Al Bastakiya, Dubai, United Arab Emirates. Credit: Wikipedia

https://www.mining.com/web/dubai-cant-shake-off-the-stain-of-smuggled-african-gold/?utm_source=Daily_Digest&utm_medium=email&utm_campaign=MNG-DIGESTS&utm_content=dubai-cant-shake-off-the-stain-of-smuggled-african-gold

In the moon-like landscape of northern

Sudan, informal gold miners toil with spades and pickaxes to extract

their prize from shallow pits that pockmark the terrain.

Mining ore in the sweltering heat of the Nubian desert is the first

stage of an illicit network that has exploded in the past 18 months

following a pandemic-induced spike in the gold price. African

governments desperate to recoup lost revenue are looking to Dubai to

help stop the trade.

Interviews with government officials across Africa reveal smuggling

operations that span at least nine countries and involve tons of gold

spirited over borders. That’s a cause for international concern because

the funds from contraband minerals dealing in Africa fuel conflict,

finance criminal and terrorist networks, undermine democracy and

facilitate money laundering, according to the Organisation for Economic

Cooperation and Development.

While it’s impossible to say precisely how much is lost to smugglers

each year, United Nations trade data for 2020 show a discrepancy of at

least $4 billion between the United Arab Emirates’ declared gold

imports from Africa and what African countries say they exported to the

UAE.

The UN and NGOs have long questioned the apparent role of one of the

Emirates — Dubai — in facilitating the trade by closing its eyes to

imports from dubious sources. The UAE strenuously denies any involvement

in illegal practices. But as global scrutiny over corporate governance

intensifies, the extent of the smuggling now under way poses

increasingly uncomfortable questions for Dubai and its reputation as a

gold trading hub.

Allegations that it’s not doing enough to stamp out questionable

flows of the precious metal have led to public slanging matches with

London, home to the world’s largest gold market, and with Switzerland,

the top refiner. Deputy U.S. Treasury Secretary Wally Adeyemo discussed

concerns about gold smuggling with Emirati officials during a visit to

Dubai and Abu Dhabi in mid-November, according to two people with direct

knowledge of the matter who asked not to be identified because they’re

not permitted to speak publicly about it.

That same week, the head of Dubai’s commodities exchange, Ahmed bin Sulayem, answered the accusations head on.

“I want to address the elephant in the room: namely, the consistent

and unsubstantiated attacks launched on Dubai by other trading centers

and institutions,” he said at a conference in the Emirates. They are, he

said, “lies.”

African governments are adding to the pressure. Besides Sudan,

authorities in Nigeria, the Democratic Republic of Congo, Zimbabwe,

Mali, Ghana, Burkina Faso, Central African Republic and Niger complain

that tons of gold leaks across their borders each year, and they allege

most of it heads to Dubai.

“It’s a huge loss,” Nigerian Mines Minister Olamilekan Adegbite said

in an interview in his office in Abuja, the capital, where glass

cabinets display rock samples that illustrate the nation’s mining

potential, so far largely untapped.

The bulk of Africa’s illegally mined gold is channeled to Dubai

through refineries in countries like Uganda and Rwanda, or is flown

there directly in hand luggage, often with false papers, according to

government and industry officials, UN experts and civil rights groups.

Once there, it can be further melted down to obscure the source before

being turned into jewelry, electronics or gold bars, they say.Play Video

“Most European countries will ask you for your certificates of export

from the country of origin,” said Adegbite. “If you do not have that,

the gold is confiscated and returned back to source.”

On paper, the UAE requires the same. “But, you see,” Adegbite added, “in Dubai they look the other way.”

The UAE’s foreign trade ministry declined to answer questions on

gold from Africa. Bin Sulayem said in an interview that a global ban on

gold hand-carried on airlines — a traditional means of smuggling — would

fix the problem. “We have a better track record than any of the major

cities,” he said. “The main complaint we’re getting is ‘you’re too

tough.’”

