http://www.vox.com/2014/10/7/6934819/oil-prices-falling-russia-OPEC-shale-boom-gasoline-prices

The sharp drop in oil prices over the last month is arguably the biggest energy story in the world right now — with major repercussions for dozens of countries, from the United States to Russia to Iran.

Ever since 2011, oil prices have stayed consistently high, hovering around $100 per barrel. But this year, they've dropped as much as 20 percent since June — and some analysts now think they could keep nosediving in the months ahead:

/cdn3.vox-cdn.com/uploads/chorus_asset/file/2331306/oil_prices_brent.0.png)

If oil prices keep falling, that could have plenty of far-reaching effects. OPEC is already fighting bitterly over how to respond. Russia, a major oil producer, could see its economy crippled if prices decline. Some shale oil producers in North Dakota and Texas may find it unprofitable to keep drilling. And lower gas prices could bolster the US economy (though it would also curtail the recent drive for energy-efficient vehicles). Here's an over:

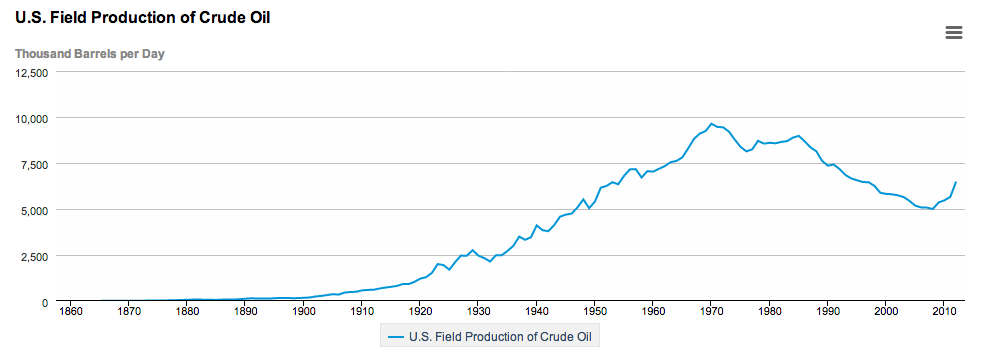

But that wasn't the end of the story. As oil prices surged, many energy companies suddenly found it profitable to start extracting oil from difficult-to-drill places. In the United States, companies began using techniques like fracking and horizontal drilling to extract oil from shale formations in North Dakota and Texas. That helped foster a boom in "tight oil" production.

But up until recently, that US oil boom has had a minimal effect on global prices. That's because, at the same time, we were also seeing all sorts of geopolitical conflicts elsewhere in the world. There was a civil war in Libya that hurt oil output. Iraq was a mess. The United States and Europe slapped oil sanctions on Iran and pinched that country's exports.

Tally it all up, and more than 3 million barrels per day of crude oil had been taken off the market by mid-2014 (global oil production is around 75 million barrels per day, so this is a significant fraction):

/cdn1.vox-cdn.com/uploads/chorus_asset/file/2332936/iaee4.0.png)

But over the past month, those disruptions have started easing a bit. Libya's oil industry has started pumping out oil again — with exports unexpectedly rising 810,000 barrels per day in September. It's also becoming clear that the Islamic State in Iraq and Syria (ISIS) likely won't threaten Iraq's biggest oil fields in the southern part of the country. And, at the same time, oil demand in Asia and Europe has started to weaken — particularly in China and Germany.

So now oil prices are falling, from their June peak of around $115 per barrel down to around $92 per barrel at the start of October.

Mind you, oil is still much, much pricier than it was a decade ago. And it's entirely possible that the recent drop could prove only temporary (after all, we saw price dips in 2012 and 2013, but new conflicts flared up in the Middle East and prices soon popped back up). But assuming the current drop is real — and sustained — it could have a very large impact around the world.

But it's unclear whether OPEC will actually do this at its next meeting in November. For one, there are bitter divisions within the organization. Some OPEC countries need very high prices to "break even" on their budgets and pay for all the government spending they've racked up in recent years. Iran, for instance, likely needs prices at around $130 per barrel. But Saudi Arabia can probably live with prices closer to $90 per barrel.

/cdn0.vox-cdn.com/uploads/chorus_asset/file/2332958/160934_5_.0.jpg)

Andrew Critchlow of The Telegraph reports that this is already causing tensions within OPEC: "Iran's Oil Minister Bijan Zanganeh [is] calling for Opec to urgently cut output to stem the sharp recent decline in prices, which threatens the Islamic Republic's fragile economy after years of restrictive sanctions. … However, the Gulf's Arab states are all sitting on huge cash piles that are held overseas through sovereign wealth funds and foreign currency assets that can be drawn upon to help them weather any short-term drop in oil export revenues."

How OPEC responds in November could go a long way to determining the course of oil. If the group agrees to curtail production, oil prices might rise again (or at least stabilize). But if OPEC lets things be, then oil prices could conceivably keep falling.

