Thursday, March 31, 2022

Wednesday, March 30, 2022

Codelco may partly privatize some assets, executive says

Image courtesy of Codelco via Flickr

Chile’s Codelco, the world’s largest copper producer, is preparing to offer the market some “non-core” exploration assets, signaling a rare privatization for the state-owned mining firm, a senior executive said on Monday.

Vergara did not give technical details of the projects or a timeframe for the company’s plans to offer the assets.

The executive said that the firm’s nascent lithium mining push was advancing at a slightly slower pace than expected. Chile is the world’s second-largest producer of the ultra-light battery metal that is key for the global electric vehicle market.

“We’ve seen permitting, approval times have been a little bit longer than we thought. There have been higher drilling costs,” he said.

In February, Codelco said it would start drilling in the Salar de Maricunga by late March, and that it would last about 10 months.

(By Fabian Cambero; Editing by Adam Jourdan and Paul Simao)

Nickel paralysis deepens as battered LME market barely trades

The London Metal Exchange floor (Image: HM Treasury -Flickr)

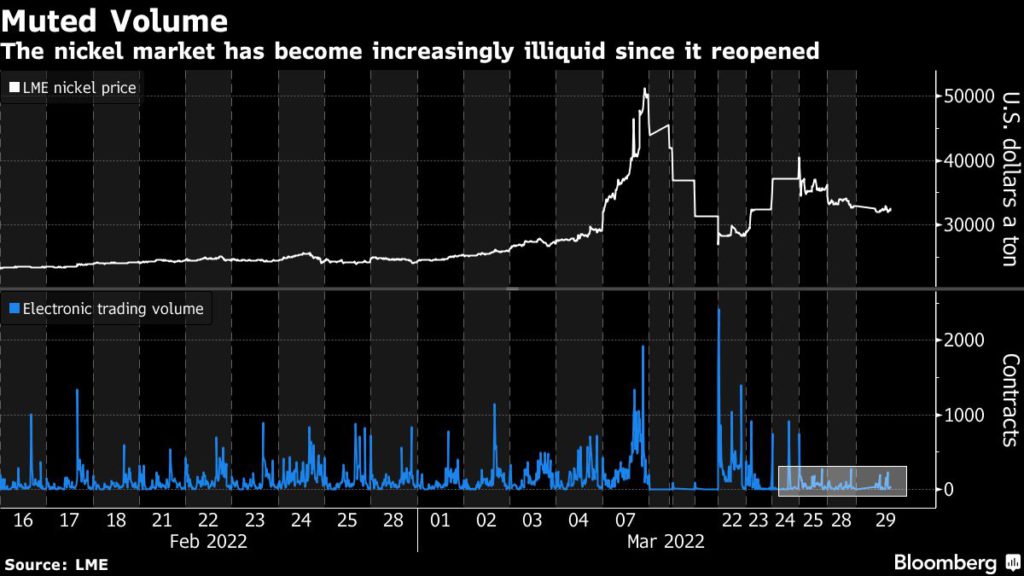

Nickel trading volumes continue to collapse on the London Metal Exchange in the wake of an historic short squeeze, setting up a liquidity crisis in the market for one of the most crucial industrial commodities.

Yet the market has remained in near-paralysis, even on days when prices have been trading within the 15% daily limit. Fewer than 210 lots had traded in the first hour after the market opened at 8 a.m. on Tuesday, down nearly 60% from the 90-day average for that time of day before this month’s trading halt.

There was a small bump in trading activity in the afternoon as Russia announced that it will sharply cut military operations near Kyiv and Chernihiv, but electronic volumes remained depressed. Nickel traded 1.9% lower at $32,120 a ton at 3:11 p.m. London time, with fewer than 1,350 lots traded electronically. Aluminum dropped 5.3% to $3,422 a ton, as the prospects for a de-escalation in Ukraine eased anxiety over supply from Russia.

“The LME need a few sessions where nickel is trading like a proper commodity,” said Colin Hamilton, managing director for commodities research at BMO Capital Markets.

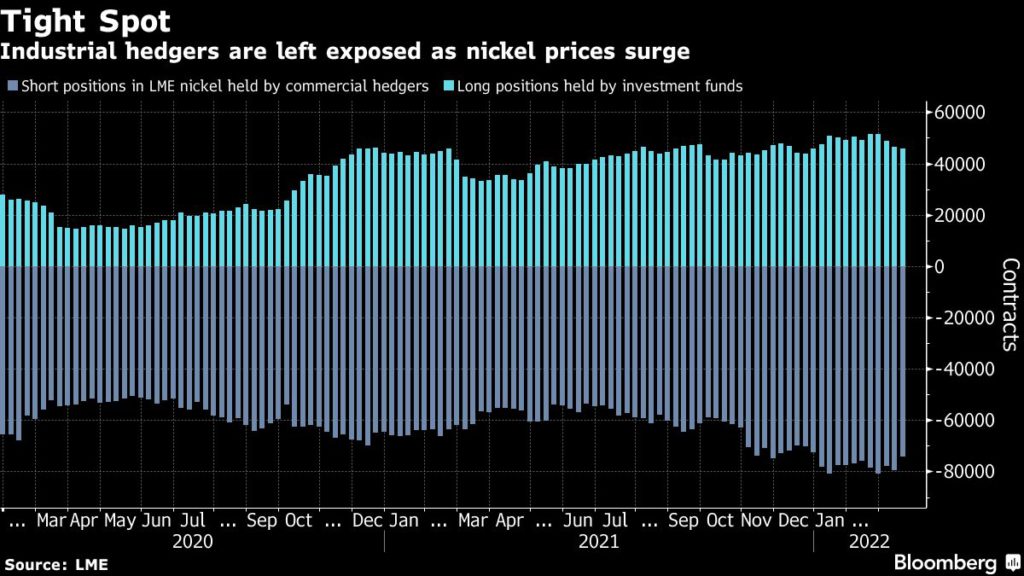

While Tsingshan owner Xiang Guangda started buying contracts on the LME last week to reduce his massive short bets, the businessman and his allies only reduced a portion of their total short position, and still held large bets on falling prices, Bloomberg reported last week. Many other industrial consumers and physical traders also have large short positions in the market.

The plunging liquidity represents an escalating crisis for producers and consumers who rely on the exchange to hedge their pricing risk.

Usage is growing rapidly in electric-vehicle batteries, and the illiquid trading conditions on the LME threaten to exacerbate volatility. That will hit car-makers — who’ve already seen a neck-breaking rally in battery metal prices over the past year — as well as the steel mills that account for the lion’s share of demand today.

The increasingly urgent question among core users is whether the 145-year-old exchange is still a viable mechanism for industrial companies seeking to hedge their price risk, as well as the traders and investors who have helped make nickel one of the bourse’s most successful contracts.

