Friday, July 30, 2021

Thursday, July 29, 2021

Petra Diamonds finds 342-carat rough at Cullinan mine

The 342.92-carat Type IIa white diamond. (Image courtesy of Petra Diamonds.)

South Africa’s Petra Diamonds (LON:PDL) has recovered a 342.92-carat Type IIa white rough at its iconic Cullinan mine.

The company said the diamond is “exceptional” quality, in terms of both its colour and clarity, and that it will likely be sold at the September tender.

Type II diamonds are found less frequently and are more valuable than Type I diamonds, as they have no measurable nitrogen impurities. This gives them exceptional transparency and brilliance.

Cullinan is known as the birthplace of the famed 3,106-carat Cullinan diamond, which was cut to form the 530-carat Great Star of Africa.

The operation also yielded the 317-carat Second Star of Africa.

They are the two largest diamonds in the British Crown Jewels.

Cullinan is known as the world’s most important source of blue diamonds, such as the 39.34-carat stone Petra found in April and which sold for $40.2 million earlier this month. It was the company’s highest price ever for a single stone.

Wednesday, July 28, 2021

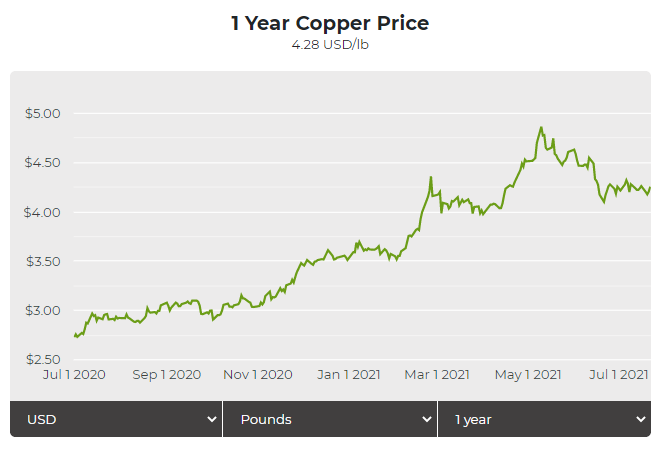

Copper price highest in 6 weeks as flooding in China raises supply concerns

Flooding has caused at least $10 billion in damage to central city of Zhengzhou (Credit: Screenshot from Al Jazeera via You tube)

Copper prices jumped on Monday as floods in China sparked demand hopes at a time when inventories are falling.

Copper for delivery in September rose 4.5% from Friday’s settlement price, touching $4.602 per pound ($10,120 per tonne) midday Monday on the Comex market in New York.

Benchmark copper on the London Metal Exchange was up 0.9% at $9,604.50 per tonne in official trading, after touching its highest since June 16 at $9,665 per tonne.

Click here for an interactive chart of copper prices

Floods in central China, especially in the industrial and transport hub city of Zhengzhou in Henan province, have raised supply concerns and demand for rebuilding damaged infrastructure.

Flooding has caused at least $10 billion in damage, according to state media.

“Sentiment has brightened again in the last few days, reflected in the copper price,” Commerzbank analyst Daniel Briesemann said, adding he believed copper was due for a correction.

A Singapore-based trader said the market was pricing in disruptions to output from floods in Henan and demand for reconstruction.

Related read: Are copper prices in a supercycle? A 120-year perspective.

Copper prices have been advancing after China revealed that will release fewer metals reserves than expected.

China will sell another 30,000 tonnes of copper, 90,000 tonnes of aluminum, and 50,000 tonnes of zinc at auction from its state reserves on July 29.

The auction will mark the second sale this month as the government aims to rein in skyrocketing commodity prices.

“It is slightly less than the market expected but it should be priced in already as it’s pretty well flagged,” said Anna Stablum, a commodities broker at Marex Spectron.

(With files from Reuters)

Tuesday, July 27, 2021

OPEC, Energy Industry Should Thank Saudi Arabia For Oil Price Recovery

OPEC—as well as the entire energy industry—should be thanking Saudi Arabia for its “magnificent” job in managing their production during the Covid-19 pandemic, according to Robert Yawger, executive director of Energy Futures at Mizuho Securities, in a Bloomberg TV interview this week.

Yawger added that the entire market would be best left in Saudi Arabia’s hands to manage.

The energy commentator made no mention of Saudi Arabia’s role in the oil price war that immediately preceded the coronavirus-inspired lockdowns. At that time, Saudi Arabia (and Russia) deliberately increased production and exports, flooding the world with oil and crashing prices.

Oil prices even fell below zero.

The demand loss that followed due to Covid-19 made it nearly impossible to recover from the deluge.

The market crash, Yawger said, “left a terrible scar on the industry. It rallied back under the management of the Saudis. The rest of OPEC has a lot to thank them for.”

Indeed, the Kingdom has been instrumental in managing the market in the months that followed the crash–even if it was helping to mitigate some of the damage that Saudi Arabia inflicted.

Of all the OPEC members, Saudi Arabia has been perhaps the most conservative when it came to adding production back in as the OPEC group tried to thread the needle between prices and market share. A delicate balancing act that Saudi Arabia felt would be best served if erring on the side of oil prices.

In the process, Saudi Arabia did have to give up some market share. It also cut even more oil production than it agreed to, while other OPEC producers—whether due to lack of ability or inclination—overproduced nearly every month that the production cut agreement was in place. The largest overproducer throughout the production cut deal was Iraq, which finds it difficult to control oil output from the semi-autonomous Kurdistan region.

Now, after much internal haggling, OPEC has agreed to bring back 400,000 bpd starting in August. Another 400,000 bpd is set to be brought back online in September and every month that follows until the cuts have been rolled back entirely.

Meanwhile, analysts and industry groups feel the inventories have been reduced and that even more barrels should be brought online.

“In my opinion, it’s best to let the Saudis manage it; they’ve done an incredible job. As long as they don’t flood the market themselves,” Yawger added.

Monday, July 26, 2021

Iran gears up to use new oil exports terminal

Oil has arrived at Iran's new exports facility off the Sea of Oman and is ready for loading as scheduled within three days, the National Iranian Oil Co. said July 19.

The Jask Oil Exports Terminal is ready to load the first batch of crude, the company said, adding that President Hassan Rouhani has ordered the operation to start on July 22.

The new terminal, whose construction took six years, walks around the chock point of Strait of Hormuz. Iran's main exports terminal is on the Kharg island in the Persian Gulf.

It marks the first phase of the Jask terminal project with a loading capacity of 350,000 b/d.

"The oil tanker has been attached to the SPM no. 1 and trial loading is being carried out," said an NIOC video from Jask port. A 1,000 km pipeline has brought oil from Goureh pump stations and Petro Omid Oil Storage Tanks [in the Bushehr province] to the Jask Terminal in the Hormozgan province.

Friday, July 23, 2021

Iron ore price rises on disappointing figures by top producers

Iron ore has been in a bull market for more than two years, and it’s not

about to end soon, according to Goldman Sachs. (Stock Image)

The iron ore price rose on Tuesday, boosted by disappointing figures by the world’s biggest producers.

The company maintained its full-year guidance of 315 million to 335 million tonnes and said it achieved an annual output capacity of 330 million tonnes.

“Full-year iron ore production guidance of 315-335 million tonnes is maintained, but hitting even the bottom end of this range would require a strong second half of the year,” Christopher LaFemina, an analyst at Jefferies told the Financial Times.

“Doable, but risk is to the downside.”

