https://www.newsbreak.com/news/2445774310782/biden-sets-out-oil-gas-leasing-reform-stops-short-of-ban?_f=app_share&s=a99&share_destination_id=MTM3MTE3MDI3LTE2MzgwMzU3ODU1ODA=&pd=09HKOxl3&hl=en_US

The Biden administration on Friday recommended an overhaul of the

nation's oil and gas leasing program to limit areas available areas for

energy development and raise costs for oil and gas companies to drill on

public land and water.

The long-awaited report by the Interior

Department stops short of recommending an end to oil and gas leasing on

public lands, as many environmental groups have urged. But officials

said the report would lead to a more responsible leasing process that

provides a better return to U.S. taxpayers.

“Our nation faces a profound climate crisis that is impacting every

American,″ Interior Secretary Deb Haaland said in a statement, adding

that the new report’s recommendations will mitigate worsening climate

change impacts “while staying steadfast in the pursuit of environmental

justice.″

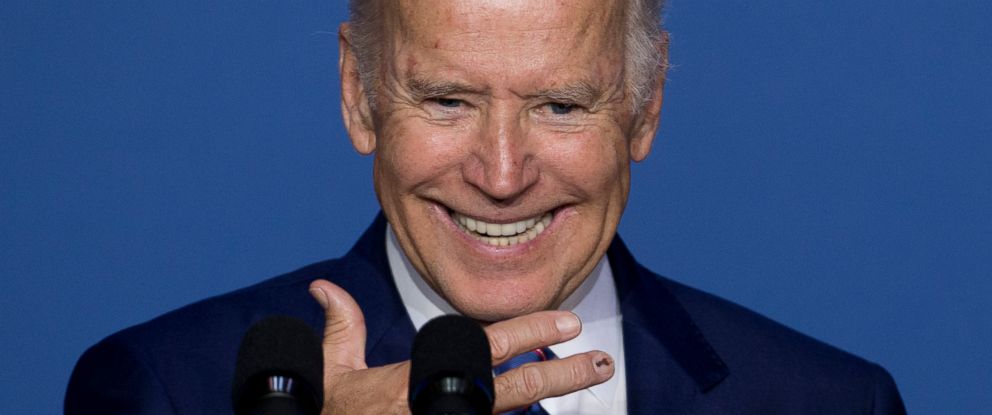

The report completes a review ordered in January by

President Joe Biden, who directed a pause in federal oil and gas lease

sales in his first days in office, citing worries about climate change.

The moratorium drew sharp criticism from congressional Republicans and

the oil industry, even as many environmentalists and Democrats said

Biden should make the leasing pause permanent.

The new report

seeks a middle ground that would continue the multibillion-dollar

leasing program while reforming it to end what many officials consider

overly favorable terms for the industry.

The report recommends hiking federal royalty rates for oil and gas

drilling, which have not been raised for 100 years. The federal rate of

12.5 percent that developers must pay to drill on public lands is

significantly lower than many states and private landowners charge for

drilling leases on state or private lands.

The report also said

the government should consider raising bond payments that energy

companies must set aside for future cleanup before they drill new wells.

Bond rates have not been increased in decades, the report said.

The Bureau of Land Management, an Interior Department agency, should

focus potential leasing on areas that have high potential for oil and

gas resources and are in proximity to existing oil and gas

infrastructure, the report said.

The White House declined to comment Friday, referring questions to Interior.

