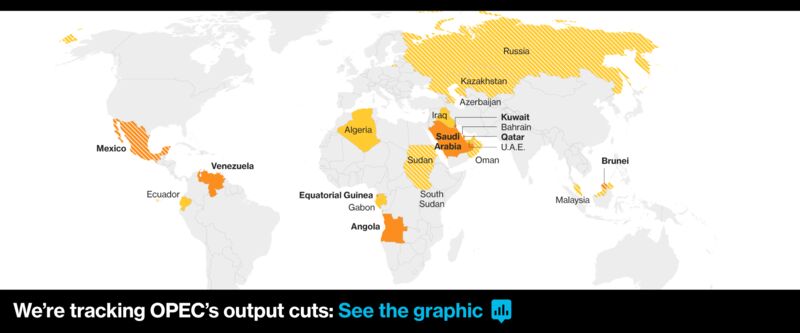

Which Countries Reached Their Output Target in May?

Eight of 21 countries involved reached their target-

Ministers will discuss supply curbs in St. Petersburg July 24

-

Changing the current deal would send wrong message: official

Russia wants to stick to the current OPEC deal and would oppose any

proposal for deeper production cuts at the group’s ministerial meeting

later this month, said four Russian government officials.

Any

further supply reductions so soon after the existing agreement was

extended would send the wrong message to the oil market, said one of the

people. Such a move would suggest that OPEC, Russia and their allies

are nervous that their pact to reduce output by a combined 1.8 million

barrels a day through March 2018 isn’t doing enough to support prices,

the official said. All four people spoke on condition of anonymity.

Russia plans to host a meeting of some ministers from

the Organization of Petroleum Exporting Countries and several

non-members in St. Petersburg on July 24. They will discuss progress

toward eliminating a global supply glut, just as doubts swirl

about whether the cuts will be successful amid a resurgence in U.S.

shale output. While Brent crude has rebounded from a seven-month low

reached in June, analysts including Goldman Sachs Group Inc. say the

supply curbs need to be intensified.

Russia’s publicly traded oil producers, both state-led and

non-state, have voluntarily reduced output by about 300,000 barrels a

day from a post-Soviet record reached in October in order to support

prices. Energy Minister Alexander Novak agreed in May to extend that

reduction for nine months to the end of the first quarter of 2018.

Part

of the government opposes both more cuts and any further prolongation

of the deal, another of the people said. The longer the output curbs

remain in place, the worse the volatility when producers are released

from the accord, the person said.

Brent oil in London was 5 cents

lower at $49.56 a barrel as of 12:04 p.m. in Hong Kong on Wednesday.

Front-month prices fell Tuesday for the first time in nine sessions. The

global benchmark crude lost 9.3 percent in the previous quarter.

No comments:

Post a Comment