Monday, February 28, 2022

Dream

All people's lives are ordained by God directly to do His Will.

You are the perfect version of yourself. No one is better being you.

Trust in God and His ultimate plan for your life.

Ukraine crisis will disrupt crude, coal and LNG flows even without sanctions

Russia’s President Vladimir Putin. (Image courtesy of World Economic Forum |Flickr.)

(The opinions expressed here are those of the author, Clyde Russell, a columnist for Reuters.)

Sign Up for the Energy Digest

That’s perhaps tacit acknowledgment of Russia’s importance to the global supply of these commodities, and especially with regard to natural gas, with Russia meeting about 40% of Europe’s annual demand.

But even if the United States, Europe and other allied nations such as Japan and South Korea decide not to impose measures against Russia’s energy exports, it’s likely that private companies will effectively do it for them.

The risks of doing business with Russia will become too much for many companies to bear, even without sanctions.

A clear illustration of this was reports that a coal bulk vessel chartered by commodity trading house Cargill was struck by a shell in the Black Sea in Ukrainian waters on Thursday, just hours after Russia launched a widespread attack on its neighbour.

Very few trading, shipping and insurance companies will be prepared to take the risk of dealing with cargoes from Russia, fearing either physical attack, payment issues because of financial sanctions, the risk of non-delivery if further measures are enacted against Russia, and even public and investor backlash for continuing to do business with a country now largely viewed as conducting an illegal war.

So, how does this play out in the real world of commodity trading?

The first point is that this is likely to be a long, drawn out process that lasts for months, if not years.

Russian energy commodity exports will likely continue for some time pretty much as they are, but will then start to change.

Crude

Russia supplied about 2.66 million barrels per day (bpd) of crude via the seaborne market to Europe in February, according to Refinitiv Oil Research data, and it regularly ships more than 2 million bpd a month.

European refiners will now be reluctant to buy Russian crude, and it’s likely that the main Urals grade will have to be offered at very steep discounts to find any buyers.

Already Urals differentials hit an all-time low, dropping to a discount of $11 a barrel on Thursday as buying interest in northwest Europe evaporated.

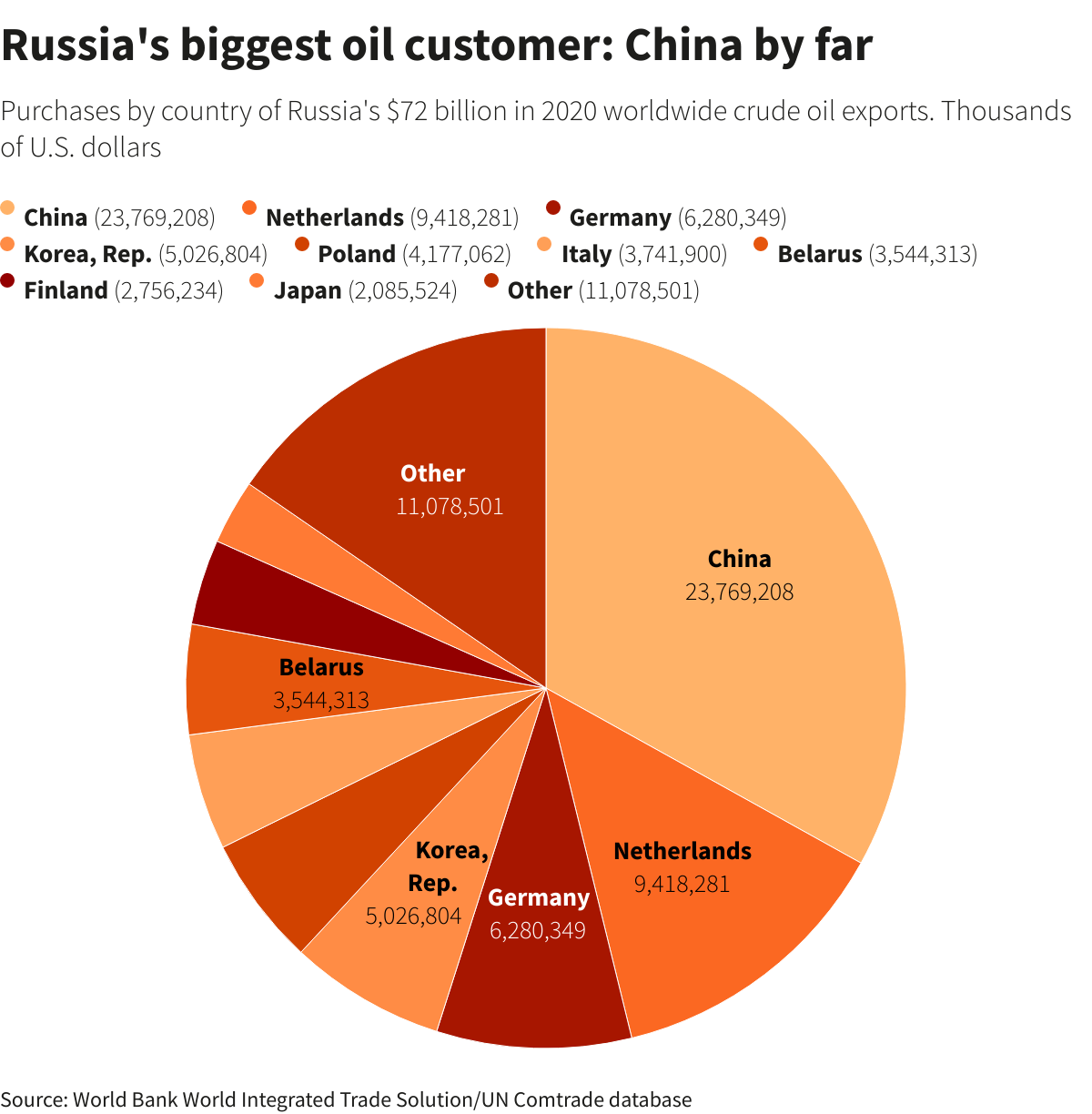

Who will be prepared to buy Urals crude? The obvious answer is China, which has so far indicated that it won’t join any sanctions against Russia.

But for Urals to go to China it would have to undertake a long sea voyage through the Suez Canal or around the Cape of Good Hope, adding to the cost of transportation.

This means Chinese refiners are likely to demand even bigger discounts in order to take Urals cargoes, and even then, it’s unlikely that they would take even close to the volumes Russia is likely to lose in Europe.

There are other countries that may be tempted by cheap Russian oil, but it’s likely they will come under pressure from Western nations, especially the United States.

Russia also supplies crude oil to Asia, with the ESPO grade being sought after, especially by Chinese independent refiners.

Russia exported 1.29 million bpd of seaborne crude to Asia in February, according to Refinitiv, with the bulk of it, about 718,000 bpd, heading to China.

But that still leaves about 572,000 bpd of Russian crude that went to other Asian buyers, including some 126,000 bpd to Japan and 355,000 bpd to South Korea.

These flows are under threat in coming months, meaning Russia will be looking for new markets, or trying to put more volumes into China.

Conversely, European refiners, as well as those in Japan and South Korea, will be seeking to boost imports from alternative suppliers, and given the current tight nature of the global crude oil market, this is going to be tricky.

It’s likely that pressure will be ramped up on members of the Organization of the Petroleum Exporting Countries to boost output rapidly, and abandon the current output deal they have as part of the wider OPEC+ group, which includes Russia, especially if global benchmark Brent crude futures hold above the $100 a barrel level breached after the invasion of Ukraine on Thursday.

Coal, LNG

Russia also supplies coal to Europe, with Refinitiv pegging February seaborne volumes at 3.27 million tonnes.

Again, this trade is likely to become poisonous for European utilities, meaning they will be scrambling to buy cargoes from the United States, Colombia and South Africa.

This is likely to tighten global seaborne coal markets, especially if Japan, which bought 1.18 million tonnes of Russian coal in January, seeks to buy from other suppliers.

Benchmark Australian thermal coal from Newcastle port was assessed by globalCOAL at $244.29 a tonne on Thursday, up 1.6% from the prior day and well above the $226.39 from last week.

Natural gas is where matters will get difficult for Europe, given its reliance on Russia and the lack of readily available alternatives.

