Wednesday, July 24, 2024

Tuesday, July 23, 2024

Friday, July 19, 2024

Wednesday, July 17, 2024

Biden administration considers expanding Alaskan oil and gas drilling ban

(WO) – On July 12, the Bureau of Land Management (BLM) announced it is seeking public opinion on whether or not to expand so-called “protected” areas in Alaska’s National Petroleum Reserve (NPR-A). If enacted, the measure would expand on the Biden administration’s recent ban on new oil and gas drilling projects in the region.

BLM is looking for input on whether to add additional protection measures by identifying additional significant resource values in existing Special Areas, expanding Special Areas, or creating new Special Areas within the NPR-A, according to an online statement.

Under the Naval Petroleum Reserves Production Act (NPRPA) of 1976, BLM is required to “balance” oil and gas development with protected “special areas” in Alaska. According to BLM, “the final rule updates the existing regulatory framework, adopted more than 40 years ago, allowing the BLM to respond more effectively to changing conditions in the NPR-A."

In April 2024, the Biden administration formally limited oil and gas drilling across 13 million acres of the 23-million-acre NPR-A. Leasing is also blocked 10.6 million acres. The move has brought wide condemnation from the oil and gas industry on concerns over harnessing U.S. resources to improve energy security at a time of geopolitical uncertainty.

The region is suspected to hold close to 9 Bbbl of recoverable resources. Earlier this month, ConocoPhillips sued the Biden administration over it’s Alaskan drilling ban. The company operated nearly 2 million acres in the state.

The commentary period will last for 60 days.

Tuesday, July 16, 2024

BREAKING NEWS: ExxonMobil unveils 30-well drilling campaign for seventh oil and gas project offshore Guyana

(WO) – Reuters has reported that ExxonMobil is planning a potential 30-well drilling campaign for its seventh oil and gas project offshore Guyana, named Hammerhead.

Hammerhead aims to start production in 2029, boosting Guyana's oil production capacity to over 1.4 MMbpd.

Exxon, along with partners Hess Corp and China's CNOOC, expects Hammerhead to produce between 120,000 and 180,000 bpd, which is less than the 250,000 bpd from its largest vessels offshore Guyana.

The project will include a floating production unit, converted from a Very Large Crude Carrier (VLCC), capable of storing 1.4 to 2 MMboe. This unit will be located 15 km (9 miles) southwest of Exxon's Liza Destiny vessel.

According to ExxonMobil’s website, Hammerhead was discovered in August 2018. Hammerhead is ExxonMobil’s ninth oil discovery in the prolific Stabroek Block offshore Guyana.

This story was originally reported by Reuters.

Monday, July 15, 2024

FDNY Commissioner Laura Kavanagh announces resignation

https://www.yahoo.com/news/fdny-commissioner-laura-kavanagh-announces-202525856.html

NEW YORK CITY - Laura Kavanagh announced on Saturday she would be stepping down as commissioner.

Kavanagh said in an email she is going to pursue other opportunities.

Mayor Adams appointed Kavanagh in 2022.

A separate statement from Adams shared with Fox News Digital bolstered that claim, saying the city "respects her decision."

"Commissioner Kavanagh has dedicated her life to keeping New Yorkers safe and while we’ve made it clear that she could have kept this position for as long as she wanted, we respect her decision to take the next step in her career," Adams said.

She was the first female commissioner in the 159-year history of the FDNY.

Kavanagh has come under fire of late, with criticism coming from both inside and outside FDNY walls.

Most

recently, Kavanagh was jeered while marching in the annual NYC St.

Patrick's Day parade in March, after she promised to "hunt" down

protesting firefighters who booed Attorney General Letitia James during an FDNY ceremony a week before the parade.

In 2023, she was hit with an age discrimination lawsuit that alleged she targeted older top FDNY staffers with demotions, retaliation and forced retirements.

Several high-level staffers in their late 50s and early 60s sued Kavanagh for unspecified damages, back pay and the return of job titles under the state’s human rights laws, according to a 53-page lawsuit filed in the Brooklyn state Supreme Court first published by the New York Post.

The lawsuit claimed staff members were forced to work in a hostile and retaliatory work environment.

"While the decision I have made over the last month has been a hard one, I’m confident that it is time for me to pass the torch to the next leader of the finest Fire Department in the world," Kavanagh said in her resignation statement.

"I look forward to spending the next several months assisting the department’s transition in leadership, before embarking on my next professional challenge. Thank you Mayor Adams for the opportunity you gave me and for your continued support of me and the FDNY," she added.

"It has been the honor of a lifetime to devote the last 10 years — five as first deputy commissioner and more than two as commissioner — to advocating for the men and women of the FDNY."

Kavanagh says she will stay on the job while they find her a replacement.

Fox News Digital's Andrew Mark Miller and Andrea Vachianno contributed to this report.

Friday, July 12, 2024

AT&T says criminals stole phone records of ‘nearly all’ customers in new data breach

https://techcrunch.com/2024/07/12/att-phone-records-stolen-data-breach/

U.S. phone giant AT&T confirmed Friday it will begin notifying millions of consumers about a fresh data breach that allowed cybercriminals to steal the phone records of “nearly all” of its customers, a company spokesperson told TechCrunch.

In a statement, AT&T said that the stolen data contains phone numbers of both cellular and landline customers, as well as AT&T records of calls and text messages — such as who contacted who by phone or text — during a six-month period between May 1, 2022 and October 31, 2022.

AT&T said some of the stolen data includes more recent records from January 2, 2023 for a smaller but unspecified number of customers.

The stolen data also includes call records of customers with phone service from other cell carriers that rely on AT&T’s network, the company said.

AT&T said the stolen data “does not contain the content of calls or texts,” but does include calling and texting records that an AT&T phone number interacted with during the six-month period, as well as the total count of a customer’s calls and texts, and call durations — information that is often referred to as metadata. The stolen data does not include the time or date of calls or texts, AT&T said.

Some of the stolen records include cell site identification numbers associated with phone calls and text messages, information that can be used to determine the approximate location of where a call was made or text message sent.

In all, the phone giant said it will notify around 110 million AT&T customers of the data breach, company spokesperson Andrea Huguely told TechCrunch.

AT&T published a website with information for customers about the data incident. AT&T also disclosed the data breach in a filing with regulators before the market opened on Friday.

Breach linked to Snowflake

AT&T said it learned of the data breach on April 19, and that it was unrelated to its earlier security incident in March.

AT&T’s Huguely told TechCrunch that the most recent compromise of customer records were stolen from the cloud data giant Snowflake during a recent spate of data thefts targeting Snowflake’s customers.