Gold smuggling is an age-old practice, but it became all the more

rewarding as the price of bullion soared to a record $2,075 an ounce in

August 2020. The illicit trade has since taken off like never before in

Africa and authorities there have made scant headway in reining it in,

an analysis of publicly available data from governments and other

sources show.

Sudan’s Finance Ministry, for example, estimates that 80% of gold

production goes unregistered. Rwanda is set to ship $732 million worth

of the metal this year, more than two-and-a-half times the value of its

2019 exports, according to International Monetary Fund figures. That’s

despite Rwanda barely mining any gold of its own, prompting accusations

from the government in neighboring Congo that the precious

metal originates from its territory.

Rwanda is working to become a regional mineral processing hub, which

accounts for its increased exports, Rwanda Mines, Petroleum and Gas

Board said in a statement. It has invested in new facilities which

“source raw materials from local and regional operators in compliance

with legal and regulatory requirements,” the board said.

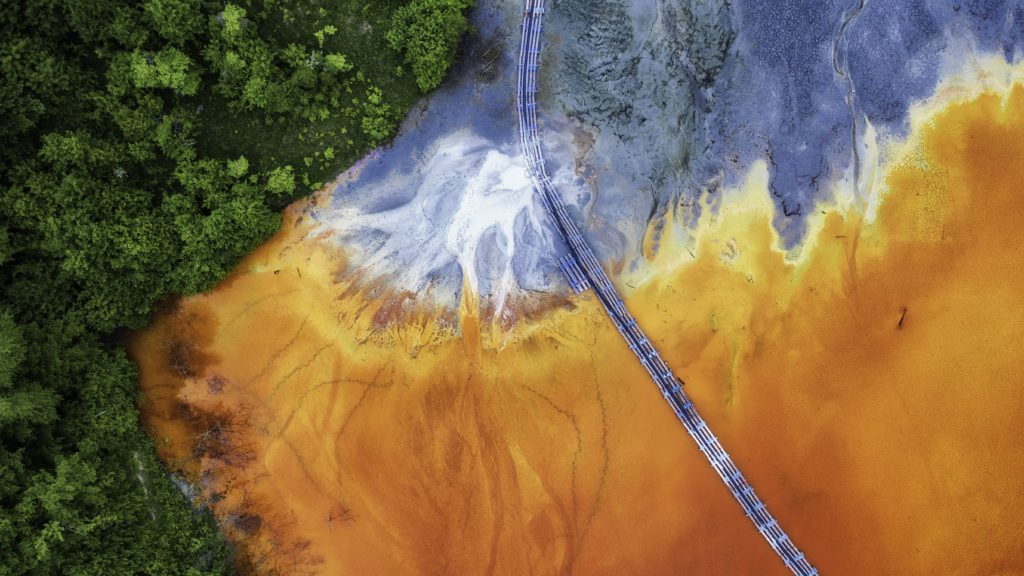

Reports from the UN and other sources point to 95% of production from

east and central Africa ending up in Dubai. That’s a potential problem

because much of the region is designated by the OECD as a conflict or

high-risk area, meaning companies are required to show that imported

gold is responsibly sourced. The European Union brought

in legislation this year aligning it with U.S. efforts to stem the

trade. However, enforcement is notoriously difficult.

Uganda, one of Africa’s main refiners of informal, or artisanal gold,

more than doubled its exports this financial year to some $2.25

billion, central bank statistics show. Again, the UAE was by far the top

destination, according to UN trade data. The UN has accused Uganda and

Rwanda of trading in gold smuggled from neighboring eastern Congo, a

region mired in conflict.

In an unprecedented move, the London Bullion Market Association,

which regulates the world’s biggest gold market, last year threatened to

bar its accredited refineries from sourcing metal from countries that

didn’t meet its responsible sourcing standards. While it didn’t name any

state, Bin Sulayem issued a rebuke on behalf of Dubai, accusing the

association of trying to undermine the UAE’s gold market.