Europe can seek to buy as much LNG as possible, effectively drawing cargoes away from top-importing region Asia, but this will be expensive, as can be seen by the jump in futures based on the Asian JKM price , which surged 28% on Thursday to a two-month high of $37.01 per million British thermal units.

Over time, Europe can buy more LNG from the United States and Qatar, which are currently building substantial new capacity, and they can seek to maximise the continent’s own output, mainly from the North Sea.

Europe can also invest heavily in renewable generation and battery storage, but in the short to medium term the continent is still dependant on Russia, given President Vladimir Putin a lever he can pull if the sanctions, and voluntary cutbacks on commodity trade, start to cause Russia real pain.

(Editing by Richard Pullin)

Sunday, February 27, 2022

Saturday, February 26, 2022

Friday, February 25, 2022

Russia-focused miners collapse on Ukraine invasion

Shares in mining companies with operations in Russia were among the first to feel the impact of Moscow’s wide-ranging attack on Ukraine on Thursday, while oil topped $105 a barrel and investors rushed to buy gold and other safe haven assets.

The local exchange suspended trading in all markets following President Vladimir Putin ‘s announcement of a military operation against Ukraine. Once it resumed, companies shares nosedived as investors braced for the toughest round of Western sanctions yet, wiping out as much as $259 billion in stock-market value.

Alrosa (MCX: ALRS), the world’s top diamond producer by output, lost more than 40% mid-morning, closing 33.7% lower compared to Wednesday’s price. The company has been included in the new sanctions announced by the US Department of the Treasury’s Office of Foreign Assets Control (OFAC), which target mainly banks and energy firms.

Gold miner Polymetal (MCX, LON: POLY) experienced massive losses in all the bourses it trades, finishing the day 35% lower in Moscow. It took the biggest hit on the FTSE 100 index, losing over 46% of its share value to £594 mid-afternoon. That’s below a four-year low of the £605 a share it hit in October 2018.

Polymetal put out a press release indicating that targeted sanctions on the company remained “unlikely”.

“The scope and impact of new potential sanctions (and any potential counter-sanctions) is yet unknown, however they might affect key Russian financial institutions as well as mining companies,” the miner acknowledged.

“Contingency planning has been initiated proactively to ensure business continuity, including selection of key equipment suppliers, liquidity management, debt portfolio diversification and securing sales channels,” it added.

Shares in London-based gold producer Petropavlovsk (LON: POG) were trading near a three-year low by mid-afternoon at £9.43 per piece.

Shares in other Russian miners, including potash producer Uralkali (MICEX: URKA) and Gazprom (MCX: GAZP), the country’s biggest stock by market capitalization, also collapsed on Thursday as the ruble hit its lowest ever level against the US dollar.

The scale of the shock to markets suggests investors had expected Putin to back down.

“You have the panic button being hit right now, I don’t think the market was pricing in the risk of a proper military conflict,” Emmanuel Cau, head of European equity strategy at Barclays, told the Financial Times. “For the time being, it’s hard to see what could be a trigger for the market to stabilise.”

News of Russia’s actions led to sharp declines on stock markets across Europe, with the UK’s FTSE 100 index down more than 3% and Germany’s Dax index falling more than 4.5%. Earlier, stocks in Asia had also collapsed.

The price of gold — considered a haven asset in times of uncertainty — jumped more than 1.7% to its highest since early January 2021.

“Markets are now more adequately pricing in the risk of something horrific happening. That, combined with the uncertainty, is a horrible environment to be in. No one wants risk exposure when that’s floating around,” Rob Carnell, head of Asia Pacific research at ING, said.

Canadian senior miner Kinross Gold’s (TSX: K)( NYSE: KGC) shares were falling slightly this morning in New York, even though it had said on Wednesday its assets in Russia’s Far East, about 7,000 km away from Ukraine, were operating normally.

Russia is responsible for a third of Europe’s natural gas and about 10% of global oil production. With both Ukraine and Russia also big crop producers, wheat and corn prices surged over 5%.

(With files from Bloomberg)

One of the world’s first dual-fuel VLCCs unveiled in South Korea

300,000dwt tanker, Eagle Valence

https://www.tankeroperator.com/ViewNews.aspx?NewsID=12899

AET, a leading owner and operator of maritime transportation assets and specialised services, named its newest vessel which is also one of the world’s first dual-fuel and amongst the most environmentally friendly VLCCs in the market.

It is the first of two dual-fuel VLCCs built for long-term charter to Chartering and Shipping Services SA, a wholly owned subsidiary of TotalEnergies SA, based on the agreement signed in April 2020.

The 300,000dwt tanker, Eagle Valence was unveiled at a virtual naming ceremony held at the Samsung Heavy Industries (SHI) Shipyard in Geoje, South Korea.

Making the announcement, Capt. Rajalingam Subramaniam, President & CEO of AET and COO of MISC Berhad said:

“AET and TotalEnergies both have clear ambitions to decarbonise shipping and we pushed boundaries to move towards a lower carbon future when we collaborated to build two of the first dual-fuel VLCCs in 2020. I am very proud that we are now setting a new benchmark for the maritime industry with our state-of-the art Eagle Valence which is one of the first and amongst the most environmentally friendly VLCCs in the market. My sincere thanks to everyone from TotalEnergies, Samsung Heavy Industries, Bureau Veritas and colleagues in the MISC Group namely from Eaglestar and my team members in AET for this remarkable industry stewardship to significantly reduce carbon emissions.

As an early pioneer in dual-fuel vessels, AET continues to invest

in technology and team up with like-minded partners such as

TotalEnergies who share our goal to create a truly sustainable global

trade network. And we won’t stop there and are doing what we can to be

impactful and reduce our and our customers’ carbon footprint to

contribute to a sustainable future for our planet. I urge everyone in

the industry to action cleaner and greener, collaborate and partner, act

now and not later.”

Eagle Valence’s sister vessel is currently under construction at the Samsung Heavy Industries yard in South Korea and due to be delivered in the second quarter of the year. AET and Eaglestar site teams have been working closely together with the SHI team to ensure all health and safety precautions were in place to safeguard the construction and delivery of the vessels during the ongoing pandemic.

Both vessels represent a game changer in conventional energy shipping with a carbon footprint reduction that is contributing to AET’s aspiration to meet or exceed IMO’s 2030 Greenhouse Gas goals. The carbon reduction is achieved through a combination of the cutting-edge LNG dual-fuel technology, energy saving devices and innovative features.

Commenting at the naming ceremony, Mr Luc Gillet, Senior Vice President of TotalEnergies Shipping & Trading commented:

“We are very proud to welcome in our time chartered fleet this best-in-class LNG dual-fuel VLCC from our partner AET. This vessel will contribute to our Climate Ambition to get to Net Zero by 2050 together with society”.

Datuk Yee Yang Chien, President/Group CEO of MISC Berhad and Chairman of AET said:

“Our investment in dual-fuel vessels illustrates our commitment as the MISC Group, and in this instance through AET, to invest in solutions that contribute to the decarbonisation of the shipping sector over the long-term. We believe that LNG is the best fuel option available immediately for use whilst we continue our on-going efforts by leading, collaborating and contributing to other long-term initiatives which we hope will bring us closer to achieving a fully decarbonised sector.

With TotalEnergies, we share a common goal and commitment to decarbonisation and I’d like to thank them again for their confidence in AET. Our sustainability actions today will chart the pathway for a better tomorrow.”

AET has 11 LNG dual-fuel vessels in its fleet portfolio with three Aframaxes in operations in the Atlantic, one Aframax operating in the Pacific and two Dynamic Positioning Shuttle Tankers (DPSTs) operating in North and Barents Seas now being joined by the first VLCC. Another four dual-fuel VLCCs are at newbuilding stage to be delivered in 2022 and 2023.

In addition to the naming of Eagle Valence, AET also took delivery of one more Suezmax Dynamic Positioning (DP2) Shuttle Tanker, bringing the number of DP shuttle tankers it operates globally to 13.