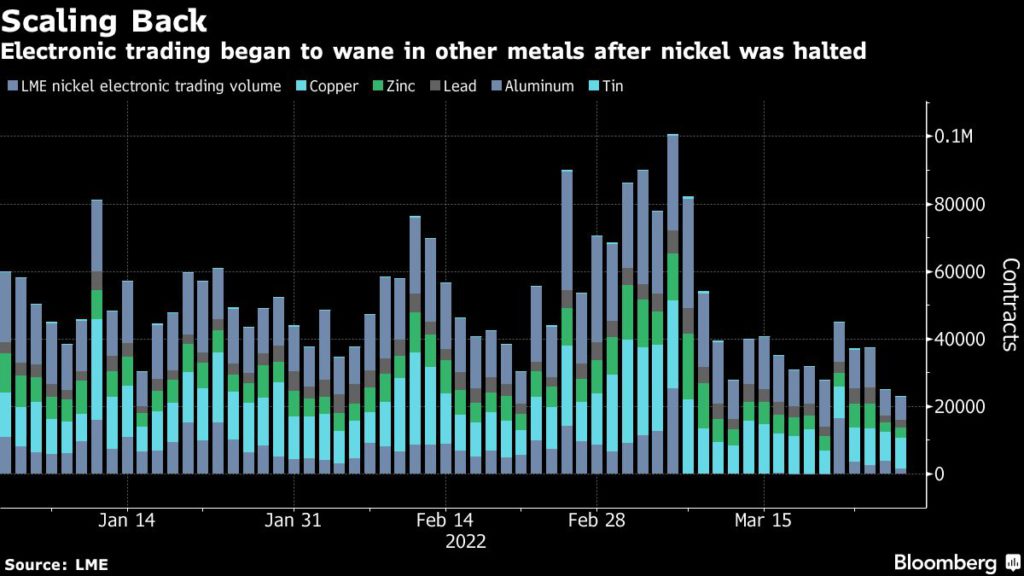

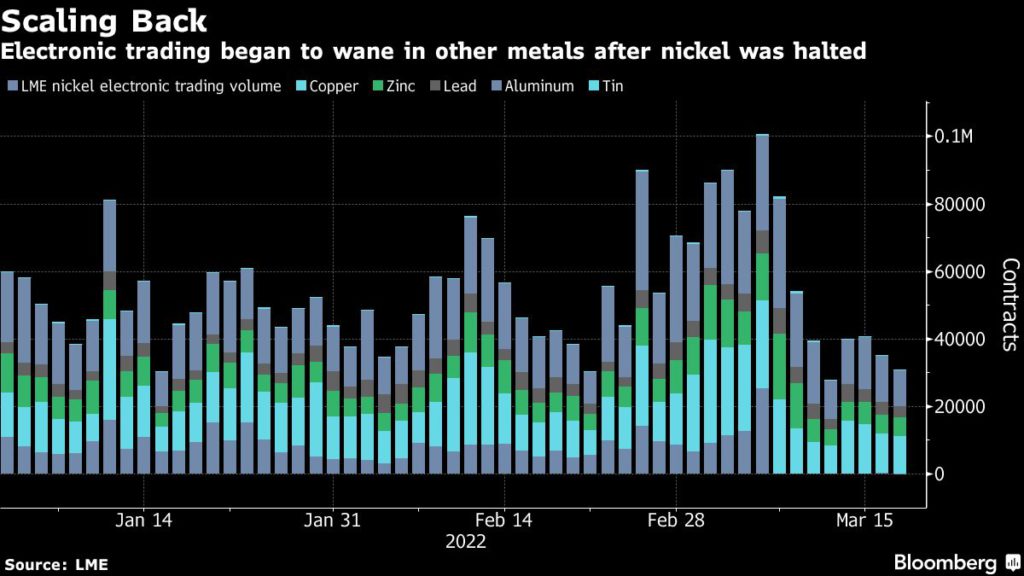

The trend isn’t limited to nickel either. Trading volumes have dropped significantly in the larger copper and aluminum markets since the LME’s controversial intervention earlier this month and the crisis has raised questions about the bourse’s status as the world’s benchmark futures market.

(By Mark Burton)

Tuesday, March 29, 2022

Monday, March 28, 2022

Bullion groups launch gold bar database to thwart fraud

Two gold industry associations are working with miners, refiners, traders and shippers to create a database of gold bars in an effort to prevent trade in counterfeit metal and allow buyers of bullion to trace its origin, they said on Monday.

The London Bullion Market Association (LBMA) and the World Gold Council (WGC) said companies including miners Barrick and Newmont, refiners Metalor and MKS PAMP, and shippers Brinks and Loomis would submit data to a pilot scheme that should eventually extend worldwide.

“Over time, this will help consumers, investors and market participants to trust that their gold is genuine and has been responsibly and sustainably sourced,” the LBMA and WGC said.

Blockchain-based ledgers run by two companies, aXedras and Peer Ledger, will “register and track bars, capturing the provenance and full transaction history,” they said.

Refiners and others already operate gold-tracking technology and have added security features to gold bars that make them harder to counterfeit.

Like the pilot, these tend to focus on 1 kilogram gold bars rather than 400 ounce wholesale bars traded by banks in the London market.

Some in the market are wary of pooling their data and expertise with others.

The LBMA and WGC, members of which include miners, banks and refiners, wants to hasten the adoption of these systems and make sure they can work together. The LBMA said on Monday it had approved six security features for gold bars.

If widely used, the database should be able to track metal if it is not melted by anyone not contributing data. But it would not identify the origin of recycled gold entering the system.

The LBMA’s chief executive, Ruth Crowell, said that over time a premium could develop for traceable gold over non-traceable metal.

(By Peter Hobson; Editing by David Goodman and Mark Potter)

U.S. Refiners Turn to Middle East for Fuel Oil After Russia Import Ban

U.S. refiners have begun snapping up fuel oil cargoes from the Middle East this month after U.S. President Joe Biden banned Russian oil imports over the country’s invasion of Ukraine, shipping data showed.

The United States last year imported about 700,000 barrels per day (bpd) of different types of fuel oil and other feedstocks that mostly went to U.S. Gulf Coast refineries to supplement heavy crude oil, according to market research data.

Russia last year accounted for just under half of U.S. fuel oil imports, Mexico for 20% and the Middle East about 5%, according to data from research firm Kpler.

Middle East supplies are set to make up at least 17% of April U.S. fuel oil purchases, according to preliminary Refinitiv Eikon tanker tracking data.

U.S. GULF COAST BUYERS

About 4 million barrels from Middle East suppliers are set to discharge along the U.S. Gulf Coast next month, the highest level in at least 12 years. For all of last year, they supplied a total of 13 million barrels, according to Kpler.

“It’s a clear sign that we’re seeing a shift in where the United States is buying fuel oil from,” said Kpler analyst Matt Smith. The United States could struggle to plug the gap left by Russia, Smith said, given the loss of Russia fuel oil imports.

Saudi Arabia, Kuwait, Iraq and the United Arab Emirates make up roughly half of all fuel oil cargoes under contract and expected to head to the United States in April, the data showed. At least one cargo was scheduled to discharge in May.

Imports of fuel oil from Mexico into the United States are also expected to rise in April, analysts said, but the cargo tracking data has not yet shown the increase as scheduling from Mexico is typically very dynamic due to short routes.

IRAQI BARRELS

Cargo from the United Arab Emirates and Kuwait due to discharge in April would be the first in at last eight months, while March marks the first time Iraqi fuel oil will arrive in the United States since mid 2021, Refinitiv data showed.

U.S. officials have been pressing other oil suppliers to boost exports. Some diplomats met with Venezuelan officials this month over the possible return of Venezuela’s heavy crude to the U.S. Gulf Coast. Refiners also have reached out to Ecuador for additional heavy crude cargoes.

“There may well be a game of musical chairs in the months ahead, as

Russian fuel oil is redirected away from the U.S. and to the Middle

East, while the Middle East sends more to the U.S. instead,” Smith said.

The United States gets less than 10% of its fuel and crude imports from

Russia. Of that, the largest share of imports are unfinished oils used

by refiners for processing into other goods.

Friday, March 25, 2022

Nickel turmoil is back as prices spike 15% again to hit limit

Nickel Mines LTD.

