Sunday, January 31, 2021

Friday, January 29, 2021

Indonesia escorts seized Iran, Panama-flagged tankers to dock for investigation

https://www.reuters.com/article/us-indonesia-iran-tanker-idUSKBN29V0U0

JAKARTA (Reuters) - The Iranian and Panamanian-flagged vessels seized by Indonesian authorities for suspected illegal oil transfers are making their way to dock at Batam island in the country’s Riau Islands Province for further investigation, a Indonesia coast guard spokesman told Reuters.

The two supertankers, with crew members from Iran and China, were seized on Sunday in Indonesian waters near Kalimantan island. The MT Horse, owned by the National Iranian Tanker Company and MT Freya, managed by Shanghai Future Ship Management Co, had a total of 61 crew members onboard.

“The ships will arrive in Batam at around 3pm (0600GMT) to 4pm later today,” Wisnu Pramandita, spokesman of the Indonesian coast guard, told Reuters.

Wisnu said some of the crew remained in the supertankers, but others were being detained on coast guard ships for questioning while the investigation was under way.

Wisnu told Reuters on Monday that the ships were “caught red-handed” transferring oil from MT Horse to MT Freya and that there was an oil spill around the receiving tanker.

Iran said on Monday that MT Horse was seized over a “technical issue” and had asked Indonesia to explain the seizure.

“The ministry of foreign affairs has coordinated with the coast guard and obtained information that two motor tanker ships ... are suspected of violating the law,” Indonesian foreign ministry spokesman Teuku Faizasyah said.

“Currently, further investigations are being carried out in order to obtain a more complete picture of the violations committed.”

The tankers were first detected at 2130 GMT on Jan. 23. Indonesia authorities said the two vessels concealed their identity by not showing their national flags, turning off automatic identification systems and failed to respond to a radio call.

Wisnu said that the ships were caught during a regular patrol.

The International Maritime Organization requires vessels to use transponders for safety and transparency. Crews can turn off the devices if there is a danger of piracy or similar hazards. But transponders are often shut down to conceal a ship’s location during illicit activities.

Iran has been accused of concealing the destination of its oil sales by disabling tracking systems on its tankers, making it difficult to assess how much crude Tehran exports as it seeks to counter U.S. sanctions. Wisnu said on Tuesday the seizure of the ships had “nothing” to do with the U.S. sanctions, when asked by Reuters.

Iran sent the MT Horse vessel to Venezuela last year to deliver 2.1 million barrels of Iranian condensate.

(This story corrects typo in byline)

Reporting by Agustinus Beo Da Costa; Writing by Fathin Ungku; Editing by Ana Nicolaci da Costa

Thursday, January 28, 2021

Wednesday, January 27, 2021

Tuesday, January 26, 2021

Monday, January 25, 2021

Sunday, January 24, 2021

Trojan Horse

https://en.wikipedia.org/wiki/Trojan_Horse

The Trojan Horse is a story from the Trojan War about the subterfuge that the Greeks used to enter the independent city of Troy and win the war. There is no Trojan Horse in the original poems by Homer about the Trojan War, and the conclusion of the story is marked by the retrieval of Hector's corpse (a great Trojan hero) by his father, Priam (king of Troy), from the willing hands of Achilles (the Greek general), though under the watchful and disagreeable eye of Agamemnon (the Greek king); the implication is that the Trojan War ended in amicable peace.

But in the popularized, fictional work of the Aeneid by Virgil, after a fruitless 10-year siege, the Greeks at the behest of Odysseus constructed a huge wooden horse and hid a select force of men inside, including Odysseus himself. The Greeks pretended to sail away, and the Trojans pulled the horse into their city as a victory trophy. That night the Greek force crept out of the horse and opened the gates for the rest of the Greek army, which had sailed back under cover of night. The Greeks entered and destroyed the city of Troy, ending the war.

Metaphorically, a "Trojan horse" has come to mean any trick or stratagem that causes a target to invite a foe into a securely protected bastion or place. A malicious computer program that tricks users into willingly running it is also called a "Trojan horse" or simply a "Trojan".

The main ancient source for the story is the Aeneid of Virgil, a Latin epic poem from the time of Augustus. The event is also referred to in Homer's Odyssey.[1] In the Greek tradition, the horse is called the "wooden horse" (δουράτεος ἵππος douráteos híppos in Homeric/Ionic Greek (Odyssey 8.512); δούρειος ἵππος, doúreios híppos in Attic Greek).

Friday, January 22, 2021

Edwin Drake - American oil driller

Edwin Drake / Wikimedia Commons

https://www.britannica.com/biography/Edwin-Laurentine-Drake

Edwin Drake, in full Edwin Laurentine Drake, (born March 29, 1819, Greenville, New York, U.S.—died November 8, 1880, Bethlehem, Pennsylvania), driller of the first productive oil well in the United States.

Raised on farms in New York and Vermont, Drake worked as a hotel and dry-goods clerk before becoming an agent for the Boston and Albany Railroad. In 1850 he became a conductor on the New York and New Haven Railroad, but a few years later he had to retire for health reasons. In 1857, while living in New Haven, Connecticut, Drake met stockholders of the Pennsylvania Rock Oil Company, which claimed a lease on land near Titusville, Pennsylvania, where oil had been gathered from ground-level seepages for medicinal uses. The company hoped to make money selling the oil for lighting, and to this end the stockholders sent Drake to Titusville to assess the viability of the enterprise. Letters of introduction to businessmen in the area referred to Drake as “Colonel,” and for the rest of his life he was known as Colonel Drake. After Drake returned to New Haven with a favourable report, the New Haven stockholders formed a new company, the Seneca Oil Company, sold some stock to Drake, and sent him back to develop the site.

Seeing the futility of gathering oil from surface seeps or trying to mine it from excavated shafts, Drake studied the techniques of drilling salt wells and decided to bore for the oil. He began drilling in May 1858 and almost immediately found it impossible to maintain a borehole in the loose rock and soil just below the surface. He solved the problem by driving sections of pipe into the ground until bedrock was struck, and from there the drilling continued until the top of an oil deposit was reached at a depth of 69 feet (21 metres) on August 27, 1859. With the spread of Drake’s drilling techniques, Titusville and other northwestern Pennsylvania communities became boomtowns.

