Friday, July 29, 2022

Thursday, July 28, 2022

Wednesday, July 27, 2022

Monday, July 25, 2022

Thursday, July 21, 2022

Wednesday, July 20, 2022

China Refinery Throughput Falls For First Time In 10 Years

Chinese refineries’ throughput fell for the first time in more than a decade during the first half of the year, by 6 percent to 13.4 million bpd.

In June alone, processing rates were higher than in May, but some 10 percent lower than the all-time high reached last year in June, Reuters said in a report citing official data.

Oil imports also fell in June, according to data from energy analytics firm OilX—by 1.6 million bpd to 9.2 million bpd.

On an annual basis, OilX analysts noted, the June average was about 1 million bpd lower than what China imported in crude oil in June 2021. They noted, however, that despite the recent series of lockdowns because of Covid flare-ups, China’s oil imports were remarkably stable over the past few months.

Chinese oil production rose during the first half of the year, by 4 percent from a year ago, with the daily average at 4.15 million bpd. In June, domestic output hit an all-time high of 4.18 million bpd.

Refinery runs have suffered from Covid restrictions since the start of the year as Beijing maintained its zero-Covid policy and by fuel export restrictions the government has imposed on refiners.

The Covid restrictions have also dampened domestic demand for fuels, but analysts expect a pick-up in refinery runs in the current quarter as the government considers making amendments to its Covid policy and steps up infrastructure spending to boost economic growth. Gasoline and jet fuel demand were the worst affected by the Covid restrictions.

According to an earlier Reuters report, Beijing plans to set up a $75-billion infrastructure spending fund to stimulate growth. China booked GDP growth of 0.4 percent for the second quarter of the year, far below analyst expectations because of the worst outbreak of Covid since 2020 in the country.

China plans iron ore giant to assert market control

https://www.mining.com/web/china-plans-iron-ore-giant-to-assert-market-control/

China is planning a state-backed iron ore company to oversee everything from massive mine investments in West Africa to buying the steelmaking material from global suppliers, according to people familiar with the matter.

Top leaders in Beijing have a vision for the new entity to assume broad responsibility for raw materials supplies to the country’s sprawling steel industry, by far the world’s biggest, said the people, who asked not to be identified as the information is private.

Sign Up for the Iron Ore Digest

The new entity would house outbound investments such as the Simandou iron ore project in Guinea, seen by the China’s leaders as the best route to ease the steel industry’s reliance on Australian ore. It would also ideally become the sole channel for buying imported iron ore from third parties, most of which comes from either Australia or Brazil.

Bloomberg reported in February that China was planning a centralized purchasing platform for iron ore imports. Plans for a new state-owned company to handle iron ore imports and overseas investments were reported by the Wall Street Journal last week and Caixin on Monday.

The plan has been under consideration for years with the backing of senior leaders, the people said. At the very least, it will be a vehicle to consolidate several overseas iron ore investments including Simandou, as well as raw materials purchasing for a handful of China’s biggest state-owned steelmakers.

The establishment of the firm is seen progressing this month after Yao Lin, the chairman of Aluminum Corp. of China and a key organizer of the iron ore firm, left Chinalco. Yao and Guo Bin, executive vice president of China Baowu Steel Group Co., will lead the new company, which will be directly under China’s State-Owned Assets Supervision and Administration Commission, said the people.

China’s State-owned Assets Supervision and Administration Commission and National Development and Reform Commission didn’t immediately reply to faxed requests for comment.

The development of Simandou in Guinea has repeatedly been delayed by legal disputes and government changes in Guinea. The reserve holds one of the world’s largest untapped reserves of iron ore and is divided into four blocks, with 1 and 2 controlled by the consortium backed by Chinese and Singaporean companies, while Rio Tinto and a joint venture between Chinalco and Baowu own blocks 3 and 4.

BHP may reconsider investments in Chile if tax hikes go forward

BHP’s Escondida operation in Chile. (Image by BHP).

https://www.mining.com/web/miner-bhp-may-reconsider-investments-in-chile-if-tax-hikes-go-forward/

Global miner BHP Billiton is likely to reconsider its investment plans in Chile, the world’s No. 1 copper producer, if the government moves ahead with mining tax hikes, according to a report on Sunday.

Sign Up for the Copper Digest

BHP did not immediately respond to a request for comment.

BHP is a major player in Chile, where it operates the world’s largest copper mine, known as Escondida. In April, BHP said it was willing to invest another $10 billion in Chile over the years, but only if the regulatory and fiscal conditions were appropriate.

Chilean Finance Minister Mario Marcel has said that raising mining royalties is his “priority number one” and the top goal of the left-wing administration that was inaugurated earlier this year. The government wants to use the tax income to fund social programs.

The tax reforms, which also include a wealth tax on high earners among other provisions, aim to raise 4.1% of GDP over four years, with 0.7% going to a new guaranteed minimum pension fund.

Other global miners operating in Chile include Glencore, Anglo American, Freeport McMoRan and Antofagasta.

(By Fabian Cambero; Editing by Cynthia Osterman)

Monday, July 18, 2022

Friday, July 15, 2022

Thursday, July 14, 2022

Wednesday, July 13, 2022

Peruvian authorities strive to keep dialogue going between Las Bambas, Indigenous communities as truce deadline looms

As the dialogue between Chinese miner MMG Ltd and six Peruvian Indigenous communities has come to a stall and the July 15th deadline to find a solution to a months-long conflict looms, government authorities are making an effort to keep the conversation going by assuring that Las Bambas copper mine goes through regular environmental inspections.

During a public hearing in Huancuire, in the southern-central Apurímac region, the director of the General Office of Socio-Environmental Affairs of the Ministry of Environment, Carlos Eyzaguirre, said that the Agency for Environmental Assessment and Enforcement has so far performed 33 environmental inspections at Las Bambas.

Sign Up for the Copper Digest

According to Eyzaguirre, such inspections have been done as part of the obligations contemplated in the mine’s environmental impact assessment. The EIA – he said – also stipulates a series of commitments related to the way the mine is supposed to operate in relation to the surrounding communities.

The government official also pointed out that the Ministry of Environment is in charge of coordinating a specific working group whose objective is to foster a dialogue between Las Bambas and the Huancauire community, under the supervision of the Ministry of Energy and Mines and the Presidency of the Ministers’ Council.