Snowflake allows its corporate customers, like tech companies and telcos, to analyze huge amounts of customer data in the cloud. It’s not clear for what reason AT&T was storing customer data in Snowflake, and the spokesperson would not say.

AT&T is the latest company in recent weeks to confirm it had data stolen from Snowflake, following Ticketmaster and LendingTree subsidiary QuoteWizard, and others.

Snowflake blamed the data thefts on its customers for not using multi-factor authentication to secure their Snowflake accounts, a security feature that the cloud data giant did not enforce or require its customers to use.

Cybersecurity incident response firm Mandiant, which Snowflake called in to help with notifying customers, later said about 165 Snowflake customers had a “significant volume of data” stolen from their customer accounts.

Mandiant attributed the breach to an as-yet-uncategorized cybercriminal group tracked only as UNC5537. Mandiant’s researchers say the hackers are financially motivated and have members in North America and at least one member in Turkey.

Some of the other corporate victims of the Snowflake account thefts had data subsequently published on known cybercrime forums. For AT&T’s part, the company said that it does not believe that the data is publicly available at this time.

AT&T’s statement said it was working with law enforcement to arrest the cybercriminals involved in the breach. AT&T said that “at least one person has been apprehended.” AT&T’s spokesperson said that the arrested individual was not an AT&T employee, but deferred questions about the alleged criminals to the FBI.

An FBI spokesperson confirmed to TechCrunch on Friday that after the phone giant contacted the agency to report the breach, AT&T, the FBI and the Department of Justice agreed to delay notifying the public and customers on two occasions, citing “potential risks to national security and/or public safety.”

“AT&T, FBI, and DOJ worked collaboratively through the first and second delay process, all while sharing key threat intelligence to bolster FBI investigative equities and to assist AT&T’s incident response work,” the FBI spokesperson said.

The FBI did not comment on the arrest of one of the alleged cybercriminals.

This is the second security incident AT&T has disclosed this year. AT&T was forced to reset the account passcodes of millions of its customers after a cache of customer account information — including encrypted passcodes for accessing AT&T customer accounts — was published on a cybercrime forum. A security researcher told TechCrunch at the time that the encrypted passcodes could be easily decrypted, prompting AT&T to take precautionary action to protect customer accounts

Thursday, July 11, 2024

ConocoPhillips sues over Biden’s oil and gas drilling ban in Alaska

Bloomberg) – ConocoPhillips sued to block a Biden administration ban on drilling across nearly half the National Petroleum Reserve in Alaska, claiming the measure violates a federal law that compels oil development there.

The lawsuit filed Friday takes aim at an Interior Department rule that explicitly bars oil leasing on 10.6 million acres (4.3 million hectares) of the 23-million-acre reserve, while restricting future oil development in 13 million acres designated as “special areas.”

The case will test one of President Joe Biden’s biggest moves to limit oil development on federal land, amid appeals by climate activists who claim it’s incompatible with a warming world.

Oil industry advocates that hold leases in the reserve say the Bureau of Land Management regulation unlawfully strangles development in territory set aside as a source of energy for the Navy a century ago.

The regulation will apply to existing leases within the area, though it won’t alter the terms of those contracts or directly affect currently authorized activities, such as ConocoPhillips’ 600 MMbbl Willow project.

Nonetheless, the rule could have wide effects for companies with leases in the reserve. ConocoPhillips’ Alaska unit holds 1.8 million acres of state and federal leases in the state, including 1 million net undeveloped acres as of year-end 2023, the company said in its filing.

In establishing the reserve, Congress said it should be used for “expeditious production of oil to meet the nation’s energy needs,” ConocoPhillips said in its lawsuit, filed in a federal court in Alaska. The reserve contains an estimated 8.7 billion barrels of recoverable oil, according to a 2017 assessment by the US Geological Survey.

Congress “plainly did not authorize BLM to promulgate sweeping regulations that thwart and prevent the production of petroleum throughout the NPR-A,” ConocoPhillips said. Yet, the rule contains “numerous new provisions that elevate resource preservation over energy production and effectively turn the petroleum reserve into a de facto wilderness area in which development is outright prohibited.”

The case joins earlier challenges filed by the Voice of the Arctic Iñupiat that represents North Alaska communities, the state of Alaska and oil companies North Slope Exploration LLC and North Slope Energy LLC, which together hold leases spanning more than 552,000 acres in the reserve.

The case is ConocoPhillips v. Department of Interior, 24-cv-00142, US District Court, District of Alaska.

Gold price tops $2,400 again on signs of cooling inflation

https://www.mining.com/gold-price-tops-2400-again-on-signs-of-cooling-inflation/

Gold has once again crossed the $2,400-an-ounce mark to close in on another record after an unexpected drop in US consumer prices bolstered hopes of a Federal Reserve interest rate cut in September.

Spot gold jumped 2.0% to $2,418.78 an ounce by 9:10 a.m. ET Thursday, for its highest in almost two months. US gold futures were up 1.6% at $2,419 an ounce in New York.

Sign Up for the Precious Metals Digest

The rally comes on the back of new US data showing a 0.1% monthly decline in consumer prices, marking the first negative reading in over four years. Another key core price gauge that excludes food and energy advanced only 0.1% in June, further supporting the case for a Fed rate cut.

The figures indicate that inflation has resumed its downward trend after a flare up at the start of the year, while broader economic activity appears to be slowing. Earlier, Federal Reserve Chair Jerome Powell said the central bank doesn’t need inflation below 2% before cutting rates.

High rates have been a headwind for gold as a non-interest-bearing asset, but prices have still hit record highs this year on a wave of buying by investors and central banks. Thursday’s rally brought the precious metal into striking distance of the all-time high of $2,450.07 set in May.

“Below-expected inflation data is compounding the precious metals rally,” Ryan Mckay, a senior commodity strategist at TD Securities, said in an emailed note. “A key macro cohort that has been on the sidelines thus far is increasingly likely to regain interest in gold.”

(With files from Bloomberg)

BREAKING NEWS: FTC to delay $53 billion Chevron-Hess deal until after ExxonMobil arbitration over assets offshore Guyana

(Bloomberg) – The U.S. Federal Trade Commission plans to delay its decision whether to block Chevron Corp.’s $53 billion takeover of Hess Corp. until after an arbitration case with Exxon Mobil Corp. is settled, according to people familiar with the matter.

The case with Exxon, which claims to have a right of first refusal over Hess’s biggest asset offshore Guyana, will likely take at least until the fourth quarter, meaning the FTC’s review will extend several more months. The agency plans to announce its decision when the arbitration is finished, said the people, who asked not to be named discussing an internal agency matter.

