JC

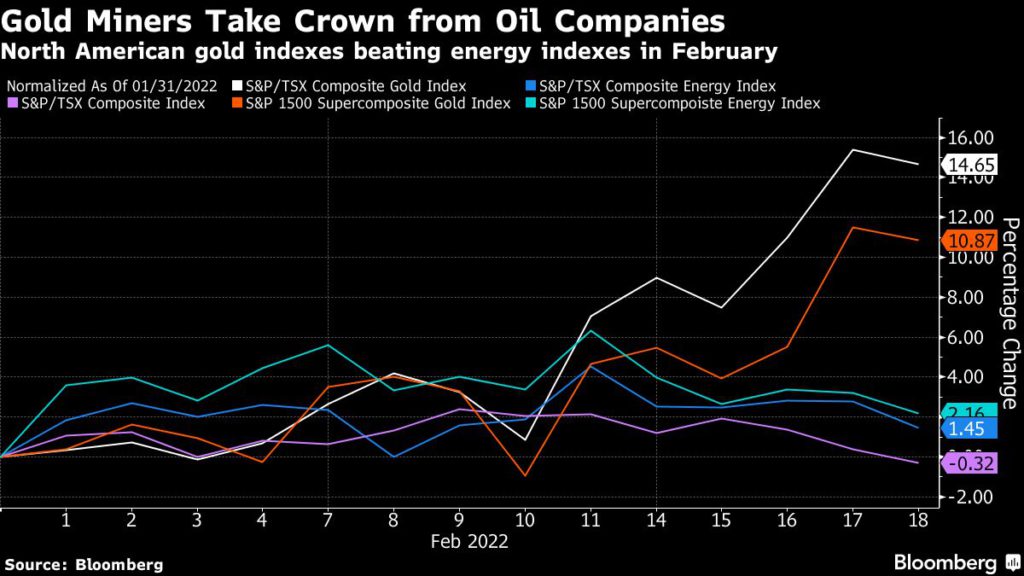

Oil and gas stocks have been the top performers in the U.S. and Canada to start the year, but gold miners are currently poised to steal that crown this month thanks to a combination of geopolitical risk in Europe and inflationary risk in North America.

“The short-term bid for gold driven by Black Sea military tensions, a spike in risky asset volatility, and inflation hedge demand will need to grapple with an increasingly hawkish Fed and higher policy rates come March,” Aakash Doshi, Citi’s head of commodities research in the Americas, wrote in a Feb. 17 research note.

Citi increased its near-term price target on gold to $1,950 per ounce — a $125/oz hike from its previous forecast — and upped its full-year outlook by 7% to an average of $1,805/oz.

However, the longer-term outlook for the precious metal is more challenged as the U.S. Federal Reserve and Bank of Canada move to raise interest rates. Doshi called gold a “pain trade” and noted his bearishness on gold for both the second half of this year and 2023, when he forecasts gold will fall to $1.675/oz.

(By Geoffrey Morgan)

No comments:

Post a Comment