The working group also operates under a committee created by ministerial resolution nº 182-2022, which is meant to oversee and evaluate the commitments agreed upon by the executive power, MMG and the communities of Fuerabamba, Chila, Choaquere, Chuicuni, Pumamarca and Huancuire.

The conflict

After a number of protests were carried out for almost two months, forcing MMG to halt operations for more than 50 days, a 30-day truce was called on June 15th by the six communities in conflict with Las Bambas.

The actions were originally launched in mid-April by the communities of Fuerabamba and Huancuire, who say Las Bambas has not honoured all of its commitments to them. Both communities sold land to the company to make way for the mine, which opened in 2016.

The Chila, Choaquere, Chuicuni and Pumamarca communities joined later with similar complaints and all six of them are part of the committee aiming to find a middle ground between people’s demands and what the miner is willing to offer.

Following the truce, copper production at Las Bambas has reached normal levels. However, MMG has said that it is unlikely to meet its production guidance of 300,000-320,000 tonnes of copper concentrates this year if a permanent solution to the conflict is not found.

Peru is the world’s no. 2 copper producer and Las Bambas is one of the world’s largest producers of the red metal, accounting for 1% of the Andean country’s gross domestic product.

Tuesday, July 12, 2022

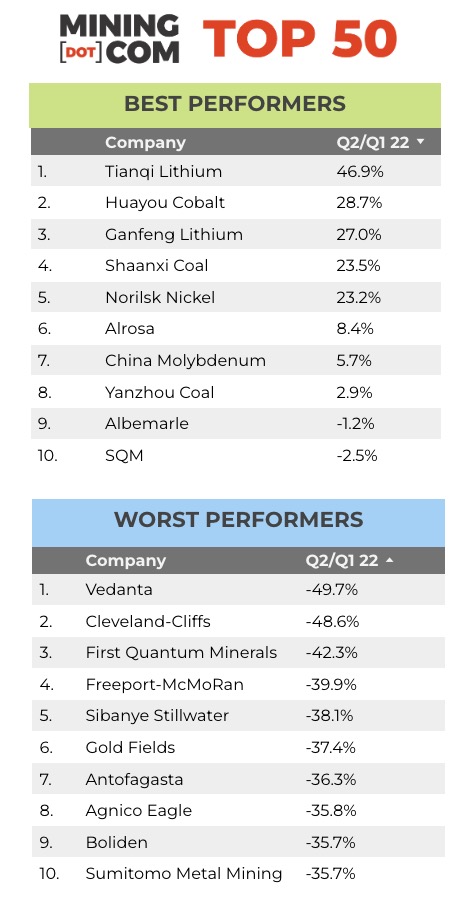

Top 50 mining stocks lose $1.2 trillion in market value from peak

HCN.org

https://www.mining.com/top-50-mining-stocks-lose-1-2-trillion-in-market-value-from-peak/

After

a brutal second quarter, investors in the world’s 50 biggest mining

companies are in full retreat as metal prices slump and uncertainty

grips the sector. ![]()

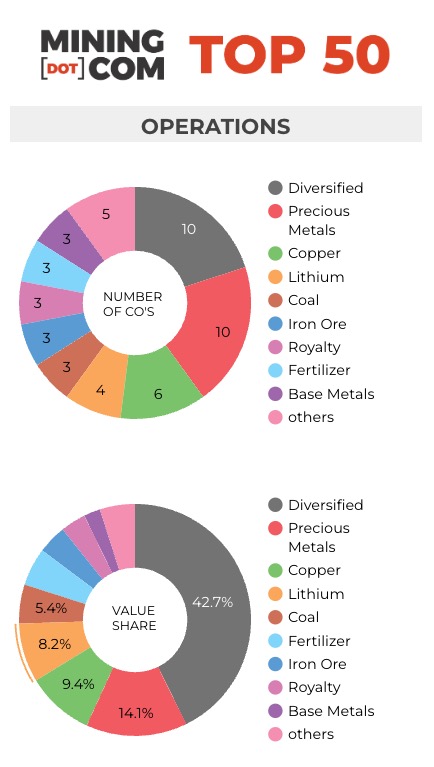

Extreme volatility on metal and mining markets intensified in the second quarter and after hitting record highs in March, copper, nickel, aluminium, zinc and tin went into meltdown mode over the three months to end June.

Copper is trading at its lowest since November. After soaring above $200 this time last year iron ore prices are again coming dangerously close to double digits.

Despite historically low stockpiles – 700kt vs 2.4m tonnes a year ago – industrial metals continue to be hammered down. Nickel’s wild ride ended up going nowhere with the price of the stainless steel ingredient back to where it started the year.

After initially offering safe harbour for investors, gold has now also succumbed to weakness dropping to nine month lows this week.

While prices for lithium have held not far off recent all-time highs, stock prices have not. The Ukraine war lit a fire under PGMs, only to give up those gains and more.

Tough at the top

As fear overtook greed in Q2, MINING.COM’s TOP 50* ranking of the world’s most valuable miners fell by $383 billion – based on primary exchange share price movements converted into US dollars – over the course of the second quarter and are now worth $1.37 trillion, down from a peak of $1.75 trillion at the end of March this year.

As an indication of just how volatile the market has become and how much sentiment has changed over the last three months measured from the stocks’ 52-week highs, mining’s top tier stocks lost a stunning $1.26 trillion.

The top 10 mining companies lost a combined $600 billion – with BHP one of the worst performers. At the end of June, nervous investors had shaved more than $110 billion, or 44% from the market value of the world’s largest miner since the stock hit a record high little less than a year ago (and came within an inch of that level again in April).

Among the heavyweights, pureplay copper producers were hardest hit and most of those losses came in the past couple of weeks.

Freeport, the world’s number two copper producer behind Chile’s state-owned Codelco, has lost 30% year-to-date while Southern Copper, Antofagasta, First Quantum and Jiangxi are all down 20% or more.

Cool coal

After spending time outside the top 10 last year, Glencore just pipped Vale’s market cap at the end of June to become the world’s third most valuable mining company. Unlike its peers, Glencore has not abandoned coal mining amid a spike in prices, and its trading arm is benefiting from sky high prices for energy, helping the Swiss firm stay in the black year to date.

Coal companies are the best performers on the index – with Shaanxi Coal and Yanzhou Coal both up more than 65% this year and the world’s top producer, Coal India, also enjoying a bull market, up nearly 20% in 2022.

While coal producers did well across the board, the top performer year to date and Chile’s sole entry into the ranking is lithium extractor SQM.