The delay is yet another blow to the embattled deal, which is still far from completion nearly nine months after it was announced in October. The agency has made second requests for information for several large deals in the oil and gas sector this year.

Chevron and the FTC declined to comment. Chevron previously has said it expected to have finished responding to the FTC’s in-depth request for information by mid-year.

“We continue to expect to complete the FTC review process during the third quarter,” Hess said in a statement.

Unless companies have an explicit timing agreement with the FTC, the agency has discretion on when to announce its decisions.

Shares of both companies fell on the news, pairing earlier gains. Hess was up 0.4% at 11:40 a.m., after earlier being up as much as 1.1% Chevron shares were up 0.6%, after rising 1% earlier.

The FTC allowed Exxon’s takeover of Pioneer Natural Resources Co. to move forward after alleging Scott Sheffield, Pioneer’s founder and former CEO, colluded with OPEC officials and blocked him from serving on the Texas oil giant’s board. Sheffield rejected the claims.

Chevron’s agreement to buy Hess, its biggest deal in two decades, has faced several hurdles, leaving both companies in strategic limbo.

In March, Exxon, which discovered and operates Guyana’s Stabroek Block, accused Chevron of attempting to “circumvent” its right to buy Hess’s 30% stake in the 11 Bbbl offshore oil field. Chevron and Hess rejected the charge, saying Exxon’s right doesn’t apply because the deal is structured as a corporate takeover rather than an asset sale.

But the case went to arbitration at the International Chamber of Commerce, a process that could take until the fourth quarter at the earliest. Exxon’s CEO Darren Woods has warned it could take longer.

In May, Hess investors approved the Chevron takeover by a razor-thin majority of 51% after several large shareholders and Institutional Shareholder Services Inc. argued the vote should be delayed until after the arbitration case. The investors expressed concern that they would not receive Chevron dividends until the deal is complete, eroding the value of the transaction.

Wednesday, July 10, 2024

Codelco eyes 10% stake in Teck’s Quebrada Blanca copper mine

https://www.mining.com/codelco-eyes-10-stake-in-tecks-quebrada-blanca-copper-mine/

Chile’s copper giant Codelco is considering taking a 10% stake in Teck’s (TSX: TECK.A, TECK.B)(NYSE: TECK) Quebrada Blanca copper mine, currently held by state mining firm Enami, in a deal valued at about $500 million.

The potential acquisition will make strategic sense for both companies, local paper La Tercera reported on Tuesday, as Codelco would get a hold of a new, massive and long-life copper asset, while Enami could improve its balance sheet and finally be able to partly finance a new smelter.

Sign Up for the Copper Digest

Enami’s stake in Quebrada Blanca (QB) is a minority, but it possesses a unique characteristic that sets it apart from other shareholders: it is non-dilutable. This means that even in the event of capital increases subscribed by other shareholders, the state-owned miner retains its ownership. This stake is comprised of series B shares, which also entitles Enami to a preferred dividend. Bonus: it is not required to finance capital expenditures.

“We cannot provide information on this matter because it is under a confidentiality clause,” Enami, which groups small and medium mining projects in the country, told La Tercera.

The state-mining company recorded losses of $200 million in 2023, more than double the $78 million loss it logged in 2022. The miner estimated the value of its investment in QB in slightly over $323 million, according to its 2023 financial statement.

Enami’s problems have not disappeared — it currently is facing financial difficulties, as its Paipote smelter in the northern province of Atacama remains halted due to pending renovations.

Newly expanded, low-cost prize

The QB mine is located in northern Chile at an elevation of 4,400 metres, about 240 km southeast of the city of Iquique and 1,500 km from capital Santiago.

It began production in 1994, as an open pit copper operation, with Teck, Canada’s largest diversified miner and current majority owner, entering in 2007.

Teck saw its overall copper production jump by 74% in the first three months of the year, thanks mainly to the ramp up of the QB extension in Chile.

The Vancouver-based miner churned out 99,000 tonnes in the first quarter, with QB producing 43,300 tonnes. QB2, as the new area of the mine is known, began production three years after originally planned, due to weather and covid-19- related construction disruptions. In the process, the key growth project saw costs balloon and ended up coming in at $4 billion over budget.

Codelco’s track record of alliances with private entities is extensive. It holds a 49% stake in El Abra through a partnership with Freeport-McMoRan and owns 20% of Anglo American Sur, which operates the Los Bronces and El Soldado mines, as well as the Chagres smelter.

Late last year, Codelco entered into a second agreement with Rio Tinto (ASX, LON: RIO) for the Agua de la Falda SA project in the Atacama Region, securing a 42.26% share.

It has also ventured beyond copper through a joint venture with SQM (NYSE: SQM) to exploit the world’s largest lithium deposit in the Atacama salt flat, a project slated to begin in 2025, with Codelco taking control in 2031.

The Chilean miner bought up Australia’s Lithium Power International in January,

which gave it the Maricunga lithium project, located on the namesake

salt flat, which is Chile’s second largest salt-encrusted field in terms

of reserves of the battery metal.

Monday, July 8, 2024

RANKED: World’s top 10 gold mining companies

https://www.mining.com/ranked-worlds-top-10-gold-mining-companies/

Gold has re-emerged as one of the top asset classes of 2024, having risen by 12% year to date and shattered multiple records along the way. It is now well on track for its best year since 2020.

The yellow metal has largely benefited from the heightened uncertainty in the global economy, namely recession fears and geopolitical risks, which in turn are driving up demand.

Sign Up for the Precious Metals Digest

In light of its rising significance as a safe haven asset, gold’s supply must also keep pace with the demand. The world’s production of gold has steadily gone up over the last four years, according to the World Gold Council.

Most of the gold production comes from a small number of companies that have been in the mining business for decades. Below, we list out the top 10 gold mining companies in the world based on their 2023 outputs*:

* Production figures are based on company press releases for the full-year ending December, 31, 2023, with the exception of Navoi Mining and Metallurgical Company.

1. Newmont

Production: 5.5 million oz.

Despite an 8% decline in output from 2022, Newmont remains the top gold producer with 5.5 million oz. across its global operations, which span four continents.

The Denver, Colorado-based company cemented its position as the world’s biggest gold miner last year with its $17 billion acquisition of Newcrest Mining. The deal gave Newmont a much bigger presence in Australia and Canada, adding two major operations in each country.

Recently, Newmont was named by TIME magazine as the best-performing mining company in terms of decarbonization.

2. Barrick Gold

Production: 4.05 million oz.

Barrick’s 2023 production of 4.05 million oz. also fell below the previous year’s (-2.1%) and was slightly short of its forecast as well as analyst expectations.