Drake drilled two more wells for the Seneca company, but he failed to patent his drill-pipe methods and never became a success in oil speculation. He worked at various jobs in Titusville, then moved to New York City, Vermont, and New Jersey. In 1870, after years of poverty, he returned to Pennsylvania, where he was eventually awarded a pension by the state legislature.

In 1901 an executive of the Standard Oil Company paid to erect a monumental tomb in Drake’s honour at a cemetery in Titusville, where Drake’s body was moved. In 1946 the Commonwealth of Pennsylvania built a replica of Drake’s original oil derrick and engine house at the well site, which subsequently became part of the Drake Well Museum.

Oil steadies after unexpected build in U.S. crude stockpiles

https://www.reuters.com/article/global-oil-int-idUSKBN29Q084

NEW YORK (Reuters) - Oil prices steadied on Thursday after industry data showed a surprise increase in U.S. crude inventories that revived pandemic-related fuel demand concerns, while U.S. stimulus hopes buoyed prices.

Brent crude futures rose 2 cents to settle at $56.10 a barrel. U.S. West Texas Intermediate (WTI) crude futures fell 18 cents to settle at $53.13 a barrel.

Both benchmarks rose over the past two days on expectations of massive COVID-19 relief spending under new U.S. President Joe Biden.

Late Wednesday, industry data showed U.S. crude oil inventories rose 2.6 million barrels last week, compared with analysts’ forecasts in a Reuters poll for a 1.2 million-barrel draw.

Official inventory data has been delayed by two days to Friday due to the Martin Luther King Jr. holiday and Inauguration Day.

“We are on pause until we get the inventory report,” said Phil Flynn, senior analyst at Price Futures Group in Chicago. “The market is waiting to see what we’re going to see in inventories tomorrow and stimulus down the road.”

Elsewhere, compliance with a deal to cut output from the Organization of the Petroleum Exporting Countries and its allies fell in December from November. Compliance reached 99% last month, two sources told Reuters.

Meanwhile, rising coronavirus cases in China, the world’s largest crude oil importer, weighed on prices.

Beijing plans to impose strict virus testing requirements during the Lunar New Year holiday season, when tens of millions of people are expected to travel, as it battles the worst wave of new infections since March 2020.

The commercial hub of Shanghai reported its first locally transmitted cases in two months on Thursday.

Longer term, the Biden administration could be bearish for oil.

Among his first actions as president, Joe Biden announced America’s return to the Paris climate accord to combat climate change and revoked a permit for the Keystone XL oil pipeline project from Canada.

The administration is also committed to ending new oil and gas leasing on federal lands.

The markets will also follow expected U.S. efforts to strengthen nuclear constraints on oil producer Iran through diplomacy. It will raise the issue in early talks with foreign counterparts and allies, the White House said.

Reporting by Stephanie Kelly in New York; additional reporting by Ahmad Ghaddar in London, Sonali Paul in Melbourne and Koustav Samanta in Singapore; Editing by Marguerita Choy, Barbara Lewis and David Gregorio

Thursday, January 21, 2021

Keystone XL pipeline halted as Biden moves to cancel permit

Argus Leader File Photo

Argus Leader File Photo

TORONTO (AP) — Construction on the long disputed Keystone XL oil pipeline halted Wednesday in anticipation of incoming U.S. President Joe Biden revoking its permit.

Biden’s Day One plans includes moving to revoke a presidential permit for the pipeline.

The 1,700-mile (2,735-kilometer) pipeline was planned to carry roughly 800,000 barrels of oil a day from Alberta to the Texas Gulf Coast, passing through Montana, South Dakota, Nebraska, Kansas and Oklahoma.

“As a result of the expected revocation of the Presidential Permit, advancement of the project will be suspended,” the Calgary, Alberta-based company said in a statement.

Keystone XL President Richard Prior said over 1,000 jobs, the majority unionized, will be eliminated in the coming weeks.

More:SD delegation signs letter urging Biden to continue Keystone XL pipeline

“We will begin a safe and orderly shut-down of construction at our U.S. pump station sites and we will conclude the Canadian pipeline scope in the coming weeks,” he said.

First

proposed in 2008, the pipeline has become emblematic of the tensions

between economic development and curbing the fossil fuel emissions that

are causing climate change. The Obama administration rejected it, but

President Donald Trump revived it and has been a strong supporter.

Construction already started.

“We are disappointed but acknowledge the President’s decision to fulfil his election campaign promise on Keystone XL,” Canadian Prime Minister Justin Trudeau said in a statement.

Trudeau said his government tried to make the case for the pipeline to Biden and his officials.

Trudeau

raised Keystone XL as a top priority when he spoke with Biden in a

phone call in November. The project is meant to expand critical oil

exports for Canada, which has the third-largest oil reserves in the

world.

Jason Kenney, premier of the oil-rich province of Alberta, said late Tuesday he urged Trudeau to tell Biden that “rescinding the Keystone XL border crossing permit would damage the Canada-US bilateral relationship.”

Trudeau and

Biden are politically aligned and there are expectations for a return to

normal relations after four years of Trump, but the pipeline is an

early irritant as Biden has long said he would cancel it.

“Despite President Biden’s decision on the project, we would like to welcome other executive orders made today, including the decisions to rejoin the Paris Agreement and the World Health Organization, to place a temporary moratorium on all oil and natural gas leasing activities in the Arctic National Wildlife Refuge, and to reverse the travel ban on several Muslim-majority countries," Trudeau said.

Kirsten Hillman, Canada’s ambassador to the United States, said Canada needs to move on now that Biden has made a decision.

Critics of Canada's oil sands say the growing operations increase greenhouse gas emissions and threaten Alberta’s rivers and forests.

