https://www.mining.com/charts-minings-top-50-companies-top-1-4-trillion-value-amid-ma-fever/

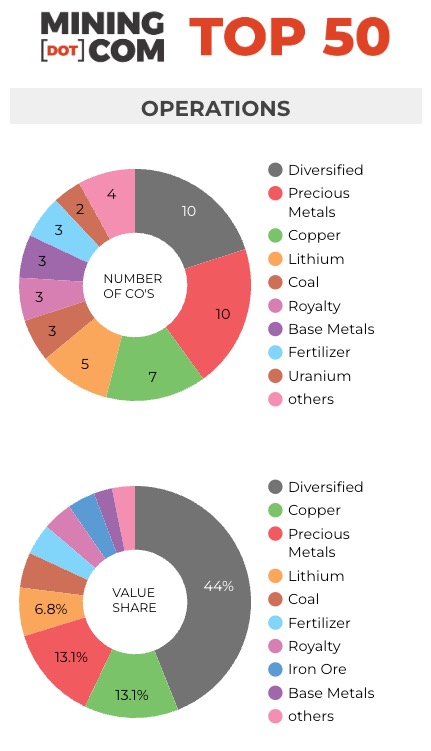

The world’s top 50 mining companies build on gains in the first quarter of 2023, but remain well below valuations this time last year as M&A fever grips the sector.

At the end of Q1 2022, the MINING.COM TOP 50* ranking of the world’s biggest miners hit an all time record of a collective $1.75 trillion in value as everything from copper and gold to uranium and tin rallied hard.

But the rout was swift and by the end of June the TOP 50 had lost an astonishing $600 billion in combined value as China’s zero-covid lockdowns remained in place, interest rates were hiked to curb stubborn inflation and the Ukraine war roiled energy markets.

Mining companies’ ratings have improved steadily since then, but at the end of Q1 this year the TOP 50 have only made up little over half the losses since the March 2022 peaks for a combined value of $1.43 trillion. That’s not far above levels seen end-March 2021 and up a relatively modest $49 billion since the end of last year.

Copper charge

Primary copper producers have fared well over the last quarter, outperforming the broader market and adding more than 16% in value as the bellwether metal continues to benefit from bullish predictions.

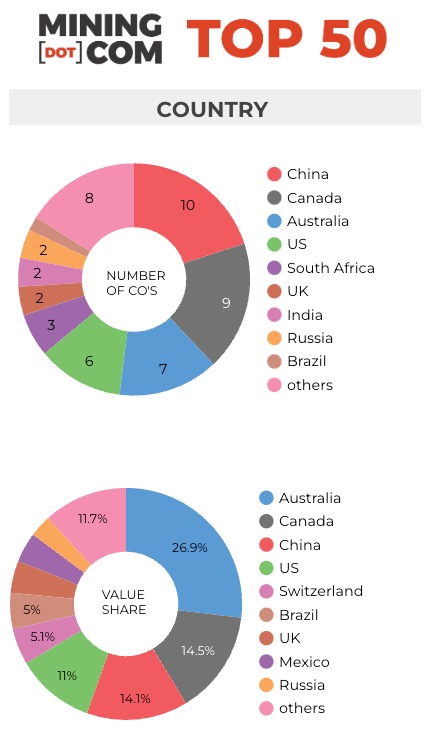

Following a string of acquisitions at home and abroad fast-growing Zijin Mining led the copper charge with a 21% gain for the quarter for a $46 billion valuation in Shanghai.

Zijin overtook First Quantum as the world’s fifth largest copper producer based on 2022 attributable production after the latter’s squabbles in Panama (since resolved) saw output decline. The Chinese copper and gold company also has growing ambitions in lithium.

Poland’s KGHM, the world’s number 7 producer with output of some 540kt in 2022 fell out of the ranking more than two years ago and is now languishing at number 61 with a market cap of $5.7 billion in Warsaw.

Coal stays in the black

Glencore’s rally, which saw the company maintain its March-2022 valuation throughout the year while other shares sank, went into reverse this year with the Swiss miner and trader only just holding the number three spot worldwide.

Glencore’s unsolicited bid for Teck Resources, in the process of spinning off its own coal operations, could, on paper at least, lead to that rarest of beasts – a mining company worth more than $100 billion.

Only Rio de Janeiro-based Vale apart from the perennial top 2 has achieved that feat, albeit for short stretches at a time.