In response to rival Newmont’s big move, Barrick CEO has repeated shot down the idea of making any big acquisitions, and instead, the company will focus on organic growth, with expansions being lined up at its operations in the Dominican Republic and Nevada.

The Toronto-based miner is also reportedly close to selling a stake in its other growth project, the Reko Diq in Pakistan, to Saudi Arabia.

3. Agnico Eagle

Production: 3.44 million oz.

In contrast to the ‘Big 2’, Agnico’s production grew nearly 10% thanks to its purchase of the remaining stake in the Canadian Malartic, Canada’s biggest open-pit mine, and a full year of production from mines acquired from Kirkland Lake Gold in 2022.

In addition to consolidating its production in Canada, Agnico has also been investing in growth projects in Finland, where it operates Europe’s largest primary gold producer at Kittila.

4. Navoi (NMMC)

Production: 2.9 million oz.

Navoi Mining and Metallurgical Company (NMMC) is the biggest industrial enterprise in Uzbekistan with a rich history of gold production.

While NMMC reports annual production on currency volume, according to information released by S&P Global, its 2023 production totalled 2.9 million oz., enough to maintain Top 4 producer status.

5. Polyus

Production: 2.9 million oz.

Polyus saw its production rise 14% in 2023 to 2.9 million oz., consisting of 2.48 million oz. in refined gold and the rest in flotation concentrate.

Like many other Russian enterprises, the Moscow-based gold company was hit with Western sanctions last year, forcing it to wind down its mining operations.

6. AngloGold

Production: 2.59 million oz.

AngloGold Ashanti’s production fell 3% year-on-year in 2023 due to fewer tonnes of ore processed and lower ore grades. Equipment failure at one of its Ghanaian operations also contributed to the output decline.

In 2024, the Johannesburg-based gold miner is maintaining an output target of 2.79 million oz. despite flooding in Australia.

7. Gold Fields

Production: 2.3 million oz.

Gold Fields once again trailed its South African rival with production of 2.3 million oz. in 2023, down 4% from the year before.

Towards the end of the year, the company sold a 45% stake in the Asanko gold mine in Ghana to joint venture partner Galiano Gold. However, the loss of production there would be offset by its new $1 billion Salares Norte mine in Chile, which poured its first gold in April after years of delays.

Gold Fields and AngloGold Ashanti were previously rumored to be in merger talks, but that has now been ruled out after the companies entered a joint venture in Ghana last March.

8. Zijin

Production: 2.17 million oz.

Zijin Mining is coming off a 20% year-on-year gold production growth, positioning itself as the No.1 listed gold mining company in China and among the top 8 globally.

It has been reported that the group is still “actively looking” to bolster its production profile through acquisitions as it had done in the past, but valuations and geopolitics have slowed down that strategy in recent years.

9. Kinross

Production: 2.15 million oz.

In 2023, Kinross produced 2.15 million oz. in gold equivalent (including silver converted into gold), nearly 10% higher than in 2022. The Canadian miner is about to add a new source of production, with the Manh Choh project in Alaska targeted for first pour this month.

Last June, it was revealed by Bloomberg that Kinross had been the target of a takeover by Endeavour Mining, which predominantly mines gold in West Africa, but the deal to consolidate the mid-sized miners did not materialize.

10. Freeport McMoran

Production: 1.99 million oz.

US-based Freeport McMoran also enjoyed a near 10% increase in gold production in 2023. The company, which is mostly known for its copper, currently operates the Grasberg mine in Indonesia, one of the largest gold operations in the world.

Notable mention: Solidcore (Polymetal)

Production: 1.71 million oz. (AuEq)

Solidcore Resources, formerly known as Polymetal International, kept its gold-equivalent output steady last year with 1.71 million oz. Since coming under US sanctions, the group has been forced to sell a majority of its Russian assets, representing about 70% of its production.

Under its new look, Solidcore is now expected to enter the Middle East market and ramp up investments in its existing operations in Kazakhstan. The aim is to produce 1 million oz. of gold equivalent by 2029.

Wednesday, July 3, 2024

Tuesday, July 2, 2024

Federal Government Sells 1 Million Barrels of Gasoline Ahead of Fourth of July Holiday

The federal government completed the sale of 1 million barrels of gasoline from the Northeast Gasoline Supply Reserve (NGSR), the White House said in a statement shared with The Epoch Times on Tuesday.

After receiving 19 proposals from five companies since May 21, the federal government awarded contracts to all the firms: BP (500,000 barrels), Vitol (200,000 barrels), Freepoint Commodities (100,000 barrels), George E. Warren (100,000 barrels), and Irving Oil (98,824 barrels).

Gas reserves were sold at an average $2.34 per gallon.

Senior administration officials touted the news as another victory for the federal government’s inflation-fighting efforts.

“The Biden-Harris Administration continues to take strategic action to lower prices for American consumers in every aspect of their lives—especially as summer driving season ramps up,” said Energy Secretary Jennifer Granholm. “By releasing this reserve ahead of July 4th, we are ensuring sufficient supply flows to the northeast at a time hardworking Americans need it the most.”

But while gasoline prices have not rocketed this summer, the White House is trying to build on the plethora of measures to reduce energy costs, says National Economic Advisor Lael Brainard.

“Gas prices have come down nearly 20 cents in the last two months, but we know there is more to do,” said Ms. Brainard. “This release will help lower prices at the pump, building on other actions by President Biden, including historic releases from the Strategic Petroleum Reserve, record energy production, and the largest-ever investment in clean energy.”

The cost of gas could start ticking higher because of the jump in crude oil prices.

U.S. crude topped $83 a barrel on the New York Mercantile Exchange during the July 1 trading session. Year-to-date, the West Texas Intermediate crude oil benchmark is up about 17 percent.

Oil prices have cooled since the end of April, but the revival of geopolitical tensions, investors bracing for the Federal Reserve to cut interest rates, an active hurricane season, and tight international energy markets have bolstered oil prices in recent sessions.

“Summer got off to a slow start last week with low gas demand,” said AAA spokesperson Andrew Gross. “But with a record 60 million travelers forecast to hit the road for the July 4th holiday, that number could pop over the next 10 days. But will oil stay above $80 a barrel, or will it sag again? Stay tuned.”

Tapping Into Reserves

In 2012, President Barack Obama created the Northeast Gasoline Supply Reserve following Hurricane Sandy, which destroyed refineries in the region.Recent EIA figures revealed domestic gas inventories totaled 233.886 million barrels for the week ending June 21, down more than 3 percent from the same period three years ago.

Additionally, following Russian President Vladimir Putin’s invasion of Ukraine, President Biden tapped into the nation’s emergency oil stockpiles to curb prices, drawing down 180 million barrels of oil. The White House estimates this trimmed gas prices by about 80 cents.