Russian resilience

While trading on Western markets in Russian stocks have been halted, the country’s miners, much like the rouble and the Moscow Stock Exchange, have proved resilient.

While there is a measure of artificiality to the valuation of the likes of Norilsk Nickel because of captive investors on the MCX, it is remarkable that the palladium, nickel and copper producer has managed to show gains so far in 2022 and strong gains in Q2 after the resumption of trading.

Diamond giant Alrosa also returns to the ranking thanks to a robust quarter, and Polyus is just in positive territory YTD.

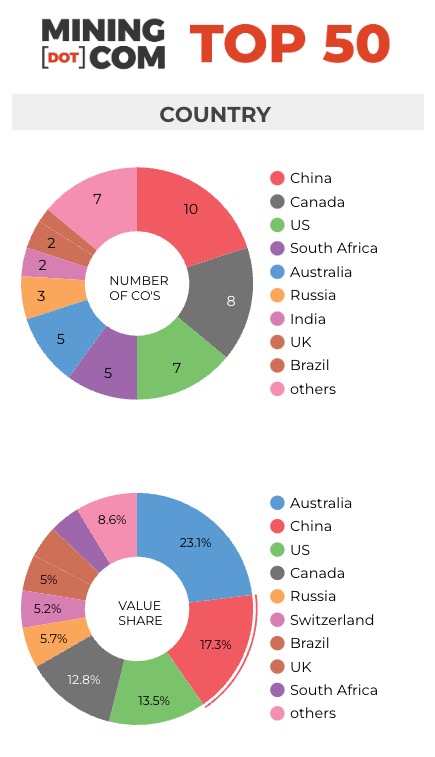

Chinese cheer

With the addition of Huayou Cobalt at position no 23, the combined value of miners from China has now surpassed that of the US at $236 billion versus $185 billion. The market worth of the country’s miners was boosted by coal and lithium mining, with Tianqi and Ganfeng both jumping in value in the second quarter.

In terms of numbers, China now also has the most firms represented at ten, followed by Canada, the US and South Africa. Australia is down to 5 representatives after lithium company Mineral Resources had to make way for uranium giant Kazatomprom, which returns to the ranking based on units in the company trading in London.

*NOTES:

Source: MINING.COM, Miningintelligence, Morningstar, GoogleFinance, company reports. Trading data from primary-listed exchange at June 30, 2022 where applicable, currency cross-rates July 4, 2022.

Percentage change based on US$ market cap difference, not share price change in local currency.

Market capitalization calculated at primary exchange from total shares outstanding, not only free-floating shares.

As with any ranking, criteria for inclusion are contentious issues. We decided to exclude unlisted and state-owned enterprises at the outset due to a lack of information. That, of course, excludes giants like Chile’s Codelco, Uzbekistan’s Navoi Mining, which owns the world’s largest gold mine, Eurochem, a major potash firm, Singapore-based trader Trafigura, and a number of entities in China and developing countries around the world.

Another central criterion was the depth of involvement in the industry before an enterprise can rightfully be called a mining company.

For instance, should smelter companies or commodity traders that own minority stakes in mining assets be included, especially if these investments have no operational component or warrant a seat on the board?

This is a common structure in Asia and excluding these types of companies removed well-known names like Japan’s Marubeni and Mitsui, Korea Zinc and Chile’s Copec.

Levels of operational or strategic involvement and size of shareholding was another central consideration. Do streaming and royalty companies that receive metals from mining operations without shareholding qualify or are they just specialised financing vehicles? We included Franco Nevada, Royal Gold and Wheaton Precious Metals.

Lithium and battery metals also pose a problem due to the booming market for electric vehicles and a trend towards vertical integration by battery manufacturers and mid-stream chemical companies. Battery producer and refiner Ganfeng Lithium, for example, is included because it has moved aggressively downstream through acquisitions and joint ventures.

Vertically integrated concerns like Alcoa and energy companies such as Shenhua Energy where power, ports and railways make up a large portion of revenues pose a problem as do diversified companies such as Anglo American with separately listed majority-owned subsidiaries. We’ve included Angloplat in the ranking as well as Kumba Iron Ore.

Many steelmakers own and often operate iron ore and other metal mines, but in the interest of balance and diversity we excluded the steel industry, and with that many companies that have substantial mining assets including giants like ArcelorMittal, Magnitogorsk, Ternium, Baosteel and many others.

Head office refers to operational headquarters wherever applicable, for example BHP and Rio Tinto are shown as Melbourne, Australia but Antofagasta is the exception that proves the rule. We consider the company’s HQ to be in London, where it has been listed since the late 1800s.

Please let us know of any errors, omissions, deletions or additions to the ranking or suggest a different methodology.

Monday, July 11, 2022

Citgo Ready to Resume Oil Imports from Venezuela if U.S. Authorizes

U.S. refiner Citgo Petroleum is willing to resume imports of Venezuelan crude, suspended since 2019 by Washington’s sanctions on its parent company PDVSA, if the U.S. government authorizes the flow, Citgo’s CEO said on Friday.

Since March, top U.S. and Venezuelan officials have been engaged in political negotiations that could lead to Washington easing oil trading sanctions that have hit the OPEC country’s production and exports.

OPEC and the French government, representing Europe, have called for Washington to allow Venezuelan and Iranian crude to flow to consuming nations that are struggling to replace Russian energy supplies during the war in Ukraine.

“To be competitive in this market, we have to buy the cheapest and most convenient crude,” said Carlos Jorda, Citgo CEO in an online conference on Venezuela’s foreign energy assets. “We should not be at a disadvantage” to other refiners.

Citgo did not immediately reply to a request for further comment.

President Joe Biden’s administration in May authorized European companies Eni (ENI.MI) and Repsol (REP.MC) to resume imports of Venezuelan crude, which last month helped boost the nation’s oil exports to over 600,000 barrels per day.

Chevron Corp (CVX.N), the last U.S. producer operating in Venezuela, also is requesting an authorization from the U.S. Treasury Department to ship Venezuelan oil to the United States and even getting operating control of its joint ventures.

“If authorized (Venezuelan) crude arrives in the U.S. Gulf Coast without penalties at competitive prices, especially if it is heavy crude, we would certainly have to evaluate it,” said Horacio Medina, president of a board overseeing Citgo, in the same conference.

“I see no reason to be radically closed to that,” he added.

Citgo, whose first-quarter profit soared more than 10 times the year-ago level to $245 million on higher crude processing volumes and surging fuel prices, expects to report second-quarter results in the coming week, Jorda said.

