Summary

Oil prices have been caught in a battle of demand loss and supply cuts.

Prices have risen off the April lows but now are facing more challenges to break through to new highs.

We remain very bullish for the years 2021-2022, but short term, there are some challenges.

We dissect out what will project the outcome for our readers.

Prices have risen off the April lows but now are facing more challenges to break through to new highs.

We remain very bullish for the years 2021-2022, but short term, there are some challenges.

We dissect out what will project the outcome for our readers.

This idea was discussed in more depth with members of my private investing community, High Dividend Opportunities. Get started today »

Co-produced with Trapping Value

When we last dissected the fundamentals for oil in a recent article,

we left with the message that there were some serious near-term

headwinds. While the supply picture was improving (or bullish), demand

was still far from having recovered. With a few more weeks of data under

our belt, we took a look to see where the balance is headed into the

second half of the year.

The Price Structure

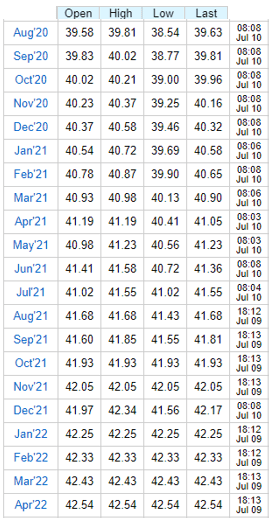

We begin this analysis by looking at Futures quotes on West Texas Intermediate Oil prices.

Source: Futures Trading

The current structure has a gentle slope of Contango. Contango essentially means that prices for months further out are actually higher than the current month. This is a marked improvement from three months back when we had a "Super Contango." Spot prices had briefly gone negative while prices for each successive month were much higher. Below we see the prices for May, June and November delivery that were hit in April.

What

this means is that the extreme price drops in May alongside supply cuts

helped clear the market. Not only has the excess been unwound, the

market does not see an immediate risk to storage overfilling.

U.S. Supply

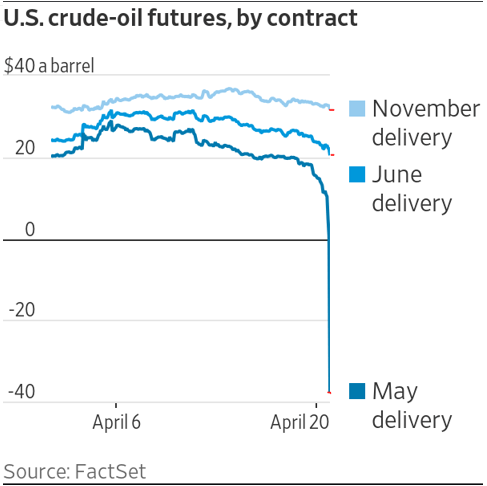

On

the US side of things, oil drilling in shale basins has come to a

standstill and has not responded to the big swing in prices since April.

This is extremely positive and will likely help the pricing further

out. The Energy and Information Administration ('EIA') data shows that

oil production has been declining sharply in the United States since

March, but the declines are bottoming out.

Source: EIA – July 8th

Two Forces at Play Today

At present two forces are playing off each other.

- In the shorter term uneconomical production (that's production with a marginal cost of production below spot price) that was turned off is coming back on. Why did this not happen sooner? After all, prices have been near $40/barrel for some time. The reason is that in many cases barrels have to be "nominated" for pipeline transport up to a month in advance. So there's a little lag in responding to price signals. This part of the production is headed up and should max out in the July or August numbers.

- On the other side of the equation, the lack of drilling and well completions are taking down the base production numbers slowly for the shale region.

As long as prices hold near $40/barrel, we expect US production to resume its decline after August.