The SPR is approximately 40 percent lower than in January 2021. Since hitting a bottom of 346.758 million barrels in July 2023, the U.S. government has been gradually refilling reserves. As of June 21, the SPR was 372.197 million barrels, the highest since December 2022.

The White House has repeatedly shifted its position to replenish the SPR.

However, Ms. Granholm told Reuters in a June 28 interview that the administration could rush offers to replenish U.S. reserves beyond a 3-million-barrel-a-month pace.

“It could pick up more than that,” she said, adding that two SPR locations in Louisiana and Texas have been in maintenance. “All four sites will be back up by the end of the year, so one could imagine that pace would pick up, depending on the market.”

The federal government established the Strategic Petroleum Reserve in 1975 in response to the 1973–1974 oil embargo. The purpose was to limit the impact of disruptions in global petroleum markets. Officials could withdraw from the SPR during emergencies, energy interruptions, or supply troubles.

The world’s largest economy consumes about 20 million barrels of oil per day, meaning current reserves would be exhausted in 18 days if production ceased.

Monday, July 1, 2024

FCC Proposes Carriers Unlock All Phones Within 60 Days

https://www.theepochtimes.com/us/fcc-proposes-carriers-unlock-all-phones-within-60-days-5678082

Cellphone service carriers would have to unlock customers’ cellphones within 60 days after activation, under a new proposal issued by the U.S. Federal Communications Commission (FCC) on June 27.

“New unlocking rules would allow consumers the freedom to take their existing phones and switch from one mobile wireless service provider to another more easily, as long as the consumer’s phone is compatible with the new provider’s wireless network,” the agency said in a statement.

Some cellphones come with software that prevents the device from being used on different mobile networks. This software restricts the phone to the network provider selling the device. Unlocking the phone allows consumers to use different mobile networks.

The FCC said that the unlocking of phones also opens the door to increased competition in the wireless services market, gives consumers more flexibility when switching service providers, increases competition by reducing consumers’ switching costs, and reduces customer confusion by applying the same unlocking rules to all mobile service providers.

FCC Chairwoman Jessica Rosenworcel said, “When you buy a phone, you should have the freedom to decide when to change service to the carrier you want and not have the device you own stuck by practices that prevent you from making that choice.”

Providers tend to lock mobile phones to their network as the devices are sold at a discounted price. In exchange, buyers are required to commit to a network plan, typically lasting months or years. These agreements also carry an early termination clause mandating a penalty if the deal is ended before the expiry of the commitment period.

“An unlocking requirement may discourage a carrier from deeply discounting a phone because it cannot recoup its subsidy if a customer immediately moves to another carrier,” Verizon said at the time.

“Providers rely on device locks to sustain their ability to offer such subsidies. Device locking periods, in fact, may greatly benefit low-income consumers because they make devices more affordable, lowering the barrier to entry to mobile service.”

The proposal will also seek public comments on the impact of the 60-day unlocking rule on service providers’ incentives to offer discounted phones.

T-Mobile Deal

Phone unlocking was a key issue in the recently concluded acquisition of Mint Mobile by T-Mobile. The deal was announced in March last year, with T-Mobile putting up $1.35 billion to acquire Ka’ena Corporation, which owned Mint Mobile and other brands. The deal was completed on May 1, 2024.Locking phones not only makes it more difficult for consumers to change carriers but also reduces the number of devices available in the secondary market, the groups argued. Smaller carriers and new entrants can be disadvantaged in the marketplace due to a lack of handset availability, the letter said.

“Locked phones, particularly those tied to pre-paid plans, can disadvantage low-income customers most of all, since they may not have the resources to switch carriers or purchase new phones. Unlocked phones also facilitate a robust secondary market for used devices, providing consumers with more affordable options.”

Back in 2014, the CTIA, which represents the U.S. wireless communications industry, adopted six standards for mobile device unlocking.

One policy states that carriers, upon request, will unlock mobile wireless devices or provide the information required to do so once the contract period under which the device was purchased ends.

The FCC advises people who are looking to unlock their phones to speak with their service provider to find out their eligibility.

If you found this article interesting, please consider supporting traditional journalism

Our first edition was published 24 years ago from a basement in Atlanta. Today, The Epoch Times brings fact-based, award-winning journalism to millions of Americans.

Our journalists have been threatened, arrested, and assaulted, but our commitment to independent journalism has never wavered. This year marks our 24th year of independent reporting, free from corporate and political influence.

That's why you're invited to a limited-time introductory offer — just $1 for 6 months — so you can join millions already celebrating independent news.

Friday, June 28, 2024

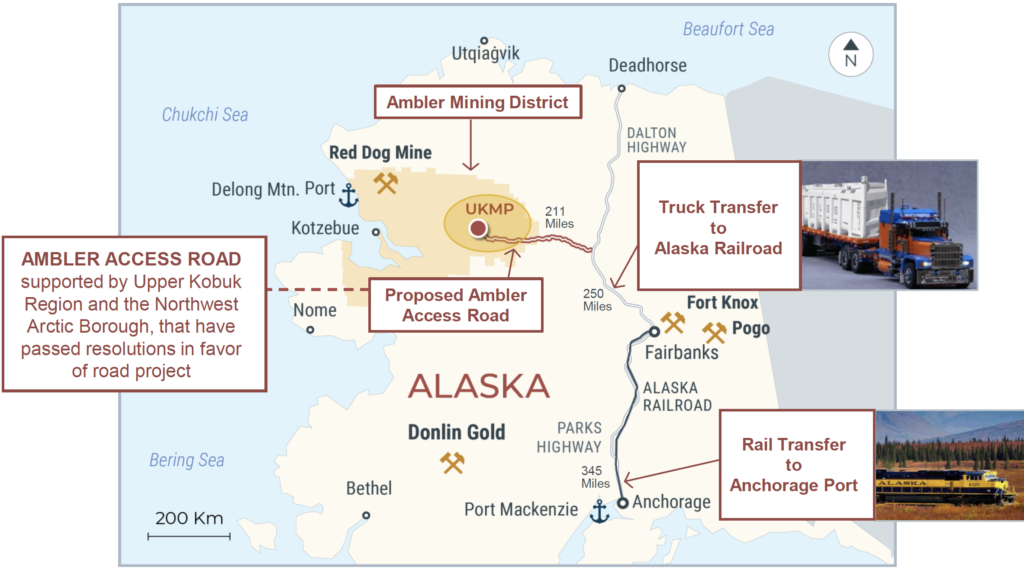

Biden administration blocks Ambler road in Alaska

https://www.mining.com/biden-administration-blocks-ambler-road-in-alaska/

The Biden administration on Friday blocked the construction of the proposed 211-mile Ambler road used for accessing minerals in Alaska.

