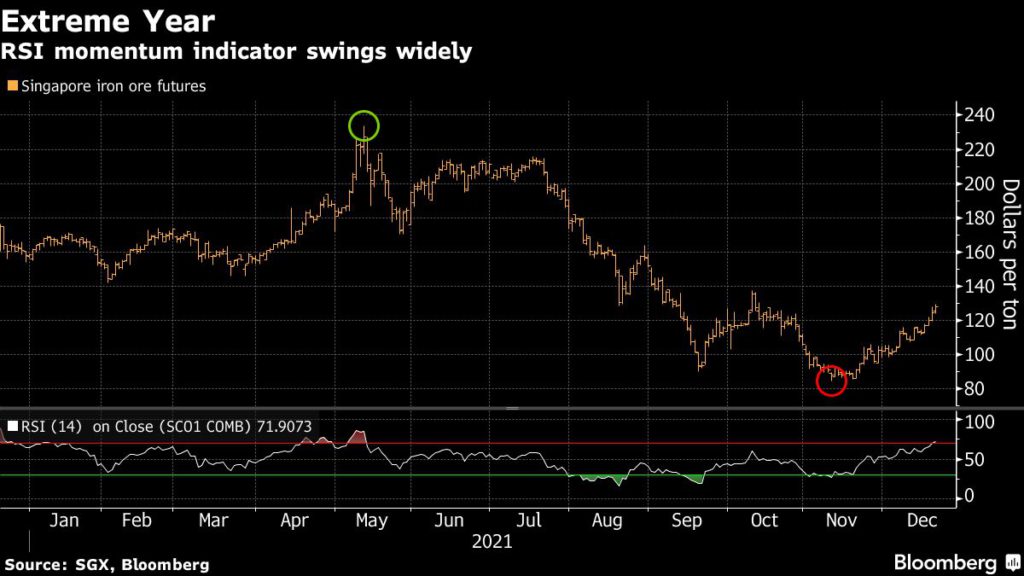

The iron ore price went on a white knuckle ride in 2021.

According to analysts, the volatility is set to persist into 2022. Here are the top iron ore stories of 2021.

#1 China

Iron ore is a barometer for the Chinese economy, so Chinese steel curbs to control carbon emissions set the tone for the metal’s performance during the year.

In March, the Tangshan government issued a second-level pollution alert, urging heavy industrial companies such as steelmakers and coking plants to cut production accordingly.

The move dampened the market’s optimism about a post-Lunar New Year demand boost for iron ore in the world’s top steel producer.

Concerns about the debt problems of Chinese property developers, a sector that accounts for about a quarter of the domestic steel demand, also added pressure on prices of iron ore and steel.

After rumours of financial difficulties, heavily indebted property giant Evergrande failed to sell assets to raise money and missed a September 23 deadline on an $83.5 million interest payment due on some of its dollar-denominated bonds.

The iron ore price in China sank to the lowest close in nearly three years as fears over the real estate market deepened.

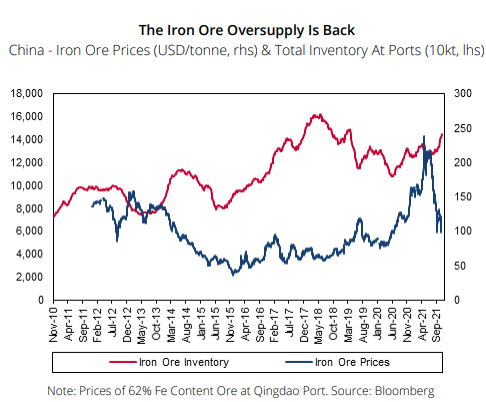

#2 Oversupply is back

On the supply side, improving production growth from Brazil and Australia has started to loosen tight supplies on the seaborne market.

Vale is working at a current iron ore production capacity of 330 million tonnes. The company’s Q1 2021 iron ore production was 68 million tonnes, 14.2% above Q1 2020, while Q2 2021 production came in at 76 million tonnes, 12% higher than Q2 2020.

Meanwhile, in Australia, Fortescue beat its full-year shipment estimate with a total volume of 182 million tonnes in FY2021 and set shipment guidance for FY2022 at 180-185 million tonnes.

Similarly, BHP reported iron ore production of 253.5 million tonnes for FY2021, which sits at the upper end of its forecast range.

“Among the major producers, only Rio Tinto painted a dismal outlook in its half-yearly results, warning that shipments are likely to come in at the bottom end of its 325-340 million tonnes guidance for 2021 at best, and this would require a significant ramp-up in output over the next five months,” said Fitch.

Related read: RANKED: World’s top 20 biggest iron ore operations

#Simandou

While major producers had positive outlooks in 2021, one treasure remained untouched.

At two billion tonnes of iron ore with some of the highest grades in the industry, the giant Simandou deposit in Guinea continued to be the subject of dispute between Vale and Israeli billionaire Beny Steinmetz.

In December, Steinmetz was arrested in Greece after a Swiss court found him guilted of minerals rights-related bribery in January.

TIMELINE: The battle for Simandou

At full production, the concession would export up to 100 million tonnes per year and be by itself the world’s fifth-largest producer behind Fortescue Metals and BHP.

#2022

Strong headwinds are building for iron ore next year.

China is pushing ahead with cutting carbon emissions ahead of the 2022 Winter Olympics in Beijing, steel output is expected to shrink for a second year, while the debt-laden property sector is weighing on steel consumption and broader growth.

“Iron ore demand will broadly, gradually decline,” said CITIC Futures Co. analyst Zeng Ning.

“The property industry is rather weak, steel consumption is likely to contract and more mills will use scrap to reduce emissions.”

UBS Group AG expects iron ore to average $85 a tonne in 2022, while Citigroup sees $96. Capital Economics predicts $70 by the end of next year.

“We are neutral on iron ore prices in the near term, given the collapse they recorded in H2 21. However, we see them trending lower later in 2022, and averaging $90 tonne next year,” Fitch said in a report.

Among bright spots are potential fiscal stimulus in China, possible further easing in monetary policy, and more support for the property industry, while steel output could rebound when limits are removed after the Olympics.

(With files from Reuters and Bloomberg)

No comments:

Post a Comment