Thursday, February 24, 2022

Wednesday, February 23, 2022

How Will Rising Oil Prices Impact The Energy Transition?

https://tankterminals.com/

Amid an increase in global demand and concerns over key supplies, global oil prices are approaching $100 per barrel for the first time since 2014.

But, with prices rising, what does this mean for the renewable energy transition, especially in Gulf countries?

After opening the year at around $78 per barrel, Brent crude prices rose sharply over the first six weeks of 2022 to surpass $94 as of February 14, the highest price in more than seven years.

Driven primarily by a lack of supply and a recent post-lockdown spike in global demand, the increase caps off a dramatic recovery of prices, which had fallen to less than $20 a barrel in April 2020.

Given the low oil price environment of the last couple of years, the recent increase has prompted discussion about the implications for investment in renewable energy, particularly for oil-exporting countries in the Gulf.

Although investment in oil and gas has fallen by about 30% since the outbreak of the pandemic, there are signs that the increased demand and rise in prices could lead to a reversal of that trend.

Carbon Tracker, a London-based climate change-focused think tank, noted last month that higher oil prices might encourage energy companies to invest in new exploration and production projects.

Indeed, on February 1 energy giant ExxonMobil announced a 45% increase in its budget for drilling and other activities this year, while a day later members of the Organisation of the Petroleum Exporting Countries and other leading oil-producing nations – an alliance known as OPEC+ – agreed to stick with their pre-planned target of increasing oil production by 400,000 barrels per day.

At the same time, there are concerns that higher oil prices could incentivise the consumption of coal, which reached an all-time high in 2021 and is on track to reach even higher levels this year, according to the International Energy Agency.

In addition to its lower price, coal use is being driven by rising energy demand – led by China and India – and insufficient levels of investment in renewables.

A boon for renewables?

Although high oil prices have the potential to incentivise new investment in oil and gas projects, renewables could ultimately benefit from the current situation.

Rather than directly challenging renewables and slowing the energy transition, many energy industry analysts believe that the current high prices – and the associated financial windfall – could lead governments and oil majors to play the long game and further increase their investments in renewable energy.

For example, in September last year French energy giant Total said it would take advantage of high oil prices to buy back $1.5bn in shares to boost investment in renewable energy, while earlier this month BP – upon announcing its highest annual profit in eight years, at $12.8bn – stated it would increase spending on low-carbon energy to 40% of total spending by 2025 and 50% by 2030.

Gulf pushing ahead with renewables

A prime example of an oil-producing region that has recently reaffirmed its commitment to renewables is the Gulf.

Indeed, many Middle Eastern countries have identified the development of renewable energy as key to their long-term economic diversification plans.

For example, Saudi Arabia aims to generate 50% of its electricity from renewables by 2030 and has set a net-zero target of 2060.

To help achieve these goals, in December the government announced that it would invest SR380bn ($101.3bn) in renewable energy production by the end of the decade, while in April last year it inaugurated the Sakaka solar power plant, the country’s first utility-scale renewables project.

Meanwhile, in October the UAE pledged to invest Dh600bn ($163.4bn) in renewables by 2050, at which point it hopes to achieve net-zero emissions.

The announcement came just a few weeks after the inauguration of the first stage of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai. The park is expected to have a capacity of 5 GW by 2030.

Elsewhere in the region, in late January Oman inaugurated the 500-MW Ibri 2 solar field, the country’s largest utility-scale renewables project, while Qatar, one of the world’s largest exporters of natural gas, has also increased its focus on renewables.

In October last year Qatar Petroleum, the national energy company, changed its name to Qatar Energy, in order to better reflect the company’s renewables-focused strategy.

Major projects include the 800-MW Al Kharsaah Solar plant, located approximately 80 km west of the capital Doha.

Once fully completed, the project will be the country’s largest renewable energy development. It is set to be inaugurated in the first half of this year.

While there is some scepticism as to exactly how much of the financial windfall associated with high oil prices will go towards the energy transition, and whether net-zero ambitions can be achieved if funds continue to be channelled into new exploration and production projects, it is clear that renewables are playing an increasingly important role in the long-term energy plans of companies and governments alike.

China plans state-backed platform to buy iron ore

China’s latest bid to wrest control of soaring iron ore prices is a plan to make global suppliers negotiate sales to the world’s biggest market through a centralized platform.

Sign Up for the Iron Ore Digest

China churns out more than half the world’s steel, and its iron ore imports last year were worth nearly $180 billion. Its steel industry has long complained at the pricing power it says is held by a handful of giant international mining companies. Authorities are also keen to head off inflation as Beijing rolls out stimulus measures in 2022 that could reboot steel demand.

China’s National Development and Reform Commission didn’t immediately respond to a faxed request for comment.

Pushing back

The latest proposals add to a flurry of actions and announcements that last week quashed iron ore’s powerful rally from mid-November. Authorities hosted a series of meetings with traders, culminating in a Thursday gathering where major global commodity firms were asked to draw down stockpiles and cooperate with a probe into possible “illegal” activities.

The cost of iron ore is largely tied to daily spot-market assessments from third-party agencies including S&P Global Platts. Long-term contracts — which cover the vast majority of supplies — are based on averages of the spot price over agreed time periods, such as monthly or quarterly.

High stakes

This regime replaced a system of high-stakes annual price talks, which collapsed in 2010 amid pressure from overseas iron ore miners. In December 2020, with prices also rallying before a round of government stimulus, China’s steel mills said the price mechanism had failed.

Centralized negotiations are by no means unprecedented for China’s purchases. A group of China’s top copper smelters collectively bargains the price for annual supplies of raw materials, for example.

But general problems with such an approach include coordination across a huge number of buyers, and the potential for cargoes to be resold at higher prices. The latter was widespread before the breakdown of annual pricing earlier this century.

Beijing is also encouraging other moves to improve its position in iron ore, the people said. The government wants further mergers and acquisitions among big steelmakers, as well as more domestic output and the purchasing of stakes in mines outside China.

Tuesday, February 22, 2022

Sister Rosetta Tharpe - Didn't it rain, children

Didn't it rain children

Talk about rain oh my Lord

Didn't it fall didn't it fall

Didn't it fall my Lord didn't it rain

Didn't it rain children

Talk about rain oh my Lord

Didn't it fall didn't it fall

Didn't it fll my Lord didn't it rain

Oh it rained forty days

And it rained forty nights

There was no land no where in sight

God send the angel to spread the news

He haste his wings and away he flew

To the East to the West

To the North to the South

All day all night how it rained how it rained

Didn't it rain children

Talk about rain oh my Lord

Didn't it fall didn't it fall

Didn't it fall my Lord didn't it rain

Some at the window some at the door

Some said Noah can't you take a little more

No no said Noah no no my friends

The nature got to keep you can't get in

I told you I told you a long time ago

You wouldn't hear me you disobey me

Lord send the angel a warning to you

It began to rain and now you are through

Well it rained forty days

Forty nights without stopping

Noah was glad

When the rain stopped dropping

Knock at the window knock at the door

Come on brother Noah

Can't you take any more

No no my brothers you are full of sin

God has the key you can't get in

Would you listen how it rained

Didn't it rain children

Talk about rain oh my Lord

Didn't it fall didn't it fall

Didn't it fall my Lord didn't it rain

Didn't it rain children

Talk about rain oh my Lord

Didn't it fall didn't it fall

Didn't it fall my Lord didn't it rain

When and why did Democrats and Republicans switch platforms?

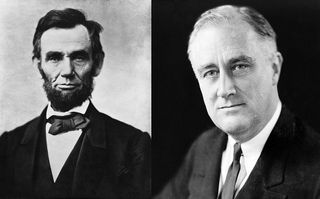

Abraham Lincoln, the 16th U.S. President and a Republican (left), and Franklin Roosevelt, the 32nd U.S. President and a Democrat. The Republican and Democratic parties effectively switched platforms between their presidencies. (Image credit: Public domain)

https://www.livescience.com/34241-democratic-republican-parties-switch-platforms.html

By Natalie Wolchover , Callum McKelvie published

Over a century ago, Democrats and Republicans switched platforms, changing their political stances.

The Republican and Democratic political

parties of the United States didn't always stand for what they do

today. The more liberal Democrats, traditionally represented by the

color blue, and the right-wing Republicans, by the color red, each have a defined set of belief systems, but these were once very different.