BHP said it would start a “major maintenance” campaign over the next three months at Port Hedland, its key iron ore loading facility in Western Australia.

Lower than expected supply growth has helped prop up prices, which at more than $220 a tonne on Tuesday are delivering huge profits for iron ore producers.

Rio Tinto said last week that its shipments fell 2% on the previous quarter and flagged annual exports could come in at the low end of its forecast, partly because of heavier than normal rain.

Bull market

Iron ore has been in a bull market for more than two years, and it is not about to end soon, say Goldman Sachs analysts.

“It would be wrong to say that the bull market for iron ore, you know, is on the cusp of ending,” said Nicholas Snowdon, Goldman’s head of base metals and bulks research, as CNBC reported.

According to Snowdon, the market will likely only return to a “comfortable position” from 2023 on.

Prices are being supported by strong demand from top steel producer China.

“Even as China shows some signs of decelerating in … steel demand growth rate in the second half of the year and into 2022, the rest of the world and (developed market) steel demand dynamics are incredibly strong,” Snowdon was quoted at the Singapore Iron Ore Forum.

“For now, it looks like a very tight market with a very strong underpin from supply demand, and still robust demand growth rates.”

“The Australian producers have almost maxed out their infrastructure availability, so they can’t expand at any pace,” said Rohan Kendall during a separate panel discussion.

“I think prices over $200 a tonne are unsustainable, but we’re likely to see prices stay around $150 a tonne,” predicted Erik Hedborg, principal analyst at CRU.

(With files from Reuters and Bloomberg)

Wednesday, July 21, 2021

Battle for Venezuelan gold starts at UK’s top court

UK Supreme Court. Credit: Wikimedia Commons

The question of who controls more than

$1 billion of Venezuelan gold stored in the Bank of England’s vaults

took another twist after the British government said that it continues

to recognize the leadership of opposition figure Juan Guaido.![]()

A U.K. Supreme Court hearing that started Monday will decide whether the BOE must release the bullion to the Venezuelan central bank, controlled by the government of Nicolas Maduro. The long-running legal battle has reached the top court after judges questioned whether the U.K.’s previous recognition of Guaido was clear and ignored Maduro’s effective control in Caracas.

The U.K. statement comes as Guaido himself faces threats from government security officials ahead of planned local and state elections in November.

The Supreme Court case is being heard after a lower court gave Maduro another shot at gaining control of the gold, saying that the U.K.’s recognition of Guaido as interim president was “ambiguous.”

The central bank argued that previous statements of recognition had ignored the reality on the ground in Venezuela where British diplomats maintained relations with Maduro officials.

“This is about sovereignty and power in Venezuela,” Nicholas Vineall told the court.

Venezuela’s central bank sued the BOE for access to the bullion that it says is urgently needed in a joint effort with the United Nations Development Fund to fight the Covid-19 pandemic.

The opposition has said that if it gets control of the bullion, it plans to safeguard the gold for the time being, as part of Guaido’s efforts to secure Venezuela’s financial assets abroad.

The Maduro government was attempting to “dance on the head of a pin” by arguing that the U.K’s recognition was limited, Guaido’s lawyer Timothy Otty said in court Monday.

“It’s always been our submission that there wasn’t a lot to argue about,” he said.

(By Jonathan Browning)

Tuesday, July 20, 2021

Iran Set to Start First Oil Export Terminal on the Gulf of Oman

Iran is set to start loading crude oil at the Jask oil terminal on the Gulf Oman as early as July 19, adding its first export terminal outside the strategic Strait of Hormuz leading to the Persian Gulf.

Some 100,000 mt of heavy crude oil could be loaded, once crude oil is reached at the terminal within the next two days, Vahid Maleki, director of the Jask Oil Terminal, told the state-run IRNA news agency on July 17. Iran’s outgoing President Hassan Rouhani has vowed to make the second main oil terminal operational before his administration ends on Aug. 3.

Iran started pumping oil into a pipeline to gear up for the Jask terminal, oil ministry-run news service Shana reported on May 19. In the first phase, the loading capacity will be 350,000 b/d, according to Maleki.

A 100,000 mt vessel has been chosen to carry the first crude, he said.

A 1,000 km conduit is capable of transferring 1 million b/d of oil from the oil-rich southwest Khuzestan province to the Jask terminal.

Jask is an alternative to the Kharg exports terminal that is located inside the Strait of Hormuz. The new facility can export heavy crude, light crude and gas condensates. It has been equipped with three metering facilities and six 36-inch pipelines that connect to three SPMs.

Storage capacity in the Sea of Oman terminal is 10 million barrels, half of Kharg.

Iran considers the terminal important to diversify its export sources, to supply feedstock for domestic petrochemical products to be exported.

Crude varieties

Iran’s crudes are mostly sour in quality due to their high sulfur content. They normally also have a higher specific gravity and are classified as heavy or medium, with gravities ranging from 27 to 34 API.

The country’s main export grade Iran Light, which is a medium sour grade with 33.6 API gravity and 1.46% sulfur content, according to the crude assay published by the state-owned National Iranian Oil Co. The Iran Heavy export grade is a heavy sour crude with an API gravity of 29.5 and sulfur content of 1.77%.

Despite US sanctions that are intended to heavily penalize buyers of Iranian oil, China’s independent refineries have maintained some level of Iranian crude imports, mainly Iran Light and some Iran Heavy, in the past few years, according to market sources.

Iran’s crudes compete directly with grades such as Saudi Arabia’s Arab Heavy, Arab Light and Arab Medium; Iraq’s Basrah Light, Basrah Medium and Basrah Heavy; Russia’s Urals; the UAE’s Upper Zakum; Oman Crude Blend; Kuwait Export Crude; Venezuela’s Mesa 30 and Merey 16; and Mexico’s Mata, among others.

Monday, July 19, 2021

Zombie mines are coming back to life on soaring metals prices

Aerial view of the Veovaca deposit at Adriatic Metals’ Vares polymetallic project in Bosnia-Herzegovina. Credit: Adriatic Metals

A silver mine in Bosnia and Herzegovina that sat derelict through the years of civil strife that gripped the region from the early 1990s may soon be taken out of mothballs to benefit from an optimistic price outlook.

Adriatic Metals Plc’s Vares project could resume production by the end of 2022 following a hiatus of more than three decades, according to Chief Executive Officer Paul Cronin. It’s part of a nascent trend toward restarting so-called “zombie” mines — operations which have been shuttered for reasons varying from weak prices to owner bankruptcy or political unrest.

“Some of these old mining assets around the world that have been discarded and dumped are an eyesore — they’re a problem. They create potential environmental issues that need to be resolved,” Adriatic’s Cronin, a former investment banker, said in a phone interview. “If we can convert the ‘zombie’ into something that adds value, that resolves some of those issues and shareholders can get a return from them, that’s great.”

Miners from Europe, to Australia and South Africa, are being motivated by the commodities price rally driven by the global economic recovery and infrastructure spending tied to the clean energy transition. Anglo American Platinum Ltd., the world’s biggest platinum company by market value, has been approached by at least four groups for its idled Bokoni mine, people with knowledge of the matter said last month.

The advantage of recycling old mines, even ones that haven’t been in production for over 30 years, is that you can save costs by using the existing infrastructure, Cronin said. Vares already had rail links and roads in place, and Adriatic was using some of the former site’s facilities including power lines. New technology can also help to make shuttered operations more economically viable. The company is also developing a zinc project in neighboring Serbia.