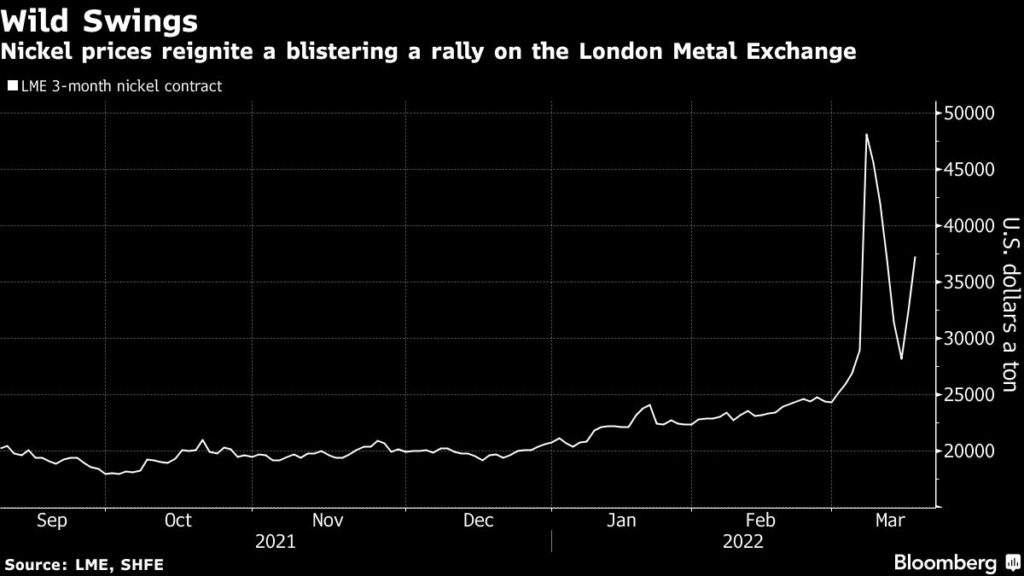

Nickel surged by the 15% exchange limit for a second day in London, putting the spotlight back on bearish position holders just two weeks since the market was roiled by an historic short squeeze.

Sign Up for the Africa, Europe & Middle East Digest

The move reduces the size of the potential pain for Xiang and his banks as prices are on the march again. However, the businessman and his allies have only reduced a portion of their total short position, and still hold large bets on falling prices, the people said.

“Ultimately the short position is still out there, and they will have to close it out,” Michael Widmer, head of metals research at Bank of America Corp., said by phone from London. Sharp daily price moves are likely to continue “at least until the short position is out of the market.”

While Tsingshan holds an outsized short position on the LME, there are many other industrial users and physical traders who hold short positions to hedge their price risk, raising the threat of another squeeze if those parties need to buy their positions back, or brokers seek to close them out to avoid further margin calls.

The total risk-reducing short positions held by commercial parties stood at 74,166 contracts at the end of last week, according to data from the bourse. To a large extent, they’ll need to turn to bullish hedge funds to liquidate their contracts — on a net basis investment funds are the largest holders of long positions in the LME nickel market.

To be sure, even if short position holders come under pressure, the new daily price limits introduced by the LME will help prevent a repeat of the extreme price swings seen earlier this month.

When nickel prices spiked in early March, the LME intervened to suspend buying and selling and canceled billions of dollars of deals in a move that drew furious criticism from many traders and investors. The market plunged when it reopened, and is now down about 63% from the record high, but up 53% so far this month. Prices rose to $37,235 a ton on Thursday.

The latest surge comes after trading had only just restarted in earnest this week, with lower prices drawing in buyers following four days of limit-down moves when the market reopened from the week-long suspension.

Shanghai Futures Exchange nickel contracts also initially surged to the maximum daily limit as the evening session got underway, tracking gains in London. Prices then moderated, and were trading 4.9% higher at 257,660 yuan ($40,463) a ton as of 3:20 p.m. London time. That equates to about $35,800 a ton when VAT is deducted.

Trading is becoming increasingly illiquid on the LME, with many investors looking to liquidate their positions in the wake of nickel’s unprecedented volatility.

Roiling price moves are also sparking turmoil in broader commodities markets and some of the world’s top physical traders warned that eye-watering margin calls are forcing them to reduce their activity, driving liquidity out of markets and exacerbating price swings.

(By Mark Burton and Jack Farchy)

When will Russian exports really stop flowing? / Poten's Weekly Opinion: Nothing To See Here (Yet)

https://www.tankeroperator.com/ViewNews.aspx?NewsID=12968

Russia invaded Ukraine on 24 February 2022. In the 22 days that followed, most of the world has responded with a vast array of economic sanctions. Initially, most of these sanctions carefully avoided targeting the energy industry, because Russia is a major oil and gas supplier, in particular to Europe. However, even though Western companies could still legally purchase Russian oil, many decided that they would no longer do business with Moscow. The oil companies that are “self-sanctioning” include most European refiners, including oil majors such as BP, Shell and TotalEnergies. Despite a lack of official sanctions, potential importers of Russian oil have to deal with significant transaction challenges, including problems financing, insuring and shipping the product. On top of that, firms that continue to transact with Russia face major reputational risks. Over time, the pressure grew to officially sanction Russian energy exports and on March 8, U.S. President Biden signed an Executive Order to ban the import of Russian oil, LNG, and coal to the United States. Canada, Australia, and the U.K. also restricted oil imports from Russia. How much of an impact will these actions have on Russian exports, when will this be visible in the physical market, and what could be the impact on the tanker market?

Thursday, March 24, 2022

Iron ore price rises despite lockdown on China steel hub

Worker repairs mechanical parts in the production workshop in Tangshan city, Hebei Province, China. Stock image.

The iron ore price rose on Wednesday despite the decision by top steelmaking city Tangshan to implement a temporary lockdown.

Sign Up for the Iron Ore Digest

“Although consumption for steel products are relatively sluggish, production is also falling,” analysts with Huatai Futures wrote in a note.

The situation of tight raw materials inventories has not been reversed yet, which could further sustain steel prices, analysts added.

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China were changing hands for $145.49 a tonne on Wednesday, up 1.4% compared to Tuesday’s closing.

Steelmaking ingredients on the Dalian Commodity Exchange were mixed after falling more than 3% during the night session, with benchmark iron ore edging up 0.4% to 823 yuan a tonne.

“Due to transportation disruptions, most steel mills face raw material shortages … and there’s even possibility for production halt,” said Huatai Futures, noting that iron ore demand will be dampened.

($1 = 6.3743 Chinese yuan renminbi)

(With files from Reuters)

Democrats Propose $100 Monthly Gas Stimulus to Combat High Fuel Costs

https://www.cnet.com/roadshow/news/gas-rebate-program-congress-democrats-proposal/

The proposal probably won't go too far, though, given the current attitude in Congress toward providing more stimulus money.

The odds are good that if you've recently stuck your head outside your front door, you've heard someone complaining loudly about how high gas prices have gotten. In some places where gas prices are usually higher already, like Los Angeles, we've seen figures topping $6 per gallon, which can be a tough pill to swallow, especially if your life forces you to drive a lot.

According to a report published on Monday by Business Insider, though, the feds are trying to put together a stimulus rebate program to help. If passed, it would see $100 stimulus payments (plus an additional $100 per dependent) made monthly as long as the average gas price is above $4 per gallon.

The program would have an income cap, which isn't surprising. Folks filing as single on their taxes would be eligible as long as they make less than $80,000 per year, while joint filers could make up to $160,000 before the rebate was phased out for them.