During the 1860s, Republicans, who dominated northern states, orchestrated an ambitious expansion of federal power, described by the Free Dictionary as "a system of government in which power is divided between a central authority and constituent political units." This helped to fund the transcontinental railroad, the state university system and the settlement of the West by homesteaders, and instating a national currency and protective tariff. The Democrats, who dominated the South, opposed those measures. Indeed, according to the author George McCoy Blackburn ("French Newspaper Opinion on the American Civil War," (Greenwood Press, 1997) the French newspaper Presse stated that the Republican Doctrine at this time was "The most Liberal in its goals but the most dictatorial in its means."

After the United States triumphed over the Confederate States at the end of the Civil War, and under President Abraham Lincoln, Republicans passed laws that granted protections for Black Americans and advanced social justice (for example the Civil Rights Act of 1866 though this failed to end slavery). Again Democrats largely opposed these apparent expansions of federal power.

Sounds like an alternate universe? Fast forward to 1936.

Democratic President Franklin Roosevelt won reelection that year on the strength of the New Deal. This was a set of reforms designed to help remedy the effects of the Great Depression, which the FDR Presidential Library and Museum described as: "a severe, world -wide economic disintegration symbolized in the United States by the stock market crash on "Black Thursday," October 24, 1929." The reforms included regulation of financial institutions, the founding of welfare and pension programs, infrastructure development and more. It was these measures that ensured Roosevelt won in a landslide against Republican Alf Landon, who opposed these exercises of federal power.

So,

sometime between the 1860s and 1936, the (Democratic) party of small

government became the party of big government, and the (Republican)

party of big government became rhetorically committed to curbing federal

power.

How did this switch happen?

Eric Rauchway, professor of American history at the University of California, Davis, pins the transition to the turn of the 20th century, when a highly influential Democrat named William Jennings Bryan (best known for negotiating a number of peace treaties at the end of the First World War, according to the Office of the Historian) blurred party lines by emphasizing the government's role in ensuring social justice through expansions of federal power — traditionally, a Republican stance.

But Republicans didn't immediately adopt the opposite position of favoring limited government.

Related: 7 great congressional dramas

"Instead, for a couple of decades, both parties are promising an augmented federal government devoted in various ways to the cause of social justice," Rauchway wrote in an archived 2010 blog post for the Chronicles of Higher Education. Only gradually did Republican rhetoric drift toward the counterarguments. The party's small-government platform cemented in the 1930s with its heated opposition to Roosevelt’s New Deal.

But why did Bryan and other turn-of-the-century Democrats start advocating for big government?

Big Government

According to Rauchway, they, like Republicans, were trying to win the West. The admission of new western states to the union in the post-Civil War era created a new voting bloc, and both parties were vying for its attention.

Related: Busted: 6 Civil War myths

Democrats seized upon a way of ingratiating themselves to western voters: Republican federal expansions in the 1860s and 1870s had turned out favorable to big businesses based in the northeast, such as banks, railroads and manufacturers, while small-time farmers like those who had gone west received very little.

Both parties tried to exploit the discontent this generated, by promising the general public some of the federal help that had previously gone to the business sector. From this point on, Democrats stuck with this stance — favoring federally funded social programs and benefits — while Republicans were gradually driven to the counterposition of hands-off government.

From a business perspective, Rauchway pointed out, the loyalties of the parties did not really switch. "Although the rhetoric and to a degree the policies of the parties do switch places," he wrote, "their core supporters don't — which is to say, the Republicans remain, throughout, the party of bigger businesses; it's just that in the earlier era bigger businesses want bigger government and in the later era they don't."

In other words, earlier on, businesses needed things that only a bigger government could provide, such as infrastructure development, a currency and tariffs. Once these things were in place, a small, hands-off government became better for business.

Originally published on Live Science on Sept. 24, 2012. This article was updated on Dec. 14, 2021.

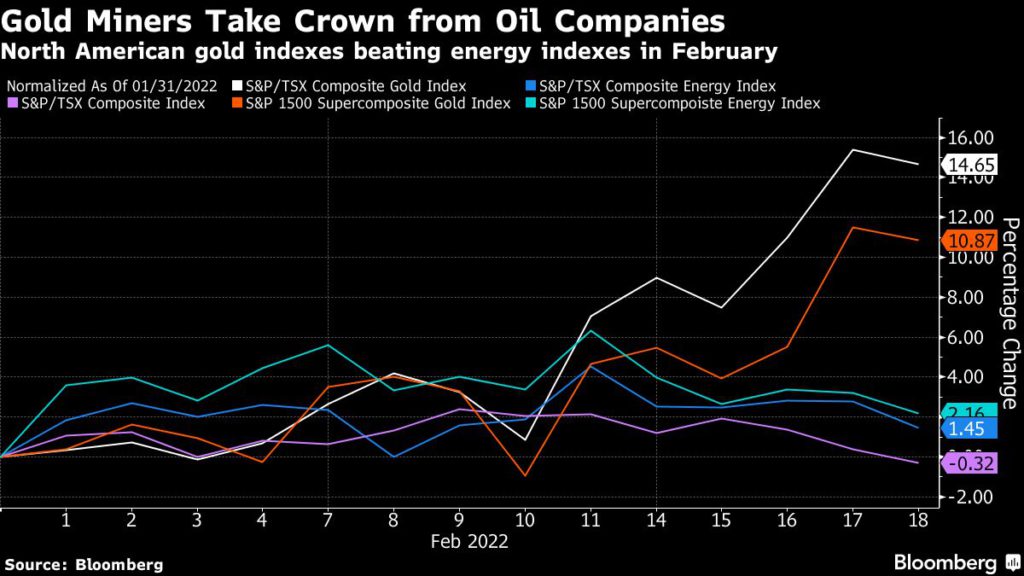

Gold stocks poised to dethrone top-performing oil in US, Canada

JC

Oil and gas stocks have been the top performers in the U.S. and Canada to start the year, but gold miners are currently poised to steal that crown this month thanks to a combination of geopolitical risk in Europe and inflationary risk in North America.

Sign Up for the Precious Metals Digest

“The short-term bid for gold driven by Black Sea military tensions, a spike in risky asset volatility, and inflation hedge demand will need to grapple with an increasingly hawkish Fed and higher policy rates come March,” Aakash Doshi, Citi’s head of commodities research in the Americas, wrote in a Feb. 17 research note.

Citi increased its near-term price target on gold to $1,950 per ounce — a $125/oz hike from its previous forecast — and upped its full-year outlook by 7% to an average of $1,805/oz.

However, the longer-term outlook for the precious metal is more challenged as the U.S. Federal Reserve and Bank of Canada move to raise interest rates. Doshi called gold a “pain trade” and noted his bearishness on gold for both the second half of this year and 2023, when he forecasts gold will fall to $1.675/oz.

(By Geoffrey Morgan)

Congo nears deal with Israeli billionaire to recover assets

Gertler, originally a diamond trader, amassed his fortune mostly by buying mining assets from the DRC at greatly discounted prices, and selling them at great profit. (Image: Screenshot from Bosolo Na Politik Officielle | YouTube.)

Democratic Republic of Congo’s government announced it is nearing a deal with Dan Gertler’s Fleurette Group to take back billions of dollars worth of its mining and oil assets in the country.

Sign Up for the Copper Digest

Kamoto Copper is managed by Glencore, which declined to comment.

A consortium of Congolese and international non-governmental organizations known as Congo is Not for Sale praised the deal as a “first step” in recovering Gertler’s assets in an emailed statement Saturday. It called on the government “to make the process and results of the negotiations more transparent.”

Gertler came to Congo to deal diamonds in the late 1990s when the country was at war. He built close ties to Joseph Kabila, who was president from 2001 to 2019. His businesses soon expanded to copper, cobalt, oil, gold and other minerals, often partnering with mining behemoths like Glencore. But his relationship with Kabila brought scrutiny from anti-corruption groups, which accused him of paying bribes and stealing money from one of the world’s poorest countries. He denies all charges.

The US sanctioned Gertler in December 2017 in part to force Kabila from power after he’d postponed scheduled elections. The Treasury Department has expanded measures against Gertler’s companies and associates twice more, including in December of last year.