More:Canadian PM Justin Trudeau urging Biden administration not to cancel Keystone XL pipeline

But Marty Durbin, president of the U.S. Chamber of Commerce's Global Energy Institute, said Biden's decision is not grounded in science and will put thousands of Americans out of work,

"The pipeline — the most studied infrastructure project in American history — is already under construction and has cleared countless legal and environmental hurdles," Durbin said in a statement. "Halting construction will also impede the safe and efficient transport of oil, and unfairly single out production from one of our closest and most important allies.”

Environmental groups applauded Biden’s move.

“Killing the Keystone XL pipeline once and for all is a clear indication that climate action is a priority for the White House,” said Dale Marshall, national climate program manager for Canada’s Environmental Defense.

4 Reasons Trump Was Right to Pull Out of the Paris Agreement

Kevin Lamarque / Reuters

President Donald Trump has fulfilled a key campaign pledge, announcing that the U.S. will withdraw from the Paris climate agreement.

The Paris Agreement, which committed the U.S. to drastically reducing greenhouse gas emissions, was a truly bad deal—bad for American taxpayers, American energy companies, and every single American who depends on affordable, reliable energy.

It was also bad for the countries that remain in the agreement. Here are four reasons Trump was right to withdraw.

1. The Paris Agreement was costly and ineffective.

The Paris Agreement is highly costly and would do close to nil to address climate change.

If carried out, the energy regulations agreed to in Paris by the Obama administration would destroy hundreds of thousands of jobs, harm American manufacturing, and destroy $2.5 trillion in gross domestic product by the year 2035.

In withdrawing from the agreement, Trump removed a massive barrier to achieving the 3 percent economic growth rates America is accustomed to.

Simply rolling back the Paris regulations isn’t enough. The Paris Agreement would have extended long beyond the Trump administration, so remaining in the agreement would have kept the U.S. subject to its terms.

Those terms require countries to update their commitments every five years to make them more ambitious, starting in 2020. Staying in the agreement would have prevented the U.S. from backsliding or even maintain the Obama administration’s initial commitment of cutting greenhouse gas emissions by 26 to 28 percent.

The Obama administration made clear in its commitment that these cuts were only incremental, leading up to an eventual 80 percent cut in the future.

In terms of climate benefits produced by Paris, there are practically none.

Even if every country met its commitments—a big “if” considering China has already underreported its carbon dioxide emissions, and there are no repercussions for failing to meet the pledges—the changes in the earth’s temperature would be almost undetectable.

2. The agreement wasted taxpayer money.

In climate negotiations leading up to the Paris conference, participants called for a Green Climate Fund that would collect $100 billion per year by 2020.

The goal of this fund would be to subsidize green energy and pay for other climate adaptation and mitigation programs in poorer nations—and to get buy-in (literally) from those poorer nations for the final Paris Agreement.

The Obama administration ended up shipping $1 billion in taxpayer dollars to this fund without authorization from Congress.

Some of the top recipients of these government-funded climate programs have in the past been some of the most corrupt, which means corrupt governments collect the funds, not those who actually need it.

No amount of transparency negotiated in the Paris Agreement is going to change this.

Free enterprise, the rule of law, and private property are the key ingredients for prosperity. These are the principles that actually will help people in developing countries prepare for and cope with a changing climate and natural disasters, whether or not they are caused by man-made greenhouse gas emissions.

3. Withdrawal is a demonstration of leadership.

The media is making a big to-do about the fact that the only countries not participating in the Paris Agreement are Syria and Nicaragua.

But that doesn’t change the fact that it’s still a bad deal. Misery loves company, including North Korea and Iran, who are signatories of the deal.

Some have argued that it is an embarrassment for the U.S. to cede leadership on global warming to countries like China. But to draw a moral equivalency between the U.S. and China on this issue is absurd.

China has serious air quality issues (not from carbon dioxide), and Beijing has repeatedly falsified its coal consumption and air monitoring data, even as it participated in the Paris Agreement. There is no environmental comparison between the U.S. and China.

Other countries have a multitude of security, economic, and diplomatic reasons to work with America to address issues of mutual concern. Withdrawal from the agreement will not change that.

Certainly, withdrawing from the Paris Agreement will be met with consternation from foreign leaders, as was the case when the U.S. withdrew from the Kyoto Protocol.

However, it could very well help future negotiations if other governments know that the U.S. is willing and able to resist diplomatic pressure in order to protect American interests.

4. Withdrawal is good for American energy competitiveness.

Some proponents of the Paris Agreement are saying that withdrawing presents a missed opportunity for energy companies. Others are saying that it doesn’t matter what Trump does because the momentum of green energy is too strong.

Neither argument is a compelling case for remaining in the agreement.

Whether it is conventional fuel companies or renewable ones, the best way for American energy companies to be competitive is to be innovative and competitive in the marketplace, not build their business models around international agreements.

There is nothing about leaving the agreement that prevents Americans from continuing to invest in new energy technologies.

The market for energy is $6 trillion and projected to grow by a third by 2040. Roughly 1.3 billion people do not yet have access to electricity, let alone reliable, affordable energy.

That’s a big market incentive for the private sector to pursue the next energy technology without the aid of taxpayer money.

The U.S. federal government and the international community should stop using other peoples’ money to subsidize energy technologies and while regulating affordable, reliable energy sources out of existence.

The Paris Agreement was the open door for future U.S. administrations to regulate and spend hundreds of millions of dollars on international climate programs, just as the Obama administration did without any input from Congress.

Now, that door has thankfully been shut.

This piece originally appeared in The Daily Signal

Wednesday, January 20, 2021

Thank you and God Bless President Trump!

God's ways are not our ways.

God's path is not our path.

God does not make mistakes and his plan is greater than our plan.

Yea, though I walk through the valley of the shadow of death, I will fear no evil: for thou art with me; thy rod and thy staff they comfort me. Thou preparest a table before me in the presence of mine enemies: thou anointest my head with oil; my cup runneth over.

Psalm 23:4

No one can stop God's plan.

God will use every known and unknown tool for His Divine and Absolute purpose.

God will prevail!

