Boric pledged to decentralize Chile, implement a welfare state, increase

public spending and include women, non-binary Chileans and Indigenous

peoples. (Image courtesy of YouTube.)

A leftist millennial who rose to prominence during anti-government protests in 2019 was elected on Sunday as Chile’s next president, following a bruising campaign against a free-market and anti-immigrant candidate often likened to Donald Trump.

“We trust that the spirit of programmatic convergence, moderation and openness to dialogue shown during the last week of the campaign will prevail,” Sonami said in a statement.

Boric, a 35-year-old former law student, vowed during his campaign to bury Chile’s “neo liberal” economic model. Although he later softened his message, he has kept the idea of giving the State a more active role in the sector, as well as higher royalties.

He is also a fierce supporter of a state lithium firm and green investments. Since Chile is the world’s top copper producer and also has the largest known reserves of lithium, Boric’s vision could prove positive for the country if he is able to deliver on his campaign promises.

Mind-blowing scenes in Santiago, where hundreds of thousands have flocked onto the streets to celebrate Gabriel Boric’s victory pic.twitter.com/uirvG1mVBg

— John Bartlett (@jwbartlett92) December 20, 2021

Both copper and lithium are among the most coveted commodities as they are both used in electric vehicles (EVs) and infrastructure to support other green technologies.

During his victory speech, Boric reiterated he would oppose mining initiatives that “destroy” the environment, particularly the controversial $2.5 billion Dominga copper and iron ore project that was approved this year.

“Destroying the world is destroying ourselves. We do not want more ‘sacrifice zones’, we do not want projects that destroy our country, that destroy communities and we exemplify this in a case that has been symbolic: No to Dominga,” he said.

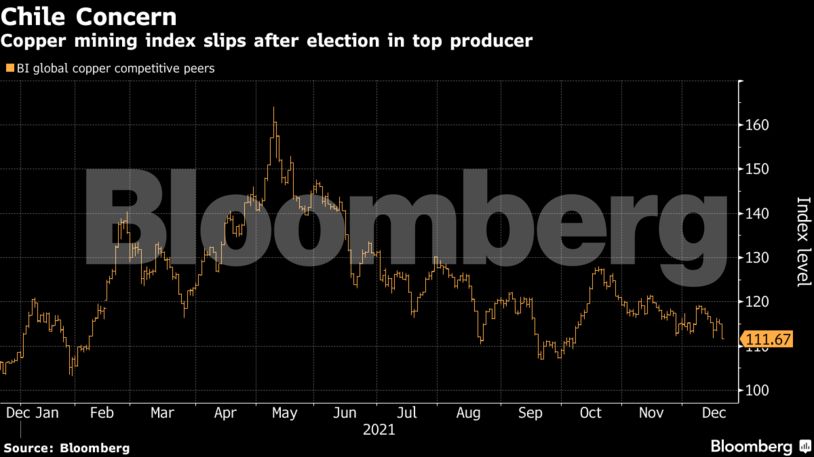

While the political shift isn’t likely to have immediate supply impacts, a slowdown in permitting or higher costs imposed by the government could slow investment in capacity to produce copper, a metal seen as key to the energy transition. That could send prices back up to record levels seen earlier this year.

“Copper and lithium miners will naturally be in the crosshairs, particularly with both commodities at or close to record prices, while we would expect a weakening of the Chilean peso,” BMO Capital Markets analyst Colin Hamilton said in a note.

Boric’s victory spells good news for copper producers outside of Chile in the medium term, according to Hamilton. Any additional delays to potential projects as they wait for approval while the new government pushes new legislation through Congress could add to copper supply issues.

Changes ahead

Born in 1986 to an educated middle-class family in the country’s southernmost Punta Arena region, Boric attended one of the most elite private schools there before studying law at the University of Chile in Santiago. He didn’t graduate, but it took his interest in activism to new heights.

In 2011, he became one of the main leaders of a historic student movement demanding free education for all, which eventually led to a wide educational reform. In 2013, he was elected to Congress, and in 2016, he started his own political party, the Autonomist Movement.

Political scientists, Including Chilean Eugenio Tironi, have highlighted that Boric’s vision connects with this century’s agenda: climate change, feminism, decentralization, green economy, diversity and direct democracy.

It will be challenging delivering on his equality promises as Chile, once the most stable economy in Latin America, also has one of the world’s largest income gaps. About 1% of the population owns 25% of the country’s wealth, according to the United Nations.

Boric, Chile’s youngest president in history, has promised to address this inequality by expanding social rights and reforming the country’s pension and healthcare systems, as well as reducing the work week from 45 to 40 hours, and boosting renewable energy.

Other major challenges include the delicate redrafting of a constitution to replace the divisive text adopted in 1980 during General Augusto Pinochet’s regime.

Mining royalty bill

The election happened against the backdrop of a controversial tax reform bill that could put a third of the world’s copper supply at risk.

Under the proposed change, the “royalty” rate – the amount taken by the government – would be based on output rather than profits and could rise to 75% when copper prices exceed $4 per pound.

Around 14 of the country’s large copper mines have production costs above $2.50 per pound. With a royalty, many could be forced to close when prices slip again.

Click here for an interactive chart of copper prices

“Many low-grade operations will be put out of businesses, destroying jobs,” Manuel Viera, president of the Chilean Mining Chamber, said in May.

The full impact of the new tax would not be felt immediately. According to the Mining Council of Chile, most privately owned mines are covered by tax invariability agreements signed with the State until 2023.

The government has projected mining investments of about $70 billion through the end of the decade, most from private firms.

Chile produced last year a third of the world’s copper in the form of concentrates, anodes and cathodes. The nation is also the no. 2 producer of lithium and is home to large zinc, molybdenum, gold, silver and lead reserves.

It’s estimated that Chile would need $150 billion in investment to hit its goal to nearly double copper output by 2050.

Chile’s peso fell over 3% and shares in lithium giant SQM (NYSE: SQM) slumped more almost 13% on Monday as markets woke up to the news of Chile’s new president.

SQM has been in the crosshairs over the potential environmental impacts of its operation in Chile’s dry north.

(With files from Bloomberg)

No comments:

Post a Comment