Since Felix Tshisekedi took over as Congo’s president in 2019, the government’s relationship with Gertler has cooled. Tshisekedi has made it a priority to take back two oil blocks owned by Gertler’s companies along the border with Uganda, which could be worth billions.

Friday’s announcement shows Tshisekedi’s government wants to claw back even more of Gertler’s empire.

The country’s justice minister is now examining the proposed deal with Fleurette with the hopes of concluding an agreement that would “allow the Congolese state to fully take back possession of these mining and oil assets,” Kibassa said.

(By Michael J. Kavanagh and William Clowes)

Worlds largest ethane carrier named Pacific INEOS Belstaff at ceremony in Texas

https://www.tankeroperator.com/ViewNews.aspx?NewsID=12878

• The ‘Pacific INEOS Belstaff’ is the latest ship to join the INEOS fleet. • The ship is the world’s first 99,000 CMB VLEC (Very Large Ethane Carrier) with type B tanks, and is the largest VLEC in the world. • The ship was named by Fran Millar CEO of the iconic Belstaff clothing brand at a ceremony held in Houston, Texas. • The naming marks the latest milestone in INEOS’ expansion of its trading and shipping capabilities.

In Houston, the world’s largest ethane carrier was named as the ‘Pacific INEOS Belstaff’ after the iconic Belstaff clothing brand, which is also owned by INEOS. The new ship joins INEOS’s growing carrier fleet and was primarily built to transport US ethane both to China and Europe.

As the world’s first 99,000 CMB VLEC (Very Large Ethane Carrier) the

vessel is fitted with type B tanks, a brand-new design for transporting

ethane. The tanks allow optimisation of vessel capacity, fitting closely

to the external shape of the vessel.

The ship also has the potential to carry other products such as ethylene and LPG.

David Thompson, CEO of INEOS Trading & Shipping, says: “Today’s ceremony is another major milestone in the expansion of INEOS’s shipping & trading capabilities. As always at INEOS we have innovated and invested in the future, so I am delighted that we now operate the world’s largest VLEC and I look forward to this vessel transporting vital feedstocks for years to come”.

At the ceremony, Fran Millar, CEO of Belstaff, formally named the ship

and in so doing became its official godmother. In addition to being

named after Belstaff, the ship also carries the brand's famous slogan,

‘Built for Life’ proudly emblazoned on its side.

Fran Millar, CEO of Belstaff, says: “I am proud to be godmother to this new and innovative carrier as it becomes a part of the growing INEOS fleet. In displaying the Belstaff brand along the length of the ship it also provides Belstaff with an enormous billboard introducing our logo to some very new places around the world.”

Built in Jiangnan, China and operated by Pacific Gas, the Pacific INEOS Belstaff is made of approximately 18,000 tonnes of steel and 40,000 meters of piping. At 230m it is longer than two football pitches combined (8 basketball courts).

Mr John Lu, President of Pacific Gas says: “We are delighted to deliver the Pacific INEOS Belstaff and start serving INEOS’ ground-breaking ethane trading business around the globe. Today marks the beginning of a very long journey with our partner INEOS. We will maintain the highest standards for the operation of the vessel and meet the fullest satisfaction of our customers.”

The launch of the Pacific INEOS Belstaff takes the INEOS ethane fleet to eleven vessels consisting of 3 VLEC’s, and 8 ‘dragon’ ships, which have been regularly transporting ethane across the Atlantic for over 5 years. A fourth VLEC, is set to launch this Spring 2022.

Monday, February 21, 2022

Amardeep Steel - Steel Pipe Manufacturer / India

Incorporated in year 1984, Amardeep Steel Centre is a well known dealer, supplier and exporter of raw materials like pipes, tubes, plates, fittings, fasteners etc. as well as process equipment like heat exchanger, pressure vessel, reactor, columns, towers, tube-bundles, etc made up of Tantalum, Titanium, Zirconium, Hastelloy, Niobium, Inconel, Monel, Nickel Alloys, Duplex Steel

Address: Sanghajkar House, 431, Dr Dadasaheb Bhadkamkar Marg, Girgaon, Mumbai, 400004, Maharashtra, India

Phone: +91 22 2389 0767

Contact: Mr. Hitesh

sales@amardeepsteel.com

NITC shipping activities increase significantly

TEHRAN – The shipments of crude oil and oil products by the fleet of the

National Iranian Tanker Company (NITC) have increased significantly

over the past few months, according to the Iranian Minister of

Cooperatives, Labor and Social Welfare.

https://www.tehrantimes.com/news/470052/NITC-shipping-activities-increase-significantly

Speaking to IRNA, Hojatollah Abdolmaleki praised the performance of NITC Head Hossein Shiva during his tenure and noted that transportation and export of crude oil and petroleum products by the company’s fleet have witnessed a serious leap in the mentioned period.

“There has been a significant leap in the transportation of oil and petroleum products by the National Iranian Tanker Company fleet so much so that the Oil Minister personally called and thanked me in this regard because we have always had some issues regarding the transportation of crude oil and products in the past,” Abdolmaleki said.

Supplying refineries with the necessary feedstock and delivering crude oil and oil products to foreign buyers is a priority of the government which has been appropriately done over the past few months, he stressed.

EF/MA

Biden Cancels 80 Million Acre Oil Lease Sale, Putting Louisiana Oil and Gas Industry in Danger

The devastating fallout of the Biden administration’s job-killing rampage continues after he canceled the sale of 80 million acres of Gulf of Mexico oil leases that was scheduled for Wednesday in New Orleans, KLFY-TV in Lafayette, Louisiana, reported Monday.

“It would kill our state. It would kill workers,” Mike Moncla, president of the Louisiana Oil and Gas Association, said of the Biden administration’s move. “It would kill jobs, and it would be a terrible thing.”

According to the Moncla and the association, nearly 250,000 Louisiana residents work in the oil and gas industry, and 98,000 of them have offshore jobs.

President Joe Biden banned all new oil and gas leases on public land and waters for 60 days in an executive order on Jan. 20, the day he took office.

He also canceled the Keystone XL Pipeline project, resulting in the loss of as many as 11,000 energy jobs.

This is all part of a sweeping initiative to make climate change the focal point of Biden’s foreign policy and national security programs.

Financial experts say all this does is hurt the U.S. economy, eliminate countless jobs, and set the stage for increased energy costs for all Americans, including sky-high gas prices.

Americans should expect the job massacre to continue as Biden continues to swing the ax through the oil and gas industry.

“Right now I think we’re still pretty much in the holding pattern,” Moncla told KLFY. “It was a 60-day ban, and he was going [to] relook at it.”

But Biden is not expected to ease his “green energy” restrictions, which means the 60-day ban will likely be extended.

Moncla said he hoped Democratic Gov. John Bel Edwards’ efforts to persuade the president to reverse course will be successful.

“Since that time, Governor Edwards has sent him a great letter letting him know exactly what that would mean to Louisiana, all of the economic and finances that come from our offshore work,” Moncla said.

“We’re hoping that Governor Edwards’ letter may have talked some sense into the president and that he won’t extend that 60 days.”

Biden mistakenly believes that blocking oil drilling in the United States will curb oil and gas production worldwide.

“Oil and gas production won’t end,” Republican Rep. Clay Higgins of Louisiana told KLFY in February. “It will only move overseas, where it’s far less regulated.

“Sending energy production to countries with horrible ecological records is the worst thing we can do for our climate.”

Republican Rep. Garret Graves of Louisiana said forcing energy jobs to flee overseas to countries that are far less eco-conscious than the U.S. will cause America to become less energy-independent and ultimately hurt the environment more.

Under former President Donald Trump, the U.S. was energy independent for the first time since 1957, according to the Institute for Energy Research. Under Biden, the nation is backsliding — without advancing the environmental causes he claims to champion.

“When you depend on these other countries, you lose the jobs, you lose the economic activity, and you result in greater global emissions,” Graves said.

Higgins agreed that Biden’s catastrophic policies and actions are annihilating the once-sizzling U.S. economy.

“The Biden administration wasted no time launching a full-scale assault on oil and gas that will send production overseas and further injure the economy,” he lamented.