Monday, January 18, 2021

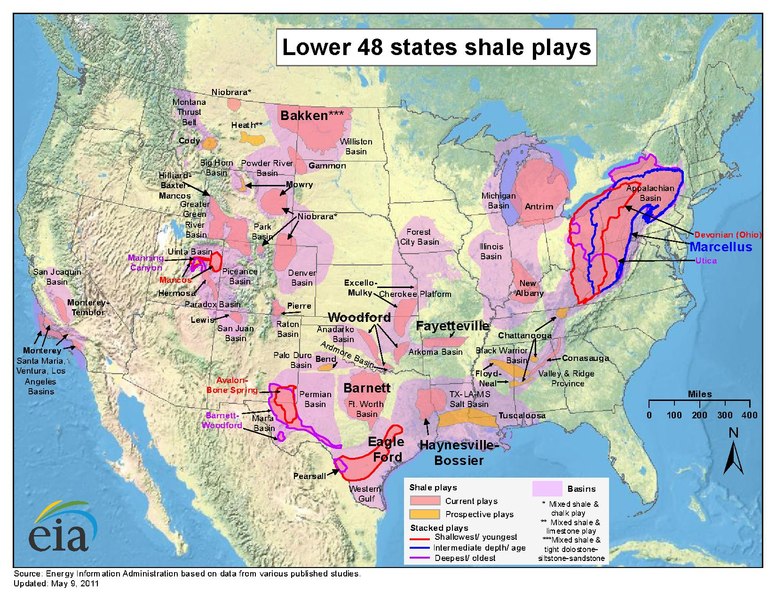

U.S. Shale Is Gaining Influence Over Oil Markets

https://oilprice.com/Energy/Energy-General/US-Shale-Is-Gaining-Influence-Over-Oil-Markets.html

OPEC was formed in 1960 by founding members Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela. For a brief period, the petroleum cartel became the dominant force behind world oil prices and a key geopolitical power broker, with its members controlling nearly half of world oil production and more than three-quarters of global oil reserves. As U.S. oil production entered a period of apparently inexorable decline after its 1970 peak, Washington’s desire to shore-up energy security and create a bulwark against communist expansion into the Middle East saw Saudi Arabia become a key U.S. ally. OPEC at the height of its power, in the 1970s, flexed its muscles by cutting oil output causing prices to spiral upward triggering two oil price shocks that sparked global recessions. Since then, OPEC’s power has steadily deteriorated, with that decline accelerating over the last two decades because of rapidly growing non-OPEC oil production, notably in the U.S and Brazil.

The U.S. shale oil boom caused onshore production to swiftly soar after nearly three decades of decline. U.S. crude oil imports from the Middle East plummeted and Congress lifted a four-decade restriction on U.S. oil exports. Even Riyadh’s 2014 plan to regain market share and obliterate the U.S. shale oil industry by opening the spigots and significantly boosting production, causing crude oil prices to enter a sustained decline, failed. In 2018, the U.S. overtook Saudi Arabia to become the world’s largest oil producer, pumping 10.96 million barrels of oil equivalent daily. Since then production, spearheaded by the shale oil industry, has grown with the March 2020 oil price collapse having little sustained material impact on the U.S. shale oil industry. The U.S. Energy Information Administration estimates U.S. 2020 oil production averaged 11.3 million barrels of crude oil daily which, while a 7% decline compared to 2019, is still a notable 29% greater than the 8.8 million barrels produced daily during 2014 during the shale oil boom’s peak. The EIA expects 2021 U.S. oil production to decline by 2% year over year to 11.1 million barrels daily, which is still 26% greater than 2014. The resilience of the U.S. shale oil industry can be attributed to improving technology and expertise which along with growing operational efficiencies has caused breakeven prices to steadily fall. According to the Dallas Federal Reserve, new shale oil wells have an average breakeven price of $46 to $52 per barrel compared to around $77 a barrel in 2014. There is every indication that U.S. shale could surprise energy markets once again during 2021 and keep pumping crude oil at a furious pace regardless of softer prices. U.S. foreign policy is also eroding OPEC’s geopolitical power and ability to manipulate oil prices. Sanctions against Iran and Venezuela are preventing those petroleum-rich nations from expanding oil production or strengthening their influence within the cartel. It also rewards Saudi Arabia by retarding Iran’s economic growth, thereby curtailing Teheran’s influence in the Middle East and cementing Riyadh’s authority as OPEC’s leading producer. The White House’s petro-diplomacy under President Trump highlights OPEC diminishing influence and ability to manipulate oil prices. During 2018 when the Brent had rallied to over $70 and was flirting with $80 per barrel, threatening U.S. economic growth, Trump weighed in exerting pressure on OPEC to boost production keeping prices low. Then in early April 2020, after oil prices collapsed because of the COVID-19 pandemic and looming price war between Saudi Arabia and Russia, threatening the survival of the U.S. shale oil industry, Trump intervened once again. He contacted Riyadh and threatened the withdrawal of U.S. troops unless the Saudi’s cut production to bolster crude oil prices.

Related: Shale Giant Chesapeake Emerges From Bankruptcy

It is not only the rapid growth of U.S. oil production over the last decade which is challenging OPEC’s control over oil prices and geopolitical power. Saudi Arabia’s growing dependence on U.S. support for waging its proxy war against Iran for control of the Middle East and leadership of the Muslim world as well as OPEC has weakened the cartel’s independence and geopolitical power. Riyadh benefits tremendously from Washington’s foreign policy, notably the severe economic and diplomatic sanctions imposed on OPEC members Iran and Venezuela. By denying both countries access to global energy markets they are unable to grow their petroleum production, crimping their influence and giving Saudi Arabia a freer hand with setting cartel policy. That ensures neither Venezuela nor especially Iran can prosper from the increased economic wealth that comes from higher oil production, placing severe pressure on both pariah regimes while bolstering Saudi Arabia’s position. A stronger, but somewhat less independent Saudi Arabia magnifies the effect of U.S. regional policy while giving Washington a more reliable proxy with which to influence regional affairs and maintain control over the Middle East’s vast petroleum resources. This also blunts Moscow’s ability to expand its regional influence through its alliance of convenience with Teheran, which saw both country’s support President Bashar al-Assad’s dictatorial regime during the bloody Syrian civil war. Those developments have given Washington a greater say on OPEC oil production and ultimately prices. This is underscored by Riyadh’s decision to cut one million barrels daily of Saudi Arabia’s oil production to buoy prices and absorb increased Russian output. Not only has Riyadh bolstered oil prices at a critical time, especially for U.S. shale, but indicates the Saudi government seeking to curry favor with the incoming Biden administration.