[Click here for an interactive chart of silver prices]

Mining giant Australia is getting in on the act: Panoramic Resources Ltd. and Mincor Resources NL are both restarting nickel operations, having put them on care and maintenance in 2016 in response to weak global prices. At the same time, the Honeymoon uranium mine, which was shuttered in 2014 due to weak prices, could be re-started in 12 months, developer Boss Energy Ltd. said in a feasibility study, citing the price outlook.

In Mincor’s case, the resumption of its Kambalda mine is backed by an off-take agreement with BHP Group’s nearby Nickel West operation, which is itself enjoying a renaissance amid a surge in demand for the battery metal. Prices have gained about a third over the past year.

A strong price environment had seen miners look at the economics of reopening mothballed operations, said Gavin Wendt, founding director of consultancy MineLife Pty. So far, it had mainly been smaller mines that had re-started, which were unlikely to have much impact on the market, he added.

“A lot of these operations sit at the high end of the cost curve, that’s why they’re not in production now,” Wendt said. “So that tells us they are quite marginal and they are the most vulnerable to movements in commodity prices.” Still, with the infrastructure already in place, re-starting a mine was a relatively low-risk strategy when compared to developing new resources, he added.

Silver has risen nearly 40% over the past 12 months and with the precious metal also in demand for use in solar panels and electric vehicle charging stations due to its conductive properties, Cronin said he is confident that the price outlook remains robust for his project.

(By James Thornhill)

“United Against Nuclear Iran” group launches Iran Tanker Tracker

https://www.tankeroperator.com/ViewNews.aspx?NewsID=12479

As part of our campaign to disrupt Tehran’s oil sales revenue, UANI has launched a new resource, the Iran Tanker Tracker.

This comprehensively tracks exports of Iranian oil through our ship-tracking methodology dating back to April 2018. In addition to our monthly Iran Tanker Tracking Blogs, the new resource provides a comparison of where Iran’s oil exports were pre-JCPOA, during the JCPOA, and post-JCPOA.

In June 2021, world oil prices surged to almost $75 a barrel as major economies ease coronavirus restrictions and demand returns. The situation in Iran, which sits on the fourth-largest reserves of oil, is also having a significant impact on prices. The Iran nuclear talks are dragging beyond what many anticipated, while the recent installation of a conservative cleric, Ebrahim Raisi, as President has also thrown another wrench into the prospects for any lifting of U.S. sanctions on Tehran’s energy exports.

Yet despite the sanctions and ongoing talks in Vienna, Iran’s exports of crude oil and gas condensates climbed back up to over 1.1 million barrels per day (bpd) in June, up by a quarter-million barrels from last month’s 850,000 bpd figure.

As the second quarter passes, we can also compare the half-years of 2020 and 2021. For the first six months of 2021, Iran’s crude oil exports have averaged around 1.34 million bpd. This is almost double the average of the first six months of 2020, which UANI tracked at 760,000 bpd.

A major reason for this almost doubling is Iran’s addition of foreign-flagged tankers to its fleet. The co-option of additional foreign-flagged tankers grants a wider bandwidth for Iranian oil to traverse the globe and skirt sanctions, which the regime accrues revenues used to further its nuclear program and fund its terrorist activities.

In June 2021, Iran used 14 different foreign-flagged tankers for oil exports. These tankers either called directly at Iran’s Kharg Island and ‘spoofed’ fake locations while there or engaged in a ship-to-ship (STS) transfer with a vessel from Iran’s sanctioned National Iranian Tanker Company (NITC). Compared to the same month twelve months ago, Iran used only five different foreign-flagged tankers to export its oil in June 2020. This speaks to an inevitable correlation between an increase in the usage of foreign-flagged tankers with a corresponding rise in oil exports.

In June, Iran loaded gas condensates into the Iranian vessel FOREST (IMO: 9283760) and dispatched the condensates into the Soroosh oilfield. This is the first time in the history of Iran’s oil industry that it has injected gas condensate from the South Pars into the Soroosh oilfield. The Soroosh offshore oilfield is located west of Kharg Island and is comprised of an underwater network of pipelines that connect to a Floating Storage Unit (FSU) vessel called the Khalij e Fars (IMO: 9544114). The FSU collects heavy sour crude oil from the pipelines. However, by injecting gas condensates into the Soroosh oilfield, the viscosity of the oil is reduced. Iran considers this an advantage by adding flexibility to its oil industry.

One of the 14 foreign tankers that visited Iran in June was the crude oil tanker LIMOSTAR (IMO: 9237539). LIMOSTAR was the first foreign tanker to load from the FSU Khalij e Fars after the project was completed. However, as it approached the FSU, LIMOSTAR utilized a practice where it purports to be a decommissioned vessel, STAR BRIGHT (IMO: 9002594). Specifically, LIMOSTAR switched off its AIS transponder and switched on a second transponder in order to claim the MMSI of STAR BRIGHT.

As Iran increases its use of foreign-flagged tankers, UANI is increasing its outreach to maritime authorities, alerting them to the vessel’s involvement in the transport of Iranian oil. Disrupting Iran’s oil sales revenue is key to combating the numerous threats posed by the Islamic Republic of Iran.

Friday, July 16, 2021

Iron ore price holds above $200 but China outlook is clouding

Iron ore prices rose on Wednesday, pressured by concerns about demand prospects for the steelmaking raw material in top steel producer China.

The most-traded September iron ore contract on China’s Dalian Commodity Exchange ended daytime trade 0.8% higher at 1,219.50 yuan ($188.36) a tonne.

“There are early signs of a turning point in Chinese demand with falling Chinese steel prices crushing margins for steel mills,” said Justin Smirk, a senior economist at Westpac in Sydney.

Declining cement prices in China, some rebar makers possibly starting to incur losses, and excavator sales in May posting the first monthly drop since early 2020 point to slowing construction activity that has also been hampered by an unfavourable weather, Smirk said.

China’s steel exports also remained weak, hit by tepid demand in Southeast Asian countries – its largest buyers of the construction and manufacturing material – due to a fresh wave of covid-19 infections in the region, Mysteel consultancy reported.

Concerns about China’s efforts to curb steel output this year to meet its carbon emissions goal also kept market participants largely at bay, even as worries persisted over the tightness in global iron ore supply.

Iron ore had been on an upward trend over last month, bolstered by the resumption of steel production in key hub Tangshan.

Related read: China to keep economy within reasonable range, act to ease commodity prices

“Steelmakers need to cut back rather than merely slow excessive production rates because raising prices of new production will not solve a fundamental problem,” Fastmarkets said in a note.

“While the (Chinese) government remains concerned by excess output, do not be surprised if steel production falls and in turn hot metal prices correct in the short term.”

“The growth of China’s steel demand in the second half will be slower than the first half,” said Wang Yingsheng, chief economist of the China Iron and Steel Association (CISA), while speaking at the opening ceremonies for the three-day Singapore International Ferrous Week.