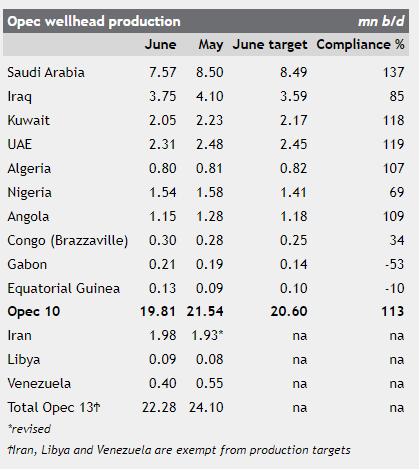

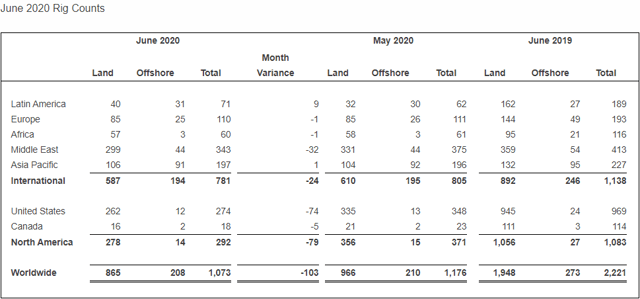

Global Non-OPEC Supply

Global rig counts stand today at half the levels of a year ago. Stand outs include Canada with an almost 90% drop year over year.

Source: Baker Hughes

These

rig cut decisions are made with a multi-month outlook and not prone to

reverse due to a sudden spike in prices. This validates our stance that

the latter part of 2021 and 2022 will see a severe supply crunch.

OPEC Supply

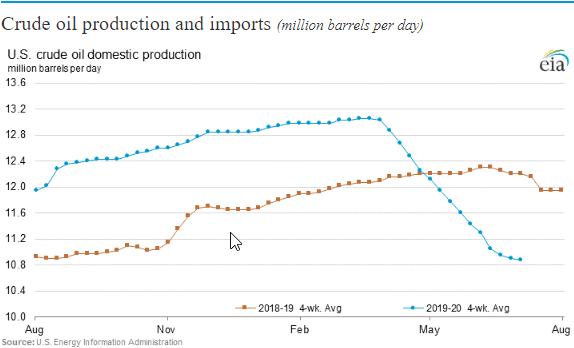

If

OPEC gets nothing else out of COVID-19, they will get this for sure.

COVID-19 was the time when OPEC functioned at peak efficiency. OPEC 10

produced 19.81 million barrels per day in June, the lowest on Argus' record.

The table below depicts oil production per OPEC country and their

compliance cuts in percentage. A compliance of 100% means that this

specific country has fully complied with the requested production cuts.

Source: Argus Media

Three

smaller countries missed their targets by a mile but compliance was at

113% overall (or over-compliance by 13%). Notably Iraq, the worst of the

bunch by a country mile, finally started complying and delivered 85% of

the promised supply cuts. Nigeria was still behind and received several

warnings from other OPEC members that it had to either step up or

possibly face consequences. Under relentless pressure, Nigeria too has committed to meeting its target by mid July.

While

Venezuela was not given a quota, its production free fall is helping

OPEC achieve its objectives. Venezuela began July with zero rigs in the

ground and production of just 300,000 barrels per day.

This is even below internal consumption estimates and down from about

800,000 barrels per day a year ago. From the oil bulls' perspective,

there's a lot of permanent damage to these heavy oil plays and a big

rebound is unlikely even if prices rise significantly.

The Demand Side

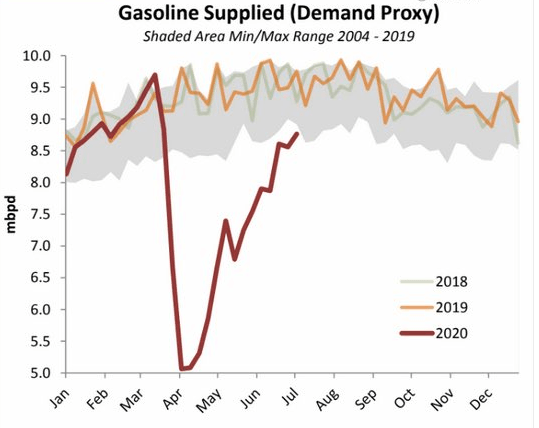

The

demand picture was murky in late March but has decidedly shown its

hand. US gasoline demand for one has been rebounding like a baseline hit

from Novak Djokovic.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

Some

of it is "pent-up" demand catch up. Some of it is shunning public

transportation in the age of COVID-19. Finally, some is replacing flight

demand as many smaller routes have been temporarily suspended. Even

after all of that, considering an economy built on working from home, this is a very, very impressive rebound!

