https://www.mining.com/iron-ore-price-sinks-amid-growing-pessimism-over-demand-outlook-in-china/

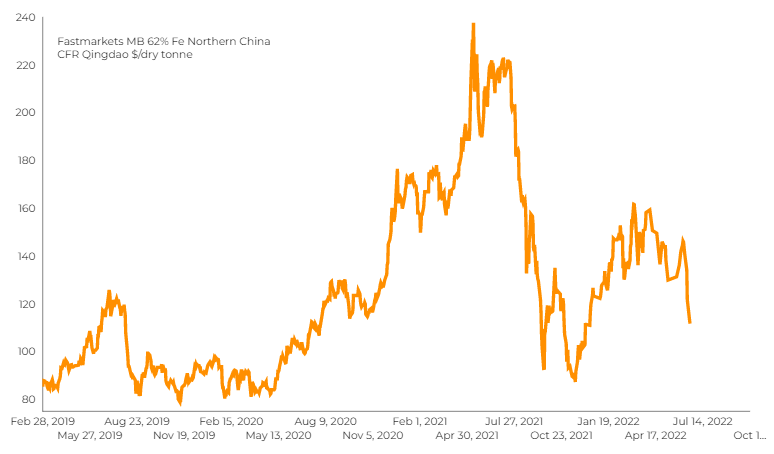

The iron ore price plunged more than 8% on Monday as steel mills idled blast furnaces amid growing pessimism over the demand outlook in China.

The most-traded iron ore contract, for September delivery on China’s Dalian Commodity Exchange ended daytime trade 11% lower at 746 yuan ($111.60) a tonne, its lowest since March 16.

Mining stocks also slid, with Vale down almost 8% from the previous week, Rio Tinto down 7% and Fortescue down 16%.

“Heavily subdued, covid-afflicted domestic steel consumption” continued to weigh on China’s ferrous complex, said Atilla Widnell, managing director at Navigate Commodities in Singapore.

China’s strict zero-covid policy of constantly monitoring, testing, and isolating its citizens to prevent the spread of the coronavirus has battered much of the country’s economy.

/fingfx.thomsonreuters.com/gfx/ce/jnvweowqjvw/China%20iron%20ore%20vs%20price%20June%2022.png_2.jpg)

The mainland reported 109 new coronavirus cases for June 19, compared with 159 a day earlier.

“Steel prices have dropped to 16-month lows as inventory rises,” analysts at Westpac said in a note.

Blast furnace rates in Tangshan fell last week for the first time since mid-May, with industry consultant Mysteel saying in a note that more mills are cutting output to do maintenance due to weak margins. An index of Chinese steel profits has plunged by almost 90% so far this month.

“With the slow spot trade, steel product prices have plunged, with more steel mills now losing money and hastening planned maintenance,” said Wei Ying, a ferrous analyst at China Industrial Futures.

“However, given the speed of the drop, iron-ore may have been oversold and there’s likely to be a rebound in the second half.”

Downstream demand remains poor with few spot trades occurring, and the bleak outlook for China’s construction industry continues to test market confidence, Mysteel said in a separate note.

A raft of supportive policy measures from Beijing over the last couple of months have failed to result in persistent price gains, with risks due to the virus and the Zero Covid policy continuing to hang over the market.

“Unless the real-estate sector mounts a stronger rebound soon — which remains far from certain — the tension between high output and weak demand will have to be resolved with lower prices, big cutbacks in production, or both,” Gavekal Dragonomics said in a note by analyst Rosealea Yao.

(With files from Reuters and Bloomberg)

No comments:

Post a Comment