Will Saudi Arabia Pump More Oil For Biden?

President Trump meets with then-Saudi Defense Minister and Deputy Crown

Prince Mohammed bin Salman at the White House in March 2017. (Jabin

Botsford/The Washington Post)

It’s not about the oil. This is what President Biden has said about

its upcoming visit to the Middle East and, more specifically, Saudi

Arabia. He even said, as reported by Politico, that he was not going to

ask the Saudis for more oil. And yet it seems that few believe this.

“No, I’m not going to ask them [to increase oil production],” the U.S. President said last week on his visit with the King and Crown Prince of Saudi Arabia.

“All the Gulf states are meeting. I’ve indicated to them that I thought they should be increasing oil production generically, not to the Saudi Arabia in particular. I hope we see them in their own interests concluding that makes sense to do,” he also said.

This is where Biden is quite wrong. It is not in the Gulf oil kingdoms’ interest to pump more. Most of them do not have any spare capacity, and the couple that do may have seriously overestimated that spare capacity. And this includes Saudi Arabia.

The issue of actual spare capacity came into the spotlight also last week when Reuters recorded France’s Emmanuel Macron telling Biden that the UAE was pumping near its maximum and Saudi Arabia could only add about 150,000 bpd to its production in short order.

“And then he [Sheikh Mohammed bin Zayed al-Nahyan] said (the) Saudis can increase by 150 [thousand barrels per day]. Maybe a little bit more, but they don’t have huge huge capacities before six months’ time,” the French President said, per the Reuters video footage.

According to estimates by the International Energy Agency, Saudi Arabia has a short-order capacity of 1.2 million barrels daily—the amount that can be added to current production in less than 90 days. The longer-term spare capacity, the IEA has estimated, stands at 2.1 million bpd. And the Kingdom’s sustainable production capacity is 12.2 million bpd, again per IEA estimates.

The problem with estimates is that they often tend to rely on insufficient information, including information supplied by the country with the spare capacity. But there is, in fact, no hard, verifiable data on Saudi Arabia’s or any other OPEC member’s spare production capacity. No OPEC member is obliged to report its spare capacity, and there is no way for the figures that they do report as spare capacity to be verified.

Per OPEC’s latest Monthly Oil Market Report, Saudi Arabia pumped 10.424 million bpd in June. That was 60,000 bpd higher than the average for May, and the Kingdom has pledged to boost production a lot more sharply this month and in August. But it might not be able to do it.

Reuters’ John Kemp noted in an analysis on the topic that Saudi Arabia has only ever reached a production level of 12 million bpd once, in April 2020. As for production sustained over a three-month period, the maximum demonstrated rate was 10.8 million bpd, pumped between October and December 2018, according to data from the Joint Organisations Data Initiative. It gets even worse over a longer period. Per the data quoted by Kemp, Saudi Arabia’s maximum demonstrated output over a period of 12 months has been 10.5 million bpd.

So, on the one hand, Saudi Arabia is quite unlikely to have the resources needed to boost production in any meaningful way that would have an impact on international prices in the immediate term. But it also probably does not want to.

The thing about spare capacity in oil production is that it can be tapped in case of an emergency. But there is no oil emergency right now, not according to Riyadh. In fact, so far, Saudi Arabia, in the face of its energy minister and brother to the Crown Prince, Abdulaziz bin Salman, has claimed that the oil market is relatively balanced, but years of underinvestment in new production have now combined with sanctions to reduce supply.

The other thing about spare capacity in oil production is that once tapped, it stops being spare, if we are talking about more than a month or two. The less spare capacity, the less flexibility a producer would have when an actual emergency arises.

Saudi Aramco last year revealed plans to boost its production capacity to 13 million barrels daily. The expansion is scheduled to take until 2027, according to chief executive Amin Nasser. In other words, boosting the country’s maximum sustained oil production capacity by 1 million bpd will take eight years.

This does not mean there is nothing Saudi Arabia can do to boost production, according to Reuters’ Kemp. According to him, it could restart old wells that have been closed to “rest the fields” and maintain pressure, or they can drill new wells in producing fields.

Yet, while it could do these things, whatever its spare capacity actually is, the bigger question is whether Saudi Arabia would want to do these things. After all, it was just last month that Prince Abdulaziz said that the relations between Saudi Arabia and Russia were as warm as the weather in Riyadh.

How Many Days of Gas Consumption Are In Europe’s Storage Tanks?

Oil pipeline map Europe

Russia turns off the Nord Steam 1 gas pipeline to Europe for its annual 10 days’ maintenance and no one is sure that it will be turned on again. If that’s it for gas deliveries this year, how many days of gas are currently in the storage tanks?

Europe is afraid that the Kremlin will spark a major energy crisis this winter by turning off its gas supplies completely. Gazprom reduced flows of gas to Europe by 60% in mid-June just as the tanks were half full.

The EU has set a target of having the tanks 80% full by the end of October and as bne IntelliNews reported, even at the reduced flow rates Europe should hit that target after the tanks reached 60% of capacity in the first week of July. Despite the reduction of gas from Russia, Europe is currently importing record amounts of LNG from the US that allow the gas in tank storage to continue growing.

But things are not quite that simple. Just getting to 80% full by the end of October is not enough gas to get through the whole heating season, which runs from October 1 to March 31, without continuous supplies of more gas during the winter.

Europe has large storage capacity, with the biggest facilities being in Germany and Ukraine. However, those facilities cannot hold enough to meet demand for the entire winter.

Storage levels and storage capacity vary greatly in the EU (chart). The tanks in Poland and Portugal are already close to 100% full. However, even the full tanks in Poland and Portugal are not enough to get through the whole winter. They hold enough gas for 79 days of consumption and 24 days respectively. That means without new supplies during the winter they would run out of gas by January 18 and November 24 respectively if all gas supplies were cut off from the current levels of gas stored.

Indeed, this is the case for all the countries of Europe; most countries’ storage doesn’t hold enough gas to last the whole winter. The exceptions are the Slovak Republic and Austria (chart), where their tanks do hold enough gas to get to the end of the heating season if full. Everyone else starts running out of gas as soon as October (assuming gas withdrawals start on October 1, but a mild winter means drawdowns can start as late as the start of November), although some survive until February. Czechia is in the third best position, as its tanks can last to April 5 if full.