For those reasons, President Biden must carefully consider whether rejoining the Joint Comprehensive Plan of Action (JCPOA) and removing all U.S. sanctions is the right move, particularly with Teheran enriching uranium in breach of the deal. This is particularly the case when Iran’s recent belligerence and aggression are considered. The Islamic Revolution Guards Corps recently seized a South Korean tanker in the Strait of Hormuz, while Teheran is ratcheting-up support for Venezuelan President Nicolás Maduro’s dictatorial socialist regime despite the massive humanitarian crisis his government has unleashed.

By Matthew Smith for Oilprice.com

Friday, January 15, 2021

Exxon’s Mega Oil Finds In Guyana Are Just The Beginning

https://oilprice.com/Energy/Crude-Oil/Exxons-Mega-Oil-Finds-In-Guyana-Are-Just-The-Beginning.html

Like many global oil majors ExxonMobil is under considerable pressure because of the significant fallout from the COVID-19 pandemic, sharply weaker oil prices and the threat of peak oil demand. There are growing fears that Exxon, because of its tremendous debt burden, is a zombie company. These are generally companies that are not generating sufficient operating income to cover its interest expenses. While Exxon is struggling because of the prolonged slump in oil prices reporting a $2.4 billion loss for the first nine months of 2020 and deteriorating cashflow it is not yet a zombie company. The global oil supermajor has several levers at its disposal to boost profitability and cash flow, key being the improved outlook for oil prices along with Exxon’s globally diversified portfolio of quality energy assets. In response to sharply weaker oil prices and the need to boost profitability Exxon announced during November 2020 that it intended to prioritize capital spending for high value assets, key among them being its operations in the Guyana-Suriname Basin located in offshore South America.

Exxon made its first Guyana oil discovery in the offshore Stabroek Block during May 2015. By December 2019, the integrated energy major had commenced production at the Liza oilfield with the capacity to pump 120,000 barrels daily. During September 2020, Exxon made its 18th oil discovery in the Stabroek Block and upgraded its estimate of recoverable oil resources to more than 8 billion barrels.

Source: Hess.

That month Exxon announced it will proceed with developing the Payara oilfield, in the Stabroek Block, which will come on-line in 2024 possessing the capacity to pump 220,000 barrels daily. By December 2020 Exxon had achieved its production goal for the Liza field and the company anticipates producing more than 750,000 barrels daily from the 6.6-million-acre Stabroek Block by 2026.

This is a highly profitable asset for the integrated oil major, even with weaker oil prices, because of its particularly low breakeven costs. According to partner Hess, which has a 30% interest in the block alongside Exxon’s 45% and CNOOC's 25%, the Liza oilfield is pumping crude oil at a breakeven price of $35 per barrel, and this will fall further. Hess claims that the breakeven price for the second FPSO to be deployed, Liza Unity which is scheduled to commence operations in 2022, will pump crude at an even lower breakeven price of around $25 per barrel. With an API gravity of 32 degrees and 0.58% sulfur content, the crude oil produced from the Liza field is relatively easily and cost effectively refined into high quality low sulfur content fuels. That will ensure that it does not sell at a significant discount to the international Brent price benchmark.

Related: Oil, Gas Rigs Increase For Seventh Straight Week

Exxon secured a favorable production sharing agreement (PSA can be viewed here) with Guyana’s government for the Stabroek Block. There was an $18 million signing bonus with only 2% royalties payable on the oil produced and a 50% profit sharing clause, which only applies once 75% of exploration and development costs have been recovered. That makes Exxon’s operations in the Stabroek Block highly profitable even if oil prices remain weak and Brent trades at around $50 per barrel, making it a key source of revenue as production grows. The PSA has attracted considerable criticism as being too generous. While the government of Irfaan Ali, who was sworn in during August 2020 bringing an end to Guyana’s electoral crisis, pledged to review the PSA thus far it has baulked at renegotiating the agreement. In fact, during September 2020 Ali’s government granted the necessary approvals for Exxon’s Payara project to proceed. The benefit for Guyana, which has suffered significantly because of the COVID-19 pandemic, is tremendous. The IMF predicted that the former British colony’s gross domestic product expanded by an impressive 26% during 2020, despite many other countries suffering recessions because of the pandemic. Guyana’s economy will then grow by an additional 8% during 2021. Industry consultancy Rystad Energy anticipates this will cause government revenues to surge more than 30-fold over the coming decade as the oil boom, spearheaded by Exxon, gains momentum.

There are further indications that this is merely the start of what will become a vast oil boom that will benefit not only Exxon and Guyana but neighboring Suriname. During December 2020, Exxon announced that along with partner Malaya’s national oil company Petronas, that hydrocarbons had been discovered in Block 52 offshore Suriname. Petronas stated: “The Sloanea-1 exploration well encountered several hydrocarbon-bearing sandstone packages with good reservoir qualities in the Campanian section. The well data proves excellent calibration of the hydrocarbon potential of the block.” This indicates the discovery holds considerable potential, especially when it is considered that Block 52 borders Block 58 where Apache and Total made three significant oil discoveries during 2020.

The Guyana-Suriname Basin was determined by the U.S. Geological Survey in 2000 to have mean undiscovered resources of over 15 billion barrels of crude oil and 42 trillion cubic feet of natural gas. In 2019, the USGS stated it was looking to resurvey the Guyana-Suriname Basin with a view to the geological formation holding greater quantities of hydrocarbons than initially estimated. That bodes well for Exxon and its partners to make more discoveries and continue growing low-cost oil production in the basin. As those oil discoveries are made and production grows, it will substantially boost economic growth in the impoverished former colonies of Guyana and Suriname as well as urgently needed government revenues.

