Glencore Plc, on course to report it best ever trading year, has

flagged that those profitable bets have tied up more working capital

than normal.![]()

The world’s biggest commodity trader is expected to report record profit next week, driven by surging thermal coal prices and record trading returns.

“Our net working capital has significantly increased during the period, in line with materially higher oil, gas and coal prices, and their elevated market volatilities,” Glencore Chief Executive Officer Gary Nagle said in a statement Friday.

“These factors result in a timing mismatch between the net positive fair value of physical forward contracts (which are not margined) and related derivative hedging requirements (which are margined),” he said. “The various commodity exchanges have also significantly increased their initial margining requirements.”

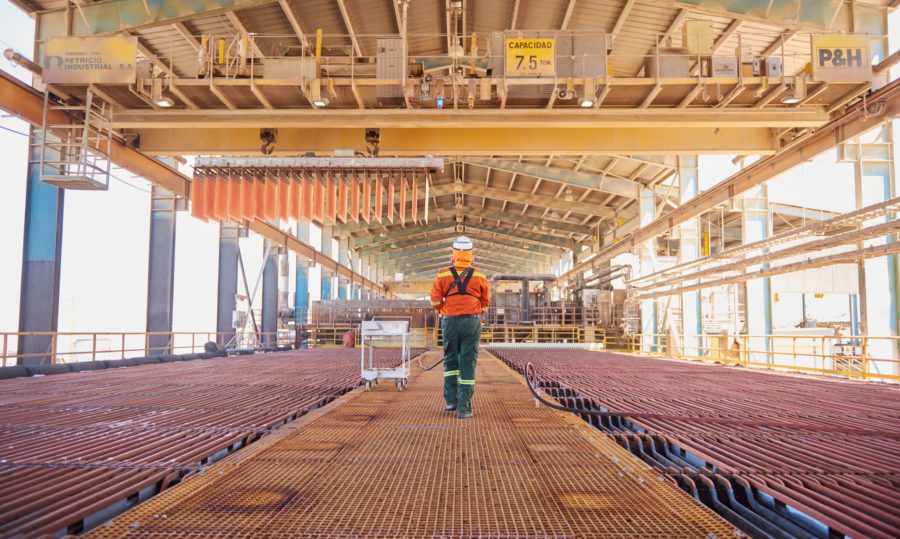

Glencore also said it will produce slightly less copper this year, lowering its goal by 50,000 tons. It’s also still assessing the impact of floods on its Australian coal business, and said the negative effect hasn’t yet been included in its current guidance.

The world’s biggest miners have been struggling to hit production goals this year as everything from Covid-19 absenteeism to extreme weather and basic missteps curbs output.

(By Thomas Biesheuvel)

No comments:

Post a Comment