Indeed, some energy analysts are starting to wonder if an oil crash might even force Russia to pull back in Ukraine and elsewhere. And on Tuesday, the Russian finance minister warned that the country could no longer afford a multibillion-dollar upgrade to its armed forces that had been approved by President Vladimir Putin.

In the United States, meanwhile, a fall in prices would have more subtle impacts. Overall, cheaper oil would likely boost economic activity — as gasoline prices declined and US households spent less on fuel, giving them more money to spend on other things.

But a price drop wouldn't necessarily benefit everyone. Oil producers in the shale regions of Texas and North Dakota typically don't find it profitable to drill unless prices are relatively high. A report from analysts at Baird Energy this week suggested US oil production could see a "sustained pullback" if global prices stay below $80 per barrel.

A fall in prices could also affect vehicle sales. Over the past few years, average fuel economy for new cars and trucks in the United States has been rising sharply in response to higher gasoline prices. But in September, average fuel economy actually fell slightly. One possibility is that lower gas prices meant that more people were buying trucks and SUVs:

/cdn1.vox-cdn.com/uploads/chorus_asset/file/2333008/EDI_mpg_September-2014_small.0.png)

One final, major caveat to keep in mind: It's hardly guaranteed that world oil prices will keep falling. Yes, some analysts are now suggesting we've entered a new era of oil "abundance." But the world is highly unpredictable. Perhaps new conflicts will arise in oil-producing regions. Or perhaps the US oil boom will lose a bit of steam. Or perhaps something else unexpected will happen. Predicting the future is always difficult — but it's especially difficult when it comes to oil.

At Politico, Elana Schor points out that Washington DC has been slow to adapt to the recent oil slide

Another DC-oriented question: Could falling oil prices (and hence falling gasoline prices) affect the 2014 midterms? It's hard to say for sure, but many political analysts have been skeptical in the past that gas prices sway elections much one way or the other

The sharp drop in oil prices over the last month is arguably the biggest energy story in the world right now — with major repercussions for dozens of countries, from the United States to Russia to Iran.

Ever since 2011, oil prices have stayed consistently high, hovering around $100 per barrel. But this year, they've dropped as much as 20 percent since June — and some analysts now think they could keep nosediving in the months ahead:

/cdn3.vox-cdn.com/uploads/chorus_asset/file/2331306/oil_prices_brent.0.png)

(NASDAQ)

So why is this happening? Partly because the United States keeps producing more and more oil, but also partly because some conflict-ridden countries are starting to pick up production. Libya, for one, is boosting its oil output after civil war and internal tensions had shut things down for a spell. Iraq's oil sector is slowly recovering. All that new crude is flooding the market, causing global prices to dip. Meanwhile, potential economic slowdowns in both Germany and China are driving down forecasts for oil demand (and reducing prices further).If oil prices keep falling, that could have plenty of far-reaching effects. OPEC is already fighting bitterly over how to respond. Russia, a major oil producer, could see its economy crippled if prices decline. Some shale oil producers in North Dakota and Texas may find it unprofitable to keep drilling. And lower gas prices could bolster the US economy (though it would also curtail the recent drive for energy-efficient vehicles). Here's an over:

Why oil prices hit $100/barrel — and why they're now falling

Oil prices rose throughout the 2000s because global oil demand surged — especially in fast-growing China — and there simply wasn't enough oil production to keep up. That led to the sharp oil spike in 2008 and subsequent recession. And once the financial crisis waned, the same dynamics returned. Oil has hovered around $100 per barrel since 2011.But that wasn't the end of the story. As oil prices surged, many energy companies suddenly found it profitable to start extracting oil from difficult-to-drill places. In the United States, companies began using techniques like fracking and horizontal drilling to extract oil from shale formations in North Dakota and Texas. That helped foster a boom in "tight oil" production.

But up until recently, that US oil boom has had a minimal effect on global prices. That's because, at the same time, we were also seeing all sorts of geopolitical conflicts elsewhere in the world. There was a civil war in Libya that hurt oil output. Iraq was a mess. The United States and Europe slapped oil sanctions on Iran and pinched that country's exports.

Tally it all up, and more than 3 million barrels per day of crude oil had been taken off the market by mid-2014 (global oil production is around 75 million barrels per day, so this is a significant fraction):

/cdn1.vox-cdn.com/uploads/chorus_asset/file/2332936/iaee4.0.png)

(US Energy Information Administration)

That helps explains why oil has floated around $100 per barrel since 2011, despite the US boom. "The best explanation for that is that it's been a coincidence," said Michael Levi, an energy expert at the Council on Foreign Relations, in a recent interview. "We've had surprising US gains in production that have been offset by surprising losses elsewhere, due to geopolitical disruptions."But over the past month, those disruptions have started easing a bit. Libya's oil industry has started pumping out oil again — with exports unexpectedly rising 810,000 barrels per day in September. It's also becoming clear that the Islamic State in Iraq and Syria (ISIS) likely won't threaten Iraq's biggest oil fields in the southern part of the country. And, at the same time, oil demand in Asia and Europe has started to weaken — particularly in China and Germany.