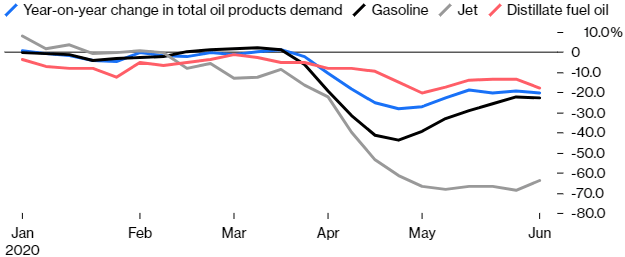

Jet fuel on the other hand has had a very tepid rebound.

Source: Bloomberg

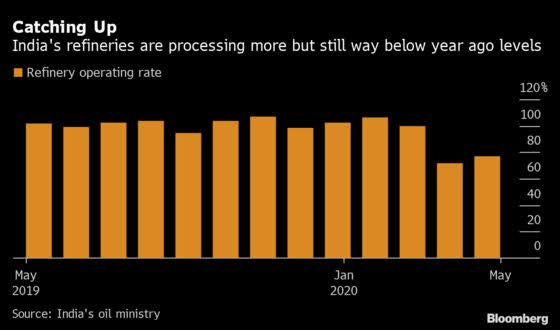

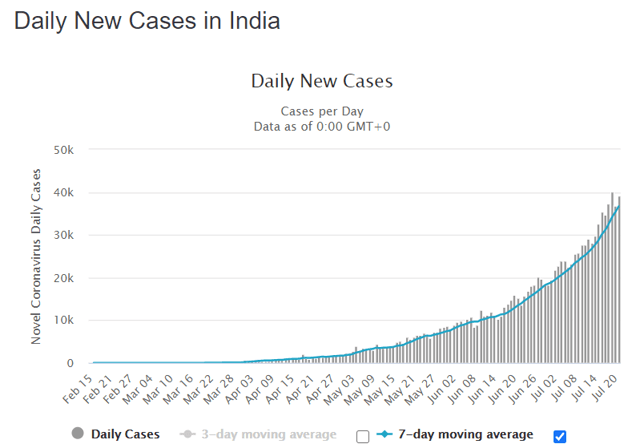

Globally,

the big demand increases in the last few years have come from India and

China. In the case of India we are seeing a very lackluster recovery in

demand.

Source: Bloomberg

This was expected as the seven-day moving average of Coronavirus cases has increased 13-fold since early May.

Source: Worldometer

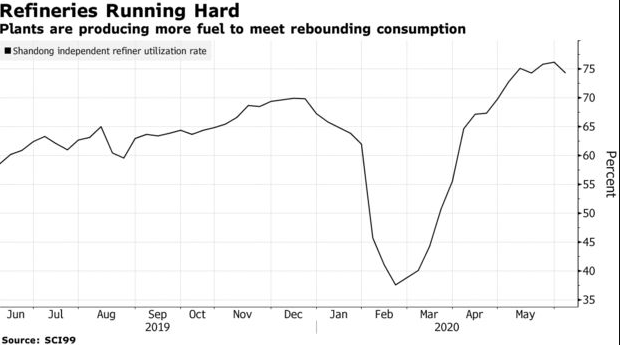

China

on the other hand is demonstrating rather exceptional demand for this

phase of the world economy. Refiners bumped up output and China imported

record amounts of crude oil in the last 30 days.

While

many doubt China's COVID-19 data, the oil import numbers are validated

from external sources as well and suggest that China's rebound is likely

stronger than investors are currently pricing in. Globally there

continues to be ups and downs in the battle with COVID-19 with Australia

just announcing that Melbourne will go into its second lockdown.