The proposal, known as the Gas Rebate Act of 2022, was introduced by congressional Reps. Mike Thompson (D-California), John Larson (D-Connecticut) and Lauren Underwood (D-Illinois). Unfortunately, their proposal seems to be a little light on detail, particularly when it comes to how Congress would fund this stimulus. This, combined with Congress' lack of interest in funding further rounds of stimulus payments in general, mean that the proposal is unlikely to find much support in government.

The national average gas price at the time of publication, according to AAA, sits at $4.24, and we suspect that it's not going to be heading down anytime soon.

Wednesday, March 23, 2022

The world’s biggest oil company just doubled its profits, and now it’s planning to produce even more

MBS

Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you.

One of the world's biggest petroleum companies more than doubled its profits in 2021 as global demand soared. Now, it’s doubling down, and investing tens of billions more into oil production this year as prices soar.

Saudi Aramco, a major oil and gas company owned and managed by the Saudi royal family, announced it made $110 billion in profits last year, a 124% increase from 2020, according to the company's annual financial statement released on Sunday.

And that was before Russia’s invasion of Ukraine prompted many governments to begin severing their ties with Russian energy, and a major price jumps in the global oil market.

Aramco's big profits are fueling big new targets for the company, as it stands to become an even more crucial player in the global oil market over the next few years.

Betting on demand growth

Saudi Aramco's lucrative year was powered by a soaring demand for oil as countries and governments began removing pandemic-era restrictions and economies reopened.

The company announced that it would increase its capital expenditure into oil production to as much as $50 billion a year, after investing slightly less than $32 billion last year, according to the annual report. Most of this will go into gradually increasing the company's oil production over the next five to eight years.

Aramco said it expects to sustain the increased investment of up to $50 billion a year until at least 2025, a target that is "in line with the Company’s belief that substantial new investment is required to meet demand growth."

But increased demand only takes into account one part of the red-hot global oil market.

Relief for strained oil markets?

Russia invaded Ukraine in February, causing international energy markets to descend into a frenzy of high and volatile prices.

Some countries, including the U.S., have banned Russian oil imports, while some lawmakers in Europe are pushing to do the same.

Russia was the world's third largest producer of oil behind the U.S. and Saudi Arabia and the largest exporter of crude oil before sanctions hit. Western limits on trade and fossil fuel companies willingly pulling out of Russia has left a gaping hole in the global oil supply just as demand was on the rise.

Leaders around the world have been scrambling since the invasion to find an alternative source of oil to replace sanctioned Russian energy imports.

Western leaders have been pushing the Saudi royal family to increase the country's oil production for weeks. The government has so far been unwilling to change its forecasted 2022 production targets, even going as far as screening U.S. President Joe Biden´s phone calls. And while Saudi Aramco's most recent annual report indicates that the company will increase production soon, this will only happen within the next five to eight years, far too late to have any tangible effect on the current global oil markets.

The Saudi government has insisted that it is not responsible for global oil shortages and high prices, citing domestic troubles with its own insurgent rebel group as the reason behind the country's inability to produce more oil in the short term.

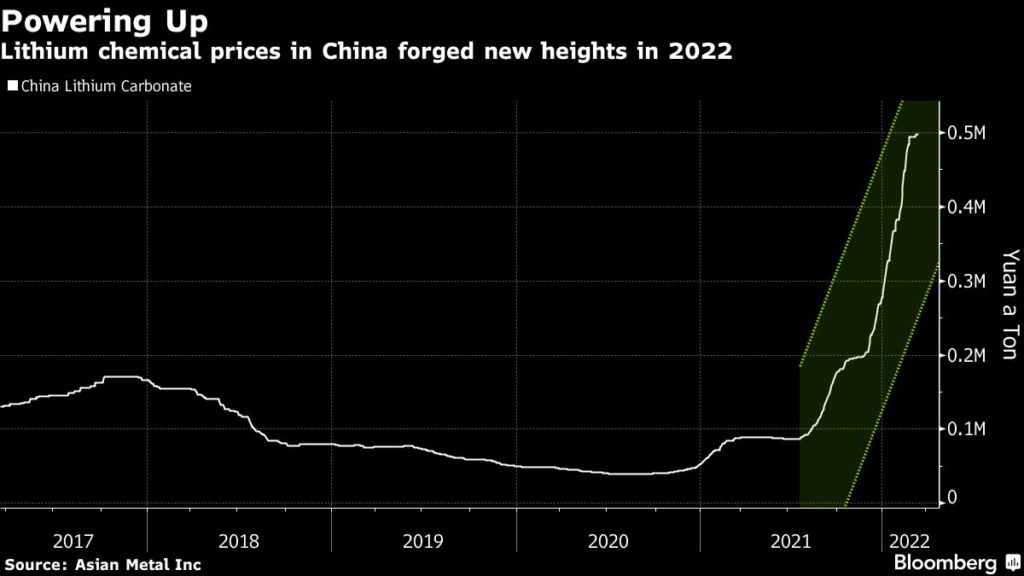

China tells EV battery chain it wants ‘rational’ lithium prices

Flamingos at Salar de Atacama, home to lithium and copper mines. (Image courtesy of Dan Lundberg | Flickr Commons..)

China is telling its electric-car battery supply chain that it wants lithium prices to return to sustainable levels.

Sign Up for the Battery Metals Digest

The seminar on March 16 and 17 was aimed at discussing surging costs and promoting what the ministry called the healthy development of the new-energy vehicle and battery sectors. It also addressed supply bottlenecks, how lithium is priced, as well as measures to steady prices and secure supply.

The meeting underscores how Beijing is getting nervous about lithium’s prolonged surge, and it’s also in line with a broader push to manage soaring commodity prices. Earlier, some manufacturers were also summoned for a meeting after prices of rare earths jumped.

Lithium has powered through records in China as an acceleration in demand from EV manufacturers outstrips supply. The burgeoning EV industry is grappling with growing risks around cost inflation, with some carmakers starting to feel the pain and raising their own price tags.

Participants at last week’s gathering included officials from the China Nonferrous Metals Industry Association, China Association of Automobile Manufacturers, China Industry Technology Innovation Strategic Alliance for Electric Vehicles and other organizations, as well as key lithium suppliers, cathode companies and EV-battery firms.

(By Annie Lee)

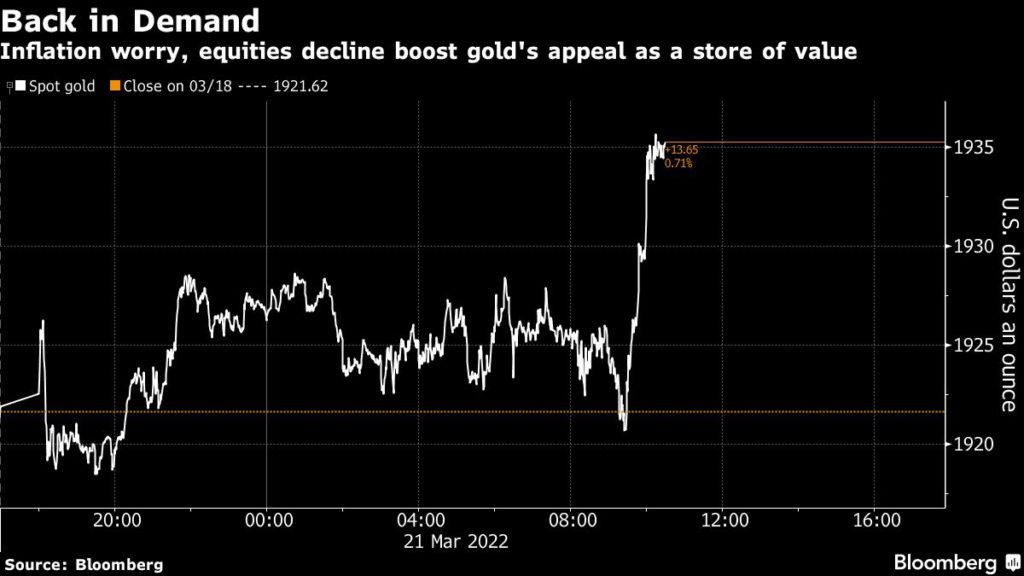

Gold price recovers from worst week since June with inflation risks creeping up

Gold rebounded from its biggest weekly drop since June as the war in Ukraine continued to push oil prices higher, adding more fuel to global inflation fears and boosting the demand for safe havens.

