https://www.mining.com/web/column-iron-ore-price-rally-justified-as-chinas-january-imports-surge/

The price of spot iron ore has been one of the major beneficiaries of expectations of strong demand as China re-opens its economy after abandoning its strict zero-covid policy.

While other commodities, such as crude oil and copper, have also enjoyed recent gains on the back of the China recovery narrative, iron ore’s rally seems grounded in actual gains in demand.

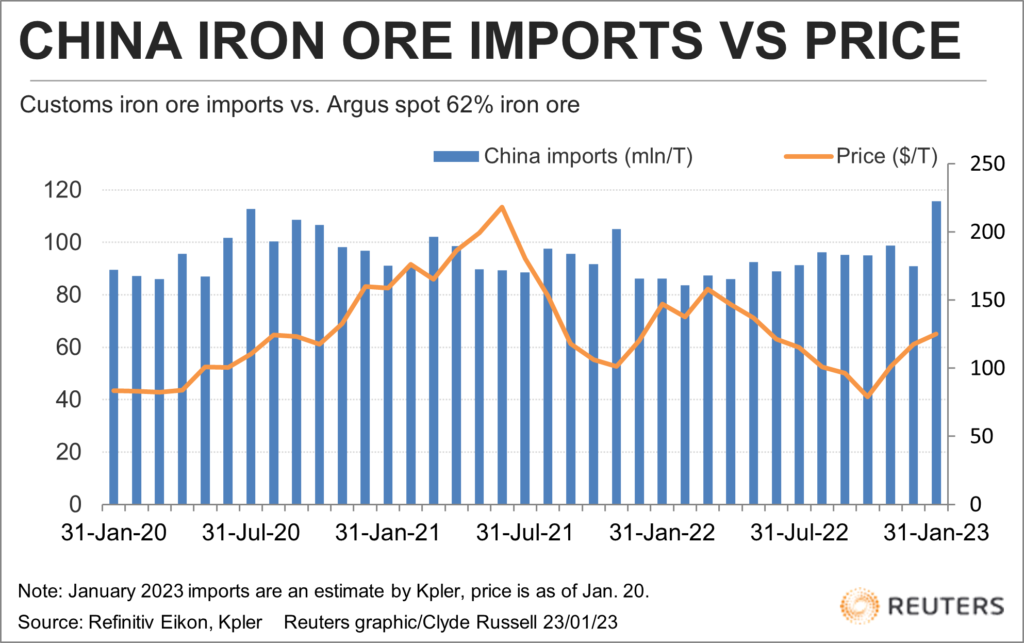

The spot price of benchmark 62% iron ore, as assessed by commodity price reporting agency Argus, ended at $126 a tonne on Jan. 20.

This is up 7.1% from the beginning of the year and the steel raw material has now surged 59.5% since its low last year of $79 a tonne, reached on Oct. 31.

At first glance, the rise in prices doesn’t appear to tally with imports by China, which dominates the global seaborne trade, buying about 70% of the total shipped volumes.

China’s iron ore imports were 90.86 million tonnes in December, down from 98.85 million in November and also weaker than October’s 94.98 million.

However, December is historically a soft month for China’s imports, and the outcome last month was actually 5.6% above the level of imports for December 2021.

What is more important for spot iron ore prices is that January’s imports appear to be considerably stronger, according to vessel-tracking and port data compiled by commodity analysts Kpler and Refinitiv.

China is on track to import 115.6 million tonnes in January, according to Kpler data, while Refinitiv is estimating 116.8 million tonnes.

The figures from the commodity analysts don’t exactly align with official customs numbers, given differences as to when cargoes are assessed as having been cleared.

Also, the seaborne figures don’t take into account the small volumes of overland iron ore from China’s neighbors Russia and Mongolia.

Nonetheless, the January estimates point to an extremely strong month for China, possibly even exceeding the record high of 112.65 million tonnes in July 2020.

An official reading on imports may not be available until March, as in recent years China customs has not reported January and February numbers separately, rather combining the first two months to filter out volatility caused by the shifting timing of the Lunar New Year holidays.

Official unhappiness

The rising spot price of iron ore is causing some consternation in Beijing, with the state planner last week issuing a third warning against excessive speculation.

The National Development and Reform Commission has stuck to verbal warnings but the risk of higher margins for futures contracts and other actions is increasing, especially if the main domestic contract on the Dalian Commodity Exchange keeps rising.

The front-month contract hit a 17-month high of 896.50 yuan ($132.23) a tonne on Jan. 13, although it has retreated a touch since then to close at 856.60 yuan on Jan. 20.

While there are more steps the authorities can take to try to rein in prices, history suggests that if the underlying market demand is strong, efforts at controlling prices are liable to only bring short-term relief.

There is unlikely to be relief on the supply front, with shipments from top exporter Australia likely to rise only modestly, while those from number two Brazil are expected to remain largely steady in 2023.

Ultimately, for the bullish view on iron ore prices to be sustained, evidence of rising steel output and demand in China will have to be forthcoming.

Its steel production rose 4.5% to 77.89 million tonnes in December from November, although annual output was 1.10 billion tonnes, down 2.1% from the record high achieved in 2021.

There are expectations of rising housing construction and infrastructure development this year in China but it seems that iron ore pricing and imports are front-running the actual demand for steel.

(The opinions expressed here are those of the author, Clyde Russell, a columnist for Reuters.)

(Editing by Robert Birsel)

No comments:

Post a Comment