China President / USA Today

https://www.mining.com/web/china-cuts-coal-import-tariffs-to-zero-to-increase-supply/

China will cut import tariffs for coal

to zero from May to the end of March to help guarantee energy supplies,

the Ministry of Finance said in a statement. ![]()

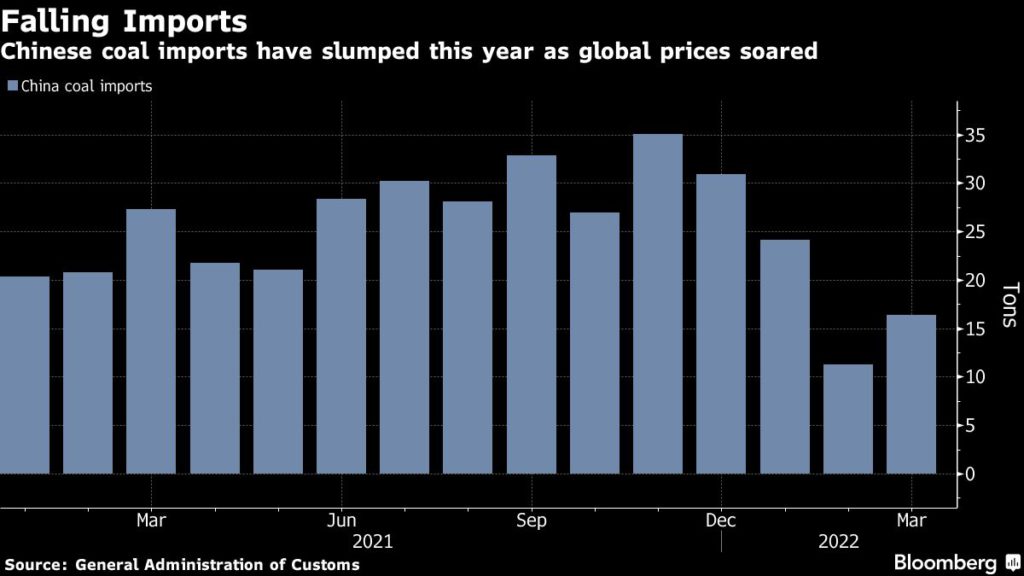

Current tariffs range from 3% to 6% depending on the type of coal, the ministry said in a statement dated April 26 and posted to its website Thursday. China’s coal imports are down 24% through the end of March this year as global prices have soared.

The nation instituted import tariffs on coal in 2014, charging 5% or 6% for different types of power plant coal, and 3% on anthracite and coking coal for steel-making.

“We see Russian coal as likely the main beneficiary,” Morgan Stanley analysts including Sara Chan said in a research note. The move could be a response “to domestic coal logistics disruptions” in Qinhuangdao, they said.

Qinhuangdao, a key coal port city in the northern Chinese province of Hebei, locked down a district Thursday following coronavirus infections.

Indonesia, China’s largest coal supplier, already enjoys zero import tariffs thanks to a previous deal. Australia does, as well, but China halted imports from the nation in 2020 amid a geopolitical spat.

After Indonesia, Russia was China’s second-biggest supplier last year. Chinese buyers last month began paying for some Russian coal in yuan to avoid international financial institutions amid U.S. and European sanctions on Russia.

China’s leaders have been obsessed with increasing coal supplies ever since a shortage of the fuel caused widespread power curtailments last fall. It’s leaned heavily on domestic miners, asking them to increase capacity by 300 million tons this year after they hit record production levels last year.

Imports have sagged, though, as seaborne prices have surged even as China put price caps on domestic fuel. China’s southern coastal provinces, which are farther away from the northern mining hubs, are particularly reliant on imports.

Earlier this month, an executive at the China Coal Transportation and Distribution Association said those regions are once again at risk of shortfalls of the fuel for industry and cooling needs.

The tariff reduction “is unlikely to lead to a substantial increase in China’s coal import volume, given artificially depressed coal prices in the domestic market,” Chan said in the note.

(With assistance from Kathy Chen and David Stringer)

No comments:

Post a Comment