Crude oil futures inched higher during the Asian early-afternoon trade

Wednesday, as the market continued to digest news of President Trump's

decision to withdraw US from the Iran nuclear deal.

Related feature -- Iran Sanctions: Global Energy Implications

OPEC's comments on remaining committed to its supply cuts despite the US' withdrawal from the deal as well as the larger-than-expected draw in US' weekly crude oil stocks had also lent support to the crude futures.

At 12:00 pm Singapore time (0400 GMT), July ICE Brent crude futures were up $1.84/b (2.46%) from Tuesday's settle to $76.74/b, while the NYMEX June light sweet crude contract was up $1.59/b (2.30%) from Tuesday's settle to $70.65/b.

Related feature -- Iran Sanctions: Global Energy Implications

OPEC's comments on remaining committed to its supply cuts despite the US' withdrawal from the deal as well as the larger-than-expected draw in US' weekly crude oil stocks had also lent support to the crude futures.

At 12:00 pm Singapore time (0400 GMT), July ICE Brent crude futures were up $1.84/b (2.46%) from Tuesday's settle to $76.74/b, while the NYMEX June light sweet crude contract was up $1.59/b (2.30%) from Tuesday's settle to $70.65/b.

The last time ICE Brent hit above $76/b was in November 26, 2014. As for

NYMEX WTI, the last time it was above $70/b was on 27 Nov 2014.

Crude futures had settled lower during Tuesday's trading session, but bounced back to touch fresh highs during mid-morning trade in Asia Wednesday.

"The upward rally this morning is a natural reaction to Trump's announcement," Vanda Insights founder Vandana Hari said.

"The rally may however not last long enough for prices to hit say $80/b[for ICE Brent] as markets may pause to reassess the situation," Hari added.

"Post the initial knee-jerk reaction, markets will actually wait to see the fallout in exports and what stance the importing countries take," Hari said.

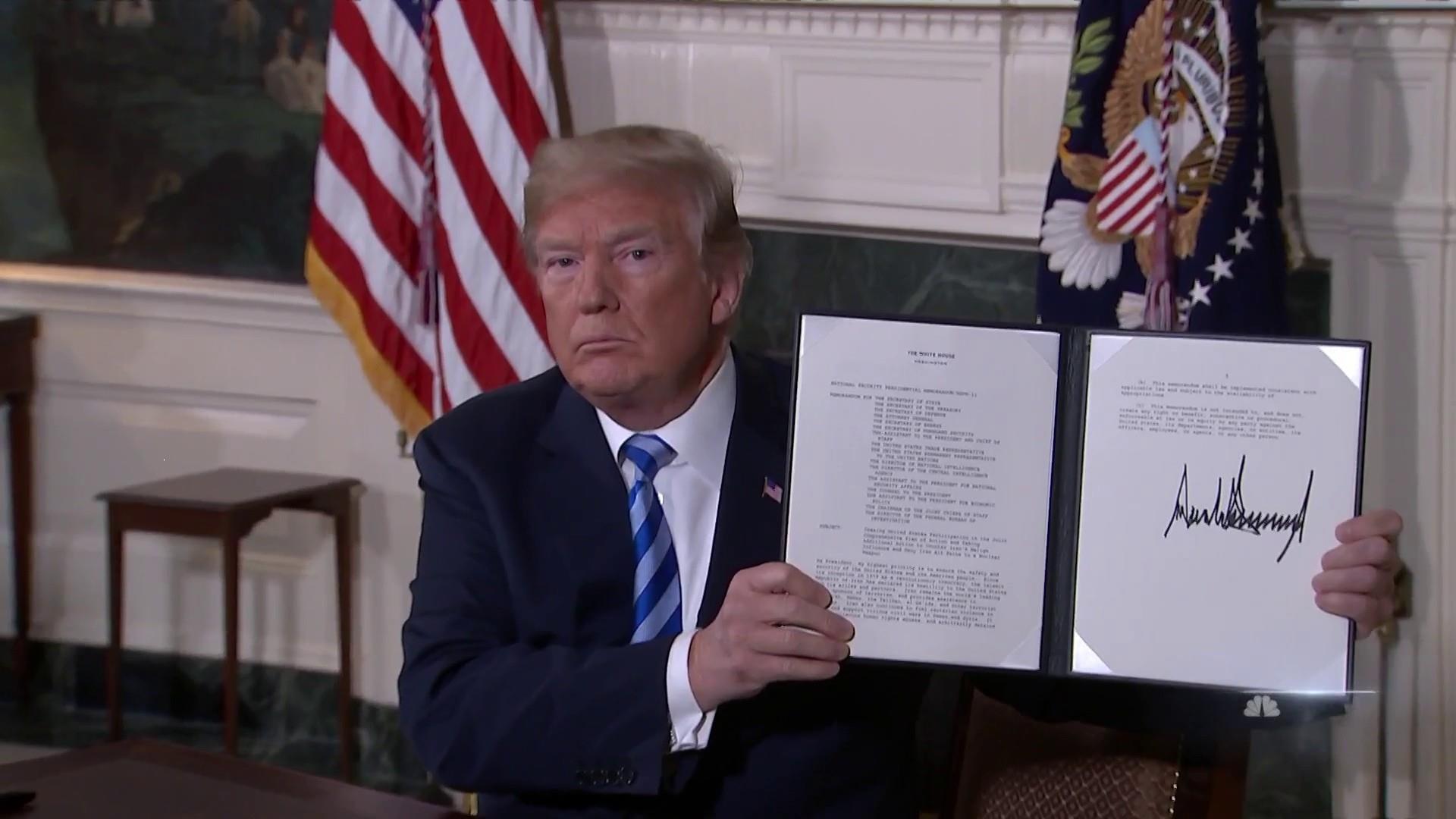

President Donald Trump announced Tuesday on the withdrawal of US from the Iran nuclear deal and that "powerful" economic sanctions "will be put into full effect."