(With files from Reuters)

Wednesday, July 14, 2021

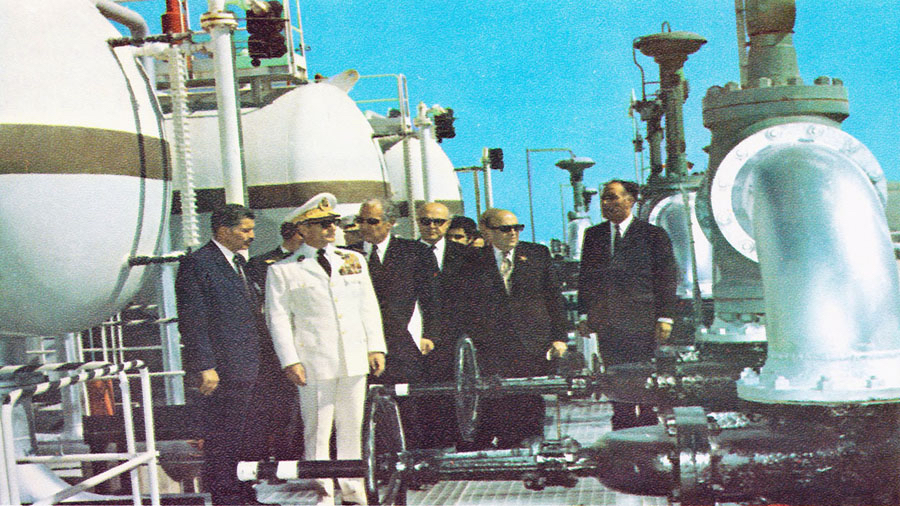

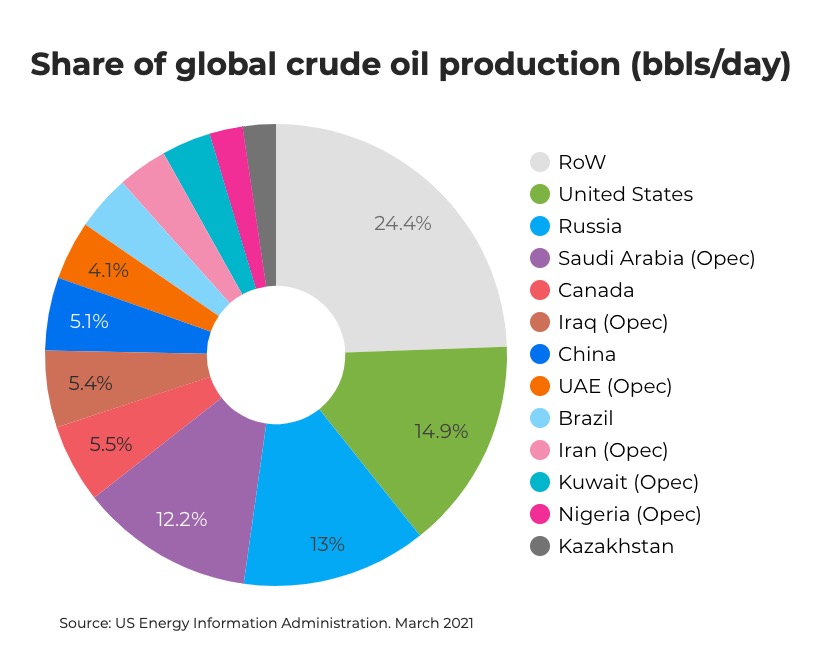

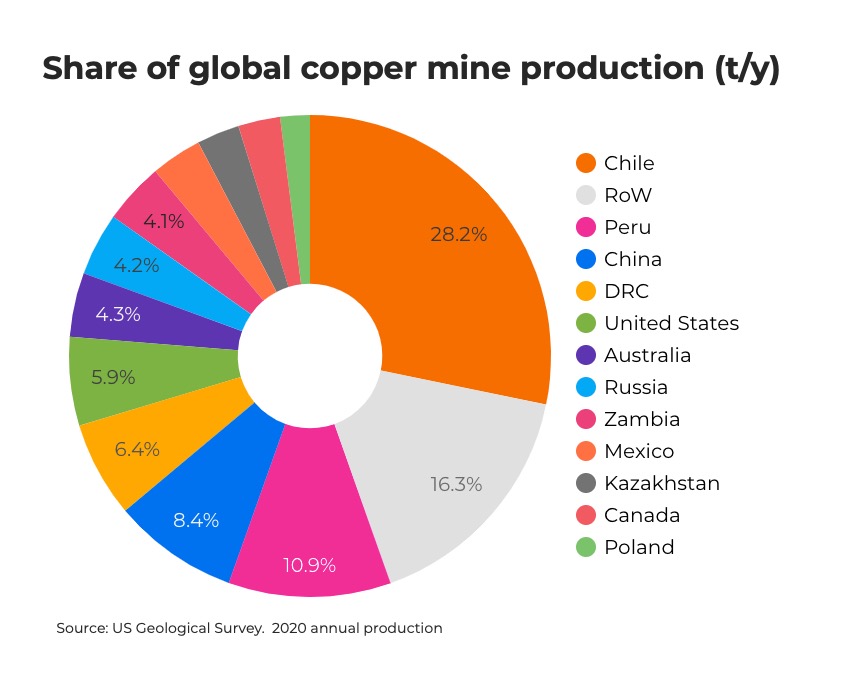

Copper mining is Opec on crack, so why is the price falling?

The Shah of Iran opens the facilities of International Naval Oil Company of Iran in 1970. File image.

Much like the reference in this piece’s headline, it’s a cliché to call a country the Saudia Arabia of something.

The top search suggestion at the moment is the Saudi Arabia of wind. That’s Boris Johnson’s dream for the UK and from a leader with an affinity for hot air, perhaps not unexpected.

The Saudi Arabia of lithium query takes you to a story about Chile, which is wrong. Neither is it Afghanistan as this article in the NYT would have it. It’s Nevada; Elon Musk confirmed it last year.

The Saudi Arabia of sashimi is… well just google it. (it’s Palau – ed.)

Chile is not the Saudi Arabia of copper either.

It’s the Saudia Arabia, Iraq, UAE, Iran, Kuwait, Nigeria, Angola, Algeria, Venezuela, Libya, Congo-Brazzaville, Gabon and Equatorial Guinea of copper.

Chile’s share of global copper output is on par with the combined output of the 13 members of Opec in the crude trade.

In 2020 the South American nation produced 5.7m tonnes of copper out of a global total of 20.2m tonnes, according to the US Geological Service. Opec countries were responsible for 24.3m of the 76.1 million barrels per day produced during March this year, according to the US Energy Information Administration.

Chile+

Chile and Peru together constitute close to 40% of world production, which is roughly the share of what is known as Opec+ (add Russia). And consider that Chile and especially Peru suffered frequent covid-related mining disruptions last year (not to mention blockades at some of the biggest mines and transport strikes).

The concentration at the top is only going to increase. The Democratic Republic of the Congo could as soon as next year overtake China as the no 3 producer when the Ivanhoe-Zijin JV, Kamoa-Kakula, adds 400,000ktpa to the country’s total (and doubling its contribution six years later).

Apart from Rio Tinto’s much-anticipated block cave at Oyu Tolgoi (330ktpa) in Mongolia on the Chinese border, the only near-production projects close to this size are in South America.

Anglo American’s greenfield Quellaveco project (300ktpa) in Peru and Teck Resources’ phase 2 at Quebrada Blanca (295ktpa) in northern Chile will further entrench the two countries’ dominance.

Playing with monopsony money

As in other spheres, China plays the long game in mining.

It bagged the largest new copper mine to come on stream in decades – Las Bambas in Peru – by making its sale to a Chinese concern a requirement for approving the 2014 Glencore-Xstrata merger.

In 2016, China Moly picked up Tenke Fungurume in the biggest overseas splash since Las Bambas, paying $2.7 billion to take it off Freeport-McMoRan and Lundin’s hands.

In all, China has spent $16 billion on buying copper projects around the world and at the moment owns 30 operating copper mines and 38 exploration projects.