The Interior Department has announced plans to retain protections for 28 million acres of land scattered across the state that the Trump administration had sought to open for mining and oil and gas drilling. These lands include unique habitats for three major caribou herds, migratory birds, as well as the Pacific salmon.

Sign Up for the Copper Digest

“Today, my administration stopped a 211-mile road from carving up a pristine area that Alaska Native communities rely on, in addition to steps we’re taking to maintain protections on 28 million acres in Alaska from mining and drilling. These natural wonders demand our protection,” US President Joe Biden said on X.

The Ambler road would provide access to untouched deposits of copper, zinc, lead, silver and gold in northwestern Alaska. The two-lane, all-season gravel road would have run through the Brooks Range foothills and the Gates of the Arctic National Park and Preserve, crossing 11 rivers and thousands of streams before it reached the site of a future mine.

The Trump administration approved the project permit in 2020. After Biden’s election, the Interior Department ordered a new analysis, citing inadequate environmental impact studies by the previous administration. In April, the department recommended against any proposed version of the road.

The decision is another setback for Ambler Metals, formed in 2019 by Trilogy Metals (TSX, NYSE: TMQ) and South32 (ASX, LON, JSE: S32), to explore the Upper Kobuk Mineral Projects (UKMP) in Alaska’s Ambler mining district.

The UKMP projects, consisting of the Arctic and earlier-stage Bornite copper assets, have a combined resource of 8 billion pounds of copper, 3 billion pounds of zinc and 1 million ounces of gold equivalent.

The proposed mine is expected to produce more than 159 million pounds of copper, 199 million pounds of zinc, 33 million pounds of lead, 30,600 ounces of gold and 3.3 million ounces of silver over a 12-year mine life.

The Interior Department, however, argues that the road would disrupt habitats, pollute salmon spawning grounds, and threaten the hunting and fishing traditions of over 30 Alaska Native communities.

MINING.COM requested a comment from Ambler Metals about the Interior Department’s decision, but the company did not respond by press time.

Thursday, June 27, 2024

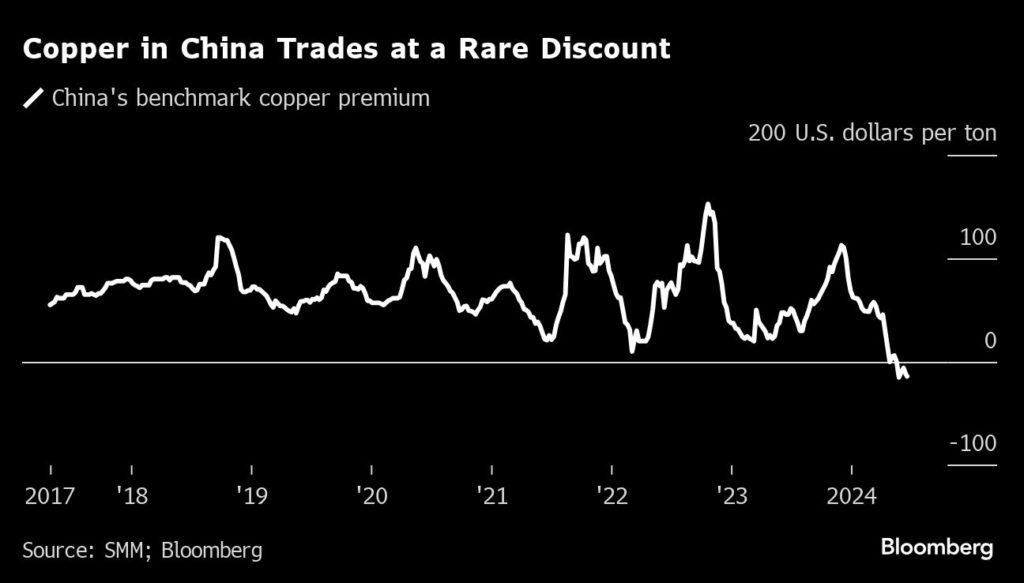

Hedge funds’ bullish copper bets run into China’s slowdown

https://www.mining.com/web/hedge-funds-bullish-copper-bets-run-into-chinas-slowdown/

As copper surged to record highs last

month, several senior Chinese traders started trying to contact western

hedge fund managers whose names they’d only read in the press. For

years, the veteran traders’ privileged insight into their own economy

had given them an edge in the copper market, where China accounts for

more than half of global demand.![]()

But now they were bewildered. Everything in China pointed to a market that should be slumping, and yet prices were soaring on a wave of speculative money. What were they missing?

Sign Up for the Copper Digest

The approaches – direct and through intermediaries, to fund managers like Pierre Andurand and Luke Sadrian who had made a splash as some of the market’s biggest bulls – highlight the tug of war that has gripped the copper market in the past few months.

On one side are bullish fund managers in London and New York, who have plowed tens of billions of dollars into copper with an eye to future shortages. On the other are Chinese purchasers, more focused on the here and now, who have rarely if ever been so gloomy.

For the Chinese traders, it has been a humbling experience. The downbeat mood at home had persuaded them to bet against international copper prices. Then a wave of investor buying pushed prices to a record, and traders who fancied themselves the smartest players in the market were wiped out.

“This year has been tough for Chinese traders,” Tiger Shi, managing director at broker Bands Financial Ltd., said in an interview last week. “Their vaunted information advantage over the Chinese physical market didn’t bring them the rewards they imagined.”

But now, as the dust settles on last month’s frenzy, the importance of the Chinese market has reasserted itself. Prices have dropped about 13% from the peak above $11,100 a ton, as speculators sharply reduced their bullish bets in the wake of the surge — with much of that reduction driven by trend-following funds, according to traders.

Without western investors buying, all eyes are back on China, and a copper market that several industry insiders say is still the weakest they’ve ever seen it.

The tug of war between the two is likely to determine where copper prices go next: If tentative signs of a recovery in Chinese buying are sustained, some copper bulls believe the market could be gearing up for fresh record highs in the second half of the year.

But if weak Chinese orders persist, it would suggest that the soft patch is not just a result of delayed buying, but an indicator of poor underlying demand. Prices could fall even further — back to $9,000 or even $8,000 a ton, according to the most bearish traders.

It’s a dynamic that’s likely to dominate conversations as more than 1,000 smelter executives, traders, bankers and analysts are set to gather in Hong Kong this week for the London Metal Exchange’s annual Asia party. It’s traditionally an occasion for western investors to glean insight into Chinese fundamentals, but this year Chinese traders are likely to be just as interested in better understanding their counterparts.

