In 2010, as fracking was taking off in Oklahoma, Jeff Andrews, a

former oil rig manager and drilling consultant, had an idea for how to

cash in on the boom. Rather than drill a well that would produce oil,

Andrews decided to drill one that could be used to dispose of all the

salty, toxic wastewater that comes up with it.

At the time, it

seemed like a sure bet. For every barrel of oil produced in Oklahoma,

drillers produce an average of about 10 barrels of wastewater. While

other states tend to treat and recycle their oil and gas wastewater,

Oklahoma has a long history of shooting it back down a hole in the

ground—and forgetting about it.

By mid-2014, oil production in

Oklahoma had jumped to 300,000 barrels a day. That summer, Andrews was

injecting about 9,000 barrels of wastewater down his disposal well

daily—and charging about 75¢ a barrel. He and his partners were on their

way to recouping the $3.2 million they’d invested in the business. But

there was one rather large problem looming on the horizon: Oklahoma was

fast becoming the earthquake capital of the U.S., and scientists were

starting to connect wastewater wells to the state’s sharp rise in

seismic activity.

A truck carries wastewater from oil fields to the West Perkins Commercial Disposal Site.

Photograph by Bryan Schutmaat for Bloomberg Businessweek

I

first met Andrews last spring on a reporting trip to Oklahoma to

examine the connection between disposal wells and earthquakes. What I

found was a state under severe stress. The quakes were rattling people’s

nerves and causing widespread property damage, yet despite increasing

scientific evidence, many were still reluctant to connect the problem to

the oil and gas industry, which accounts for one out of six jobs in

Oklahoma and has an outsize influence on state politics. Any solution to

the earthquakes would almost undoubtedly affect people’s livelihoods,

which were already under pressure from falling oil prices.

Our

reporting showed that oil companies were trying to influence state

scientists from linking fracking wastewater to the stupendous rise in

quakes. At the time, Andrews was trying to look on the bright side,

talking about putting deals to install some equipment to treat his

disposal water, rather than injecting it underground. His operation was

still making money, but it was clear that business was heading in the

wrong direction for him.

Andrews’s well has since gone from a

cash cow to a money pit. Not only have oil prices continued to slide,

causing a slowdown in the entire oil and gas industry, but regulations

aimed at reducing quakes have put tight restrictions on hundreds of

disposal wells like his. For the past year, the Oklahoma Corporation

Commission, the state’s oil and gas regulator, has been layering on

restrictions aimed at cutting the amount of water disposed underground.

On March 7, the OCC took its most aggressive step yet by ordering the

operators of 400 disposal wells in central Oklahoma to cut the amount of

water they inject underground. The goal is to reduce total wastewater

volume in the area by 40 percent, or about 300,000 barrels a day.

It’s

enough to put Andrews out of business. “I’m probably going to have to

shut my doors,” Andrews says. Under the new rules, he’ll have to cut

back to 679 barrels of wastewater per day. The crash in oil prices has

lowered the rate he can charge to about 35¢ a barrel, cutting his

revenue to a couple of hundred dollars a day.

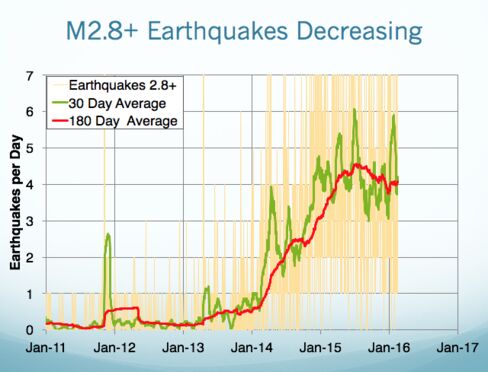

Since

2009 the amount of wastewater disposed of in Oklahoma has increased

81 percent, to more than 1 billion barrels a year. The number of

earthquakes measuring 3 or higher on the Richter scale has jumped from

fewer that two to 900 in 2015. In the past year, OCC has imposed

restrictions on hundreds of disposal wells, reducing the amount of water

disposed underground statewide by a total of 1 million barrels a day.

The actions appear to be helping in some areas. The number of

earthquakes in central Oklahoma declined 27 percent from the first to

the second half of 2015. “Until the earthquakes disappear, the threat

level will continue,” says Matt Skinner, an OCC spokesman.

Oklahoma Geological Survey

Along

with lacking adequate resources to address the earthquakes (a year ago

the OCC had just 1 seismologist dedicated to quakes) they have another

problem on their hands: The quakes are moving, migrating across the

state from east to west. In 2012, the most violent activity was

southeast of Oklahoma City; today it’s in the northwestern part of the

state. In a 30-minute period on Feb. 13, a trio of earthquakes

registering as high as 5.1 rocked northwestern Oklahoma and could be

felt in seven states.

About 1,000 of Oklahoma’s 4,000 disposal

wells are in the Arbuckle formation, a layer of limestone that stretches

hundreds of miles across the state. The Arbuckle acts like a sponge,

soaking up injected wastewater. Scientists believe that in some cases

that water is increasing pressure along Oklahoma’s extensive fault

lines, causing them to slip and setting off earthquakes. Blaming a

particular well for a particular quake, though, is nearly impossible.

“We don’t necessarily have a smoking gun that shows the mechanism of how

that pressure transmits across fault lines,” says Jeremy Boak, director

of the Oklahoma Geological Survey.

While most of Oklahoma’s

disposal wells are owned by oil and gas companies, some, like Andrews’s,

are independent operations. Problems affecting other parts of the

fracking industry are also hurting his bottom line. Four trucking

companies that pick up wastewater and pay Andrews to dispose of what

they’ve collected have gone bankrupt in the past year, leaving him with

$85,000 worth of unpaid invoices. Andrews and his partners invested $3.2

million to build their disposal facility. They’ve recouped only about

40 percent of that cost. Along with the well, the facility has an indoor

office and kitchenette where truckers can come and get a bite to eat,

take a shower, or even catch a nap. All free of charge. When Andrews

first opened in 2012, his was the classiest disposal well in central

Oklahoma. Now, all those amenities seem like wasted money. “This deal

has ended up biting me in the rear,” he says.

Rick Jackson, who

owns five disposal wells and 50 trucks in Oklahoma, is also getting

squeezed. “The profits used to be fabulous,” he says. “Those days are

gone.” Jackson’s wells, in the southern part of the state, have not been

affected by the OCC’s reduced disposal volumes. Still, his two biggest

clients, large oil producers, are cutting back, reducing the amount of

water they’re giving him. He’s had to lay off 22 of his 110 workers.

“The name of the game today is survival,” Jackson says.

The

disposal regulations will lead to further cuts in oil production, says

Kim Hatfield, vice chairman of the Oklahoma Independent Petroleum

Association, a trade group of oil and gas producers. “If you can’t

dispose, you can’t produce,” he says. Another option is to treat and

recycle the water, which Andrews and Jackson each estimate would cost

from $2.50 to $3 a barrel. Hatfield says the reality is closer to $5.

Given the state’s 10-to-1 ratio of water to oil production, that would

mean oil prices need to be at least in the $50-a-barrel range for

producers to cover their water treatment costs. “I probably review at

least one project a week promising to turn bad water into good,”

Hatfield says. “Can they do it? Absolutely. Can they do it economically?

No.”

No comments:

Post a Comment