Base metals headed for the worst quarterly slump since the 2008 global financial crisis as China’s economy recovered only gradually and fears of a world recession intensified.

A gauge of Chinese factory activity expanded in June for the first time since February, as virus controls were eased. The improvement was fairly muted, however, and a weak property market continues to weigh on metals demand. The Covid Zero policy also remains intact, despite relaxation of quarantine rules, meaning there’s a constant risk of more restrictions if case numbers pick up again.

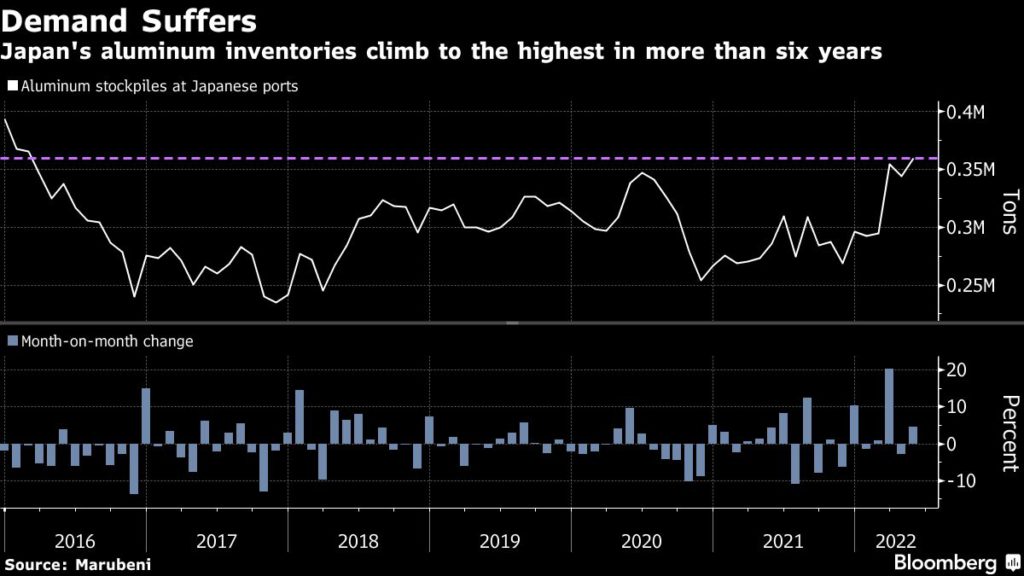

China’s lockdowns have also caused severe knock-on impacts in Japan, where industrial output slumped 7.2% in May, undershooting estimates of a 0.3% decline. The nation is Asia’s biggest importer of aluminum, and stockpiles of the metal in major ports have swelled to the highest in more than six years as automotive demand slumps due to supply-chain constraints.

The looming threat of a recession in the US, and perhaps even globally, also continues to hang over the market. Federal Reserve Chair Jerome Powell and other central bankers warned the world is shifting to a regime of higher inflation at the European Central Bank’s annual forum in Portugal. At the very least, major economies are heading for a slowdown that will curb construction activity.

Zinc pared some of its declines Thursday on the London Metal Exchange, trading 2.8% lower to $3,265 a ton at 10:02 a.m. local time. Copper fell 0.9% to $8,324 a ton, while aluminum was 0.9% lower. Despite the chunky quarterly drop, the LMEX gauge is only down about 13% so far this year.

No comments:

Post a Comment