By Matthew Smith for Oilprice.com

Thursday, January 14, 2021

Wednesday, January 13, 2021

Another $1 billion wipeout: Why is Bitcoin seeing extreme price moves?

Total Bitcoin liquidations. Source: Bybt.com

https://cointelegraph.com/news/another-1-billion-wipeout-why-is-bitcoin-seeing-extreme-price-moves

Nearly $1 billion worth of Bitcoin (BTC) futures contracts were liquidated on Jan. 13, a day after the big shakeout. The continuous loop of liquidations is causing extreme volatility and large price swings in the cryptocurrency market.

What are futures liquidations, and why are so many Bitcoin positions being liquidated?

In the Bitcoin futures market, traders borrow additional capital to bet against or for Bitcoin. The technical term for this is leverage, and when traders use high leverage, the liquidation threshold gets tighter.

For example, if a trader borrows 10 times the initial capital, a 10% price move to the opposite direction would cause the position to be liquidated. Once it is liquidated, the position becomes worthless and all of the initial capital is lost.

When Bitcoin saw the big 20% drop from $41,000 to $30,500 on Jan. 12, nearly $2 billion worth of futures contracts were liquidated.

However, within 24 hours, another $1 billion worth of contracts were liquidated. Yet, there were no large price swings other than the range between $32,000 and $35,500.

The data indicates that many traders have been overleveraging their positions to short BTC after it recovered from $30,500. Hence, as Bitcoin rallied to $35,500, many short contracts were liquidated.

The cascading liquidations of short contracts are most likely the main reason behind BTC’s swift 20% relief rally from $30,500 to $35,500.

The market is less leveraged compared with the past two weeks. The futures funding rate is moving in between 0.01% and 0.05%, which means buyers still represent the majority of the market but are not dominating the market.

By comparison, when Bitcoin was above $40,000, the futures funding rate consistently remained at around 0.1% to 0.15%. This meant that the market was overwhelmed by buyers and overleveraged traders.

“Healthy” shakeout

Although extreme volatility is not favorable, the shakeout of an overleveraged market is healthy and essential for the continuation of the rally.

If the Bitcoin market remains extremely overleveraged while rallying above $40,000, it risks a much larger correction than 25%.

In previous bull markets, Bitcoin frequently saw 30% to 40% pullbacks, and as such, the recent drop from $42,000 to nearly $30,000 is nothing out of the ordinary for a BTC bull market.

Additionally, as the pseudonymous trader known as “Byzantine General” noted, the $30,000 area has become a major support level.

The Bitcoin futures market cooling down while solidifying $30,000 as a support area is highly optimistic for the medium-term prospect of BTC.

Whale clusters also identify the $30,000 level as a whale cluster support, which means that this psychological level will certainly be defended by the bulls if the price turns south.

Monday, January 11, 2021

Caspian Oil Flow Through Baku-Tbilisi-Ceyhan Pipeline Reached 3.5 Billion Barrels by End of 2020

Independent Graphics

A total of 3.5 billion barrels of crude oil had been shipped to the global markets as of the end of 2020 from the marine terminal in the Ceyhan district of Adana province in southern Turkey, the last stop of the Baku-Tbilisi-Ceyhan (BTC) pipeline, according to information provided by Turkey’s Petroleum Pipeline Corporation (BOTAŞ).

The pipeline, inaugurated in July 2006 and dubbed the “energy project of the century,” carries Azerbaijani oil from the Caspian Sea, in addition to volumes from other countries in the region like Russia and Kazakhstan.A total of 4,659 tankers have operated at the Haydar Aliyev Marine Terminal during the pipeline’s nearly 15 years of operation.

The Turkish section of the 1,076-kilometre-long (669-mile-long) pipeline is operated by BOTAŞ International (BIL). In 2019, 233.1 million barrels of crude oil were shipped from the terminal. In 2020, that figure was 278.2 million barrels.

Last year, the company shipped the most barrels in April despite the worldwide lockdowns that decreased the energy needs, reporting 21.3 million barrels, while November was the lowest month with 15.3 million barrels

Friday, January 8, 2021

Saudi Surprise Cut Continues To Lift Oil Prices

Oil prices remained elevated and were still on the rise on Thursday, hitting an 11-month high, as the effects of Saudi Arabia’s surprise announcement about an additional million barrels of crude oil production cuts still has enough juice to withstand civil unrest in the United States and the global pandemic.

At 4:11 p.m. EST, the WTI benchmark was trading up 0.61% on the day at $50.94. The last time WTI traded above $50 per barrel was February. One week ago, the WTI benchmark closed at $48.52.

The Brent crude benchmark is now trading at $54.50, up 0.37% on the day. February was the last time the Brent benchmark sat above $54.

The oil market seems to be focusing more on what Saudi Arabia can do to rebalance oil’s supply and demand than on any political instability brewing in the United States. The oil markets also seem to be discounting the serious impact that new waves of lockdowns will have on the overall demand picture.

While oil prices did slip briefly on Wednesday as a group of President Trump supports stormed into the Capitol, it was unable to tamp down effects of Saudi Arabia’s gift that keeps on giving. The market is for now satiated.

Still, oil prices are multiple dollars per barrel lower than they were in the summer of 2019, and Brent is still trading $20 per barrel below what it was trading at in the summer of 2018 as the pandemic has stripped millions of barrels per day off of the demand side.

Not even swing producer Saudi Arabia has enough juice to offset that demand destruction.

By Julianne Geiger for Oilprice.com

Thursday, January 7, 2021

Tankers set course for thick ice as part of experiment on Northern Sea Route

LNG carrier Christophe de Margerie in Arctic sea-ice. Photo: Novatek

As natural gas carrier Christophe de Margerie sails eastwards towards China, the Nikolay Zubov enters the Bering Strait in the opposite direction. It a first mid-winter operation of the kind, the two commercial ships will cross each others' paths in one of the most icy parts of the Arctic sea route.