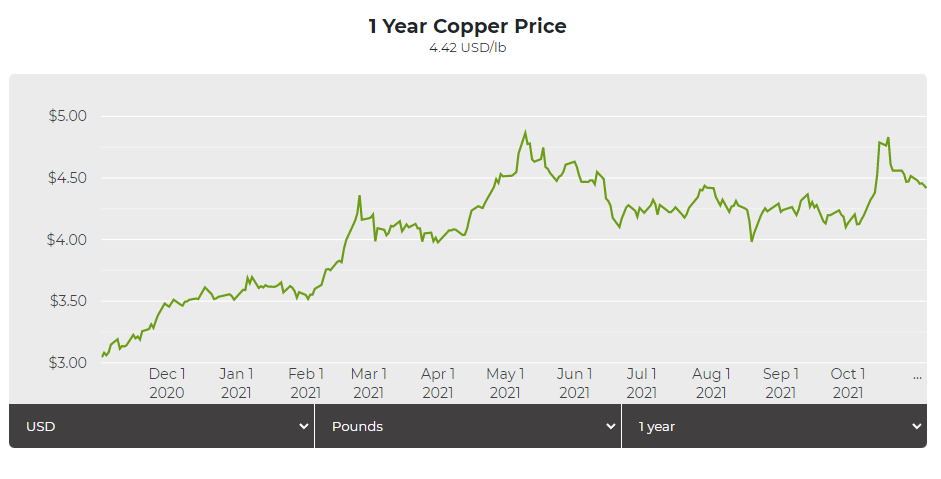

The federal leasing program has drawn renewed focus in recent weeks as

gasoline prices have skyrocketed and Republicans complained that Biden

policies, including the leasing moratorium, rejection of the Keystone XL

oil pipeline and a ban on oil leasing in Alaska’s Arctic National

Wildlife Refuge, contributed to the price spike.

Biden on

Tuesday ordered a record 50 million barrels of oil released from

America’s strategic reserve, aiming to bring down gas prices amid

concerns about inflation. Gasoline prices are at about $3.40 a gallon,

more than 50% higher than a year ago, according to the American

Automobile Association.

The Biden administration conducted a

lease sale on federal oil and gas reserves in the Gulf of Mexico last

week, after attorneys general from Republican-led states successfully

sued in federal court to lift the suspension on federal oil and gas

sales that Biden imposed when he took office.

Energy companies including Shell, BP, Chevron and ExxonMobil offered a

combined $192 million for offshore drilling rights in the Gulf,

highlighting the hurdles Biden faces to reach climate goals dependent on

deep cuts in fossil fuel emissions.

The leases will take years

to develop, meaning oil companies could keep producing crude long past

2030, when Biden has set a goal to lower greenhouse gas emissions by at

least 50%, compared with 2005 levels. Scientists say the world needs to

be well on the way to that goal over the next decade to avoid

catastrophic climate change.

Yet even as Biden has tried to

cajole other world leaders into strengthening efforts against global

warming, including at this month’s U.N/ climate talks in Scotland, he’s

had difficulty gaining ground on climate issues at home.

The administration has proposed another round of oil and gas sales

early next year in Wyoming, Colorado, Montana and other states. Interior

Department officials proceeded despite concluding that burning the

fuels could lead to billions of dollars in potential future climate

damages.

Emissions from burning and extracting fossil fuels from

public lands and waters account for about a quarter of U.S. carbon

dioxide emissions, according to the U.S. Geological Survey.

Environmentalists hailed the report's recommendation to raise royalty

rates, but some groups said the report falls short of action needed to

address the climate crisis.

"Today’s report is a complete

failure of the climate leadership that our world desperately needs,''

said Taylor McKinnon of the Center for Biological Diversity, an

environmental group.

The

report “presumes more fossil fuel leasing that our climate can’t afford”

and abandons Biden’s campaign promise to stop new oil and gas leasing

on public lands, McKinnon said.

The American Petroleum

Institute, the top lobbying group for the oil industry, said Interior

was proposing to "increase costs on American energy development with no

clear roadmap for the future of federal leasing.”

Other groups were more upbeat.

“This report makes an incredibly compelling case both economically and

ecologically for bringing the federal oil and gas leasing program into

the 21st century,” said Collin O’Mara, president and CEO of the National

Wildlife Federation. “Enacting these overdue reforms will ensure

taxpayers, communities and wildlife are no longer harmed by below-market

rates, insufficient protections and poor planning.''

The

wildlife federation and other groups urged the Senate to include reforms

to the oil and gas program in Biden's sweeping social and environmental

policy bill. Many reforms, including an end to drilling in the Arctic

refuge and a ban on offshore drilling along the Atlantic and Pacific

Coasts and the eastern Gulf of Mexico, were included in a House version

of the bill approved last week.

Jennifer Rokala, executive

director of the left-leaning Center for Western Priorities, said the

report “provides a critical roadmap to ensure drilling decisions on

public lands take into account (climate) impacts on our land, water and

wildlife, while ensuring a fair return for taxpayers.''

Republicans called the report a continuation of what they call Biden's war on domestic energy production.

While the report hides behind language of “necessary reforms'' and

royalty rates adjustments, ”we know the real story,'' said Arkansas Rep.

Bruce Westerman, the top Republican on the House Natural Resources

Committee.

The Biden administration “will bog small energy

companies down in years of regulatory gridlock, place millions of acres

of resources-rich land under lock and key (and) ignore local input,''

Westerman said. "Ultimately, the American consumer will pay the price.

Look no further than the skyrocketing prices you are already paying at

the gas pump.''