Wednesday, December 31, 2025

Tuesday, December 30, 2025

Monday, December 29, 2025

Tuesday, December 23, 2025

Thursday, December 18, 2025

Tuesday, December 16, 2025

Monday, December 15, 2025

Friday, December 12, 2025

Wednesday, December 10, 2025

Tuesday, December 9, 2025

Iraq Offers U.S. Oil Giants Russia’s 14 Billion Barrel Lukoil Oilfield Stake

Iraq has invited major U.S. oil companies to develop the giant West Qurna 2 field following Russian energy giant Lukoil’s forced exit under Western sanctions. The move represents a significant shift in Iraq’s energy partnerships and a major opportunity for American firms to regain ground in one of the world’s largest oilfields.

The Field

West Qurna-2 is one of the world’s largest onshore oilfields, located 65 kilometers northwest of Basra in southern Iraq. The field holds initial recoverable reserves of approximately 14 billion barrels, with more than 90% concentrated in the Mishrif and Yamama formations.

The field currently produces about 9% of Iraq’s total oil output, with capacity reaching 480,000-500,000 barrels per dayfollowing completion of its second development phase. At peak efficiency, the field can sustain production between 635,000 and 650,000 bpd.

Lukoil’s Exit

Russian oil company Lukoil held a 75% operating stake in West Qurna-2, with Iraq’s state-owned North Oil Company holding the remaining 25%. Lukoil declared force majeure at the field after the United States rejected a sanctioned asset sale, effectively forcing the Russian company out of the project.

In early December 2025, Iraq temporarily shut down production at the field due to a pipeline leak, though operations were later restored. The disruption added urgency to Iraq’s search for a new operator.

U.S. Companies Enter the Race

Iraq’s Oil Ministry has now extended exclusive invitations to several major U.S. energy firms to take over development of West Qurna-2. Chevron has entered the race for the field, while ExxonMobil is in active talks with Iraqi officials about acquiring Lukoil’s stake.

ExxonMobil recently signed agreements to develop Iraq’s Majnoon oil field, marking the company’s return to Iraqi upstream operations after exiting the West Qurna-1 project in early 2024. The Majnoon deal demonstrates ExxonMobil’s renewed commitment to Iraq and positions the company as a strong contender for West Qurna-2.

Strategic Context

The shift represents a reversal of Iraq’s energy trajectory over the past decade, during which Russia and China built deep leverage in the country through oil contracts, pipeline control, and ties to Iran-backed groups. Western companies are now regaining ground through major new deals:

- TotalEnergies launched the final phase of Iraq’s Gas Growth Integrated Project (GGIP) in September 2025

- BP maintains significant operations in the Rumaila field

- Chevron and ExxonMobil are both pursuing expanded Iraqi portfolios

A senior legal source working closely with the U.S. Treasury Department told OilPrice.com that the development marks “a huge turnaround in the trajectory it [Iraq] had been headed with Russia and China, marking a massive win for us [the U.S.] and Europe.”

Development Plans

Under a 2023 supplementary agreement that Lukoil signed with Basra Oil Company, the field development plan called for:

- Doubling production capacity to 800,000 bpd by 2025

- Bringing new multi-well pads into production

- Commissioning complex gas treatment plants for the Yamama formation

- Construction of export pipelines and water flooding units

- Expansion of tank battery infrastructure

The incoming U.S. operator will inherit these development plans and the responsibility for executing the next phase of expansion.

Bottom Line

West Qurna-2 represents one of the most significant oilfield opportunities to emerge in years. With Lukoil’s forced exit under sanctions, U.S. energy companies have a chance to secure long-term access to world-class reserves while strengthening America’s strategic position in Iraq. The outcome of current negotiations will shape both Iraqi energy policy and U.S.-Iraq relations for decades to come.