It has been under planning for a long time, and repeatedly announced by Russian Arctic developers. On the 5th of January, the Christophe de Margerie set out from LNG terminal Sabetta with east-bound course for Chinese port Dalian. Eleven days earlier did the Nikolay Zubov leave Dalian with course for Sabetta.

While the former is expected to reach its destination in China on the 26th of January, the latter is due to arrive in Sabetta on the 16th of January.

Never before have two commercial ships conducted this kind of parallel voyages on the Northern Sea Route at this part of the year. None of the ships are accompanied by icebreakers.

The operations are part of a series on experimental shipments on the remote and icy shipping route. In July last year, Sergey Frank, board chairman of shipping company Sovcomflot, made clear that ice-class tankers will be sailing on the Northern Sea Route in January and February.

The experiments are conducted in cooperation with natural gas producer Novatek and nuclear power company Rosatom, Frank said. It is part of a bid to show that the route can be used also in winter time. According to ship operators, the NSR can soon be used for sailing up to 10 months of the year.

In May 2020, Sovcomflot sent its Christophe de Margerie across the route in a record-early voyage, more than a month earlier than the previous record.

Previously, voyages across the eastern part of the NSR in January were conducted in 2019 by Boris Sokolov, a condensate tanker, and Yamal LNG carrier Boris Davydov. The two ships sailed from east to west without icebreakers. In January 2018, LNG carrier Eduard Toll made the same voyage.

The natural gas tankers are part of a fleet of 15 vessels that serve the Yamal LNG project. They can carry up to 70,000 tons of liquified nature gas, and all have ice class Arc7, that enables them to autonomously break through up to 2,1 meters of sea ice.

The fleet of LNG carriers are instrumental in the major spike in shipping in the Russian Arctic. In 2020, more than 32 million tons of goods was shipped on the Northern Sea Route, up from 2019 when the volume amounted to 31,5 million tons.

The lion’s share of the goods is LNG.

By year 2024, the Kremlin intends to boost volumes on the NSR to 80 million tons and further to 130 million tons by 2035.

US Imports No Saudi Crude Oil for First Time in 35 Years

An oil pumping jack operates in Texas. (Matthew Busch/Bloomberg News)

https://www.ttnews.com/articles/us-imports-no-saudi-crude-oil-first-time-35-years

The U.S. didn’t import any Saudi crude the week of Dec. 28 for the first time in 35 years, a reversal from just months ago when the Kingdom threatened to upend the American energy industry by unleashing a tsunami of exports into a market decimated by the pandemic.

The absence of deliveries follows a slump in crude shipments to the U.S. that left the desert kingdom in October. Since tankers from Saudi Arabia take about six weeks to reach import terminals on either the west or Gulf coasts, the drop is only starting to show up now. This is the first week America had no deliveries based on available weekly data through June 2010 from the U.S. Energy Information Administration. A longer history of monthly figures shows this is the first time there were no Saudi imports since September 1985.

Earlier this year, the oil producing countries of the Organization of Petroleum Exporting Countries and 10 non-OPEC allies agreed to cut production by a record 9.7 million barrels a day after a brief production free-for-all that saw prices plunge. The supply cuts have helped shore up crude, even as fuel consumption struggles to return to pre-pandemic levels. In the past month, oil prices have risen on hopes that demand could improve as a number of vaccines have been announced to combat the health crisis.

But America is still in the throes of the pandemic, with record infections in many states forcing new restrictions, while other parts of the world are recovering. U.S. gasoline consumption plunged to the lowest in years during the usual high-demand Thanksgiving holiday period.

The demand loss is so acute some U.S. refineries have been idled. “Throughput is still below where it was before the crisis because of reduced domestic demand. So why send more here when Asia is where recovery has been clear,” said Sandy Fielden, director of oil and products research at Morningstar Inc.

For Saudi Arabia, cutting shipments to the U.S. is the quickest way to telegraph to the wider market that it’s tightening supply. The government is alone in publishing weekly data on crude stockpiles and imports, which carry enormous influence among oil traders. Other big petroleum consuming nations, like China, publish less timely information about oil supplies.

In May and June, Saudi deliveries to the U.S. more than doubled from a year ago. The onslaught prompted Senator Ted Cruz, a Texas Republican, to tweet in April: “My message to the Saudis: TURN THE TANKERS THE HELL AROUND.” American refiners received the final installment of that bumper load in early July.

20 tankers—filled w/ 40mm barrels of Saudi oil—are headed to the US. This is SEVEN TIMES the typical monthly flow. At the same time, oil futures are plummeting & millions of US jobs in jeopardy. My message to the Saudis: TURN THE TANKERS THE HELL AROUND. https://t.co/gYoQzvHAEQ

— Ted Cruz (@tedcruz) April 21, 2020

Since then, Saudi oil shipments to the U.S. have steadily declined. Just two weeks ago, it delivered only 73,000 barrels a day to customers, preliminary U.S. Energy Information Administration data shows.

Still, Saudi Arabia won’t be giving up on supplying the U.S. anytime soon even during this pandemic. Tanker tracking data monitored by Bloomberg show shipments from the kingdom rising in November. Even so, after the first of those ships arrives off the west coast this week, there is a long gap until the next one is due.

“The Saudis will be mindful about not losing any more U.S. market share to other sellers not if they can help it,” said Morningstar’s Fielden. That’s why despite the low seasonal U.S. demand, the Saudis cut prices for January shipments to its American buyers, he added.

In the short term, the election of Joe Biden could benefit Saudi Arabia. While transitioning away from hydrocarbons would have a long-term impact on oil demand, hopes to revive the 2015-Iranian nuclear deal would pave the way for more Iranian oil to flow globally. “Those sales will displace Saudi oil and that would mean Arabia would have to turn to the U.S. to maintain sales,” said Andy Lipow, president of Lipow Oil Associates in Houston.

