https://www.mining.com/web/gold-heads-for-yearly-gain-as-market-eyes-rate-cuts-in-2024/

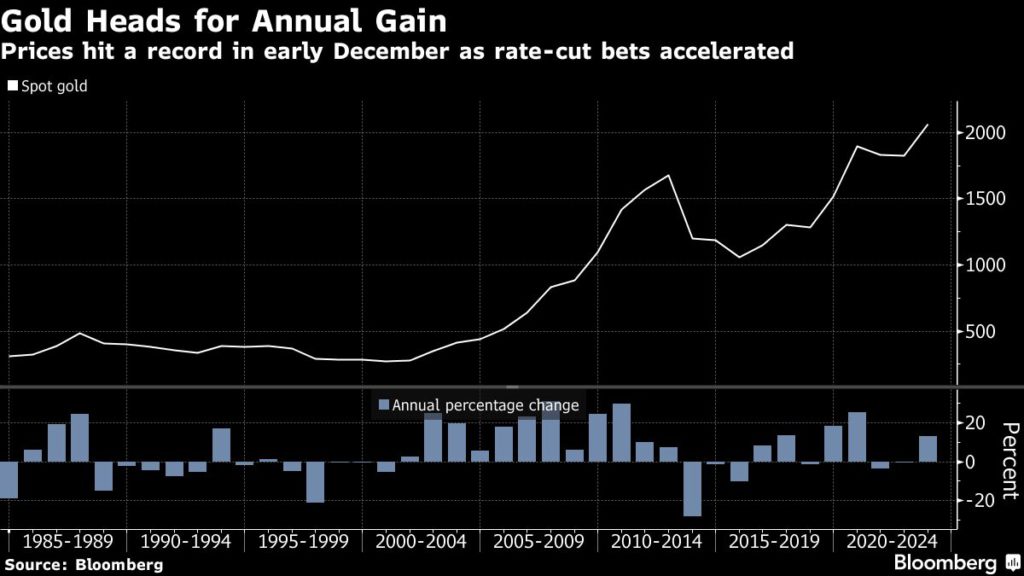

Gold headed for its first annual gain in three years as investors doubled down on bets that the Federal Reserve will start to unwind its restrictive monetary policy stance in 2024.

The precious metal typically has an inverted relationship with interest rates — the lower rates fall, the higher gold climbs. This year’s price movement has mostly been dictated by changing views on the Fed’s next steps on interest rates.

There has been growing expectation since October that the Fed will pivot to monetary easing in 2024 as inflation eases and the US labor market cools. Concerns around recession risks also boost the case to own debt, with traders betting global central bankers may have to aggressively cut rates to bolster growth. Such views have seen bullion gain nearly 13% since Oct. 6 amid declines in Treasury yields and the dollar, which is on pace for its worst year since 2020.

Gold surged to a record high in early December as traders bet the US central bank will start cutting rates at a sharper pace next year, only to quickly give up those gains when those positions were seen as overdone. It surged above $2,000 again in mid-December after Fed officials in their last meeting of the year gave the clearest signal yet that an aggressive rate hike campaign is over.

One important force behind gold’s strength has been central banks’ record buying of the haven asset. Such ferocious purchases help bullion trade at a significant premium to real Treasury yield — one of its biggest drivers — on a historical basis.

Gold has also been underpinned factors including geopolitical uncertainty, with 41% of the world’s population due to go to the polls in 2024.

Gold was little changed $2,064.79 an ounce as of 11:46 a.m. in New York.

(By Yvonne Yue Li)

No comments:

Post a Comment