So now oil prices are falling, from their June peak of around $115 per barrel down to around $92 per barrel at the start of October.

Mind you, oil is still much, much pricier than it was a decade ago. And it's entirely possible that the recent drop could prove only temporary (after all, we saw price dips in 2012 and 2013, but new conflicts flared up in the Middle East and prices soon popped back up). But assuming the current drop is real — and sustained — it could have a very large impact around the world.

OPEC is sharply divided over how best to respond

The big unknown is how OPEC might respond to this fall in prices. OPEC countries — including Saudi Arabia, Iran, Iraq, and Venezuela — still produce 40 percent of the world's oil. And OPEC members can, in theory, coordinate to cut back on production in order to prop up prices.But it's unclear whether OPEC will actually do this at its next meeting in November. For one, there are bitter divisions within the organization. Some OPEC countries need very high prices to "break even" on their budgets and pay for all the government spending they've racked up in recent years. Iran, for instance, likely needs prices at around $130 per barrel. But Saudi Arabia can probably live with prices closer to $90 per barrel.

/cdn0.vox-cdn.com/uploads/chorus_asset/file/2332958/160934_5_.0.jpg)

OPEC "break-even" prices in 2012. (Matthew Hulbert/European Energy Review)

Andrew Critchlow of The Telegraph reports that this is already causing tensions within OPEC: "Iran's Oil Minister Bijan Zanganeh [is] calling for Opec to urgently cut output to stem the sharp recent decline in prices, which threatens the Islamic Republic's fragile economy after years of restrictive sanctions. … However, the Gulf's Arab states are all sitting on huge cash piles that are held overseas through sovereign wealth funds and foreign currency assets that can be drawn upon to help them weather any short-term drop in oil export revenues."

How OPEC responds in November could go a long way to determining the course of oil. If the group agrees to curtail production, oil prices might rise again (or at least stabilize). But if OPEC lets things be, then oil prices could conceivably keep falling.

How falling oil prices affect other nations, from Russia to the US

Lower oil prices could have lots of knock-on effects around the world. Take Russia, which depends on oil sales to bring in foreign currency. The Russian government has set its three-year budget with the expectation that oil prices would stay at $100 per barrel. A sustained fall in prices could seriously hurt the Russian economy and drive up deficits.Indeed, some energy analysts are starting to wonder if an oil crash might even force Russia to pull back in Ukraine and elsewhere. And on Tuesday, the Russian finance minister warned that the country could no longer afford a multibillion-dollar upgrade to its armed forces that had been approved by President Vladimir Putin.

In the United States, meanwhile, a fall in prices would have more subtle impacts. Overall, cheaper oil would likely boost economic activity — as gasoline prices declined and US households spent less on fuel, giving them more money to spend on other things.

But a price drop wouldn't necessarily benefit everyone. Oil producers in the shale regions of Texas and North Dakota typically don't find it profitable to drill unless prices are relatively high. A report from analysts at Baird Energy this week suggested US oil production could see a "sustained pullback" if global prices stay below $80 per barrel.

A fall in prices could also affect vehicle sales. Over the past few years, average fuel economy for new cars and trucks in the United States has been rising sharply in response to higher gasoline prices. But in September, average fuel economy actually fell slightly. One possibility is that lower gas prices meant that more people were buying trucks and SUVs:

/cdn1.vox-cdn.com/uploads/chorus_asset/file/2333008/EDI_mpg_September-2014_small.0.png)

(Michael Sivak and Brandon Schoettle, University of Michigan Transportation Research Institute)

Now, overall fuel economy will still keep rising over time — because the federal government has imposed new fuel-economy standards on cars and light trucks that will keep rising through 2025. But lower gas prices might well convince more people to buy SUVs and trucks instead of smaller cars.One final, major caveat to keep in mind: It's hardly guaranteed that world oil prices will keep falling. Yes, some analysts are now suggesting we've entered a new era of oil "abundance." But the world is highly unpredictable. Perhaps new conflicts will arise in oil-producing regions. Or perhaps the US oil boom will lose a bit of steam. Or perhaps something else unexpected will happen. Predicting the future is always difficult — but it's especially difficult when it comes to oil.

Further reading

How the oil and gas boom is changing America.At Politico, Elana Schor points out that Washington DC has been slow to adapt to the recent oil slide

Another DC-oriented question: Could falling oil prices (and hence falling gasoline prices) affect the 2014 midterms? It's hard to say for sure, but many political analysts have been skeptical in the past that gas prices sway elections much one way or the other

No comments:

Post a Comment