Investor Positioning

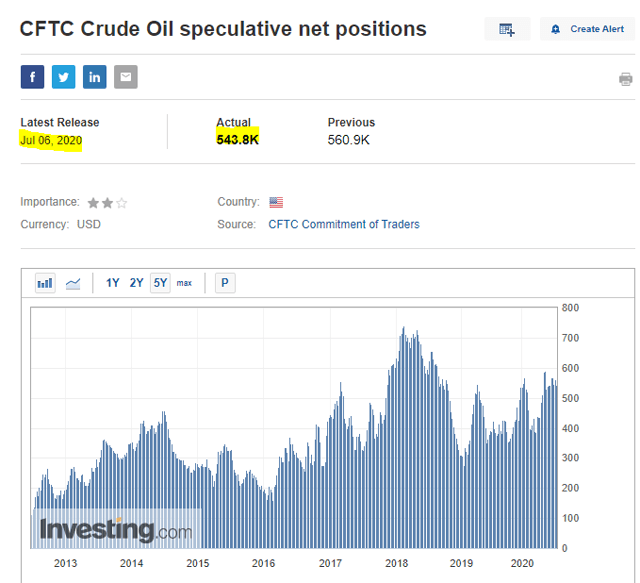

While

the fundamentals are improving, positioning in the futures market has

gradually become more negative. Net speculative long positions are on the higher side historically at over 543,000.

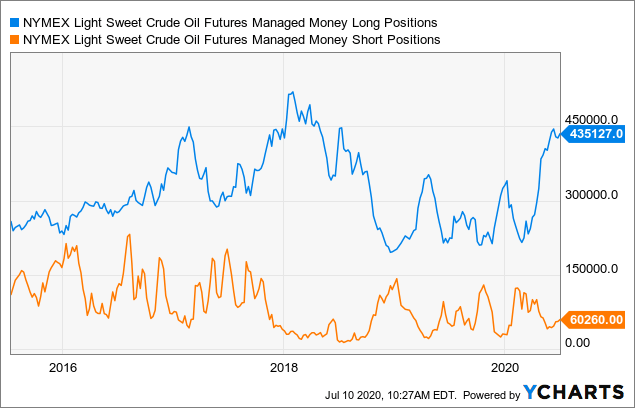

Within

this group we like to focus on "Managed Money" which is the best proxy

for sentiment. Long positions are up sharply since the March bottom

while short positions have declined.

This

shows that sentiment is strongly bullish on oil prices. This

bullishness puts the markets at an increasing risk of a significant

pullback, possibly into the low $30s area, in our opinion.

Conclusion

Factors

that continue to line up positively for oil are falling US supply and

rebounding US gasoline demand. This is buttressed further by exceptional

OPEC compliance and falling rig counts globally. Jet fuel remains the

strongest outlier of the recovery plan and is pushing demand

normalization much further out on the curve. Refiners also are reluctant

to bid up crude as margins have been non-existent even in the peak

driving season. With refiners on the sidelines, speculators have jumped

into the fray. But they will likely be shaken out before we advance

higher. Expect $45/barrel to act as a hard ceiling in the next two to

three months.

The bottom line is that we remain very bullish

on oil price longer term with a price target of +$60 a barrel to be

reached in the years 2021-2022. However, shorter term, we are likely to

see a pullback.

Investors should use any pullback in oil to add positions in our favorite oil stocks Imperial Oil (IMO) and Whitecap Resources (OTCPK:SPGYF).

For instant diversification in the energy space, we recommend the closed end fund: BlackRock Energy & Resources Trust (BGR). BGR provides exposure to some of the biggest names in the industry including Exxon Mobil (XOM), BP (BP), Royal Dutch Shell (RDS.A) (RDS.B), and Chevron (CVX). BGR currently yields 7.8%.

For income investors looking for super high yields, we are very bullish on some preferred stocks of midstream companies. The following preferred stocks offer extraordinarily fat yields:

- The NuStar Energy LP (NS) preferred stocks NS-B (NS.PB) with a yield of +10.9%

- The Crestwood Equity Partners (CEQP) preferred stock with a ticker symbol CEQP- (CEQP.PR) with a yield of 14.2%.

The energy sector is likely to be one of the biggest winners over the next 24 months, despite possible short-term headwinds.

Thanks

for reading! If you liked this article, please scroll up and click

"Follow" next to my name to receive our future updates.

On the other hand she might have found a guy who she is seeing so i feel you should hack the phone because some women are mischievous they keep secret and find a way to move out of this i feel there is someone she is seeing so you can contact WWW.HACKINTECHNOLOGY.COM and see so you can have a concrete reason so its up to you just a piece of advise from a rea life similar problem

ReplyDeleteYou fully match our expectation and the selection of our data.

ReplyDeleteuser experience design services