Teck enters the Top 20 for the first time after holding its value since the March 2022 peak with investors betting that a stand-alone copper entity, fed by coal profits from a sister company, will attract a new set of investors.

While coal prices have begun to moderate, coal miners in the ranking have held onto most of the gains as large parts of the world turn to traditional sources of energy amid Russian oil and gas sanctions.

Uranium stocks enriched

Uranium counters also continue to find favour among investors amid volatile global energy markets with Kazatomprom re-entering the ranking in the final slot after a brief absence.

Canada’s Cameco makes the best performer list over the three months after spending much of the post-Fukushima period in the wilderness.

The Kazakh uranium producer, the world’s largest, pushed out Fresnillo as the Mexico City-based company suffers from silver’s relative underperformance to gold.

Golden years

Newcrest Mining tops the percentage gain table thanks in part due to its absorption of Canada’s Pretium Resources.

With a sweetened bid for the Australian miner from Newmont announced this week, a combined company could be worth around $55 billion and mark the return of a gold-focused company to the Top 10.

Bullion’s recent strength sees half the best performer list made up of gold companies, and representation in the ranking is destined to increase given merger fever among the lower rungs in the sector.

Platinum undercard

Weakness in platinum prices and operational woes for South African producers amid a power crisis sees Impala Platinum fall to just outside the top 50 for the first time.

Impala follows Sibanye Stillwater, which despite a diversification strategy away from South Africa and PGMs over many years and ranked at number 30 less than two years ago, dropped out a year ago.

Anglo American Platinum is the worst performer for the quarter, losing more than a third of its value this year.

Lithium lingers

Despite the sharp pullback in lithium prices so far in 2023, the five lithium stocks in the the Top 50 have held up well with a combined value of $97 billion.

Positioned at number 52 and 53, both Pilbara Minerals and IGO could

swell the presence of Australian lithium miners in the rankings although

gold counters Endeavour Mining and Kinross (post its Russia exit) – both of which are partial to acquisitions – could get in the Top 50.

Click on table for full resolution image:

*NOTES:

Source: MINING.COM, Mining Intelligence, Morningstar, GoogleFinance, company reports. Trading data from primary-listed exchange at April 3, 2023 where applicable, currency cross-rates April 7, 2023.

Percentage change based on US$ market cap difference, not share price change in local currency.

As with any ranking, criteria for inclusion are contentious issues. We decided to exclude unlisted and state-owned enterprises at the outset due to a lack of information. That, of course, excludes giants like Chile’s Codelco, Uzbekistan’s Navoi Mining, which owns the world’s largest gold mine, Eurochem, a major potash firm, Singapore-based trader Trafigura, and a number of entities in China and developing countries around the world.

Another central criterion was the depth of involvement in the industry before an enterprise can rightfully be called a mining company.

For instance, should smelter companies or commodity traders that own minority stakes in mining assets be included, especially if these investments have no operational component or warrant a seat on the board?

This is a common structure in Asia and excluding these types of companies removed well-known names like Japan’s Marubeni and Mitsui, Korea Zinc and Chile’s Copec.

Levels of operational or strategic involvement and size of shareholding were other central considerations. Do streaming and royalty companies that receive metals from mining operations without shareholding qualify or are they just specialised financing vehicles? We included Franco Nevada, Royal Gold and Wheaton Precious Metals.

Lithium and battery metals also pose a problem due to the booming market for electric vehicles and a trend towards vertical integration by battery manufacturers and mid-stream chemical companies. Battery producer and refiner Ganfeng Lithium, for example, is included because it has moved aggressively downstream through acquisitions and joint ventures.

Vertically integrated concerns like Alcoa and energy companies such as Shenhua Energy where power, ports and railways make up a large portion of revenues pose a problem, as do diversified companies such as Anglo American with separately listed majority-owned subsidiaries. We’ve included Angloplat in the ranking but excluded Kumba Iron Ore in which Anglo has a 70% stake to avoid double counting.

Many steelmakers own and often operate iron ore and other metal mines, but in the interest of balance and diversity we excluded the steel industry, and with that many companies that have substantial mining assets including giants like ArcelorMittal, Magnitogorsk, Ternium, Baosteel and many others.

Head office refers to operational headquarters wherever applicable, for example BHP and Rio Tinto are shown as Melbourne, Australia, but Antofagasta is the exception that proves the rule. We consider the company’s HQ to be in London, where it has been listed since the late 1800s.

No comments:

Post a Comment