It’s also a sign that, after more than two decades in which China’s industrialization and urbanization has been the major driver of the copper market, the situation is evolving as the electrification of everything gobbles up greater volumes of copper the world over.

Among Chinese copper traders and the fabricators who shape raw metal into pipes, wires and other parts used in everything from air conditioners to power transmission cables, the mood remains overwhelmingly gloomy.

“Business is shrinking significantly. The physical sales business is very bleak”

Even though some of the people Bloomberg spoke to in the past two weeks said they had seen a recent uptick in demand, they were reluctant to suggest that the market is turning around.

“This could be the most difficult year during my over-a-decade industry history,” said Ni Hongyan, vice general manager at trading firm Eagle Metal International Pte. “Business is shrinking significantly. The physical sales business is very bleak,” she said.

The data paints a similar picture. Copper in Shanghai’s tax-free bonded zone has been selling at a highly-unusual discount to London Metal Exchange prices for more than a month. That was painful for many Chinese merchants, who consider the second quarter the peak season for fabricators to purchase and prepare raw material stocks after the annual political meetings of the country. Instead, copper inventories on the Shanghai Futures Exchange have risen by 78% since the end of Chinese New Year to a record high for this time of the year.

A senior executive at one of the world’s top metals traders said the market for refined copper in China was weaker than he had ever seen it – “by a distance.”

Short squeeze

The disconnect between the Chinese market and western investors had been building for several months. Investors and analysts fell over one another to make the most bullish prediction for copper prices amid forecasts of soaring demand from the energy transition, and challenges boosting mine production. A series of reports estimating massive amounts of copper needed for artificial-intelligence data centers added to the frenzy.

Goldman Sachs Group Inc. said copper was in “the foothills of what will be its Everest,” predicting prices would average $15,000 a ton next year, while Andurand called for copper to hit $40,000.

The situation came to a head in May. As copper prices in China lagged international prices, many domestic traders had been placing bets that the gap would narrow, going short the international copper contracts and long the Shanghai market. After their brokers refused to put on new short positions in London to avoid being exposed to volatility during a week-long Chinese holiday, some traders placed bearish bets on the Comex in New York instead.

But as investor money kept piling in to the market, particularly US copper futures in New York, the Chinese traders were caught in a short squeeze. Faced with rising copper prices, their cash flow was running out and they had no choice but to give up, causing an unprecedented blowout in New York futures that saw them trade far above other price benchmarks.

Since then, however the Chinese market has reasserted itself.

Chinese copper exports hit a record 149,000 tons in May. LME stocks in South Korea and Taiwan — the locations closest to China — have been rising. And traders have been rushing to ship copper to the US to arbitrage the difference in prices – though none of it has yet appeared in Comex-registered inventories.

‘Not there yet’

In compiling this account, Bloomberg spoke to more than a dozen senior figures in China’s copper trading industry, most of whom who asked not to be identified discussing private information.

Many of the traders gathering in Hong Kong this week will still be nursing their wounds. The past six months could be among the worst performing period in their copper trading careers, several said.

For the wider market, the key question is what happens next.

In China, some traders say there have been tentative signs of a pick-up in buying in the past couple of weeks, a move which, if sustained, could put a floor on prices. Inventories of copper on SHFE have fallen for the past two weeks, albeit by a modest 14,000 tons. Beijing is also set to announce more long-term policy support for the economy at a key Communist Party meeting next month, which is seen boosting demand for raw materials like copper.

Wang Wei, general manager at major copper trader Shanghai Wooray Metals Group Co., which sells refined copper to hundreds of Chinese fabricators, said that demand was “rebounding a bit,” although only to return to similar levels as a year ago.

But there are still reasons to worry about China’s underlying copper consumption. Property is a key driver of copper demand, and the weakness in the Chinese sector is likely to continue as a drag, according to Eugene Chan, trading manager at Zhejiang Hailiang Co. There are also some indications that high prices are spurring a greater push for substitution of copper for aluminum.

“The financial market flood of net new length has become a trickle. Without that incremental macro-driven buyer, it comes down to whether the underlying physical market can support the current price,” said Colin Hamilton, managing director for commodities research at BMO Capital Markets. “We have to reset to a level to bring these buyers back, and we’re not there yet.”

Codelco copper output falls behind target in May, document shows

https://www.mining.com/web/codelco-copper-output-falls-behind-target-in-may-document-shows/

Chile’s state mining giant Codelco, one of the world’s largest copper producers, fell further behind its production target in May, an internal document obtained by Reuters showed, underscoring the challenge to revive output at a 25-year low.

The mining firm, which has yet to publicly release data for May, produced 103,100 metric tons of the red metal in the month, some 8.6% below its target of 112,800 tons, the previously unreported June document revealed.

Sign Up for the Copper Digest

The firm produced 484,500 tons of copper in the first five months of the year, 6.1% off its target, the document showed.

Codelco, which is battling hard to revive production, did not immediately respond to a request for comment.

Codelco, which posted production in April below 100,000 tons for the first time in at least 18 years, has been hit by a deadly accident at its Radomiro Tomic in March, which led to a stoppage at the site amid the investigation of the incident.

The company’s CEO has pledged that it will boost output this year after its worst performance in around a quarter of a century in 2023, affected by delay to major projects. The company has shaken up its leadership in recent months.

It is also pushing ahead with its new Rajo Inca project to extend the life of its small Salvador division and plans to begin partial operation of an expansion of its El Teniente underground mine in October-December this year.

(By Fabian Cambero; Editing by Adam Jourdan and Nick Zieminski)

Capstone produces first saleable copper concentrate at MVDP in Chile

https://www.mining.com/capstone-produces-first-saleable-copper-concentrate-at-mvdp-in-chile/

Capstone Copper (TSX: CS) (ASX: CSC) has produced its first saleable copper concentrate at the Mantoverde development project (MVDP) in Chile as the mine advances commissioning and ramps up to full production levels.

Mantoverde is a multi-pit mine located in the Atacama region of Chile, about 56 km southeast of the city of Chañaral. It is a jointly owned operation between Capstone (70%) and Japan’s Mitsubishi Materials (30%).

Sign Up for the Copper Digest

Capstone’s chief executive John MacKenzie said the first saleable copper concentrate production at MVDP represents “a significant milestone” for his company, adding that the mine remains on track and on budget with its previous guidance.

The MVDP is designed to expand on the mine’s existing production from approximately 35,000 tonnes of copper (cathodes only) to a run-rate of approximately 120,000 tonnes. This is expected to occur sometime in the third quarter of 2024, Capstone has said.

This expansion required a new plant to process sulphide material from the open pits into copper concentrates; previously, the Mantoverde operation only processed oxide ores. The concentrator plant was completed in late 2023, with the whole project costing $870 million.