But neither Poland nor Portugal will run out of gas even if Russia turns off the spigots. Poland will open a new pipeline to Norway on October 1 and is the first EU country to have entirely weaned itself off Russian gas supplies. Portugal’s supplies of gas are almost all LNG that is brought by ship under long-term contracts and also stands little chance of running out.

With the other countries much depends on their relations with Russia and the size of their tanks. Hungary’s storage tanks hold 133 days’ worth of gas, which means it would run out on March 13 if its tanks were full when Russia turned off supplies, but earlier this year it signed a new gas supply contract with Russia and has locked in supplies for this winter.

Germany remains the most exposed, as it is almost entirely dependent on Russian gas imports. Despite having by far the largest storage tanks in Europe, its demand for gas is equally large and its tanks only hold 108 days of consumption – full tanks would run dry on February 16 and they are currently only 60% full, which would be emptied on December 8 if Russia turned off the gas tomorrow.

The EU as a whole is in the same position with an average storage capacity of 98 days of consumption, so full tanks run dry on February 6, but as the tanks for the whole of the EU are also 60% full, if the gas were turned off tomorrow Europe would run out of gas on November 28 (assuming an October 1 start to winter).

And the country in the worst position is Ukraine, which also has huge storage tanks accounting for about 20% of Europe’s entire capacity, but those tanks are currently only 21% full. In the normal course of things Ukraine’s hold enough gas for 135 days of consumption, which takes it through to the middle of March, but the current amount of gas will run out on October 29 if deliveries are turned off tomorrow and at best the end of November if the autumn is mild. Ukraine is very likely to have an energy crisis this winter, as it has not imported gas from Russia for over three years and its European friends will be short of gas for themselves this winter.

So even if Europe gets to its 80% full tank target by October 1, it remains at Russia’s mercy, as it will still need to import gas during the winter from somewhere to cover the missing months, albeit at lower volumes than now.

It is not clear how much LNG can make up the shortfall, but in general LNG supplies can cover some 15% of Europe depend and there are also technical limits on how much LNG Europe can import due to the capacity of available LNG terminals in Europe. There are other sources of gas from production in Norway and the Netherlands, but it is not enough for everyone.

Depending on how aggressive Russia is and to what extent it reduces flows, the scenarios Europe may face could be extreme. Europe needs to cut its usage by 15%, according to study by Bruegel, if it is to get through the winter. In the more extreme scenarios, it would have to ration gas and order companies to reduce industrial production to make sure there was enough gas to heat homes.

Germany has already introduced the “alert” status, the second of the EU’s energy crisis warning system, while another 12 EU member states are on the first “early warning” state. German Vice-Chancellor Robert Habeck, in charge of the economy and energy, has ordered coal-fired power stations to be readied in case Germany runs out of gas. Germany uses the bulk of its gas for heating and only 15% is used for power generation, which can be replaced by coal-fired power plants.

With a 15% reduction in consumption and by making use of non-Russian sources of gas, plus the alternative power sources like nuclear and coal, Europe should be able to survive the upcoming winter, the think-tanks said. But it won’t be fun.

Friday, July 8, 2022

crude-oilprices.com

Crude oil assay

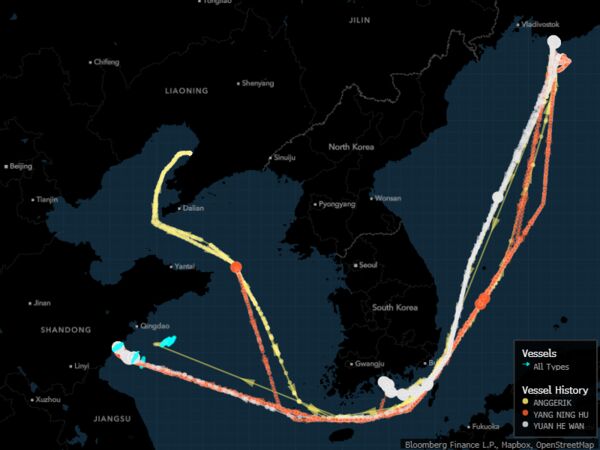

Shippers Still Willing to Touch Russian Crude Oil Are Cashing In

- Earnings surged for hauling ESPO grade from Kozmino to China

- Chinese, Greek, Turkish ship owners dominate lucrative trade

A handful of shipowners still willing to transport Russian crude are reaping big rewards on at least one route as others shun the trade.

Shippers can earn around $1.6 million hauling Russian ESPO oil on a small tanker from the eastern port of Kozmino to China, said shipbrokers. That’s around triple the amount prior to the invasion of Ukraine, based on data compiled by Bloomberg. The lucrative trade has become a regular fixture for vessel owners from China, Turkey and Greece, they added.

Russia’s invasion of Ukraine has led to fewer shipowners handling the OPEC+ producer’s crude oil on concerns about reputational damage or running afoul of financial sanctions. Almost all recent exports of ESPO have been transported to, or are bound for Chinese ports, with the occasional shipment going to India.

China’s Cosco Shipping Holdings Co. is among the most active in the ESPO trade alongside Russia’s Sovcomflot, data compiled by Bloomberg and shipbrokers show. Active Shipping & Management Ltd., BEKS Ship Management & Trading SA and Dynacom Tankers Management Ltd. from Turkey are still hauling the grade, along with Greek companies Avin International Ltd. and Estoril Navigation Ltd.

The shipping companies didn’t respond to emails seeking comment.

It usually takes about five days to haul ESPO to China on an aframax tanker, making it one of the more profitable routes globally, said shipbrokers. The short transit time means ships have little downtime when sailing back empty to Kozmino, thus increasing their utilization rates and profits, they added. An aframax can carry about 730,000 barrels of crude.

| Related stories: |

|---|

Those shippers still in the ESPO trade are capitalizing on high profits before new European Union sanctions kick in, after which there will be more scrutiny on dealings with Moscow.

The Group of Seven nations last week discussed different ways to maintain global oil supplies while limiting Moscow’s revenue. A proposal, which included price caps and restrictions surrounding access to insurance cover and shipping services, was floated although no decisions have been finalized.

— With assistance by Sharon Cho, and Sarah Chen

Political changes boost risk for miners in Latin America

A rising demand to participate in the revenues from natural resources, tougher environmental protection rules and changes to laws are increasing risks for mining and energy companies across Latin America, even in countries once considered safe investment destinations, a new study shows.

Sign Up for the Suppliers Digest

The higher the overall score, the better a jurisdiction is for mining investment because the risks are not as acute, the authors explain.