Sign Up for the Precious Metals Digest

[Click here for an interactive chart of gold prices]

Meanwhile, both the S&P 500 and Nasdaq 100 fell after posting their best five-day streak since November 2020. West Texas Intermediate oil rose above $110 a barrel as investors assessed the war in Ukraine and Middle East tensions.

Rising commodities prices are helping underpin bullion’s appeal as an inflation hedge. Former US Treasury Secretary Lawrence Summers said last week that the Fed will need to raise borrowing costs higher than officials are currently projecting if it’s to wrestle inflation back under control.

On Monday, Atlanta Federal Reserve Bank President Raphael Bostic said he was open to more aggressive policy tightening, while pencilling in six rate hikes for 2022.

“The main fundamental driver that is still supporting gold prices to potentially trade higher in the medium term continues to be the stagflation risk,” Kelvin Wong, an analyst at CMC Markets in Singapore, told Bloomberg. “The Fed has so far failed to cool down future inflationary expectations.”

“Another escalation around Ukraine will drive significant safe haven flows to gold, even inflation hedge moves if we see sanctions that trigger another commodity surge,” Craig Erlam, senior market analyst at OANDA, said in a Reuters report.

“As real interest rates creep up, appetite for gold as an inflation hedge could diminish,” analysts at Heraeus precious metals warned.

“However, even if the Fed’s upper estimates of rate raises become reality, inflation will still be ahead, and real interest rates negative, maintaining a positive environment for gold in the medium term,” Heraeus analysts added.

(With files from Bloomberg and Reuters)

Tuesday, March 22, 2022

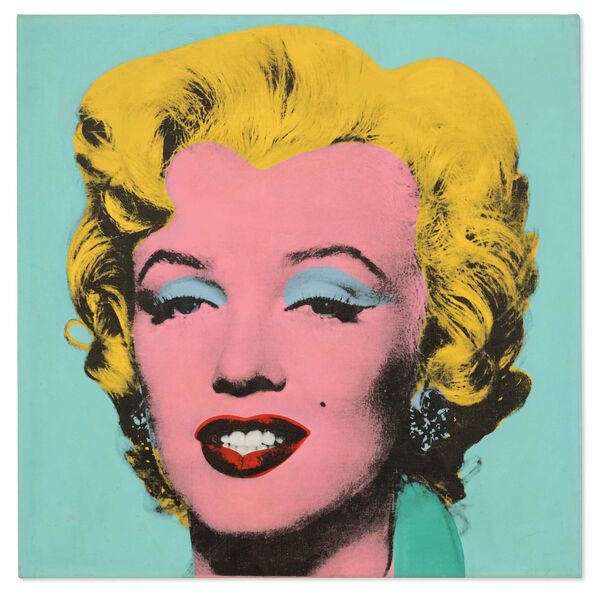

Christie’s Plans to Auction a Warhol for $200 Million—and Break Records

Andy Warhol’s Shot Sage Blue Marilyn from 1964, which could sell for $200 million at Christie’s Source: Christie’s Images Ltd. 2022

The highly coveted 1964 Marilyn Monroe painting would become the most expensive 20th century work ever to sell at auction.

In May, Christie’s will lead its marquee New York sales week with an auction of an Andy Warhol Marilyn silkscreen carrying an estimate in the region of $200 million.

If the 1964 work, Shot Sage Blue Marilyn sells for that amount, it will be the most expensive 20th century painting to ever sell at auction, according to Christie’s.

“This is one of the most iconic paintings of our time,” says Alex Rotter, the chairman of 20th and 21st century art at Christie’s. “It’s always been a coveted painting, and it’s always been an icon.”

The artwork is being consigned by the Thomas and Doris Ammann Foundation in Zurich. Thomas was one of the most influential dealer/collectors of the 1980s, selling modern and Impressionist art to billionaires including Gianni Agnelli and Ronald Lauder. After he died of what was understood to be AIDS-related complications in 1993 at the age of 43 (his family officially listed the cause of death as cancer), his sister Doris took over the gallery and ran it until her death last year.

Proceeds from the sale will go, in their entirety, to the foundation, which is devoted to healthcare and educational programs for children.

Market Information

Rotter says that the painting is not guaranteed, meaning that Christie’s didn’t commit to the work selling for a fixed price in advance of the sale; that means that if no buyers show up with a spare $200 million to spend, the work could go unsold.

“The foundation didn’t feel that a guarantee was necessary,” Rotter says, adding that there’s the possibility that between now and the May sale, a so-called third party guarantor could step in and effectively agree to buy the painting for a minimum price before the auction. (In that situation, if the sale price is higher than the guaranteed price, the third-party guarantor would usually receive a cut of the proceeds.)

Given the precarity of the sale, and the fact that the Warhol market has periodically sagged during the last decade, the $200 million estimate could be a tall order.

But Rotter says that the price tag has precedent. He cites the reported (although not confirmed) $250 million sale of an orange Warhol from the same series to Citadel’s Ken Griffin in 2018, and says that “there have been private sales of Warhols over $100 million.”

The $200 million estimate, Rotter continues, “is based on market information that told me that this is roughly the price-setting expectation, but also it obviously has something to do with the consignor, who agreed to that base valuation.” On the one hand, Rotter says, “at auction you wish you could estimate everything at $1 to $2 and let everyone decide, but it’s not realistic.”

The Warhol in question is one of a coveted series of five paintings of Marilyn, each on a different-colored background. One work from the series became a poster-child for tax avoidance schemes, when in 2008 the Chicago collector Stefan Edlis sold a turquoise Marilyn to hedge fund manager Steve Cohen for $80 million; Edlis avoided nearly $20 million in taxes by rolling the taxable proceeds of the sale into more art purchases.

This time around, Rotter speculates that bidders could primarily come from America and Asia. “It can go anywhere, but if you ask me now to make a guess, and I’d say America or Asia. Or the Middle East for that matter,” he says.

Oil Tycoons Have Seen Their Net Worth Explode Higher Since Russia Invaded Ukraine

Sometimes, the irony is just wonderful.

The very same ultra-rich oil tycoons that the left absolutely loves to hate (because not only are they rich, but rich from oil) are benefitting the most from the left insane economic policies that have helped to drive up the price of the commodity.

According to the Bloomberg Billionaires Index, oil and gas industrialists now share a collective net worth of $239 billion, which is up 10% higher since Russia invaded Ukraine on February 24. The rise in wealth is directly tied to the spike in energy prices over the last few months.

Since Russia invaded Ukraine, Brent prices have risen as much as 32% and finished last week at about $106, Bloomberg wrote. While the price spikes have sent other industries into chaos, it has translated to pure profit for those in the business of producing or transporting fossil fuels.

Continental

Resources Inc. co-founder Harold Hamm, for example, moved up 28 places

on the BBI to 93rd and now has a fortune of over $18 billion dollars.

Richard Kinder, of Kinder Morgan, has seen his net worth move to $8.5

billion.