Overall, the MVDP is expected to enable the mine to process 236 million tonnes of copper sulphide reserves, which represent approximately 20% of total sulphide resources, in addition to the existing oxide reserves, over a 20-year life.

Meanwhile, the company is also analyzing an optimization of the sulphide concentrator to sustain an average annual throughput of up to 45,000 tonnes per day (current capacity is 32,000 tonnes per day). A feasibility study for the optimized project is expected in Q3.

Shares of Capstone Copper traded at C$9.66 apiece by 11:40 a.m. ET for a 3.6% gain. The Americas-focused copper miner has a market capitalization of C$7.3 billion ($5.3bn).

Supreme Court Pauses EPA’s ‘Good Neighbor’ Rule That Cracks Down on Smog

The Supreme Court voted 5–4 on June 27 to temporarily put on hold the U.S. Environmental Protection Agency’s (EPA) “good neighbor” rule that cracks down on states whose industries are said to be contributing to smog.

Justices Amy Coney Barrett, Sonia Sotomayor, Elena Kagan, and Ketanji Brown Jackson dissented.

The Supreme Court held that the emissions-reduction standards established by a federal plan would probably cause irreversible harm to several of the affected states, unless the plan was stayed until it could be reviewed by the lower courts.

The nation’s highest court stayed the plan, pending review by the U.S. Court of Appeals for the District of Columbia Circuit.

Led by Ohio, the states said the regulation was costly and could lead to blackouts, while the EPA said the rule was urgently needed to fight air pollution.

The coalition of states also said the EPA’s plan is an illegal overreach that undermines the principles of the federal Clean Air Act, which allows states leeway to propose their own air pollution control measures.

The plan is reportedly in effect in 11 states; courts have blocked it in 12 states.

The case, known as Ohio v. EPA, came as the Supreme Court has become increasingly reluctant in recent years to side with the EPA in legal battles.

In 2022, the nation’s highest court held in West Virginia v. EPA that the federal Clean Air Act doesn’t give the EPA widespread power to regulate carbon dioxide emissions, which a popular theory says contributes to global warming.

In 2023, in Sackett v. EPA, the Court voted to rein in the power of the EPA to regulate wetlands.

In the case at hand, on Dec. 20, 2023, the Court declined to block the smog regulation itself but agreed to expedite consideration of the case.

Oral arguments were heard on Feb. 21 in Ohio v. EPA. The same hearing also covered three other applications filed against the EPA by Kinder Morgan Inc., the American Forest and Paper Association, and U.S. Steel Corp., which were consolidated.

The EPA finalized its “Federal ‘Good Neighbor Plan’ for the 2015 Ozone National Ambient Air Quality” regulation on June 5, 2023, despite the objections of states and energy companies.

The plan imposes emissions standards on 23 “upwind” states.

According to the agency, cross-state air pollution, also called interstate air pollution or transported air pollution, is emitted at an “upwind” location and then blown to a “downwind” location.

The plan is supposed to address the interstate effect of air pollution under the Clean Air Act’s Good Neighbor Provision in 42 U.S.C. Section 7410(a)(2)(D), which requires upwind states to make sure their emissions don’t hinder the ability of downwind states to meet federal air-quality standards.

The EPA toughened ozone standards and ordered states to file updated state implementation plans, or SIPs, demonstrating how they would comply with the new standards.

This new top-down regulation sparked opposition in many states, which are litigating against it.

Courts have blocked the program in 12 states: Alabama, Arkansas, Kentucky, Louisiana, Minnesota, Mississippi, Missouri, Nevada, Oklahoma, Texas, Utah, and West Virginia, according to the EPA.

In Ohio v. EPA, the D.C. Circuit previously declined to stay the Good Neighbor Plan while litigation was proceeding.

Enforcement Blocked

In the new opinion, the Supreme Court blocked enforcement of the EPA rule at least until the D.C. Circuit reviews the case.Justice Gorsuch’s opinion was joined by Justices Clarence Thomas, Samuel Alito, and Brett Kavanaugh, along with Chief Justice John Roberts.

The Clean Air Act is supposed to be about states and the federal government working together to improve Americans’ air quality, Justice Gorsuch wrote.

The law assigns states “primary responsibility” for developing plans to achieve air quality goals, however, if a state fails to prepare a legally compliant plan, the federal government is sometimes allowed to step in and assume that authority for itself, he wrote.

The federal government said it would reject more than 20 states’ plans for controlling ozone pollution and would impose its own uniform federal plan, so this case is about whether, in adopting that plan, the government complied with the Clean Air Act, he continued.

The Supreme Court ruled in Train v. NRDC (1975) that because the states have primary responsibility for writing compliance plans, the EPA has “no authority to question the wisdom of a State’s choices of emission limitations,” the justice noted.

As long as a SIP complies with the Act, the agency “shall approve it” within 18 months of its submission, but if a SIP falls short, the EPA “shall” issue a federal implementation plan, or FIP, for the noncompliant state unless the state corrects its SIP first, Justice Gorsuch wrote, citing another precedent.

At one point, several states and industry groups challenged the FIP in the D.C. Circuit.

The states said the Act allows the courts to reverse any action taken regarding an FIP that is “arbitrary” or “capricious,” and argued that the EPA’s decision to apply the federal plan to them even after many other states had dropped out met that standard for reversal, he wrote.

“Because each side has strong arguments about the harms they face … our resolution of these stay requests ultimately turns on the merits and the question [of] who is likely to prevail at the end of this litigation,” he wrote.

“We agree with the applicants that EPA’s final FIP likely runs afoul of … long-settled standards.”

In her dissenting opinion, Justice Barrett suggested the Supreme Court’s order in this case was ill-considered.

“Our emergency docket requires us to evaluate quickly the merits of applications without the benefit of full briefing and reasoned lower court opinions,” Justice Barrett wrote.

“Given those limitations, we should proceed all the more cautiously in cases like this one with voluminous, technical records and thorny legal questions.”

The court’s order “leaves large swaths of upwind States free to keep contributing significantly to their downwind neighbors’ ozone problems for the next several years” while the case is being litigated, she wrote.

If you found this article interesting, please consider supporting traditional journalism

Our first edition was published 24 years ago from a basement in Atlanta. Today, The Epoch Times brings fact-based, award-winning journalism to millions of Americans.

Our journalists have been threatened, arrested, and assaulted, but our commitment to independent journalism has never wavered. This year marks our 24th year of independent reporting, free from corporate and political influence.

That's why you're invited to a limited-time introductory offer — just $1 for 6 months — so you can join millions already celebrating independent news.