Friday, February 18, 2022

Thursday, February 17, 2022

Revealed: Diezani now Dominican citizen

https://www.vanguardngr.com/2020/06/revealed-diezani-now-dominican-citizen/

…Bottlenecks forestalling her trial

By Soni Daniel, Northern Region Editor

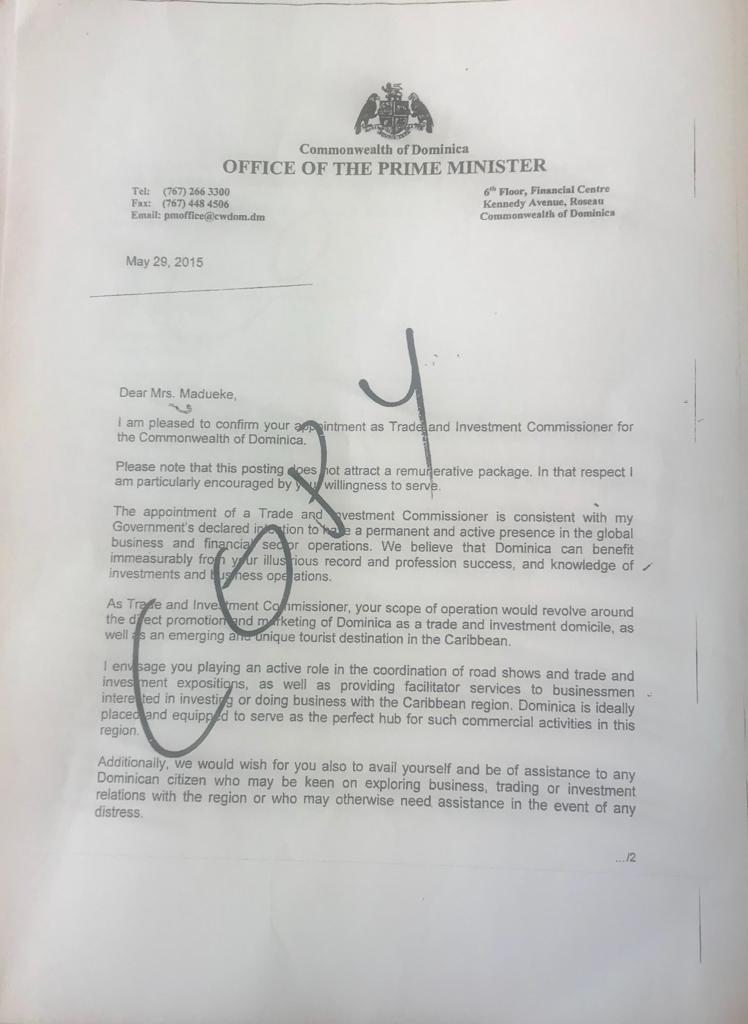

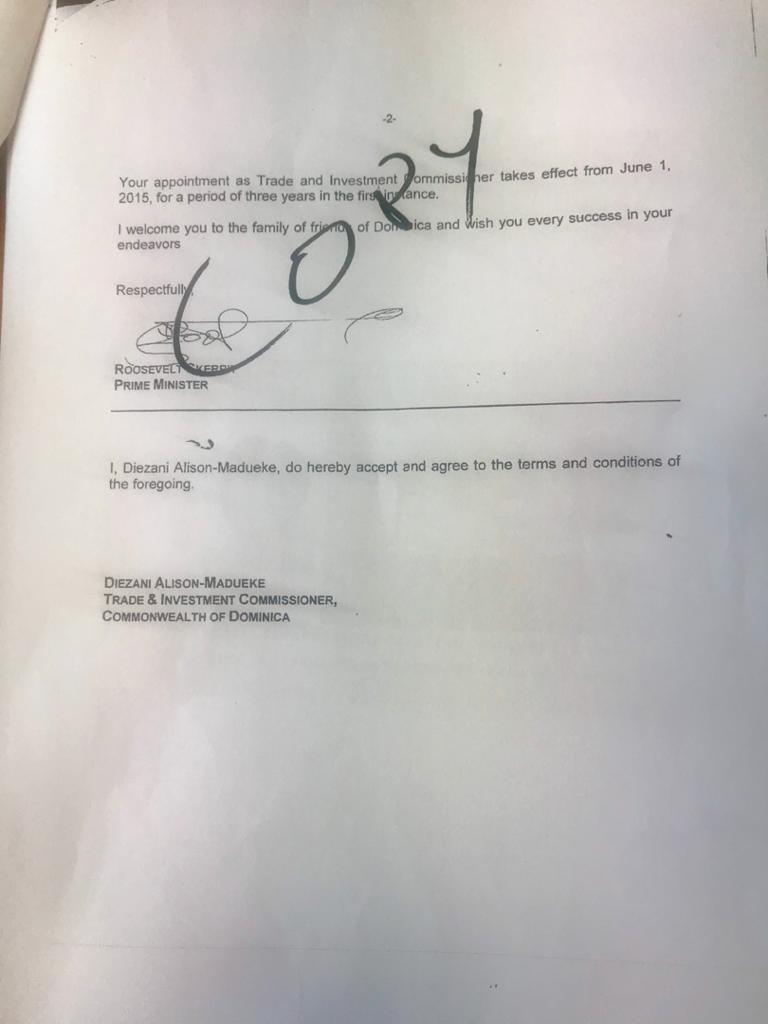

Fresh evidence has now emerged in Nigeria of how former Petroleum Minister, Mrs. Diezani Allison Madueke, plotted and secured a foreign country’s citizenship and political appointment in order to secure immunity from prosecution.

Documents at the disposal of Saturday Vanguard indicate that she carefully planned and obtained the citizenship of the Commonwealth of Dominican Republic, which subsequently appointed her as a Trade and Investment Commissioner in that country.

To show that the appointment and offer of citizenship were not accidental, Diezani’s offer and acceptance were completed a few days before she left office on June 1, 2015, barely two days before the expiration of her tenure on May 29, 2015.

According to the document she had perfected arrangements with the Office of the Prime Minister, Commonwealth of Dominica and lobbied to be appointed as Trade and investment Commissioner with effect from June 1, 2015.

The lobby actually worked. In a letter dated May 29, 2015 and signed by Prime Minister Roosevelt Kerry, Diezani was offered not only the citizenship of Dominica, a Caribbean island but also an appointment as Trade and Investment Commissioner.

