Jeb Bush introduced his energy proposals on Tuesday at Rice Energy, a natural gas and oil company in Canonsburg, Pa.

CANONSBURG, Pa. — Jeb Bush,

keen to establish himself as the most policy-focused candidate in the

Republican field amid a slide in the polls, introduced a package of

energy proposals here on Tuesday, calling for the repeal of a

four-decade ban on crude oil exports.

Speaking

before employees of Rice Energy, with supporters seated on the flatbeds

of two well-placed pickup trucks beside him, Mr. Bush also assailed

President Obama and Hillary Rodham Clinton for opposing the Keystone XL pipeline, among other positions likely to be popular with the conservative base.

“Where’s

the marching band, for crying out loud?” he said, accusing “radical

environmentalists” of demonizing businesses like Rice, a natural gas and

oil company. “This is what we should be doing.”

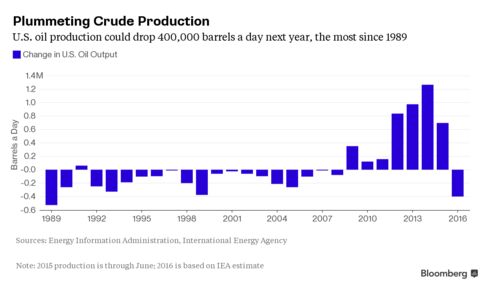

Mr.

Bush’s discussion of crude oil exports seeks to inject a roiling

congressional debate into the presidential race. Several Republicans in

the House have pressed to repeal the ban, an effort that has been

championed by the oil industry and has drawn the ire of environmental

groups. Though other candidates, including Senator Ted Cruz of Texas,

have expressed support for a repeal, the issue has not resonated on the

campaign trail.

The

oil industry has begun a lobbying campaign in Washington for the repeal

of the ban, which was imposed during the 1970s energy crisis.

“It might have made sense then; I’m not sure it did,” Mr. Bush said Tuesday. “It makes no sense now.”

The Bush campaign estimated that retail gasoline prices would drop by 6 cents a gallon within three years of lifting the ban.

The

White House opposes legislation to reverse the ban. Though stopping

short of an explicit veto threat, that opposition could make it more

difficult for supporters to attract Democratic votes. At a briefing this

month, the White House press secretary, Josh Earnest, said the issue

was a“decision that is made over at the Commerce Department, and for

that reason, we wouldn’t support legislation like the one that’s been

put forward by Republicans.”

In

a statement on Tuesday evening, John D. Podesta, Mrs. Clinton’s

campaign chairman, said that Mr. Bush’s proposal “reads like a Big Oil

wish list, while apparently omitting clean energy and renewables.”

Mr.

Bush, trumpeting his energy plan, said he was “sick and tired of people

thinking that the Chinese are eating our lunch” — using phrasing his

rival Donald J. Trump has used on several occasions.

Vowing

to fight some regulations imposed by the Obama administration, Mr. Bush

said he was “not suggesting unregulating the world,” merely

“common-sense 21st-century rules.”

Critics

moved quickly to tie Mr. Bush’s positions, which include calls for

greater deference to states on energy issues, to those of the oil

industry. “His dirty-oil-driven plan has been tried before, and it was

disastrous for the American people,” said Christina Freundlich, a

spokeswoman for the Democratic National Committee, invoking former Vice

President Dick Cheney and other officials from the administration of

George W. Bush.

At

his Pennsylvania gathering, Mr. Bush referred to his relationship with

his brother, and on happier terms. Spotting the second-oldest brother

from the Rice family business, Mr. Bush allowed himself a detour from

his energy pitch

“I always admired the second brothers in families; I don’t know about you,” he said. “I think the guy’s going places.”

Mr.

Bush, still straining to shed the “low-energy” label supplied by Mr.

Trump, tried to convey excitement about the civic arcana of energy

policy. “Let’s unleash the American experience on permitting,” he said.

“Praise Jesus!” he shouted later, amid a discussion of Rice’s business. “I just get fired up when I see examples like this.”

Mr.

Bush also issued an unsubtle jab on Twitter at Mr. Trump, who released a

tax plan on Monday that has been described as similar to Mr. Bush’s.

“Finally

saw Donald’s ‘tax plan.’ Looks familiar!” he wrote. “I’m flattered. But

he should’ve stuck with growth & fiscal responsibility.”

Still, Mr. Bush had much to live up to Tuesday after an introduction from Dan Rice, the company’s chief executive.

“This

presidency isn’t about choosing the smartest, the richest or the most

charismatic candidate,” Mr. Rice said, moving on as audience members

began to whisper.

Mr.

Bush turned to the crowd, contorting his face a bit, and Mr. Rice

backtracked for a clarification. “You’re all three of those,” he said.