That’s over and above Beijing’s annual foreign direct investment in mining and exploration, which reached $2.2 billion in 2019.

Go downstream, things will be great when you’re downstream

It’s not only primary production that’s highly concentrated, there’s a lock on the midstream.

Overall, 63% of China’s copper concentrate comes from Chile and Peru, and after decades of investment in the sector, the country refines over 40% of the world’s copper, six times its nearest rival, Japan.

The Tenke deal supercharged the 4C supply chain – Congo-Copper-Cobalt-China – as Chinese imports of concentrate from central Africa and elsewhere accelerated towards 2020’s total of just under 22m tonnes per year.

The Biden administration reportedly wants to copy the Chinese playbook, but in order to placate environmentalists will skip the mining part

Cobalt is a by-product of copper mining — primarily in the DRC which is responsible for some two-thirds of global output. China owns 82% of global midstream processing of cobalt for batteries. For nickel in the EV supply chain it’s 65%.

The Biden administration reportedly wants to copy the Chinese playbook, but in order to placate environmentalists will skip the mining part.

In the words of one official involved in critical minerals policy, “it’s not that hard to dig a hole. What’s hard is getting that stuff out and getting it to processing facilities.”

Just like all the oil processing facilities in the US shielded it from the Opec-induced oil supply shocks of the 1970s. Right?

Earthquake in Chile

While the Middle-East is a volatile region (to use a well-worn euphemism), its hereditary leaders and pseudo-democracies have a way of keeping the oil flowing regardless of any palace intrigue, proxy wars, or sanctions.

In contrast, Chile and Peru are in the early stage of fundamental political shifts driven by elections fought over income inequality, poverty and the environment – hardly on the political agenda in places like Saudi Arabia and the Gulf states.

A debate between Opec’s crown princes and emirs has sent oil to three-year highs, up 50% in 2021.

Let’s count the ways Chile can cause a copper market meltup:

It’s rewriting its Pinochet-era constitution, new copper windfall taxes and royalties already approved by the lower house, could, to put it mildly, dampen enthusiasm (your last euphemism – ed.) for new projects, so-called tax stability deals for half the country’s mines (including Escondida, the copper world’s Ghawar) expire in 2023 if they last that long, a powerful mining union is lobbying for state-owned Codelco to have dibs on projects, and if the current frontrunner becomes president in November elections he would be the first person from the Communist Party to do so.

Daniel Jadue also has other ideas to increase the state’s take and involvement – creating a Codelco for lithium (gentle reminder: Codelco was created by seizing mines from US companies in the 1970s) and like Indonesia renegotiate state shareholding in private companies like Freeport had to with Grasberg.

Another successful Indonesian strategy Chile and others would want to copy is to force miners to build smelters and refineries in-country by banning ore exports.

A bit like the current US administration’s clever strategy around critical minerals, focusing on processing facilities, except Chile also produces feedstock for said facilities.

Dear prudence

Now take all of the Chilean political and mining trends, turn them up a few notches, and apply to Peru and its new president Pedro Castillo.

At the start of his campaign, Castillo said he wanted to nationalize the mines but later softened his stance by calling for Chile-like royalties in the 70-percents.

This is a recent headline about Castillo’s latest plans for the industry:

Peru’s Castillo expects mining firms to accept “prudent” tax changes, adviser says

You can read that as having a conciliatory tone, or perhaps it sounds more like: “Nice little copper mine you have there. It would be a shame if something were to happen to it. We’ll make you an offer you can’t refuse.”

Ocec nocec

The copper-oil analogy only goes so far.

While regional co-operation to align mining rules for Chile, Peru, Argentina, Bolivia and others so as to “not compete for investments” (Jadue again) is being discussed, an Opec-like cartel in copper is never going to happen.

Most Opec disagreements are about how much to up production (the UAE wants to pump more oil now because the assumption is as the world moves away from fossil fuels it would be stuck with stranded oil and gas assets down the line).

Codelco is spending more than $40 billion just to keep output steady. Opec-members output hikes can also hit oil markets within months. For copper it takes years, often decades to bring new supply online.

Low and declining grades and with it ever costlier and bigger mines, uninspiring green discoveries, modest brownfield expansions, thin project pipelines, underinvestment in exploration, and glacially slow permitting processes, have become rules of thumb in the industry. And when tailings reprocessing is being discussed as a significant source of new supply, you know something in the industry has changed.

Depletion is oddly little discussed (must be in miners’ DNA – it’s always about the next discovery, not this old hole in the ground – ed). A recent study found that most porphyries (which supply 80% of the world’s copper) are fast nearing the end of their productive life due to the specific nature of how these deposits are formed.

So why is the price falling? idk

The copper price is down 10% since hitting all-time highs of $10,500 a tonne ($4.75/lbs) in May and forecasts are for further declines.

Two years out among more than 30 investment banks, economists and research houses polled consensus is for an average $8,131 a tonne ($3.68/lb).

Technically, that means copper is entering a bear market.

But it’s worth remembering that the metal also traded at these levels as far back as 2011.

Rapid demand growth and rising risks to supply since then does not

seem baked into today’s price, much less in continuing declines.

Tuesday, July 13, 2021

Energy Fuels’ first shipment creates US-Europe rare earths supply chain

Image from Energy Fuels.

https://www.mining.com/energy-fuels-first-shipment-creates-us-europe-rare-earths-supply-chain/

Energy Fuels (NYSE: UUUU) (TSX: EFR) and Neo Performance Materials (TSX: NEO) created a new United States-to-Europe rare earth supply chain this week when the first container – with 20 tonnes of product – of an expected 15 containers of mixed rare earth carbonate produced at Energy Fuels’ White Mesa Mill in Utah was shipped to Neo’s rare earth separations facility in Estonia.

More shipments of RE Carbonate will be en route as Energy Fuels continues to process natural monazite sand ore mined in the US state of Georgia by Chemours (NYSE: CC) for both the rare earth elements (REEs) and naturally occurring uranium that it contains.

REEs are the building blocks of an array of clean energy and advanced technologies, including wind turbines, electric vehicles, cell phones, computers, advanced optics, catalysts, medicine, and national defense applications. Monazite also contains significant recoverable quantities of uranium, which fuels the production of carbon-free electricity using nuclear technology.

Both the US- China trade war and the pandemic induced shutdowns to manufacturing plants in China that could potentially cut off US rare earths imports last year shone a spotlight on the fact the nation is reliant on China for its rare earths needs.

While some rare earths miners are testing samples in labs and engaged in permitting processes, Energy Fuels is the only company actually moving product, CEO Mark Chalmers told MINING.COM.

“The demand for rare earths is projected to increase fivefold in 10 years,” Chalmers said. We’re making more progress than anybody else in North America.”

The new supply chain will initially produce rare earth products from monazite that is processed into RE Carbonate at Energy Fuels’ Mill in Utah. The RE Carbonate is then processed by Neo at its Silmet rare earth processing facility in Sillamäe, Estonia into separated rare earth oxides and other rare earth compounds.

Neo is the only commercial producer of separated rare earth oxides in Europe and there is currently no separation facility in America, Chalmers said.

Energy Fuels was able produce carbonate quickly by retrofitting an existing uranium facility that already had permits for dealing with uranium recovery, and using existing infrastructure, Chalmers said.

“It’s the highest grade and best distributions of rare earths that facilities in the US can’t handle — that’s where we come in,” Chalmers said. “There is no next step in the United States. We ship to Estonia because that’s the only separation plant that makes the high purity rare earth elements in Europe.”

