https://www.bloomberg.com/news/articles/2018-02-14/opec-russia-to-discuss-new-oil-inventory-measurements-in-april

-

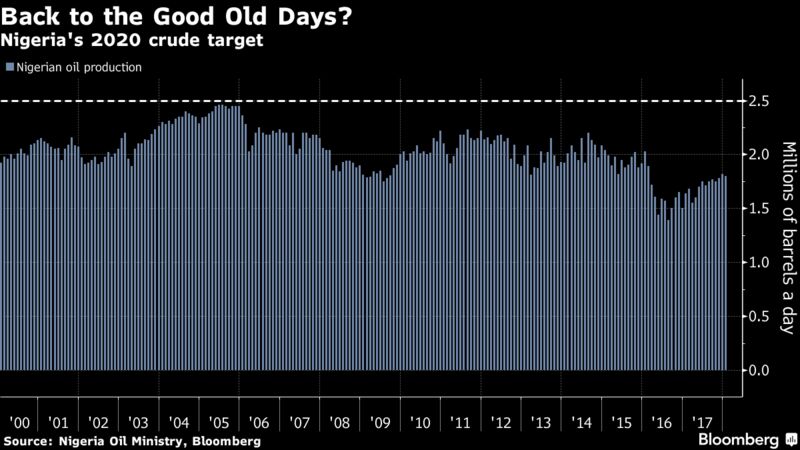

Nigeria limiting oil production to 1.8 million barrels a day

-

Domestic companies are planning to bolster their output

Add independent Nigerian drillers to the list of oil producers

itching to supply more crude at a time when OPEC and allies like Russia

are trying to restrict output and prop up prices.

Domestic

Nigerian producers are aiming to pump almost 250,000 barrels a day more

crude by 2020 as part of a wider plan for the nation to lift output to

2.5 million a day, Oil Ministry data show. Shoreline Group, the third-biggest independent, wants to double output by December with Seplat Petroleum Development Co., the second-largest, also intending to produce more.

They

are planning to add barrels at the same time as Nigeria participates in

a global pact to restrict oil supply that’s being led by the

Organization of Petroleum Exporting Countries and non-member nations

including Russia. If any one country relents -- and similar internal

pressures are bubbling up elsewhere -- then the entire deal could come

under strain.

“If they can pump more in Nigeria, I don’t see why they

wouldn’t,” said Warren Patterson, a commodity strategist at ING Bank NV.

“If you get Nigeria exceeding the cap, then you’re going to get others

who pump a little bit more. The longer the deal goes on for, the more

likely it’s going to fall apart.”

Not Alone

Countries

and companies both inside and outside OPEC are looking to add

production. Iraq is building infrastructure to allow a huge increase in

capacity, while Iran’s oil minister has said the country can produce

more almost instantly. An Angolan field will come on stream by year end

and add 250,000 barrels daily, while companies in Russia pushed to pump

more before the country renewed its supply-curbs deal with OPEC late

last year.

Along with Libya, Nigeria’s involvement was critical

when OPEC agreed with non-member producers to extend global curbs to oil

production until the end of 2018. It pledged not to let output exceed

1.8 million barrels a day in 2018.

The country’s total planned

increase is 700,000 barrels a day. Just over a third will come from the

state-run Nigeria Petroleum Development Co., a third from independents,

and the remainder from oil majors. The expansion depends, among other

things, on peace being maintained in the Niger Delta. A militant group said last month it would attack oil and gas facilities.

Refinery Feed

One

probability is at least some of the extra Nigerian supply will end up

feeding the Dangote oil refinery, the continent’s largest, which is due

to start operating next year. While doing that would help rid Nigeria of

its dependence on fuels produced overseas, it wouldn’t extricate the

country from its commitments to OPEC.

Back in 2016, Shoreline had to cancel a planned $500 million

Eurobond. With oil prices rallying, the company is making a comeback. It

agreed a $530 million deal with financiers led by Vitol Group, the world’s biggest independent oil trader, as it seeks to double crude output to 100,000 barrels a day by year end.

“It

represents a massive vote of confidence in the future growth of our

operations and of Nigerian upstream producers,” Kola Karim, chief

executive officer of Shoreline, said in an interview.

Shoreline’s

progress mirrors that of other Nigerian independents. Seplat, said to be

among companies bidding for Petroleo Brasileiro SA’s African oilfields,

expects to ramp up drilling this year after output recovered from

militant attacks and low prices, according to company statements.

“We

are on course,” Emmanuel Kachikwu, Nigeria’s Minister of State for

Petroleum Resources, said Thursday of the goal to pump 2.5 million

barrels a day by 2020. “Capacity-wise, the volumes are there.

Infrastructure-wise we suffer a little bit in terms of being able to

deliver.”

There are at least a dozen small to mid-sized Nigerian

producers pumping between 5,000 and 100,000 barrels each day. Together,

they plan to add incremental supply of at least 150,000 barrels a day

this year. Aiteo E & P Ltd., Nigeria’s largest independent, didn’t

immediately comment about its expansion plans.

Half a decade ago,

these producers were hailed as the future of Nigeria’s production

because of their potential to pump 40 percent of the OPEC member’s

output. They had bought oilfields that hold at least a third of the West

African nation’s 37.5 billion barrels of crude reserves from companies

including Royal Dutch Shell Plc, Total SA and Eni SpA.

Their

day may still come. The OPEC deal is currently in place until the end

of this year and global demand is rising fast. The International Energy

Agency this month revised up its growth estimate for world oil

consumption by 100,000 barrels a day, taking it up to 1.4 million.

“As

the oil market rebalances in the years ahead, OPEC will have to lift

its production cap,” Pabina Yinkere, an energy analyst at Lagos-based

Vetiva Capital Management, said by phone, adding that a lot of extra

Nigerian crude could be used to feed the Dangote refinery. “Moves to

raise production is in view of expected demand growth.”

— With assistance by Alex Longley

No comments:

Post a Comment