However, he did not give any timing for when or how the US plans to restart the sanctions regime.

Reimposing US sanctions on Iranian oil buyers will likely have an immediate impact of less than 200,000 b/d and block less than 500,000 b/d after six months, most analysts surveyed by S&P Global Platts said. But some analysts expect a substantial supply disruption of up to 1 million b/d.

As it did from 2012-2015 before the nuclear deal, the US will consider allowing countries to continue importing Iranian crude as long as they demonstrate they are significantly reducing those volumes every 180 days, a Treasury Department fact sheet showed.

"Countries seeking such exceptions are advised to reduce their volume of crude oil purchases from Iran during this wind-down period," the notice said.

Market participants were convinced that the Iran sanctions bode well for prices, analysts said. "If the supply squeeze materialize [from the Iran sanctions], oil producing countries can increase production within the permissible limits. Market sentiments are already geared towards this." Phillip Futures' investment analyst Benjamin Lu said.

"Fundamentally, we can already see global inventories falling, if the OPEC report inventories hitting below the 5 year average, prices will get a boost again," Lu added.

"A six-month loss of 250,000b/d of Iran supply could support oil prices by $3.50/b above our summer $82.50/b Brent forecast if other OPEC members do not respond to offset it," a Goldman Sachs' report showed.

UAE Energy Minister Suhail al-Mazrouei on Tuesday indicated OPEC would remain committed to its production cuts, saying that "Working collaboratively with our partners, our joint efforts to re-balance the oil market and bring investment back into our industry are progressing well."

Separately, data from the American Petroleum Institute reported a draw of 1.85 million barrels in crude stocks for the week ending May 4, indicating an uptick in global demand as refineries come out from the maintenance slumber.

Analysts surveyed Monday by S&P Global Platts expected crude stocks to have fallen by 400,000 barrels for the same period.

As of 0400 GMT, the US Dollar Index was 0.04% lower at 93.015.

--Jing Zhi Ng, jz.ng@spglobal.com

--Avantika Ramesh, avantika.ramesh@spglobal.com

--Edited by Norazlina Juma'at, norazlina.jumaat@spglobal.com

Crude futures had settled lower during Tuesday's trading session, but bounced back to touch fresh highs during mid-morning trade in Asia Wednesday.

"The upward rally this morning is a natural reaction to Trump's announcement," Vanda Insights founder Vandana Hari said.

"The rally may however not last long enough for prices to hit say $80/b[for ICE Brent] as markets may pause to reassess the situation," Hari added.

"Post the initial knee-jerk reaction, markets will actually wait to see the fallout in exports and what stance the importing countries take," Hari said.

President Donald Trump announced Tuesday on the withdrawal of US from the Iran nuclear deal and that "powerful" economic sanctions "will be put into full effect."

However, he did not give any timing for when or how the US plans to restart the sanctions regime.

Reimposing US sanctions on Iranian oil buyers will likely have an immediate impact of less than 200,000 b/d and block less than 500,000 b/d after six months, most analysts surveyed by S&P Global Platts said. But some analysts expect a substantial supply disruption of up to 1 million b/d.

As it did from 2012-2015 before the nuclear deal, the US will consider allowing countries to continue importing Iranian crude as long as they demonstrate they are significantly reducing those volumes every 180 days, a Treasury Department fact sheet showed.

"Countries seeking such exceptions are advised to reduce their volume of crude oil purchases from Iran during this wind-down period," the notice said.

Market participants were convinced that the Iran sanctions bode well for prices, analysts said. "If the supply squeeze materialize [from the Iran sanctions], oil producing countries can increase production within the permissible limits. Market sentiments are already geared towards this." Phillip Futures' investment analyst Benjamin Lu said.

"Fundamentally, we can already see global inventories falling, if the OPEC report inventories hitting below the 5 year average, prices will get a boost again," Lu added.

"A six-month loss of 250,000b/d of Iran supply could support oil prices by $3.50/b above our summer $82.50/b Brent forecast if other OPEC members do not respond to offset it," a Goldman Sachs' report showed.

UAE Energy Minister Suhail al-Mazrouei on Tuesday indicated OPEC would remain committed to its production cuts, saying that "Working collaboratively with our partners, our joint efforts to re-balance the oil market and bring investment back into our industry are progressing well."

Separately, data from the American Petroleum Institute reported a draw of 1.85 million barrels in crude stocks for the week ending May 4, indicating an uptick in global demand as refineries come out from the maintenance slumber.

Analysts surveyed Monday by S&P Global Platts expected crude stocks to have fallen by 400,000 barrels for the same period.

As of 0400 GMT, the US Dollar Index was 0.04% lower at 93.015.

--Jing Zhi Ng, jz.ng@spglobal.com

--Avantika Ramesh, avantika.ramesh@spglobal.com

--Edited by Norazlina Juma'at, norazlina.jumaat@spglobal.com

No comments:

Post a Comment