READ ALSO: No Twist In President Buhari’s Popularity Index

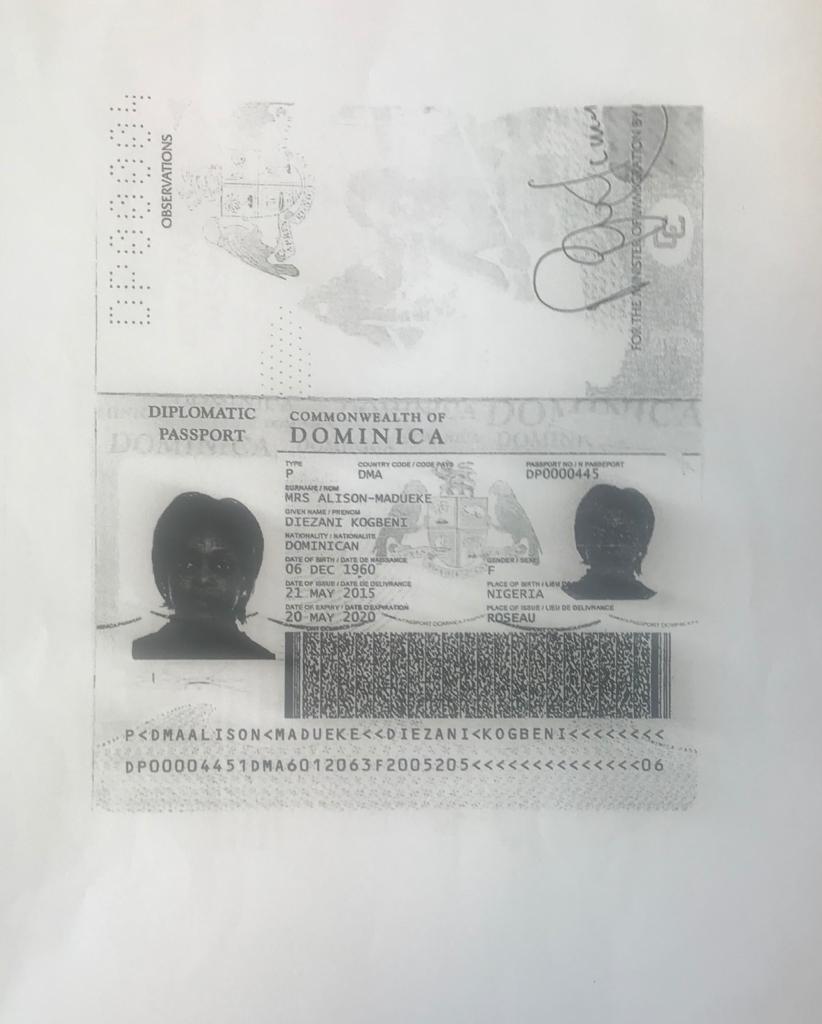

The offer also entailed the issuance of a Diplomatic Passport on May 21, 2015, with an expiry date of May 20, 2020, to the formerly powerful and influential minister, now cooling off in the United Kingdom.

Although the diplomatic visa expired on May 20 this year, she is said to be immune from arrest and prosecution by any law enforcement agency, including the Interpol.

This is due to the fact that the 32-page diplomatic passport contains a restraining order against any arrest or prosecution.

The strange immunity order says:” The President of the Commonwealth of Dominica requests and requires in the name of the Government of Dominica all those whom it may concern to allow the bearer to pass freely without let or hindrance and afford the bearer such assistance and protection as may be necessary”.

Diezani’s Dominican Republic Diplomatic Passport’s number is DP0000445.

In the appointment letter issued by Prime Minister Kerry, Diezani was assigned the task of “directing promotion and marketing of Dominica as a trade and investment domicile, as well as an emerging and unique tourist destination in the Caribbean”.

Kerry’s letter said, “I envisage you playing an active role in the coordination of road shows and trade and investment expositions, as well as providing facilitator services to businessmen interested in investing or doing business with the Caribbean region. Dominica is ideally placed and equipped to serve as the perfect hub for such commercial activities in this region”.

Diezani is believed to be busy working for the Commonwealth of Dominica, strengthened by a diplomatic shield which no law enforcement agency around the world can ignore.

Besides, her British citizenship is another protective hedge she has been using against repatriation to Nigeria to answer overwhelming charges of corruption against her.

Diezani is awaiting trial for sundry allegations of corruption, including fraudulent ownership of 76 properties in Lagos, Abuja and Port Harcourt, valued at about N23 billion.

Besides, she has 14-count charge bordering on stealing and concealment of $153 million already preferred against her by the EFCC.

When contacted, a top official of the EFCC, who sought anonymity because of the sensitive nature of the matter, confirmed the development.

He added that the commission would operate within the ambit of the law and ensure that Diezani is brought to justice.

Find below documents at the disposal of Saturday Vanguard

Diezani Alison-Madueke Net Worth 2022 Biography & Career

https://www.currentschoolnews.com/articles/diezani-alison-madueke-net-worth/

Many Nigerians are interested in the legal tussle over the beleaguered former petroleum minister Diezani Alison-Madueke net worth. But, aside from the atrocities you’ve heard, she’s done, what else do you know about her? As a result, pay attention and read thoroughly.

However, despite the claim that they recently appointed her as Trade and Investment Commissioner in Dominica, a lot of Nigerians still say she must pay for her crimes in Nigeria if found guilty.

Table of Contents

The Biography of Diezani Alison-Madueke and Her Net Worth

She is one of the most popular women politicians in Nigeria. And the first female President of The Organization of the Petroleum Exporting Countries (OPEC).

Also, she was the first woman to be appointed as an Executive Director by Shell in Nigeria.

We’d be reading Diezani Alison-Madueke’s biography. And this will cover her date of birth, age, early life, family, husband, career, net worth, etc.

Diezani Alison-Madueke Date of Birth and Parents

Her full name is Diezani Alison-Madueke. And her date of birth is 6th December 1960. She is 59 years old. She was born in Port Harcourt, Rivers State.

Her father is Chief Frederick Abiye Agama. While the mum is Beatrice Agama. And she is a Nigerian.

Education

After completing her primary and secondary education in Nigeria, she secured admission to study Architecture in England but completed it at Howard University in the United States.

Diezani Alison-Madueke returned to Nigeria on completing her bachelor’s degree and joined Shell Petroleum Development Corporation.

Occupation

She is a politician, Nigerian entrepreneur, investor, and business magnate. In 2002, after working with Shell for some years, she attended Cambridge Judge Business School for her MBA degree.

After returning to Nigeria, she was appointed as an Executive Director in Shell. Thus, becoming the first woman ever to be appointed by Shell as an Executive Director in Nigeria.

Political Career

Diezani Alison-Madueke has held several significant positions in Nigeria and beyond. In July 2007, she was appointed Transportation Minister. And a year later, she became the Minister of Mines and Steel Development.

When former President Goodluck Jonathan became the acting president in February 2010, he dissolved the cabinet and swore in a new cabinet with Alison-Madueke as Minister for Petroleum Resources.

On 27 November 2014, Alison-Madueke was elected as the first female President of The Organization of the Petroleum Exporting Countries (OPEC).

In June 2020, news broke out that she had secured a foreign country’s citizenship and a political appointment in order to secure immunity from prosecution.

Personal Life

In 1999, Diezani Alison-Madueke got married to Admiral Allison Madueke (retired), He was a one-time Chief of Naval Staff who was at various times governor of Imo and Anambra State.

She wasn’t the first wife of the Admiral, his first wife died in the 1990s.

She is now the mother of six children: one biological son and five stepchildren. The names of the children are Ngozi, Ugonna, Chimezie, Chima, and Donald.

In 2008, there was an unsuccessful attempt to kidnap Alison-Madueke and her son, Chimezie at their Abuja residence.

She revealed that while in office, she had been undergoing treatments for breast cancer in the United Kingdom.

Allegations and Arrest

On 2 December 2015, Sanusi Lamido Sanusi, a former CBN governor, made a comment during a PBS interview revealing that Diezani Alison-Madueke has been charged with responsibility for $20 billion missing from the Petroleum agency. She, however, dismissed the allegations.

Thus claiming that the former CBN governor made the allegations to retaliate after she didn’t help him to get appointed as the president of the African Development Bank (AfDB).

In other news, a PBS Newshour segment quoted American and British officials saying that Alison-Madueke might personally have organised a diversion of $6 billion from the Nigerian treasury.

They have also accused her of squandering government funds and awarding multi-billion Naira contracts without recourse to due process.

The Economic and Financial Crimes Commission (EFCC has officially charged her to court) for ‘Money Laundering’. This led to her Abuja home being raided and sealed by the agencies.

The Nigerian government has also seized money and properties worth millions of dollars traced to the former minister.

READ ALSO!!!

➢ Biography of Olusegun Obasanjo

➢ President Muhammadu Buhari Biography

➢ Anthony Joshua Net worth and Biography

Achievements and Awards

1. Diezani Alison-Madueke was the first woman to be appointed as an Executive Director by Shell in Nigeria – April 2006.

2. Also, she was the first female Federal Minister of Transportation in Nigeria – July 2007.

3. Additionally, she was the first female Federal Minister of Mines and Steel Development – December 2008.

4. Also, she was the first female Federal Minister for Petroleum Resources – April 2010.

5. Additionally, she was the first woman to serve as the president of the Organization of the Petroleum Exporting Countries (OPEC) – November 2014 to December 2015.

Diezani Alison-Madueke Net Worth

Diezani Alison-Madueke is one of the richest politicians in Nigeria. They have traced stolen funds worth billions of dollars to her since 2015 when she left the office as the Federal Minister for Petroleum Resources.

If all the allegations levelled against her were true, she’d be worth billions of Naira. She also reportedly has over 76 properties in Lagos, Abuja and Port Harcourt, valued at about ₦23 billion.