The UAE signed up to LBMA’s recommendations and “has long been

cooperative with all international regulations and best practices

including anti-money laundering efforts and unethical sourcing of

gold,” minister of state for foreign trade, Thani Al Zeyoudi, said in a

statement to Bloomberg News. “The UAE is committed to embedding

the very highest international gold standards.”

More than 12 months later, the LBMA has yet to follow through on its

threat. Sakhila Mirza, its general counsel, said the association is

still assessing what the UAE has done to combat smuggling. The LMBA does

see the need for urgency, but has to act within the rules, and

“disengaging is the last step,” Mirza said in an interview.

Dubai’s long association with the gold trade is evident in its main

market in the oldest part of the city, where scores of shops with

elaborate window displays of glittering necklaces, bodices and

sunglasses line a pedestrian walkway. Trading operations are conducted

in an adjacent rabbit-warren of a building, where men run between small

offices, some with reinforced security doors.

“We welcome the world, we welcome anyone who wants to do trade”

Several traders who spoke on condition of anonymity because they

feared repercussions said they risked having their supply cut off by

Emirati refineries if they asked too many questions about where it came

from. Still, controls have been tightened to tackle money laundering,

with customers who spend more than $15,000 required to submit their

identity documents and source of funds.

During his visit last month, the U.S. Treasury’s Adeyemo noted that

stronger enforcement efforts targeting illicit finance could give the

UAE a competitive advantage in the region, according to the two people

with knowledge of the talks. The Treasury Department declined to comment

through a spokesperson for the Office of Foreign Assets Control, who

asked not to be named due to the sensitive nature of sanctions policy.

Thani Al Zeyoudi told reporters last month that Dubai will introduce a

publicly accessible system for monitoring imports and exports of gold,

and the Dubai Multi Commodities Centre’s “Good Delivery Standard,” will

be rolled out nationwide — if only on a voluntary basis. All gold

refineries in the UAE will be required to conduct audits that prove

bullion deliveries are responsibly sourced, starting in February, the

Economy Ministry said in a statement in December.

“We’re trying to be a real hub when it comes to gold trading,” Thani

Al Zeyoudi said. “So we welcome the world, we welcome anyone who wants

to do trade and we want to make sure that we adhere to the international

standards through the delivery standards.”

In October, Switzerland’s State Secretariat for Economic

Affairs instructed Swiss refineries to take steps to identify the true

country of origin for all gold emanating from the UAE, saying that was

necessary to ensure they weren’t being sent illicit supplies. Bin

Sulayem again took to LinkedIn to say the Emirates enforced the OECD’s

guidelines on sourcing minerals and accused the Swiss authorities of

hypocrisy.

Michael Bartlett-Vanderpuye, the chairman of M&C Group Global,

which mines and sources gold from Ghana that’s mainly sold to clients in

the UAE, described the clashes with London and Switzerland as “an

international gold power play” with each center protecting its turf.

“I always found it very difficult to believe that people are actually

able to bring gold to the UAE without the documentation,” he said.

“When I look at the system at the airport, I find it near to

impossible.”

Swiss refiner Metalor Technologies SA remains skeptical.

“We don’t think everything coming from Dubai is illegal, but we have

doubts about the legitimacy of some of the integrity of the supply

chain,” Jose Camino, Metalor’s group general counsel, said in an

interview. “We are happy to pass it by.”

Dubai’s supporters claim African customs data aren’t reliable and

even the UN can’t accurately measure illicit trade flows. Behind closed

doors, UAE officials point the finger at their counterparts in Africa

and forgers who obscure the gold’s origins by issuing documents that are

impossible to distinguish from the real thing.

That’s little comfort to the authorities in the Democratic Republic

of Congo, a vast central African country that’s struggling to rebuild

after more than two decades of conflict. It has some of the world’s

richest reserves, including Kibali in the northeast of the country

— Africa’s biggest gold mine — yet, perversely, the DRC is one of the

biggest losers of the illicit gold trade.

