-

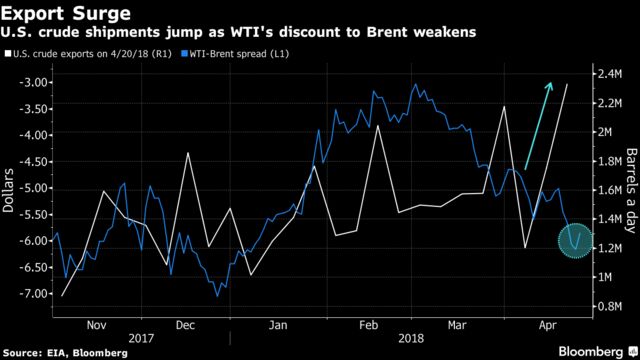

Soaring output, weak U.S. oil prices to fuel record outflows

-

American refiners may be near limits on local oil processing

Selling more than two million barrels a day of U.S. crude overseas may soon be the new normal.

The

U.S. sent out record amounts of crude to foreign destinations last

week, with domestic output hitting an all-time high, thanks to growth in

the Permian Basin.

The ballooning production has weakened benchmark West Texas

Intermediate crude at Cushing, Oklahoma, relative to its international

counterpart Brent, making it attractive to buyers overseas.

"We

will push into 2 million barrels a day consistently over the summer,"

said Rob Thummel, managing director at Tortoise, which handles $16

billion in energy-related assets. The nation will likely expand its

share in the world crude market to 18 percent from 12 percent in the

next couple of decades, he said.

Once the world’s largest importer of crude, the U.S. now is closing in on Russia

to become the world’s largest producer. America exported 2.33 million

barrels a day of oil last week, the highest on record going back 25

years, Energy Information Administration data released Wednesday showed.

This month, shipments averaged 1.76 million a day. The EIA also

reported that U.S. crude output jumped to 10.6 million barrels a day.

As

long as Permian production remains strong, that WTI "discount should

remain and then you definitely should still see strong demand for

exports,” said Joseph Bozoyan, a portfolio manager at Manulife Asset

Management LLC in Boston.

Earlier this month, WTI traded at the

biggest discount to its global counterpart since January. Signs that the

spread will widen further through the year will help boost exports as

traders may take advantage of cheaper U.S. oil.

Besides,

U.S. refineries may already be at their limits in terms of consuming

local shale oil which is almost entirely light, low-sulfur crude,

Thummel said. Plants sitting in the country’s main refining belt along

the U.S. Gulf Coast are designed to use mainly heavy, high-sulfur crude

and their intake of light, low-sulfur crude is at most a third of their capacity.

"This is where exports becomes more significant," Thummel said.

No comments:

Post a Comment