However, a reliable source has it that net worth is $500 Million.

Social Media Handles

You can follow/kconnect with Diezani Alison-Madueke on Twitter @DiezaniMadueke

Now you know more than you thought you knew about Diezani Alison-Madueke. Share this article if you find it helpful.

U.S. Gasoline Demand And Prices Jump

https://oilprice.com/Energy/Energy-General/US-Gasoline-Demand-And-Prices-Jump.html

As winter storms across the United States eased, gasoline demand jumped last week to stand at 1.8 percent above the four-week rolling average, according to data from for fuel-savings app GasBuddy, while gasoline prices are soaring and could hit a national average of $3.50 a gallon this week.

Due to fading winter storms, GasBuddy data showed that weekly U.S. gasoline demand jumped by 6.4 percent last week from the previous week and was 1.8 percent above the four week rolling average, Patrick De Haan, head of petroleum analysis at GasBuddy, said in the Weekly US Gasoline Demand Update on Monday.

Broken down by day, the first three days of the week saw U.S. gasoline demand level off after spiking the prior week. Later in the week, however, gasoline demand bounced back for the second half of the week with Wednesday up 4.9 percent from the prior Wednesday, Thursday jumped 34.3 percent from the prior Thursday with Friday up 30.1 percent from the prior Friday, and Saturday down 10.1 percent, De Haan noted.

As Brent oil prices hit $95 a barrel early on Monday, before paring gains later in the day, the national average U.S. gasoline price will likely continue to rise this week, De Haan said on Sunday.

“WTI $94, national average gas price will eclipse $3.50/gal this week,” he tweeted.

As of February 14, the national average per gallon of regular gasoline was $3.488, AAA data showed. That’s up from $3.306/gal a month ago and up from the $2.505/gal price at this time last year.

High crude oil prices remain the main driver behind the jump in pump prices in recent weeks, AAA said on Monday, adding that “Moderating winter weather and optimism over a potential fading of the omicron variant have led to an increase in gas demand.”

“More drivers fueling up here coupled with a persistent tight supply of oil worldwide provides the recipe for higher prices at the pump,” AAA spokesperson Andrew Gross said. “And unfortunately for consumers, it does not appear that this trend will change anytime soon.”

By Tsvetana Paraskova for Oilprice.com

Wednesday, February 16, 2022

Tuesday, February 15, 2022

Goldman sees copper price “breakout”, risk of “extreme scarcity episode”

Image: Codelco.

After a 26% rise in 2021, copper prices have struggled for direction this year. On Thursday, March futures made another attempt to find higher ground, jumping to $4.7085 a pound ($10,380 a tonne) the highest since October’s spike. But on Friday, the bellwether metal was once again under siege, dropping nearly 4%.

“With a diversified set of demand drivers – from EVs to electrical grids – sustaining a very tight micro into 2022, we believe that copper will reprice once these broader macro concerns abate.”

Goldman says the limited seasonal build-up of copper inventories from record low levels – currently at just over 200,000 tonnes – scarcely enough to cover three days of global consumption is “entirely insufficient to tackle” its expected deficit of 197,000 tonnes for this year.

“The longer this continues, the higher the risk of extreme scarcity episode by the end of the year,” Goldman says in its report released Tuesday.

Mid-October copper futures jumped to an intra-day high of $4.82 a pound or $10,633 a tonne in New York after available LME inventories fell to its lowest since 1974.

Goldman believes the copper market has just two years of primary production growth left.

After fresh tonnes from the likes of Ivanhoe Mines Kamoa-Kakula in the Congo, Anglo American’s greenfield Quellaveco project in Peru and Teck Resources Quebrada Blanca Phase 2 in Chile hit the market, the investment bank sees “an open-ended decline in mine supply.”

Amid long-standing issues such as declining grades and a dearth of new projects there is also growing uncertainty in Chile, the world’s top producer by a long stretch, about onerous taxation and threats of state appropriation.

Goldman says a mining royalty bill before the South American nation’s parliament has the potential to put at risk as much as one million tonnes of production.

”Such political uncertainty raises the threshold for much needed investment in future mine supply, creating an additional hurdle for prices to overcome.”

In the report, Goldman reiterates its bullish forecast for copper to average $11,875 a tonne ($5.40/lbs) in 2021, rising steadily to $15,000 ($6.80/lbs) during 2025.

Brent crude price

West Texas Intermediate price

Crude Oil Consumption YTD

Natural gas

Commodities current pricing

U.S. Nationwide Gasolione Prices

Gold Price

American dollar exchange rate

Crypto Prices

World Debt By Country

Blog Archive

-

▼

2022

(581)

-

▼

February

(61)

- Kudlow: This is madness

- US needs 'grown ups running energy policy': Americ...

- Biden has been undermining US energy independence ...

- Leaving Kyiv On A Refugee Train 🇺🇦

- Antonov An-225 - The World's Largest Aircraft | Fu...

- Dream

- Ukraine crisis will disrupt crude, coal and LNG fl...

- Larry Kudlow: Biden has made an ‘enormous mistake,...

- Ukraine: Huge Explosion and fire at oil depot afte...

- Ukrainian citizen confronts Russian soldiers after...

- Biden Halts Natural Gas Leases In Insane Move Duri...

- U.S., UK, Europe, Canada to block Russian access t...

- Jesus Walks

- Russia-focused miners collapse on Ukraine invasion

- One of the world’s first dual-fuel VLCCs unveiled ...

- Varney predicts oil price surge amid Russian invas...

- Biden admin made a ‘voluntary decision’ to end US ...

- How Will Rising Oil Prices Impact The Energy Trans...

- China plans state-backed platform to buy iron ore

- Sister Rosetta Tharpe - Didn't it rain, children

- Germany's Scholz Halts Certification of Nord Strea...

- Why Did the Democratic and Republican Parties Swit...

- When and why did Democrats and Republicans switch ...

- Gold stocks poised to dethrone top-performing oil ...

- Congo nears deal with Israeli billionaire to recov...

- Worlds largest ethane carrier named Pacific INEOS ...

- Happy Presidents Day 2022...God Bless America! 35t...

- Amardeep Steel - Steel Pipe Manufacturer / India

- NITC shipping activities increase significantly

- Sen. Kennedy: Biden administration has waged a ‘fr...

- Biden Cancels 80 Million Acre Oil Lease Sale, Putt...

- Biden has 'declared war' on the American people: S...

- Oh Canada! Ginette Reno / Canadiens de Montréal

- Black History Month: Jackie Brown

- Revealed: Diezani now Dominican citizen

- Diezani Alison-Madueke Net Worth 2022 Biography & ...

- U.S. Gasoline Demand And Prices Jump

- Candace Owens OUTSTANDING Speech, Gets A Standing ...

- Goldman sees copper price “breakout”, risk of “ext...

- Plains All American Pipeline Reports Rebounding Ea...

- Naughty Boy, Mike Posner - Live Before I Die

- Copper price: Global stocks are down to three days...

- U. S. Steel Big River Steel Works Ground Breaking ...

- Ottawa residents carry empty gas cans to throw off...

- An Artist Placed a Cube Made From $11.7 Million Wo...

- China built Congo a toll road that led straight to...

- THAT IS WRONG !!! POLICE SEIZE FUEL FOR THE FAMILI...

- The Nigerian oil thieves desperate to be seen as l...

- Nigeria: 77 Percent of Oil Spills in Nigeria Occur...

- Ted Lasso: Sam boycotts Dubai Air sponsorship / Ce...

- World's first hydrogen tanker to ship test cargo t...

- Kudlow: Biden is on his heels

- Gas price rises to $3.39 per gallon, just shy of s...

- ★ Ray Charles ★ America the Beautiful ★ 2001 World...

- 2021 Remaster "While My Guitar Gently Weeps" with ...

- Stevie Wonder - For Once In My Life [Ed Sullivan S...

- Sly And The Family Stone "I Want To Take You Highe...

- JAMES BROWN Live in Rome

- Louis Armstrong - What A Wonderful World (Original...

- Whitney Houston - Star Spangled-Banner

- Ottawa Canada Freedom Gas for Truckers

-

▼

February

(61)