An army of small-scale miners operate below the government’s radar,

but data show the informal industry generated just $2.4 million in

official gold exports last year. Statistics from the UN and IMF suggest

the fruits of their labor slipped across the border instead: Uganda and

Rwanda shipped bullion worth $1.8 billion and $648 million respectively

in 2020, despite having little gold of their own.

“It’s ours,” Congolese Finance Minister Nicolas Kazadi said in an

interview at his office in the capital, Kinshasa. “It’s gold from

Congo.”

Under U.S. law, gold from Congo and its neighbors is considered a

“conflict mineral,” meaning companies publicly traded in the U.S. are

required to report to the Securities Exchange Commission if they might

be using gold mined in conflict areas — but there’s no sanction for

doing so. A June report by UN experts found that much of the illegal

gold trade in Congo is overseen by armed groups or soldiers, who traffic

it across the borders or fly it directly to Dubai using forged

documents to obscure its origin.

Sasha Lezhnev, policy consultant for Washington-based anti-corruption

group The Sentry, said that refiners trading in conflict gold aren’t

being held publicly accountable by the UAE. “Dubai is the linchpin for

change in the gold trade in east and central Africa,” he said.

Smuggling is also troubling the government in Nigeria, where most

minerals are extracted by at least 100,000 informal miners whose

operations are difficult to regulate and tax. Formal gold production

totaled just 1,288 kilograms last year, almost all of which went to

Dubai, according to Nigerian government data.

Efforts are being made to formalize the industry. Fatima Shinkafi is

head of the Presidential Artisanal Gold Mining Initiative, which has

registered 10,000 informal miners and is developing a supply chain

whereby their output will be sent to LBMA-certified refineries in

Europe, processed and transferred to the central bank to boost Nigeria’s

foreign reserves.

Adegbite, the mines minister, wants to work with the UAE to combat

smuggling, and says he even proposed to his government that it split the

proceeds “50-50” with the Emirati authorities of any

undeclared Nigerian gold recovered. The UAE Ministry of Economy and the

Ministry of Foreign Affairs and International Cooperation didn’t respond

to emailed requests for comment on the minister’s proposal.

In Sudan, more than 2 million small-scale miners produce some 80% of

the nation’s gold. They are paid about a quarter less for what they

extract than it would fetch on international markets and are charged a

$64 tax on each ounce of output, which encourages some to bypass

official trading channels.

Some of Sudan’s internal trade happens in a dank six-story building

in downtown Khartoum, the capital, where men melt rough nuggets into

bars and dealers can be seen exiting the premises carrying piles of cash

wrapped in cling film. Illicitly traded gold is flown to Dubai through

the porous international airport or trafficked into neighboring Egypt,

Ethiopia and Chad, according to industry experts.

Political upheaval has frustrated efforts to ensure Sudan’s people

benefit from its mineral endowment. Dictator Omar al-Bashir was toppled

in a popular uprising in 2019, then a transitional government was

overthrown in an Oct. 25 coup as the military reasserted itself.

The security forces have set up road blocks between mining areas and

Khartoum to combat smuggling. But controls remain woefully inadequate,

according to Dafalla Idriss, the deputy chair of a panel in River Nile

state set up to freeze assets plundered by the al-Bashir regime.

“There is corruption inside all government institutions,” he said. “The gold that leaves the country is getting past everyone.”

(By Simon Marks, Michael Kavanagh and Verity Ratcliffe, with

assistance from Ben Bartenstein, William Clowes, Eddie Spence, Leanne de

Bassompierre, Yinka Ibukun, Prinesha Naidoo, Daniel Flatley and Saul

Butera)

:max_bytes(150000):strip_icc()/religious-leaders-rally-for-immigrant-rights-at-capitol-57193123-592a30d83df78cbe7edd7726.jpg)