The nation is redrafting its market-orientated constitution, which dates back to the military dictatorship of Augusto Pinochet. It will hold a nationwide referendum vote on the new text in September, which could bring a full ban to mining in glaciers, many of which are adjacent to lithium deposits.

The new constitution may also include mandatory community prior consent on new concessions near indigenous land claims and the end to ownership of water within concession boundaries, replaced by a water permitting process.

The consultants use a proprietary approach that divides risk into seven overlapping categories, namely political interference, economic pressure, community opposition, legal and regulatory instability, reputational risk, safety and security and operational risk.

Perhaps surprisingly in light of recent community opposition-driven turmoil, Peru is the second most welcoming jurisdiction, with 61 points and 80 projects on hold.

The mining industry blames President Pedro Castillo for the recent wave of social unrest, which has taken a toll on production. Since the former rural activist from a Marxist party took office, the number of social conflicts is up about 7% as the administration is prioritizing the right to protest over other concerns such as free transit.

“Peru’s political class has generally understood the economic importance of mining and has promoted it accordingly,” Alejandro Alvarez, one of the authors, told MINING.COM.

“This may change in next year’s edition of the ranking if the

Castillo administration does not manage to harmonize community

opposition and social demands with the intrinsic importance of the

industry to the country’s economy,” Alvarez added.

Argentina, with 56 points, is the third best country for miners and energy firms in Latin America.

The country has attracted over the past year major players, including the world’s second largest miner Rio Tinto and South Korean steelmaker Posco.

Economic pressure may hinder some of the expected growth in the industry, as an ever-present fiscal crisis in Argentina pushes the government to raise taxes on its natural resource sectors, including mining, the report reads.

Brazil holds the fourth position, with 54 points. The country’s diverse geography, history, and people, combined with its decentralized political system, makes it challenging to analyze risk on a national level, the authors of the index say.

They highlight an increasing number of projects in the Amazonian basin, thanks to concessions given by President Jair Bolsonaro, which have drawn global criticism.

Costs are other issues in Brazil, as almost everything is more expensive in Brazil than in the rest of Latin America, the authors say. Logistical costs in the country are, according to the report, 50% higher than in Canada.

On top of that, in some Brazilian states like Bahia, security is of grave concern, mostly due to drug trafficking.

Completing the “top five” countries is Panama, with 53 points. First Quantum’s Cobre Panamá put the country on the map by developing the world’s third-largest mine. With little mining history, Panama is only now waking to the industry’s potential, the report reads.

The nation’s mining code, written in 1963, is outdated and fails to incorporate today’s best practices. Key issues that need to be addressed include adherence to best environmental stewardship practices, such as water, waste, and biodiversity management, the study says.

The mining risk index assigns a lower numeric value to countries with adverse environments to miners and investors. Based on that metrics, Venezuela, Bolivia and Honduras rank last across all categories, including heightened security, regulatory instability and operational concerns.

The authors of the ranking warn mining investors that country risk is only one of many factors to be considered ahead of project investment or lending.

Of equal or greater importance is the local investment climate, including interests of local stakeholders, fears and aspirations of local communities, the rule of law and security environment, as well as the historical relationship between the local community and national authorities, among other issues, they say.

The report also highlights that most obstacles to mining projects Latin America currently originate from local, not national, issues.

Thursday, July 7, 2022

Copper price lowest since November 2020 on economic slowdown worries

Credit: Montanwerke Brixlegg AG

https://www.mining.com/copper-price-lowest-since-november-2020-on-economic-slowdown-worries/

Copper prices extended a decline on Tuesday as aggressive interest rates, a spike in covid-19 cases in China, potential recession, and rising inventories weighed on investor sentiment.

Sign Up for the Copper Digest

Click here for an interactive chart of copper prices

The most-traded August copper contract in Shanghai ended daytime trading down 1.9% to 60,110 yuan ($8,975.66) a tonne by midday trade.

“There was a bull trap set early at the open today as S&P and Nasdaq futures pointed higher. However, the rest of the bearish sentiment is just because of recession fear, which is almost certain for most US and Europe already,” a Singapore-based metals trader said.

Pulling down economic activity and inducing recession fears are soaring inflation and interest rate increases in many countries, including the United States, where the Federal Reserve is expected to deliver another 75-basis-point increase this month.

Meanwhile, copper stocks in LME-approved warehouses jumped 10,100 tonnes to 136,950 tonnes. They have risen more than 20% over the past week.

Cities in eastern China tightened covid curbs on Sunday as coronavirus clusters emerged.

(With files from Reuters)

One of the largest crypto miners sold most of its Bitcoin holdings as market turmoil leads to big pain for major companies

Photo illustration by Fortune; original photos by Getty Images

Sign up for the Fortune Features email list so you don’t miss our biggest features, exclusive interviews, and investigations.

One of the largest cryptocurrency mining companies is feeling the heat of the latest market downturn.

Core Scientific sold most of its Bitcoin holdings in June, the company said on Tuesday in a monthly update. It traded 7,202 Bitcoins for about $167 million, and now holds 1,959 Bitcoins and $132 million in cash on its balance sheet.

Proceeds from its Bitcoin sales were used for payments for ASIC servers, which are typically used to mine cryptocurrency; investments in data center capacity; and scheduled repayment of debt, according to Core Scientific.

The company says it will continue to sell its mined Bitcoins to pay operating expenses and maintain liquidity, among other things.

The announcement is just the latest sign that major crypto players are taking drastic actions to try to survive a struggling market. The second quarter of 2022 was rough for the entire sector, with June being particularly damaging. Forced selling and liquidations caused a stir across the industry, and as the price of Bitcoin plunged, it also took a toll on miners.

“Our industry is enduring tremendous stress as capital markets have weakened, interest rates are rising, and the economy deals with historic inflation,” said Mike Levitt, Core Scientific CEO, in the update.

Core Scientific did not immediately respond to Fortune’s request for comment.

Miners like Core Scientific are crucial in keeping the Bitcoin network secure. Miners validate Bitcoin transactions by using expensive equipment and a lot of computer power to try to solve complex puzzles, resulting in coins.

Previously calling itself the “King of Bitcoin,” Core Scientific is a juggernaut for Bitcoin mining. It operates over 180,000 ASIC servers, and in March the company said it ran over 10% of Bitcoin’s network.

Although it has cashed out more than 7,000 Bitcoins, the company is still bullish on the cryptocurrency and plans to grow its Bitcoin data centers and continue to self-mine.