Even before the invasion of Ukraine, oil prices in the U.S. were being pushed higher by post-Covid demand. And it was mostly private companies, not public, who seized the opportunity of higher prices the most, the report says.

Andrew Dittmar, a director at energy-analytics and software firm Enverus, told Bloomberg: “On the private side, those pressures from shareholders aren’t nearly as acute. It makes good economic sense for private firms to invest in growing production.”

The founder and sole owner of Lafayette, Louisiana-based Hilcorp Energy, Jeffery Hildebrand, now sports a net worth of more than $12 billion as a result. Autry Stephens, founder of Endeavor Energy Resources, has seen his net worth move higher to $5.2 billion.

Michael Smith, who owns about 63% of Freeport LNG, saw his wealth rise to $6.2 billion after the company sold 25% of itself to a Japanese company that valued Freeport at $9.7 billion.

Talon Custer, a Bloomberg Intelligence analyst, concluded: “Michael Smith’s bet on the U.S. gas industry has paid off. And they have options to grow.”

Monday, March 21, 2022

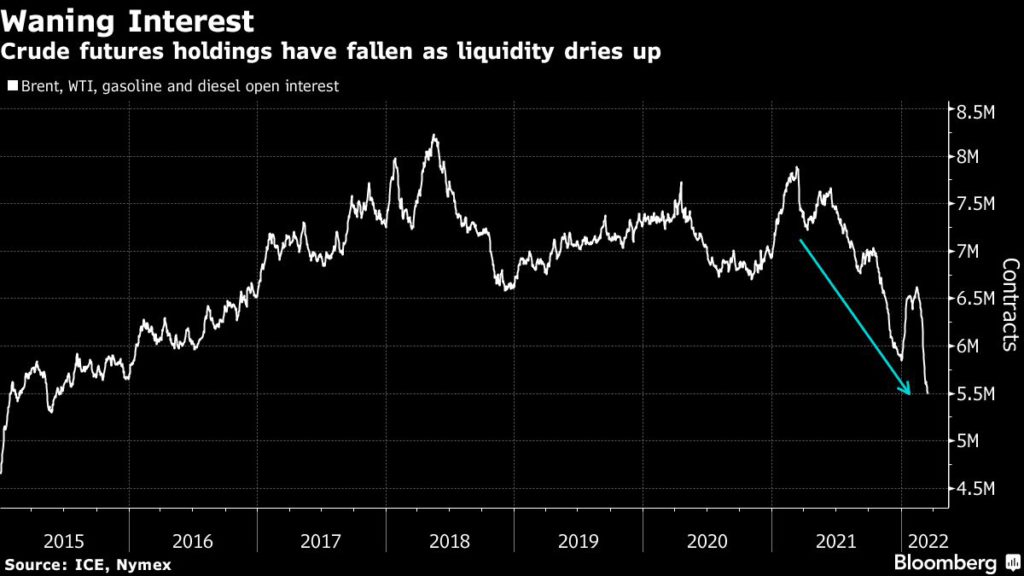

The world’s biggest commodities markets are starting to seize up

It’s getting harder to deal in some of the world’s most important commodities as everything from geopolitical turmoil to exchange snafus prompt traders to rush for the exits, rapidly draining liquidity.

Prices of materials like crude, gas, wheat and metals have become alarmingly erratic as a gulf emerges between buyers and sellers who are facing big financing strains. Markets have been roiled on fears about Russia’s invasion of Ukraine constraining commodities flows, though in many cases rallies were quickly followed by a drop in prices.

The volatility is particularly difficult to navigate because some moves appear to defy fundamentals, with hedge funds exiting long-term bullish bets just as supply looks the tightest in years. Merchants are finding it harder to snap up any cheap cargoes because of huge margin calls and credit line caps.

“Volatility as an asset class is enormous now, and on top of that you have some serious operational issues,” said Ilia Bouchouev, a Pentathlon Investments partner and adjunct professor at New York University. “It’s a vicious loop where volatility forces companies to reduce positions, which means what’s left in the market is forced trading. That in turn contributes to even more volatility.”

Metals mayhem

Ructions from the Ukraine war have been compounded by a historic nickel short squeeze. The LME suspended trading as prices surged 250% to a record, canceling almost $4 billion of transactions.

That caused uproar among investors who stood to profit from bullish bets prior to last week’s closure — and snags with the reopening have hardly improved the mood. Many previously bullish investors are now in a long queue of sellers enduring sharp price drops while they wait for buyers.

By late Thursday, almost $3.3 billion of nickel was on offer at the limit-down price, but there wasn’t a single bid on the LME’s order book. Just two trades took place that day in the electronic market. The illiquidity is a worry for consumers who use nickel in stainless steel and electric-vehicle batteries.

There are signs of contagion as trading in other metals also slumps. That’s bad news for manufacturers and end users as it could leave them exposed to more violent price swings.

There are signs of spillover in specialist instruments LME traders use to manage price risks. Three long-standing participants in the options market said it’s become much harder to secure quotes from dealers in recent days and that trading spreads between contracts is increasingly erratic.

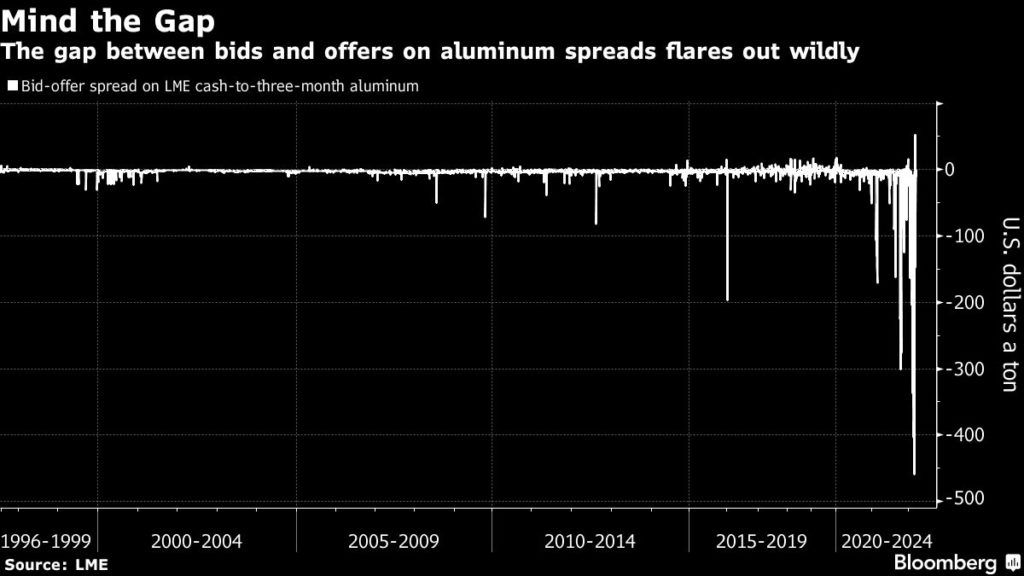

In aluminum, dealers say scarce liquidity is sparking wild moves in prices between key contracts, such as the cash-to-three-month spread. For that spread, which was at about $17 on Thursday, bids and offers are now frequently hundreds of dollars apart.

Traders say the gap is due to electronic bids that were likely placed by algorithmic traders, because in practice the spread shouldn’t reach such extreme levels. But with low liquidity and many specialist traders and hedge funds stepping back, those low-ball orders are often the only ones to appear on the screen.

Crude chaos

There are clear signs traders are pulling back. Combined open interest on main crude and refined product contracts have hit the lowest since 2015. Almost 1 billion barrels of contracts were liquidated in a period that saw Brent post 16 consecutive $5-a-barrel intraday swings — its longest such run ever.

