-

Vale SA’s disaster has hurt seaborne supplies, roiling prices

-

Miners in China may respond by increasing output, Goldman says

The global iron ore market is reeling from the sustained and

expanding impact of Vale SA’s deadly dam breach last month, which has

roiled prices and spurred concerns about a shortage. Since the initial

incident in Brazil in late January, the top producer has announced supply cuts of as much as 70 million tons, although it’s said it will try to offset some lost production.

As

the drama unfolds, investors, users and producers are grappling with a

host of unknowns, starting with how much supply Vale will actually lose

this year and next as executives seek to respond to what’s likely the greatest challenge

the company has faced. There are other critical variables too, which

will help to influence the direction of prices, which sank on Tuesday

for a second day.

Since the disaster, Vale’s force majeure,

benchmark spot prices have spiked to the highest since 2017, then lost

some ground. Most banks and commentators expect further gains, although

opinion is divided on how long the gains will last. Both Citigroup Inc.

and Commonwealth Bank of Australia have flagged the prospects for a

near-term surge to $100 a ton. Fitch Solutions Macro Research pushed up

its full-year forecast $75 from $60.

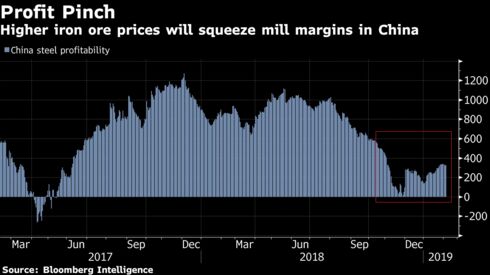

Iron ore’s dramatic rally will raise costs for steelmakers, potentially

crimping their profit margins unless they are able to pass on the

additional burden to customers. That’ll be a critical issue in China,

the world’s largest steelmaker, which accounts for half of global

output. Before Vale delivered its supply shock, margins went close to

breakeven in the fourth quarter, before rebounding a little. Higher

raw-material costs will now add pressure on steelmakers, and may prompt a

further shift back toward cheaper lower-quality ores ores. That’ll

probably aid Australian miners, especially Fortescue Metals Group Ltd.

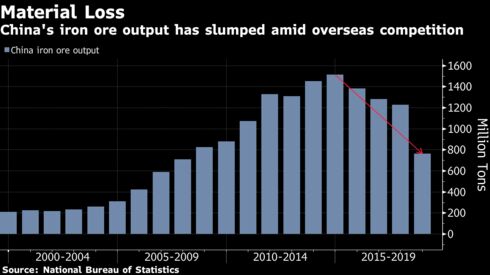

If Vale’s troubles restrain seaborne supplies, can China’s mills get

more ore from home? The mainland has a very substantial ore-mining

industry, but production has been hurt in recent years as the content is

lower-grade and higher-cost than foreign supplies, and Chinese

producers have been the target of a strict environmental clampdown.

After Vale’s woes, Goldman Sachs Group Inc. raised the prospect of a

rebound in output from non-Brazilian sources, including China. Still,

Argonaut Securities Asia Ltd. says local miners will be cautious: “The

thing is, this is not a cyclical increase, with prices seen rising for

one-to-two years.”

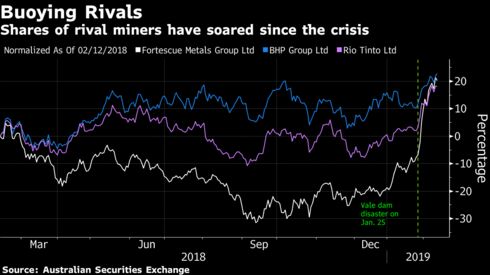

If China’s mills can’t get enough extra material from miners on their

doorstep, what about elsewhere? Since Vale’s tragedy, the shares of

rival miners --- principally in Australia, the top-producing nation --

have soared, including BHP Group, Rio Tinto Group

and Fortescue. While they’ll undoubtedly benefit from the higher-price

environment, there may be a catch when it comes to greater volumes.

Among the major producers, only Rio will be able to substantially

increase supply, according to Goldman.

No comments:

Post a Comment