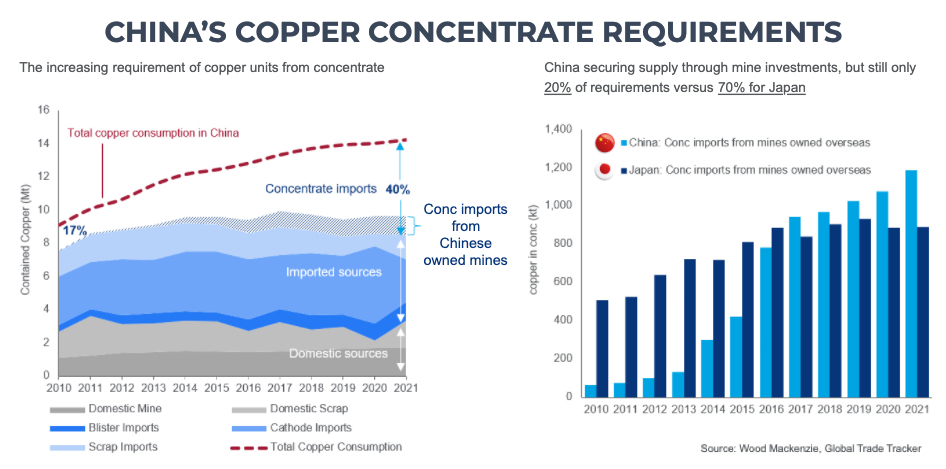

China consumes nearly 14 million tonnes of copper each year – more than the rest of the world combined. But domestic supply last year was only around 2m tonnes, including scrap, and mined output has been stagnant for years.

In a presentation at the Wood Mackenzie LME Forum, Nick Pickens, research director for copper markets, showed two graphs that put China’s significant copper supply challenges in perspective.

Imported concentrate, including from roughly 30 Chinese-owned mines in Africa and elsewhere, now supplies 40% of the country’s needs, a share that has more than doubled over the past decade as imports set fresh records every year.

Tanked up on Tenge

Over and above direct foreign investment in mining projects around the world China, has splashed more than $16 billion on buying overseas copper companies and assets since 2010.

Glencore’s disposal, under some duress, of Las Bambas in Peru to a Chinese consortium, China Moly’s 2016 acquisition of the Tenke Fungurume mine from Freeport for $2.65 billion and Zijin Mining’s joint venture with Ivanhoe Mines on the Kamoa-Kakula mine, both in the Congo, are three high-profile examples.

Turning Japanese

But if China is to follow the Japanese model of securing long term supply to feed its downstream industry — it has some work to do.

Japan has managed, through well-known companies like Sumitomo, Marubeni and Mitsui acquiring minority interests and JVs in scores of projects, to own 70% of the copper in concentrate it imports.

While larger in absolute terms at just shy of 1.2 million tonnes of metal in concentrate, Chinese-owned companies overseas supply only 20% of the country’s needs. Needs that have grown significantly in just the last few years on breakneck refinery buildouts.

Scramble for Africa

Asked which regions have the best investment potential Pickens said that it pretty much aligns with the current environment although investing in Chile and Peru has become a riskier proposition as political pressure increases in the two top producing nations.

Vast reserves in the central Africa copper belt remains attractive, likewise North America, and further out Ecuador and Argentina could become the next copper frontiers, according to Pickens.

China enjoyed a pretty much open field in Africa, its number one copper – and crucially, cobalt – destination by some stretch, but the Congo is now chafing under some of these investments.

China may in the future also have to compete with the likes of BHP, which recently said it could consider looking at erstwhile no-go areas like Zambia or Congo following its foray into Ecuador (rumours of a BHP tie-up with Ivanhoe in the DRC remain just that at the moment though).

No comments:

Post a Comment