Stunning Amount Of Oil Released By Biden Found Its Way To China, Other Countries

Biden / The Western Journal

Millions of barrels of oil President Joe Biden released from the United States’ Strategic Petroleum Reserve found their way to European and Asian nations, including China, according to a Tuesday report from Reuters.

Biden has frequently touted the release of one million barrels of oil per day as an “unprecedented” move to “provide a historic amount of supply” as Americans face surging prices at the pumps. Indeed, the national average price of gas in the United States is currently $4.80 per gallon, according to AAA, with the national average temporarily surpassing $5.00 per gallon last month.

However, Reuters found through customs data that at least five million barrels of oil were exported to Europe and Asia last month as the strategic reserve drains to its lowest level since 1986. American oil refiner Phillips 66, for instance, shipped 470,000 barrels of sour crude from Texas to Trieste, Italy, while Atlantic Trading & Marketing (ATMI) — a division of French entity TotalEnergies — exported two cargoes of 560,000 barrels each.

Meanwhile, industry sources told the outlet that more crude oil was sent to China, India, and the Netherlands.

When asked about the report, White House Press Secretary Karine Jean-Pierre said that she was not aware of the matter and needed to “look into it.”

Fuel costs across the world have risen since the Russian invasion of Ukraine — yet the Biden administration has pursued policies such as nixing expansions to the Keystone XL Pipeline last year and delaying new drilling permits. Beyond releasing fuel reserves, Biden has also resorted to pleading with oil companies to cut into their own profits.

“There is no question that Vladimir Putin is principally responsible for the intense financial pain the American people and their families are bearing,” Biden wrote in a recent letter to seven oil and gas companies. “But amid a war that has raised gasoline prices more than $1.70 per gallon, historically high refinery profit margins are worsening that pain.”

Biden has likewise set his sights on gas stations — which run on margins as low as 1.4%, according to industry research company IBISWorld.

“My message to the companies running gas stations and setting prices at the pump is simple: this is a time of war and global peril,” Biden said on social media. “Bring down the price you are charging at the pump to reflect the cost you’re paying for the product. And do it now.”

The U.S. Oil and Gas Association — a petroleum industry advocacy group — responded to Biden by affirming that they are “working on it.” The organization wished Biden a happy Fourth of July and asked him to “please make sure” the White House intern who posted the tweet “registers for Econ 101 for the fall semester.”

Beyond gas station prices, analysts at JPMorgan Chase are warning that oil prices could triple to $380 a barrel as Russian officials continue their invasion of Ukraine. “It is likely that the government could retaliate by cutting output as a way to inflict pain on the West,” the analysts wrote. “The tightness of the global oil market is on Russia’s side.”

Yet crude inventories in the United States are currently at their lowest levels since 2004, according to Reuters, as refineries along the gulf coast operate at nearly 98% capacity.

Wednesday, July 6, 2022

Tuesday, July 5, 2022

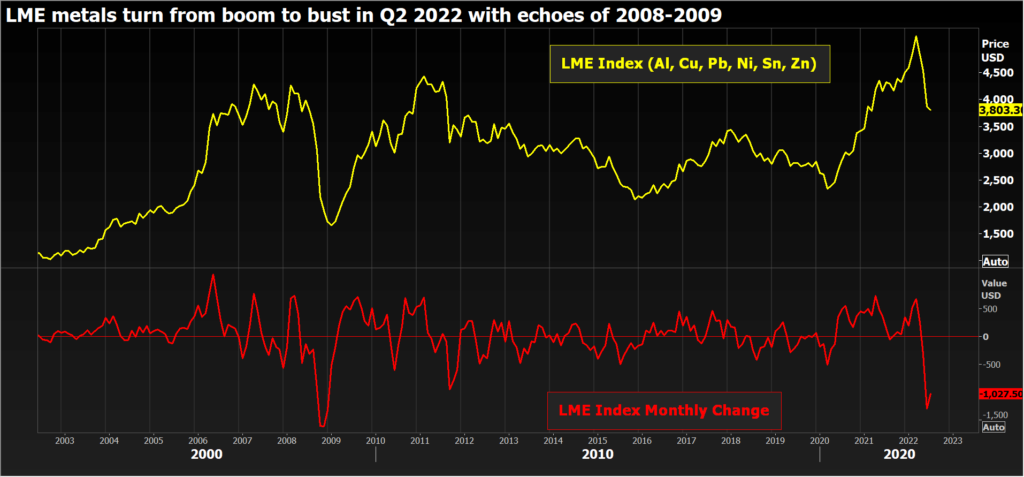

Metals melt down as recession fears overwhelm supply woes

(The opinions expressed here are those of the author, Andy Home, a columnist for Reuters.)

Sign Up for the Copper Digest

Copper, aluminium, zinc and tin all hit record price highs in March. Lead was the only LME base metal to miss out on the super-bull party.

After the March melt-up, however, industrial metals are now in meltdown. The LME Index has just experienced its sharpest quarterly fall since the global financial crisis.

The pivot in sentiment from super-bullish to super-bearish has been the Feb. 24 launch of what Russia calls its “special operation” in Ukraine.

Fears of sanctions against Russian metal helped drive prices to those record highs in March. But flows of Russian aluminium, copper and nickel have so far been largely unaffected.

Rather, traders are now focused on the recessionary impact of high energy prices as the Russian invasion grinds on.

Bears come out to play

Investor positioning across the industrial metals has flipped from long to short over the last few weeks, with systematic funds responding to chart breakdowns and downside price momentum by increasing bear bets.

Money managers were net long of the CME copper contract to the tune of 42,000 contracts at the start of April. The net short now stands at 25,402 contracts, the most bearish positioning since April 2020.

The last few remaining bulls are throwing in the towel. Funds’ outright long positions have shrunk to a two-year low of 33,926 contracts.

This is symptomatic of the broader investor landscape in metals, with heavier-weight funds trimming passive long exposure and systematic trend-following funds selling into price weakness.

LME broker Marex estimates there are now significant speculative short positions across the whole complex in the London market, several of them close to multi-year highs in terms of size.

China to the rescue?

It’s not hard to understand investors’ bear rationale.

High energy prices are fuelling inflation and central banks are responding by tightening policy.

They are also starting to chill manufacturing activity.

The latest string of purchasing managers indices captured stalled growth in Asia, the United States and Europe.

China is the potential bright spot in the global economy, with manufacturing activity expanding in June for the first time since February as the country gradually emerges from rolling lockdowns over the first half of the year.

