Teck’s Greenhills steelmaking coal operation in Elk Valley, British Columbia. (Image courtesy of Teck Resources.)

https://www.mining.com/teck-rejects-unsolicited-takeover-bid-from-glencore/

Teck Resources (TSX: TECK.A, TECK.B) (NYSE: TECK), Canada’s largest diversified miner, has rejected an unsolicited acquisition proposal from Swiss commodity trader and mining company Glencore Plc (LON: GLEN).

The board’s decision, Teck said, was unanimous. It noted that Glencore’s bid was to acquire the company and subsequently create two units, which would expose Teck shareholders to a large thermal coal and oil trading business.

The Vancouver-based company said a merger would increase geopolitical risk for its shareholders, given Glencore’s presence in jurisdictions such as the Democratic Republic of Congo (DRC), and the inclusion of oil trading in the metals unit would undermine its appeal to investors.

“[All of this] would negatively impact the value potential of Teck’s business, is contrary to our ESG commitments and would transfer significant value to Glencore at the expense of Teck shareholders,” chief executive, Jonathan Price, said in the statement.

Teck announced in February it was switching its name to Teck Metals Corp. and spinning off its multibillion-dollar steelmaking coal unit into a new company — Elk Valley Resources Ltd.

Teck had been weighing options for its metallurgical coal division for over a year, as the commodity is used in steelmaking, one of the most polluting industries.

“The proposed separation into Teck Metals and Elk Valley Resources is in the best interest of Teck and all its stakeholders,” the company said on Monday.

“The board is not contemplating a sale of the company at this time,” chair Sheila Murray said.

The miner’s controlling Keevil family said through Norman Keevil, who holds the role of chairman emeritus, that now was “not the time to explore a transaction of this nature.”

Teck is instead urging shareholders to approve the separation of Teck Metals and Elk Valley Resources at an April 26 meeting.

The two companies had discussed a potential merging in 2020, but those talks did not advance, according to documents both companies published Monday.

Eyes on copper

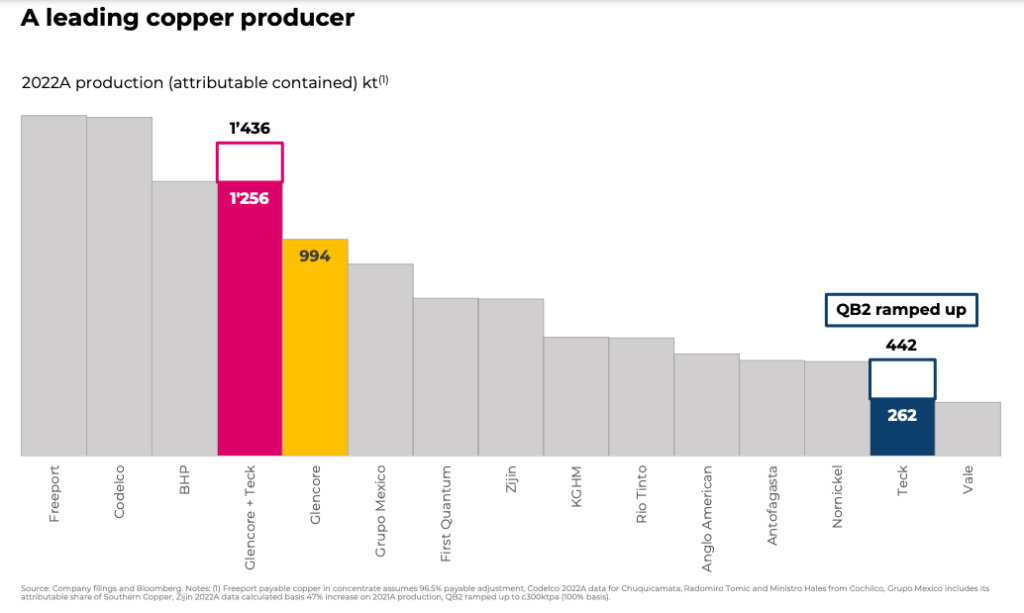

Experts had anticipated that the company’s decision to split the business in two would make Teck Metals a takeover target. The company owns four copper mines in South America and Canada, which produced 270,000 tonnes combined last year.

Teck also expects to double copper output after the second phase of its Quebrada Blanca project in Chile ramps up to full capacity by the end of 2023.

Top miners, in turn, are hungry for copper assets as demand for the metal accelerates and a global shortfall looms. BHP, Rio Tinto and Glencore itself have disclosed that they are actively looking to grow their copper exposure.

The main difficulty for any potential suitor for Teck’s copper assets will be the new structure, post-breakup, which funnels royalties from a separated coal business to the base metals operations, as well as a six-year phase-out of a dual-class share structure, under which Canada’s Keevil family currently controls the company.

“Adding Teck Metals would position any major miner as a dominant player in base metals,” Citi analyst Alexander Hacking said in a February note to investors. “That said, six years can be a long time in equity markets and a lot could change between now and then.”

US-listed shares of Teck rose more than 11% to $40.52 each in pre-market trading and were last trading at $42.87 each. Glencore’s shares were down on Monday afternoon almost 2.7% to 451.25p, but recovered later to close 1.15% higher at almost 470p.

For Glencore, acquiring Teck would be its biggest acquisition since buying Xstrata Plc in 2012 and it would “unlock approximately $4.25 billion — $5.25 billion of post-tax synergy value”, it said in a letter.

The Swiss company noted that its proposed acquisition would create two larger and more diversified companies than Teck’s own spinout plans.

It also highlighted that the combined metals-mining company would be headquartered in Canada, adding its coal business would stick to its plans to exit thermal coal by 2050.

Sweeter offer to come

Several mining experts are already predicting that Glencore won’t give up on Teck easily. Analysts at both the Royal Bank of Canada and Jefferies Group said the UK mining and commodities giant will likely raise its bid to win over Teck shareholders and the Keevil family.

Jefferies analyst Christopher LaFemina said in a note that while Glencore’s proposal is “compelling on paper,” a higher price and/or “cash kicker” is clearly needed. An improved offer is likely, he said, though “it is not clear that a modestly higher price is all that is necessary.”

RBC analysts led by Tyler Broda called the offer “relatively modest” that “potentially leaves room for Glencore to return.”

So far Glencore seems undaunted by Teck’s rebuffal. A few hours after

the Canadian miner’s rejection Glencore chief executive officer, Gary

Nagle, and other company executives held a conference call highlighting

the virtues of the deal to investors and analysts. The tone suggested

the potential acquisition is still on the cards, with Nagle describing

Teck’s objections as “not real issues.”

No comments:

Post a Comment