“When prices can move $10 per barrel in either direction three times a day, no one can warehouse overnight risk and market makers are disappearing,” Energy Aspects analysts including Amrita Sen said.

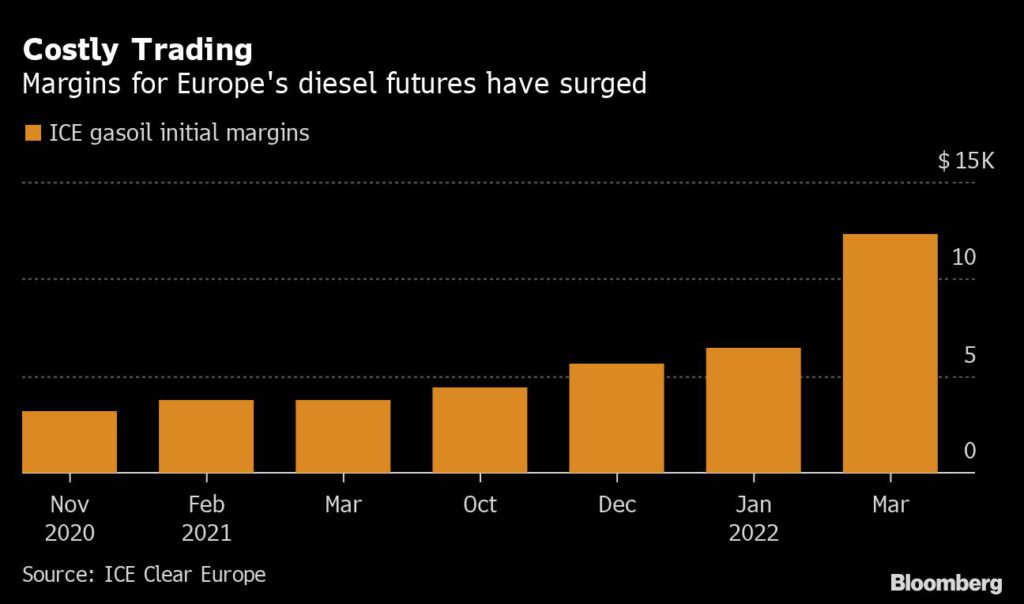

Clearinghouses have boosted initial margins — the collateral traders put up to finance their positions. In the case of gasoil, that meant traders had to stump up almost twice as much cash to trade the same amount.

Traders said they’re scaling back positions and not holding them for as long due to the volatility.

Gas tumult

On one day this month, benchmark European gas traded in a range of 140 euros ($155) a megawatt-hour — more than the contract costs now. With the swings spooking traders, open interest is near a two-year low.

Even before the Ukraine war, Europe’s gas and power markets were extremely turbulent due to concern about a winter supply crunch. Surging costs forced German energy giant Uniper SE to borrow $11 billion to pay down margins calls. German utility Steag GbmH and Norway’s Statkraft AS also had to boost liquidity.

Skyrocketing gas prices “require significant cash,” said Alfred Stern, who runs Austrian oil and gas company OMV AG. “So far, we were able to manage that in quite a good way, but it has been significant in the last couple of weeks here, lets say in the three-digit kind of millions that we had to inject.”

Crop trading

Chicago wheat volumes soared at the start of the war in Ukraine as prices climbed toward a record, but have this week slumped. In Kansas City wheat — the type closest to what Russia grows — open interest hit the lowest since 2015.

(By Mark Burton and Alex Longley, with assistance from Michael Hirtzer, Isis Almeida and Vanessa Dezem)

Sunday, March 20, 2022

Friday, March 18, 2022

Ukraine legalizes cryptocurrency as it receives millions in crypto donations

/cdn.vox-cdn.com/uploads/chorus_image/image/70634523/VRG_Illo_STK010_K_Radtke_Russia_Crypto.0.jpg)

Illustration by Kristen Radtke / The Verge, Icons by Shutterstock

The Ukrainian government has been actively soliciting crypto donations

Ukrainian President Volodymyr Zelenskyy has signed into law a bill that effectively legalizes the cryptocurrency sector in the country. The decision comes as Ukraine has received cryptocurrency donations worth tens of millions of dollars from individuals and groups hoping to help the country’s war effort against Russia.

The bill signed by Zelenskyy was approved by Ukraine’s parliament last month and “creates conditions for the launch of a legal market for virtual assets in Ukraine.” It allows Ukrainian banks to open accounts for crypto firms; appoints the National Bank of Ukraine and the National Commission on Securities and Stock Market as financial watchdogs for the sector; and, as reported by CoinTelegraph, means crypto exchanges and companies that handle other virtual assets will have to register with the government. The state says it will protect citizens’ cryptocurrency holdings with the same legal force as its fiat currency, the hryvnia.

In a post shared on Telegram, Ukraine’s Vice Prime Minister and Minister of Digital Transformation, Mykhailo Fedorov, said the law would “bring the cryptosector out of the shadows.” (Translation via Google Translate.)

“With the beginning of the war, cryptocurrencies became a powerful tool for attracting additional funding to support the Armed Forces of Ukraine,” wrote Fedorov. “In more than three weeks of war, the Crypto Fund of Ukraine has raised more than $54 million in cryptocurrencies.” (Other outlets have reported that the government has received close to $100 million in crypto donations.)

Cryptocurrency is playing a significant role in the war between Russia and Ukraine. As well as being a prime vector for donations to Ukraine, it’s been seen as a possible lifeline for Russians hit by financial sanctions. Ordinary Ukrainians have also been buying up crypto assets in increasing numbers, with trading on domestic exchange Kuna surging 200 percent following the country’s invasion by neighboring Russia. Swapping virtual assets for fiat to carry out purchases is still often necessary and difficult, but legal recognition of the crypto sector should help ameliorate some of these problems.

India’s Russian coal imports could be highest in over two years in March

India’s coal imports from Russia in March could be the highest in more than two years, data from research consultancies showed, as Indian buyers continue buying the fuel from a market that is now increasingly isolated by sanctions.

Sign Up for the Energy Digest

About 870,000 tonnes of Russian coal have already delivered or are expected to be delivered at Indian shores until March 20, the highest since April 2020, Indian consultancy Coalmint says.

The number would be higher if more coal was loaded at Russian ports since mid-February, as it typically takes about a month for Russian vessels to deliver to India, said Aditi Tiwari, coal market head at Coalmint.

“Indian buyers have taken a backseat after the SWIFT ban and sanctions on Russia. They are looking out for alternatives from Australia and the U.S,” Tiwari said.

A number of Russian banks have been cut off from the SWIFT secure messaging system that facilitates cross-border payments.

But at least three vessels carrying coal set sail to India from Russian ports after Russia launched its invasion of Ukraine on Feb. 24, according to Refinitiv vessel tracking data and an industry source.

“Indian buyers are still getting coal from Russia into the market here, but are starting to find it increasingly difficult because banks are not willing to open letters of credit,” the industry source said.

“Bankable long-term customers are being handed over coal on a trust basis, while relatively new customers aren’t able to procure coal because of financing issues,” the source said.

V R Sharma, the managing director of Jindal Steel and Power Ltd (JSPL), said importing from Russia would be difficult unless there is a “rupee-rouble” trade.

India is exploring ways to set up a rupee payment mechanism with Russia to soften the blow on New Delhi of Western sanctions imposed on Russia.

“If rupee-rouble trade is approved, then we can get coal at affordable and cheaper prices from Russia,” Sharma told Reuters.

JSPL is among the importers from Russia in March, along with Tata Steel, Kalyani Steels and JSW Steel. JSW declined to comment, while Kalyani and Tata Steel did not respond to Reuters requests seeking comment.

