the Pentagon

technical reports remain buried secrets.

Non-refundable deposit

The Mes Anyak deal was billed as the largest foreign investment in Afghanistan in its modern history.

Perplexingly, this May 2008 press release

from Jiangxi Copper put the figure paid to the Afghan government for

the mining rights not at $2.83 billion but $808 million, a figure not

quoted in any media story.

There were also allegations that the then mines minister Mohammed

Ibrahim Adel took some $30 million in bribes related to the tender. (It’s Afghanistan. Don’t get so hung up about missing dollars – Ed.)

The copper project, also the site of an ancient buddhist city, never got off the ground (neither has Hajigak iron ore, the only other deposit which had any prospect of becoming a mine).

MCC blamed the costs

of building a smelter, power plant and railway and the steep royalties

for halting work. Mention of Mes Aynak disappeared from Jiangxi’s annual

reports after 2013 wherein the company blamed the “relocation of

historical relics” as the reason for the delay in the project.

Now that the Taliban are in charge that could change – they do not exactly care for Buddhist statues.

Sitting around in pajamas

There was some criticism of the New York Times frontpage story at the time saying that it wasn’t the scoop it was made out to be because of Abdullah and others’ work in the 1970s the 2007 USGS study. Some questioned the timing of the article when the war was going badly in Afghanistan.

Risen was irked by the skepticism

telling Yahoo News “bloggers” who are “sitting around in their pajamas”

instead of doing real reporting — shouldn’t “deconstruct other people’s

stories.” (Go put some pants on – Ed.)

Dean Baquet, who edited the piece and was the Washington bureau chief

for the New York Times then (now executive editor) said Risen “is the

last person the government would try to get to carry their water,” attributed the criticism to sour grapes for not getting the story first, and that the Pentagon holding a briefing was proof of the article’s newsworthiness.

Task Force for BS Ops

The Task Force for Business and Stability Operations (Task Force for

BS Ops) also came under scrutiny – albeit only in 2016 – in a 136 page

report by the RAND Corporation titled Lessons from the Task Force for Business and Stability Operations in Afghanistan.

To their credit (and I don’t know how much credit, I only know that the US military, air force and Secretary of Defense stuffed $147.1 million in RAND’s coffers in 2020)

RAND said the $908 billion “is notional only; it does not reflect the

value of commercially exploitable deposits. Therefore, it is

misleading.” (p.22)

It also fell to the think tank to address the biggest elephant in the

room full of elephants that was the New York Times and Task Force for

BS Ops stitch-up, and with admirable succinctness:

“Challenges impede the extraction

of this natural wealth. Security concerns aside, most of the mineral

rich provinces lack road, rail, or electric power infrastructure, and

the nascent mining industry would have to compete with agriculture, an

economic mainstay, and municipalities for limited water supplies.”

Let x = x

The manner in which the task force and its teams of mining experts

calculated (tonnes x price = x,xxx,xxx,xxx,xxx) the $1 trillion value –

or $3 trillion

as successive mines & petroleum ministers, and President Karzai was

fond of quoting – is not the biggest problem with the New York Times

story.

While the number has no real world meaning, it certainly attracts attention – by the paper’s own reporting it led to greater violence in Afghanistan.

To focus only on non-fuel resources in the article also smacks of marketing. Afghanistan also has vast oil and reserves

but “No war for oil” protesters had grown in ranks seven years into the

Iraq occupation and trotting out a crude message would likely have

misfired.

$34,482.76

That all US and most international media outlets continue to parrot

the $1 trillion tale a decade later also makes its propaganda value

clear.

How easily the Western armchair media swallowed the story is

inexcusable, but the way Afghans were duped into believing in their

country’s mineral wealth seems cruel.

The New York Times followed up the big scoop a few days later with a piece headlined Afghan Officials Elated by Minerals Report:

“As they waited to hear Mr.

Karzai’s spokesman, some Afghan reporters excitedly calculated among

themselves how much each Afghan would theoretically get if the mineral

treasure trove were divided equally.

“Assuming the $1 trillion

valuation and Afghanistan’s population of 29 million, that would give

each Afghan man, woman and child $34,482.76.”

If not in scope then in tenor, U.S. Identifies Vast Mineral Riches in Afghanistan was not dissimilar to the paper’s weapons of mass destruction coverage of a few years earlier.

At least the New York Times has taken some responsibility for boosting the case for the Iraq invasion.

But there’s been no such soul searching by the paper for cheerleading the extension of the US occupation of Afghanistan.

/https://public-media.si-cdn.com/filer/20120723113006afghanistan-map.jpg)