Wednesday, January 6, 2021

End of Qatar blockade is ‘a win for the region,’ Saudi foreign minister says

- The end of the Gulf dispute is a win for the region, Saudi Arabia’s foreign minister, Faisal bin Farhan al-Saud, told CNBC after announcing that relations between Qatar and four Arab countries have been fully restored.

- The Al-Ula declaration resolves all of the outstanding issues that Qatar and other Arab nations had, said al-Saud.

- Saudi Arabia, the UAE, Bahrain and Egypt in 2017 imposed a travel, trade and diplomatic blockade on Qatar, accusing it of supporting terrorism. Doha has denied these allegations.

Saudi Arabia on Monday opened its airspace, land and sea borders to Qatar. Saudi Crown Prince Mohammed bin Salman welcomed Qatar’s emir, Sheikh Tamim bin Hamad al-Thani, with a hug when the latter arrived on Saudi soil.

Al-Saud said he thinks the deal will be a “very, very strong basis” for regional stability going forward.

Asked if it was a win for the outgoing Trump administration, al-Saud said: “I think this agreement racks up a win for the region, first of all, a win for all of us.”

Saudi Arabia on Monday opened its airspace, land and sea borders to Qatar. Saudi Crown Prince Mohammed bin Salman welcomed Qatar’s emir, Sheikh Tamim bin Hamad al-Thani, with a hug when the latter arrived on Saudi soil.

Al-Saud said he thinks the deal will be a “very, very strong basis” for regional stability going forward.

Asked if it was a win for the outgoing Trump administration, al-Saud said: “I think this agreement racks up a win for the region, first of all, a win for all of us.”

Still, he acknowledged support from the U.S. and Kuwait, which has been mediating between Saudi Arabia and Qatar. “Absolutely, President Trump and (White House senior advisor) Jared Kushner contributed to reaching this agreement, working very closely with Kuwait, who has been working on this for some time,” he told CNBC’s Hadley Gamble.

Not about Iran or Washington

Saudi Crown Prince Mohammed bin Salman said on Tuesday that GCC unity is needed to counter challenges in the region, “particularly the threats posed by the Iranian regime’s nuclear program,” according to Arab News.

Foreign minister al-Saud told CNBC the deal is for the good of the region’s security. “This agreement is not about Iran or about anyone else. It’s about bringing our countries together and making sure that we work together to deliver prosperity and security for our people.”

When asked if Saudi Arabia may be trying to get into President-elect Joe Biden’s good graces before the inauguration, he said: “This isn’t about Washington, it’s about the region and the priorities that our countries have.”

Biden is expected to roll back U.S. support for the kingdom when he takes office.

The Saudi foreign minister said the Gulf nations will cooperate on security issues as well as economic integration.

“We believe very strongly that the Al-Ula declaration resolves all of the outstanding issues and concerns that the countries’ parties would have had, and that it lays the basis for now a very strong, cooperative agenda for the GCC, and also for the region,” he said.

‘First step’

However, one diplomat called for caution.

Michael Greenwald, former U.S. Treasury attache to Qatar and Kuwait, said the agreement was just a “first step.”

“This is a political resolution,” he told CNBC’s “Capital Connection” on Wednesday. He said the opening of airspace is helpful ahead of the Qatar 2022 World Cup, and the nations want to “boost themselves economically” while preparing for a new U.S. administration.

But Greenwald, who is also a director at investment management firm Tiedemann Advisors, said more needs to be done. “There needs to be a much stronger, detailed framework put in place so that this does not happen again,” he said.

Tuesday, January 5, 2021

Saudi Arabia restores diplomatic ties with Qatar after three-year rift

- Saudi Arabia reinstated diplomatic relations with Qatar on Tuesday, more than three years after Riyadh and several other Arab countries severed ties with Doha.

- Kuwait, a mediator for both sides, announced that Saudi Arabia is reopening its airspace, sea and land borders with Qatar.

- Saudi Arabia, the United Arab Emirates, Bahrain and Egypt had imposed a diplomatic, trade and travel blockade on Qatar, accusing it of supporting terrorism.

Saudi Arabia has reinstated diplomatic relations with Qatar, more than three years after Riyadh and several Arab countries severed ties with Doha.

Kuwait, a mediator for both sides, announced that Saudi Arabia is reopening its airspace, sea and land borders with Qatar.

Qatar’s emir, Sheikh Tamim bin Hamad al-Thani, arrived in Saudi Arabia on Tuesday for the first time since the dispute erupted in 2017. He was there to attend the annual Gulf Cooperation Council summit in the ancient city of Al-Ula.

Relations among the Arab nations soured in 2017, when Saudi Arabia and its allies — the United Arab Emirates, Bahrain and Egypt — imposed a diplomatic, trade and travel blockade on Qatar. They accused the tiny Gulf nation of supporting terrorism and of being too close to Iran, allegations that Doha has always denied.

The dispute plunged the region into a diplomatic crisis not seen since the 1991 war against Iraq, and exposed deep ideological differences in the region.

Qatar’s emir in 2018 said the dispute was a “futile crisis,” and that Qatar preserved its sovereignty despite “aggression” from its neighbors.

Saudi-owned media Al-Arabiya also reported on Tuesday that Egypt has agreed to reopen its airspace to Qatar.

Ahead

of the summit, the UAE’s minister of state for foreign affairs, Anwar

Gargash, said in a tweet the GCC meeting will restore Gulf cohesion.

“There is still work to be done and we are in the right direction,” he

said.

Restoring diplomatic ties between Saudi Arabia and Qatar is part of Washington’s latest effort to broker deals in the Middle East. In a diplomatic win for President Donald Trump, the UAE, Bahrain, Sudan and Morocco normalized relations with Israel in 2020.

Turkey’s ministry of foreign affairs on Monday welcomed the reopening of borders between Qatar and Saudi Arabia.

“It is our hope that a comprehensive and lasting solution to this conflict will be reached on the basis of mutual respect to sovereignty of all countries and that all other sanctions against the Qatari people will be lifted as soon as possible,” the ministry said in a press release.

— CNBC’s Ryan Browne and Mila Latoof contributed to this report.