Plans are in the works to build a separation plant at White Mesa in the next 2-3 years, and possibly adding metals, alloys, and rare earth permanent magnets manufacturing capabilities. As a first step, the company has hired the French firm Carester SAS to produce a scoping study including capital and operating costs for a full rare earth separations capability at the White Mesa Mill.

“The launch of this new supply chain is a real gamechanger for Neo and our growing customer base in Europe,” said Constantine Karayannopoulos, Neo’s Chief Executive Officer.

“This U.S. to Europe supply chain will supplement Neo’s existing rare earth supply from our long-time Russian supplier. It will enable Neo to expand value-added rare earth production in Estonia to meet growing demand in Europe for these materials,” Karayannopoulos said in a media release.

“It begins to unlock the extraordinary economic and environmental potential presented by utilizing low-cost rare earth feedstock from monazite ore that is a byproduct of existing mining. And, it helps Neo ramp up rare earth production in Estonia just as Europe accelerates vehicle electrification and other initiatives aimed at mitigating climate impacts.”

The end products emerging from NEO’s Estonia plant are magnetic rare earth elements neodymium and praseodymium.

“We’re in a transformation period, and it’s staggering, how this transformation is occurring in the energy markets,” Chalmers said.

“Rare earths is emerging very, very quickly. We’re catching up to what China is doing – but we’re doing it at western world standards… [and] bringing back the supply chain, to get materials out of America, Canada, and Latin America and not be 90% dependant on China.”

Monday, July 12, 2021

Friday, July 9, 2021

Thursday, July 8, 2021

Wednesday, July 7, 2021

Glencore names Kalidas Madhavpeddi as new chairman

Miner and commodity trader Glencore (LON: GLEN) has chosen non-executive director Kalidas Madhavpeddi to replace Tony Hayward as the company’s new chairman, completing a leadership overhaul at the company.

During his time at the Chinese company, Madhavpeddi made a series of key acquisitions, including Freeport-McMoRan’s (NYSE: FCX) majority stake in the Tenke copper project in the Democratic Republic of Congo for $2.65 billion and Anglo American’s (LON: AAL) niobium and phosphates business in Brazil.

Madhavpeddi, 65, also spent more than 25 years at US miner Phelps Dodge, and is currently a non-executive director at Novagold Resources (TSX: NG).

The announcement comes just one week after Gary Nagle replaced billionaire Ivan Glasenberg as chief executive officer and marks a shift to new leadership for the company, which is facing pressure from investors to cut carbon emissions.

“As the world transitions to cleaner forms of energy and mobility, our portfolio of commodities will allow Glencore to play a key role in helping us achieve the goals of Paris and play a key role in the ongoing energy and mobility transition,” Madhavpeddi said in the statement.

“I am very pleased that the board has appointed Kalidas as my successor,” departing chairman Tony Hayward added. “His history of working in the resources industry and familiarity of operating across the globe provides excellent experience for this appointment.”

Hayward, former chief executive of BP, joined Glencore’s board in 2011. He should have left the company at the end of a nine-year term, in line with a UK governance code. Yet, the board extended his stay to oversee the wider management changes.

Analysts had expected Glencore to appoint an internal candidate as its next chair.

Focus on cobalt and copper

The appointment of Madhavpeddi highlights the weight Glencore is placing on its giant cobalt and copper operations in Congo, which are crucial to the electric vehicle and green energy revolution.

Instead of exiting coal, Glencore has committed to run down its assets by 2050, which will allow it to reach its net-zero emissions goal. That pledge includes so-called Scope 3 emissions, produced when customers burn or process the materials the company mines.

The company, which has also set a short-term emissions reduction target of 15% by 2026 from 2019 levels, acquired last week Anglo American and BHP’s (ASX, LON, NYSE: BHP) stakes in the Cerrejón thermal coal mine in Colombia.

Glencore is currently the world’s No. 1 cobalt producer, thanks to its Katanga mine in Congo. It has spent billions of dollars developing cobalt and copper assets in the African country and plans to reopen a second operation in the country next year.

Madhavpeddi will start as Glencore chairman at the end of July.

Tuesday, July 6, 2021

Gold price boosted by recovery in central bank buying

National Bank of Serbia. Image courtesy of serzhile, Flickr Commons.

Gold prices climbed higher on Monday as it appears that central banks have regained their appetite for buying bullion after staying on the sidelines for the past year.

[Click here for an interactive chart of gold prices]

Gold has come under pressure this year as higher bond yields made the non-interest bearing haven seem less attractive to investors. After recovering in April and May, the yellow metal fell by the most in more than four years last month as the US Federal Reserve turned more hawkish and the dollar strengthened.

However, gold has recaptured some of its shine lately as central banks from Serbia to Thailand have been adding to their holdings.

“Long term, gold is the most significant guardian and guarantor of protection against inflationary and other forms of financial risks,” said the National Bank of Serbia.

Serbian President Aleksandar Vucic recently announced the central bank intends to boost holdings of the precious metal to 50 tonnes from 36.3 tonnes.

Ghana also recently announced plans for purchases, as the specter of accelerating inflation looms and a recovery in global trade provides the firepower to make purchases.

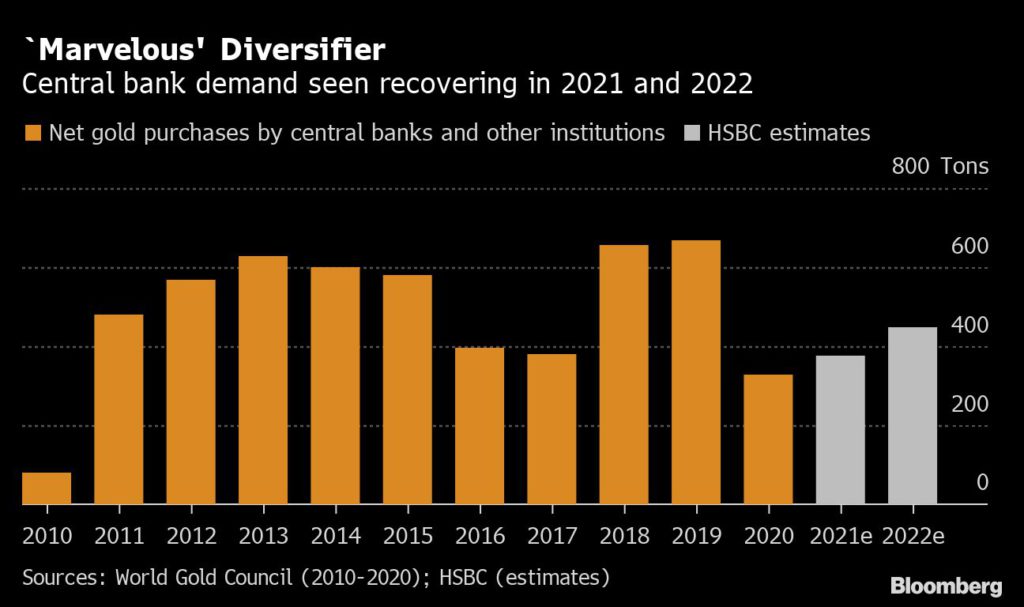

A rebound in central bank buying — which had dropped to the lowest in a decade — has bolstered the prospects for gold prices as some other sources of demand falter.

The recovery in global trade is bolstering the current accounts of emerging market nations, giving their central banks the option of buying more gold. Higher crude prices are also boosting bullion purchases by oil exporters, including Kazakhstan, according to James Steel, chief precious metals analyst at HSBC Holdings Plc.