However, there’s plenty of caution that China’s recovery may yet be held back by Beijing’s zero covid-19 policy, with several cities tightening curbs over the weekend as new cases emerged.

Tellingly, Chinese players are themselves playing metals such as copper from the short side.

Marex estimates the collective short positioning on the Shanghai Futures Exchange’s copper contact, expressed as a percentage of open interest, is as high as it’s been since 2008.

That speaks to a lack of conviction about the strength of any recovery in the world’s largest metals user.

Liquidity trap

The speed of the base metals price collapse is partly explained by a drainage of liquidity on the London Metal Exchange in the wake of its controversial suspension of the nickel market and subsequent cancellation of trades.

LME volumes have been sliding ever since. Trading activity in the second quarter was down by 13% on the year-earlier period and by 21% on the first three months of 2022.

Nickel is the most obvious casualty, prone to sharp price swings on low volumes, but this is a broader issue for both the LME and the physical supply chain.

Lower investor and industry participation on the LME leaves market action increasingly dominated by short-term systematic funds.

The resulting elevated volatility is reducing financing capacity for physical players as banks reassess their exposure to the metals sector.

Revenge of the micro?

It’s possible such financing constraints could lead to inflows of metal at LME warehouses, reversing a defining trend of recent months.

Total registered stocks of all metals amounted to 696,000 tonnes at the end of June, down from 2.36 million tonnes a year earlier.

Available LME zinc inventory is currently just 22,050 tonnes, which is why time-spreads have been tightening, the cash premium over three-month metal spiking out to over $200 per tonne last month even as the outright price was falling.

Such is the disconnect between micro and macro right now. Recessionary gloom is crushing all micro positives such as zinc’s dangerously low inventory cover.

Or the lengthening list of aluminium smelter curtailments in Europe and the United States, as high energy prices take a toll on a notoriously power-intensive sector.

Alcoa has become the latest producer to announce a cutback of 54,000 tonnes of capacity at its Warrick smelter in Indiana, citing “operational challenges”.

The whole Western aluminium supply chain is operationally challenged right now. So is that for zinc. Physical premiums for both metals remain extremely high, particularly in Europe, where regional production losses have been compounded by logistics problems.

It’s a sign of the extraordinary supply tensions in the West that China has been exporting both aluminium and zinc despite high tariffs on outbound shipments of refined metal.

With no relief in sight for European power prices, regional metal smelters are facing margin pain until further notice.

The LME paper market is pricing in a recessionary hit to demand while simultaneously ignoring the still bullish fundamental story of low inventory and continuing supply-chain stress.

The mismatch is increasingly stark, and it may be only a matter of time before ever larger short positions clash with ever smaller stocks.

Combined with patchy liquidity, there’s a good chance there’s more metallic boom and bust to come in the second half of 2022.

(Editing by Jan Harvey)

Supreme Court curbs EPA’s climate authority in blow to Biden

A deeply divided US Supreme Court dealt a major blow to President Joe Biden’s climate-change agenda, restricting the Environmental Protection Agency’s ability to curb power-plant emissions and saying Congress would have to act to give the agency more authority.

Sign Up for the Energy Digest

“A decision of such magnitude and consequence rests with Congress itself, or an agency acting pursuant to a clear delegation from that representative body,” Roberts wrote.

The court’s three Democratic-appointed justices — Stephen Breyer, Sonia Sotomayor and Elena Kagan — blasted the ruling.

“The court appoints itself — instead of Congress or the expert agency — the decisionmaker on climate policy,” Kagan wrote for the three dissenters. “I cannot think of many things more frightening.”

The ruling casts fresh doubt on Biden’s pledge to reduce US emissions in half by the end of the decade and his goal of a carbon-free electric grid by 2035. Hitting those targets will be impossible without regulations to stifle greenhouse gases from oil wells, automobiles and power plants, as well as tax incentives designed to spur clean energy, according to several analyses.

A White House spokesperson characterized the ruling as a devastating decision that damages the administration’s ability to address climate change. The White House also called on Congress to act, something the high court decision left as a possibility.

“The Supreme Court’s decision does not mean the end of President Biden’s climate agenda, but the administration will now have to quickly assess which regulatory actions it can still move forward on and which actions it must rethink or abandon,” said Kevin Minoli, formerly a senior official in the EPA’s Office of General Counsel.

Key doctrine

Roberts pointed to the so-called major questions doctrine, saying “we presume that Congress intends to make major policy decisions itself, not leave those decisions to agencies.”

The court’s reasoning could spur challenges to other federal regulations, from EPA automobile emissions curbs to vaccine mandates from the Centers for Disease Control, particularly when issues of congressional authorization are involved.

“The big thing that this case makes clear is that there is now this major questions doctrine that agencies will have to grapple with,” said Tom Lorenzen, of Crowell & Moring, a former assistant chief of the Justice Departments environmental division. “You can expect opponents of federal regulations to be raising that in litigation challenging a host of EPA and other regulations, including automobile emissions.”

Under the Clean Power Plan, states were encouraged to shift electricity generation from higher-emitting sources, such as coal, and toward lower-emitting options, such as renewable power. The Clean Power Plan never took effect, and when Donald Trump became president, the EPA rescinded the rule and adopted a narrower approach.

The Supreme Court case grew out of a group of legal challenges to the Trump rule. A federal appeals court in Washington said the Trump plan was based on an overly restrictive read of the EPA’s authority.

That prompted backers of the Trump rule — companies including Westmoreland Mining Holdings, and 19 Republican-led states led by West Virginia — to turn to the nation’s highest court. Their appeal said the lower court ruling would let the EPA remake the US electric system, going well beyond what Congress intended when it enacted the Clean Air Act in 1970.

The Biden administration said the text of the Clean Air Act doesn’t preclude efforts to shift power generation to cleaner sources. The White House drew support in the case from a mix of industries, including technology companies and electric utilities, as well as environmental organizations.

The case centered on a Clean Air Act provision that requires the EPA to identify the “best system of emission reduction” for existing pollution sources and then tasks states to come up with implementation plans.

The cases are West Virginia v. EPA, 20-1530; North American Coal Co. v. EPA, 20-1531; Westmoreland Mining Holdings v. EPA, 20-1778; and North Dakota v. EPA, 20-1780.

(By Greg Stohr, with assistance from Kimberly Robinson, Jennifer Hijazi, Stephen Lee and Peter Jeffrey)