A trader at Sibuglemet, one of Russia’s major exporters, said the firm and his competitors are continuing to supply coal to India, but said “some issues are appearing.”

“Tomorrow, if they were to put strict controls on payments, then trade would be organised through buyers in other countries,” he said.

(By Sudarshan Varadhan; Editing by Edmund Blair)

China seeks to cut reliance on coal imports with mining boom

China plans a massive increase in coal mining, a move that will dramatically reduce its reliance on imports and deal a blow to its near-term climate actions.

Sign Up for the Energy Digest

It’s hard to overstate the importance to China of coal, the most-polluting fossil fuel. The nation produces and consumes more than half of global supply, and it’s the biggest contributor to its world-leading greenhouse gas emissions. China has said that coal consumption should begin to fall off in the second half of this decade as it strives to peak emissions across the economy by 2030.

The production increase would be split, with 150 million tons of capacity coming from new, upgraded operations and another 150 million from open-pit mines and some mines that had previously been shut. Daily output should average 12.6 million tons, according to the NDRC, which is even higher than the record-breaking levels reached in the fall after shortages caused widespread industrial brownouts.

The NDRC didn’t give a timeline for the ramp-up, but if last year’s all-out push on production is anything to go by, it could happen relatively quickly. The added 300 million tons of capacity is equivalent to China’s typical annual imports. The nation produced over 4 billion tons of its own coal last year.

The stockpiles would be split between several sectors:

- The national government would contribute 70 million tons

- Local governments would hold 150 million tons

- Power plants would have 200 million tons

- Coal mines would have 100 million tons

- Other large users would have 100 million tons

The new edicts on supply follow other measures intended to guarantee a smoothly running power system, which still relies on coal for about 60% of its needs. The government has ordered mines and power plants to sign medium and long-term contracts for 100% of their generation, and will enforce a price range of between 570 and 770 yuan a ton for those supplies.

The NDRC also announced several other plans at the meeting:

- The third batch in a massive build-out of desert solar and wind projects will be announced soon, with priority given to developments backed by coal power that allow for continuous generation

- The country will start development of 17 cross-regional power systems this year

- Provinces should speed up the development of peak-shaving power supply and pumped hydro power storage

U.S. seizing tankers has failed to stop Iran's oil exports, minister says

March 12 (Reuters) - The U.S. seizure of Iranian tankers in recent months has not stopped sanctions-hit Tehran from increasing oil exports, Iran's oil minister was quoted as saying on Saturday.

“The United States has on several occasions in the past months violated Iranian oil tankers to prevent export of shipments," Javad Owji said in an interview carried by Iranian media.

"When the enemy realised it could not stop our exports and contracts, they went after our ships," Owji said.

His remarks follow reports of a recent seizure of an Iranian oil tanker in the Bahamas, even as indirect Iran-U.S. talks in Vienna to revive a 2015 nuclear deal could see the lifting of U.S. sanctions in return for Tehran curbing its nuclear work.

A last-minute demand by Russia, a close ally of Iran, has forced world powers meeting in the Austrian capital to pause for an undetermined time, despite having a largely completed text.

On March 5, Russia unexpectedly demanded sweeping guarantees its trade with Iran would not be affected by sanctions imposed on Moscow over its invasion of Ukraine - a demand Western powers say is unacceptable and Washington has said it won't accept.

"Iran's oil exports have risen under the toughest sanctions and without waiting for the outcome of the Vienna talks," said Owji.

The increase was thanks to "different methods used to win contracts and finding different buyers," Owji said.

The rise had "even increased the bargaining power of friends in Vienna," he said, without elaborating.

Tehran's oil exports have been limited since former U.S. President Donald Trump in 2018 exited the 2015 nuclear accord and reimposed sanctions.

Iran views U.S. sanctions as illegal and has said it will make every effort to sidestep them.

Its oil exports have risen to more than 1 million barrels per day (bpd) for the first time in almost three years, based on estimates from companies that track the flows, reflecting increased shipments to China.

Iran increased exports in 2021 despite the sanctions, according to estimates from oil industry consultants and analysts. But they remained well below the 2.5 million bpd shipped before sanctions were reintroduced.

Thursday, March 17, 2022

Nickel price plunges as traders fume over latest London Metals mayhem

LME

Nickel fell by the maximum allowed for a second day as the market seeks to reset from last week’s historic short squeeze, while brokers were left stunned as yet another glitch delayed the start of trading in London.

Sign Up for the Australasia Digest

The latest price drop brings the LME prices a little closer to the value of futures in Shanghai, which continued to trade during the London suspension. It’s also another indication that the short squeeze that has gripped the nickel market may be easing.

[Click here for an interactive chart of nickel prices]

Prices had spiraled up 250% in a little more than 24 hours early last week as top producer Tsingshan Group Holding Co. struggled to pay margin calls on its large nickel short position. The Chinese company announced a deal with its banks on Monday to avoid margin calls, which gave the LME confidence to reopen the market, and most traders and analysts had predicted prices would fall when trading resumed.

“It has become all but inevitable to have another round of limit-down for LME nickel as well, for at least for another 3 days if we are to follow the adjusted 8% pace,” Marex said in a note before the London open on Thursday.

However, while the drop in prices was expected, the reopening of the London market has been anything but predictable. After a series of false starts on Wednesday that left exhausted traders exasperated with the LME, the problems started back up on Thursday even before trading had begun.

Speaking privately on Thursday morning, several investors and brokers said they were stunned by the repeated blunders. One usually garrulous hedge fund manager said he was lost for words.Play Video

First, traders found that orders to sell at the lower-limit of 8% below Wednesday’s closing price were being rejected, after the LME expanded the trading band the previous day. Then three trades did appear to go through at that price — but four minutes before the electronic market had been due to open.

Finally, the LME informed brokers that trading wouldn’t restart until 8:45 a.m. and canceled the three earlier trades. When the electronic-trading market finally opened, futures dropped by the daily limit. But only two trades had taken place by 2 p.m.

The chaotic start to the session piles embarrassment on the LME as it seeks to restore order to the market that sets global prices for one of the world’s most important metals. The crisis in nickel has sparked furious criticism of the exchange for its handling of the situation, from metals markets veterans as well as generalist investors, and several have said they will stop trading on the market.

“Credibility is very quickly slipping through their fingers,” Keith Wildie, head of trading at Romco Metals, said by phone from London. “It’s eroding very rapidly.”

On Wednesday morning, the LME briefly restarted electronic trading in nickel, but was forced to halt due to a technical glitch that allowed prices to fall below a 5% lower limit. It reopened in the afternoon, but there was a gulf between bids and offers for most of the day, leading to highly illiquid trading conditions in the world’s benchmark pricing venue for the metal used in stainless steel and electric-vehicle batteries.

The LME widened the limit from the initial reopening level of 5% for nickel to 8% on Thursday, in an attempt “to further assist the market to discover the true market price.”

While electronic trading has faced glitches, the exchange is still operating its large phone-based market, which tends to be used by banks, brokerages and institutional clients needing to place large and complex trades. Its open-outcry floor — where dealers gather on red leather couches to set benchmark prices by screaming orders at one another — also remains open.

Still, across the market, there has been little interest to buy at the limit-down price.

And for a second day on Thursday, a huge volume of nickel was offered for sale, suggesting prices are poised to fall further. More than 13,000 lots, or 78,000 tons of nickel, had been offered as of 1:45 p.m.

(By Mark Burton, Alfred Cang and Jack Farchy, with assistance from Kiuyan Wong)