That’s likely to continue, Steel said in a note to Bloomberg.

“If a central bank is looking at diversifying, gold is a marvelous way of moving out of the dollar without selecting another currency,” he added.

In a bullish scenario, as the global economy rebounds, central bank buying could reach about 1,000 tonnes, Aakash Doshi and other Citigroup Inc. analysts wrote in a report.

The bank’s forecast is for purchases to climb to 500 tonnes in 2021 and 540 tonnes next year. That is below the twin peaks above 600 tonnes in 2018 and 2019, but a significant advance on the 326.3 tonnes purchased last year, according to World Gold Council data.

(With files from Bloomberg)

Monday, July 5, 2021

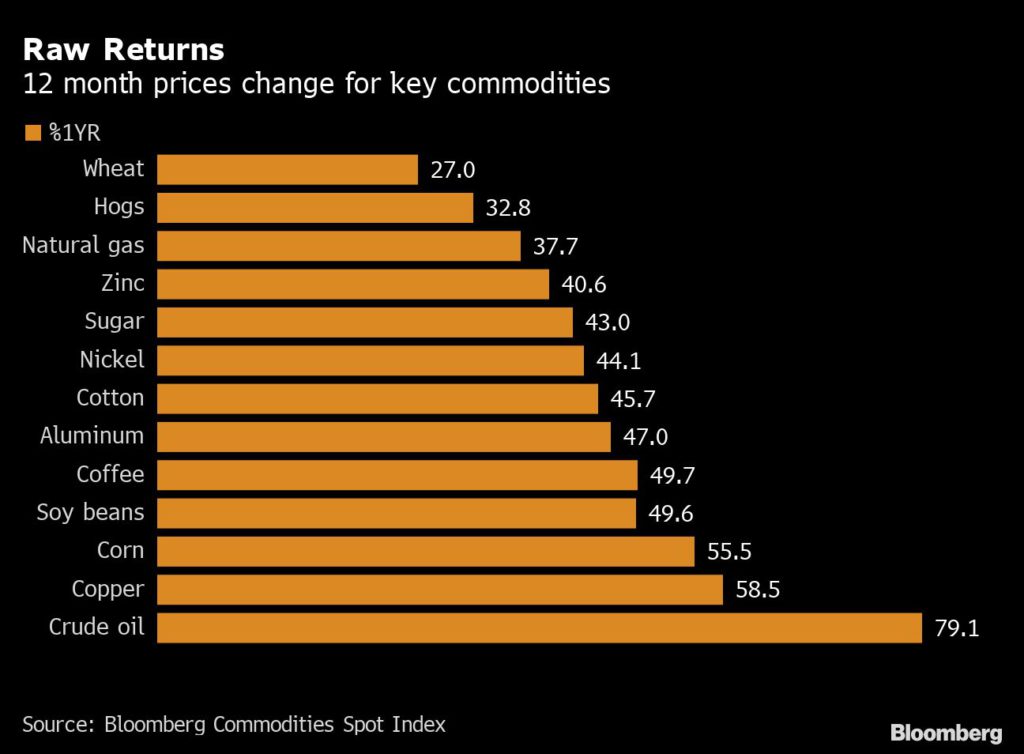

Commodity traders make billions as oil, copper, battery metals prices rise

Cargo ships entering one busiest ports in Singapore. Stock image.

Doug King set up his hedge fund in the early days of the commodity super-cycle in 2004. It was perfectly timed: voracious Chinese demand lifted the price of everything from oil to copper to record highs. Investors flooded the commodities sector. At the peak, King’s Merchant Commodity Fund was managing about $2 billion.

“We are facing a structural inflation shock,” King said. “There’s a lot of pent up demand, and everyone wants everything now, right now.”

For the first time since the pre-crisis years before 2008, the commodities boom means central banks are fretting about inflation. The rally will have a political impact, too. With oil back at $75 a barrel, Saudi Arabia and Russia are back in the driving seat of the global energy market — a remarkable come back from negative prices just over a year ago. The boom is also an unwelcome development for policymakers tackling the climate crisis: rising commodities prices will make the shift more expensive.

China, reliant on raw materials imports to feed millions of factories and building sites, is so nervous the government has tried to force prices lower, threatening crackdowns on speculators and releasing strategic stockpiles. It’s worked to some extent — copper has given up all its gains this year— but prices across the complex remain robust: iron ore is still near a record, U.S. steel prices have tripled this year, coal has risen to a 13-year high and natural gas prices are on a tear.

Even after the recent pullback, the Bloomberg Commodities Spot Index, a measure of 22 raw material prices, is up 78% from the March 2020 low when the pandemic first hit.

And crude oil, the global economy’s most crucial commodity, keeps powering higher as the world emerges from lockdown and the OPEC+ alliance puts a lid on supply. Benchmark Brent prices are up 45% this year, prompting traders and Wall Street banks to talk again about the potential for prices to surpass $100 a barrel for the first time since 2014.

As prices have surged, so has Wall Street’s interest. The annual Robin Hood investor conference, which every year congregates hedge fund luminaries from Paul Tudor Jones to Stanley F. Druckenmiller and Ray Dalio, featured a panel on commodities earlier in June — the first time in at least five years the conference has found time to discuss raw materials.

Jeff Currie, Goldman Sachs Group Inc.’s veteran head of commodities research, who argues for a long-term bull market across commodities despite the recent sell-off in metals and grain, says there’s room for a lot more investment into the market.

“Commodities are back in vogue,” Currie said, but so far the excitement about sky-high prices hasn’t yet attracted the money flows the sector harnessed during the 2004-2011 boom.

For those investors and physical traders who have already poured cash into commodities, betting on post-pandemic recovery, the rally has showered them in money.

Take Cargill Inc. The world’s largest trader of agricultural commodities made more money in just the first nine months of its fiscal year than in any full year in its history as net income surged above $4 billion.

Or Trafigura Group, the world’s second biggest independent oil trader, where the more than $2 billion in net profit posted in the in six months to the end of March was nearly as much as it made during its previous best ever full year.

“Our core trading divisions are firing on all cylinders,” said Jeremy Weir, the chief executive of Trafigura.

For consumers, however, the commodity boom means rekindling memories of high inflation. For now, companies are mainly absorbing the brunt of the impact, pushing factory inflation in some countries, including China, to their highest in more than a decade. But sooner or later, consumers will pay the price, too.

From Unilever Plc to Procter & Gamble Co., companies have announced plans to raise prices in the near term.

“We’re seeing levels of commodity inflation that we have not seen in a very long time,” Graeme Pitkethly, the chief financial officer at Unilever, told investors after disclosing first quarter results. “The commodity inflation that we’re seeing is impacting all businesses.”

he speed and breadth of the rally, affecting dozens of raw materials from vegetable oil to coal, have prompted many to talk about a new commodities supercycle, similar to the one that started nearly two decades ago as China’s rapid industrialization changed the structure of the global economy.

Economists typically define a supercycle as a period of abnormally strong demand that oil companies, miners and farmers struggle to match, sparking a rally that outlasts a normal business cycle. Before China, modern history century witnessed three distinct commodities supercycles, each driven by a transformational socioeconomic event. U.S. industrialization sparked the first in the early 1900s, global rearmament fueled another in the 1930s, and the reconstruction of Europe and Japan following World War II powered a third during the 1950s and 1960s.