Monday, December 8, 2025

Friday, December 5, 2025

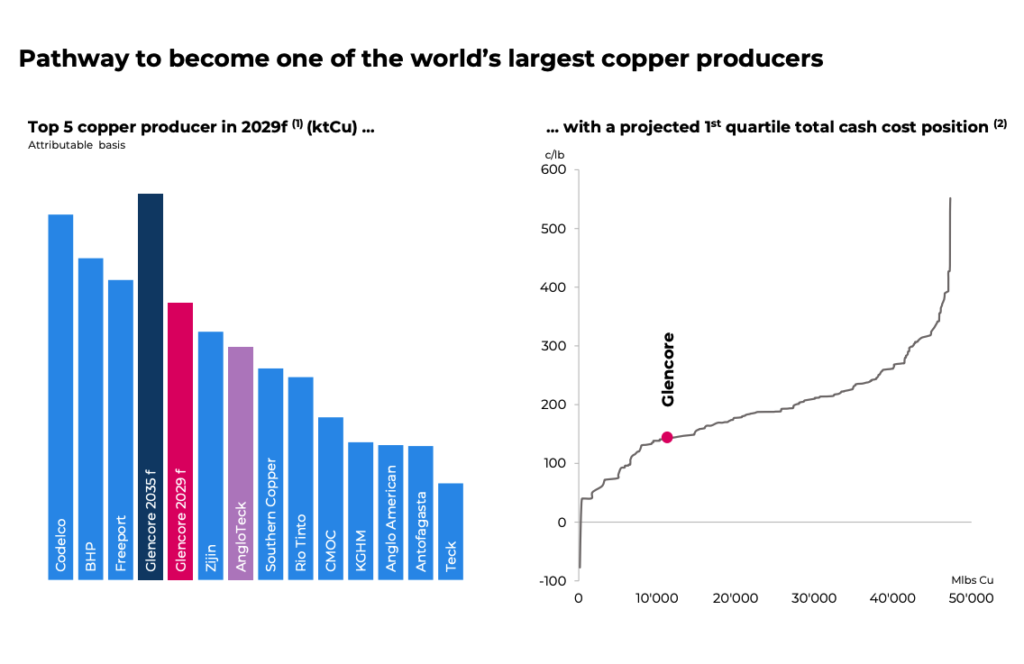

Glencore cuts 2026 copper target but sets up for long-term surge

https://www.mining.com/glencore-cuts-2026-copper-target-but-sets-long-term-surge/

Mining and commodities giant Glencore (LON: GLEN) plans to expand annual copper production to about 1.6 million tonnes by 2035 as it seeks to reverse a multi-year slump in output.

Chief executive Gary Nagle told investors in London that the company expects its base copper business to exceed 1 million tonnes a year by the end of 2028, positioning Glencore among the world’s five largest producers.

The push comes as global miners race to increase supply, even as Glencore’s own copper output is set to fall for a fourth straight year and sit about 40% below 2018 levels.

The Swiss miner has faced pressure after its shares hit their lowest since 2020 and investors complained about repeated production cuts and operational underperformance. In response, Glencore has launched a sweeping operational review, which will see it cut about 1,000 jobs. It targets roughly $1 billion in recurring cost savings by the end of 2025, the miner announced at its first investor day in London in three years.

Copper prices hit a fresh record above $11,400 a tonne on Wednesday, extending a 30% gain this year on the back of supply disruptions and strong investor demand tied to electrification and the energy transition.

Eyes in South America

Despite outlining long-term growth plans, Glencore cut its 2026 copper guidance to 810,000–870,000 tonnes from a previous 930,000-tonne target after setbacks at Chile’s Collahuasi mine, which it jointly owns with Anglo American (LON: AAL). The company also lowered its zinc and cobalt forecasts for next year.

The Swiss firm reiterated that copper output should reach 1 million tonnes by 2028 and said the restart of its Alumbrera mine, in the Catamarca Province of Argentina, will support that ramp-up.

The operation is expected to restart in Q4 2026, with first production in the first half of 2028. Once fully operational, it is expected to produce about 75,000 tonnes of copper, 317,000 ounces of gold and 1,000 tonnes of molybdenum over four years.

“These projects are mostly brownfield and expected to be highly capital efficient,” Nagle said. He added that Glencore would be looking for partnerships to “reduce financial and operations risks” in certain projects.

Glencore noted the restart offers strong stand-alone economics and serves as a natural enabler for the Minera Agua Rica–Alumbrera (MARA) project by reducing ramp-up risk for the concentrator and downstream logistics, maintaining and retraining the workforce ahead of first ore, and keeping critical infrastructure active for shared use, generating operational synergies.

Keeping Chile footprint

In neighbouring Chile, Glencore plans to keep an equal share in its copper joint venture with Anglo American should the partners eventually merge the Collahuasi operation with Teck Resources’ (TSX: TECK.A TECK.B, NYSE: TECK) nearby Quebrada Blanca mine once Anglo acquires Teck. “We won’t be a junior partner,” Nagle said, adding Glencore could inject cash to keep its stake level in any future combination.

Teck and Anglo shareholders will vote next week on the deal to create a copper-rich mining giant, with the two Chilean assets seen as a central motivation. The expectation that Collahuasi and Quebrada Blanca could be integrated to unlock major cost savings has circulated for years.

Nagle said any combination must reflect Collahuasi’s improved relative value after recent setbacks at Quebrada Blanca. “We’re not ignorant to some adjacent potential synergies,” he said. “At a minimum, the value attributed to the two properties, the value has materially moved towards Collahuasi.”

.jpg)