The emergence of a fifth supercycle would be a major event. The price rally backs the talk of a new boom: the Bloomberg Commodity Spot Index, a basket of 23 raw materials, is nearly 500 points, matching the 2007-08 and 2010-11 peaks. And yet, what’s more likely happening is that the world is still experiencing the impact of the China-led supercycle, now turbo-charged by counterintuitive economic shifts triggered by the coronavirus pandemic.

Initially, Covid was bad news for commodity demand. The world went into lockdown, travel plunged and factories closed. The price of everything from oil to copper followed consumption, falling sharply between March and May of last year. But after the first few months, the world started to get back on its feet and consumption patterns changed in a way that favored commodities.

To appreciate what happened, the key is understanding the typical relationship between commodity demand and wealth. Generally, poor countries consume few raw materials because most spending is devoted to basic needs, like food and shelter.

The sweet spot for commodities is countries with per capita income between $4,000 and $18,000 — the middle-income range that China entered in the early 2000s. It translates disproportionately into commodity demand because it’s at the level when countries urbanize and industrialize. At those per capita income ranges, families have money to buy cars, household appliances and other goods that require lots of raw materials. Industrializing countries also build railways, highways, hospitals and other public infrastructure.

Above $20,000 per capita, demand for commodities starts to cool down as richer populations devote incremental wealth to services like better education, health and recreation.

The coronavirus pandemic altered those dynamics. With many families under lockdown, spending shifted from services into goods everywhere, even in the richest nations like the U.S. In many ways, American and European consumers behaved for a few months like their counterparts in emerging countries, spending on everything from new bicycles to television screens.

The U.S. economy offers the best example of the trend. Overall consumer spending remains below the 2018-19 trend, but that masks a huge divergence between spending in goods and services. According to the Peterson Institute for International Economics, household spending in goods is now running 11% above the pre-pandemic trend; meanwhile spending in services, like holiday, restaurants or entertainment, remains 7% below the pre-pandemic trend.

“Ultra-accommodative monetary policy, unprecedented fiscal stimulus, pent-up demand, strong household balance sheets, and record savings all combine to paint a picture of a resilient and strong growth trajectory,” said Saad Rahim, chief economist at Trafigura. The fiscal stimulus has other parallels with emerging markets as Western governments are targeting infrastructure spending, promising to rehabilitate their highways, railways and bridges.

Governments are also keen to build a greener future, spending on electrification to move away from fossil fuels. While that’s bad news for coal and oil, it means more demand for raw materials like copper, aluminum and battery metals like cobalt and lithium that are key for the energy transition.

“Commodity prices will stay strong for a long way longer,” said Ivan Glasenberg, the outgoing CEO of commodities giant Glencore Plc. For the first time the world’s two super powers, the U.S. and China, were simultaneously pushing big infrastructure projects as a way to rescue their economies from the impact of the coronavirus pandemic, he said.

Supply is struggling to catch up. Some of the bottlenecks are due to deliberate moves by producing countries, like the OPEC+ alliance, which slashed oil production last year. And others are due to the difficulty of running mines, smelters, slaughters houses and farms in the middle of the pandemic.

Crucially for the longevity of the rally, there’s a structural supply constraint that means high prices may not work as a signal to increase production and eventually bring the market back into balance.

The forces slowing the supply response are twofold. First, companies are under pressure from shareholders and courts to join the fight against climate change, reducing their production of fossil fuels like coal, oil and gas. Second, the same shareholders are demanding that chief executives reward them with higher dividends, in turn leaving less money to expand mines or drill new wells.

The impact of those forces are evident already in some corners of the commodity market, where companies stopped investing in new supply several years ago. Take thermal coal, for example. Mining companies have been cutting spending since at least 2015. As demand has picked up, coal prices have jumped to levels unseen in 10 years. The same has happened in iron ore, where prices shot up to all-time high earlier this year. Next is likely to be oil, where companies are cutting spending significantly.

For the commodity bulls, like Doug King, the hedge fund manager, it’s the sign to double down. “This is the beginning of a proper boom cycle — this isn’t a transitory spike,” he said.

(By Javier Blas)

Sunday, July 4, 2021

Friday, July 2, 2021

Venezuela to Cut Six Zeroes Off Bolivar to Simplify Transactions

-

Central bank may print new bills in August: people familiar

-

Inflation remains high, though dollarization has slowed gains

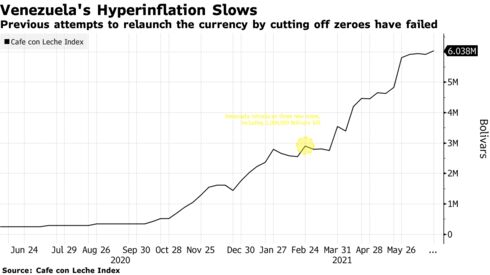

Venezuela is preparing to once again lop off zeroes from the national currency in an attempt to simplify daily transactions which sometimes barely fit on a calculator or require swiping cards multiple times to complete a purchase.

The central bank is planning to slash six zeroes from the bolivar as early as August after previous attempts to issue larger-denomination bills failed to resolve problems created by endemic inflation, according to three people with direct knowledge of the matter who aren’t authorized to speak publicly about the plans.

That means one dollar would fetch 3.2 bolivars instead of 3,219,000 at present.

Venezuela last carried out a “redenomination” of the bolivar in 2018 and in March began printing a 1 million-bolivar note, the largest in the country’s history. But that bill is now worth just $0.32 and isn’t enough to buy a cup of coffee. Since 2008, the government -- first under the late Hugo Chavez, and then under current President Nicolas Maduro -- has removed 8 zeroes from the currency, as hyperinflation decimated people’s savings.

While the country has now informally adopted the U.S. dollar for many every day transactions, most Venezuelans only earn bolivars and the local currency is needed for things like bus fare, parking and tips.

With electronic payments on the rise in Venezuela, the central bank shouldn’t have to print as many of the new bills as in previous “redenominations,” the people said. The bank will likely roll out six different denominations ranging from 2 to 100 bolivars, they said. The name would remain “bolivar soberano.”

The push for simplifying bolivar transactions has come largely from companies who have raised the issue with the government. Things like paying taxes and dealing with other accounting calculations have become absurdly complex.

“This has been desperately awaited by businesses due to the serious operational consequences that come from the overflow of digits in the system,” said economist Tamara Herrera, head of consulting firm Sintesis Financiera.

The central bank didn’t respond to several requests for comment while the government declined to comment on the matter.

Maduro’s Reluctant Reforms May Halt Venezuelan Economic Freefall

While previous attempts to relaunch the currency by cutting off zeroes and printing new bills have failed shortly after implementation, a series of recent reforms that have slowed consumer price gains may mean it has a better chance of sticking now.

Following the second-longest hyperinflation stretch in the country’s history, annual inflation is down to 2,339% a year from more than 300,000% in 2019, according to Bloomberg’s Cafe con Leche index. On a monthly basis, price gains slowed even further to about 20% in May from April. The central bank no longer publishes regular inflation data.

Venezuela’s economy may have hit bottom after seven years of economic contraction during which the currency became virtually worthless amid crashing oil prices and unchecked state spending. Under pressure by U.S. sanctions, the government was forced to scrap some price controls, reduce subsidies on goods including gasoline and remove many restrictions on foreign exchange which may allow the economy to grow this year.

“Everyone has been affected by the huge lag in providing cash for the country,” Herrera said. “Without a real economic stabilization program, we will need another redenomination in a few years.”

— With assistance by Fabiola Zerpa, and Nicolle Yapur