China's import of US crude oil crossed 1 million mt for the first time in June, an eight-fold rise year on year, as elevated Dubai prices prompted both state and independent refiners to use it as an opportunity to diversify supplies, a trend that could add to the headache of OPEC suppliers.

While shipments from the US to China hit 1.09 million mt, or 268,000 barrels/d, in June, imports from Saudi Arabia fell to a six-month low of 940,00 b/d in the same month, a sign that China is more than willing to shed its dependence on OPEC supplies and widen its feedstock sources as much as it can.

"China's imports from the US in H2 is likely to go up because of expectations that the supplying country will lift production, thereby boosting availability," said S&P Global Platts senior analyst Song Yen Ling.

China's imports from the US have multiplied from just about 34,034 b/d a year ago. June 2017 import volumes were also 49.1% higher than May imports of 179,442 b/d, data released by the General Administration of Customs showed.

A closer look at the cumulative import numbers shows that OPEC's share in the world's second-biggest oil consuming market fell to around 55% in H1, from 58% in the same period a year earlier.

Market participants said that OPEC's share is unlikely to rebound in H2, as Saudi Arabia's crude exports are expected to be more or less capped at the current level because of OPEC-led efforts to clear the global oil supply glut.

While shipments from the US to China hit 1.09 million mt, or 268,000 barrels/d, in June, imports from Saudi Arabia fell to a six-month low of 940,00 b/d in the same month, a sign that China is more than willing to shed its dependence on OPEC supplies and widen its feedstock sources as much as it can.

"China's imports from the US in H2 is likely to go up because of expectations that the supplying country will lift production, thereby boosting availability," said S&P Global Platts senior analyst Song Yen Ling.

China's imports from the US have multiplied from just about 34,034 b/d a year ago. June 2017 import volumes were also 49.1% higher than May imports of 179,442 b/d, data released by the General Administration of Customs showed.

A closer look at the cumulative import numbers shows that OPEC's share in the world's second-biggest oil consuming market fell to around 55% in H1, from 58% in the same period a year earlier.

Market participants said that OPEC's share is unlikely to rebound in H2, as Saudi Arabia's crude exports are expected to be more or less capped at the current level because of OPEC-led efforts to clear the global oil supply glut.

A surge in the appetite for US crudes have emerged on the back of significant discounts at which US crudes are offered against global benchmarks.

Crude oil vessels normally take around 53 days to sail from the US Gulf Coast to China.

Prompt WTI has largely been at a discount to prompt Dubai so far in 2017, making US exports attractive to Asian refiners.

In April, the spread averaged at minus $1.08/b, which lifted US exports to China to 323,000 b/d in April, US Census Bureau's data showed.

Those barrels loaded in early April would reach China in late May, while the rest would arrive in June.

Crude oil vessels normally take around 53 days to sail from the US Gulf Coast to China.

Prompt WTI has largely been at a discount to prompt Dubai so far in 2017, making US exports attractive to Asian refiners.

In April, the spread averaged at minus $1.08/b, which lifted US exports to China to 323,000 b/d in April, US Census Bureau's data showed.

Those barrels loaded in early April would reach China in late May, while the rest would arrive in June.

OPPORTUNITY OPENS UP

Agreed OPEC output cuts have largely targeted medium sour grades, driving the price of sour benchmarks like Dubai higher. In addition to light sweet US grades like Eagle Ford and WTI Midland that have been shipped to Asia in 2017, even sour grades like Mars and Southern Green Canyon have also made inroads.

Mars, Thunder Horse and Southern Green Canyon crudes have found favor among Chinese refineries in the southern and eastern coasts under state-owned Sinopec, as well as independent refineries in the eastern Shandong province.

Some other US crude grades are also on their way to China, including 1 million barrels of Bakken shale oil, which was sold on FOB basis in early July, as well as 500,000 barrels of Bryan Mound Sour shipped from the US Strategic Petroleum Reserve. The Bryan Mound Sour, imported by PetroChina's trading arm Chinaoil, arrived in Shandong province in July for independent refineries.

Meanwhile, Unipec, the top importer of US crude, plans to import more US crudes to run at Sinopec refineries, in an effort to blend them with other crudes and aim to optimize feedstock plans, said a source with the company on Tuesday. Unipec is the international trading arm of state-owned Sinopec.

Looking ahead to July, arrivals from the US are expected to take a breather because of relatively lower exports from the US in May for late June and July delivery. The US Census Bureau data showed that US crude exports to China in May reduced by more than half of April's level to 147,000 b/d.

Mars, Thunder Horse and Southern Green Canyon crudes have found favor among Chinese refineries in the southern and eastern coasts under state-owned Sinopec, as well as independent refineries in the eastern Shandong province.

Some other US crude grades are also on their way to China, including 1 million barrels of Bakken shale oil, which was sold on FOB basis in early July, as well as 500,000 barrels of Bryan Mound Sour shipped from the US Strategic Petroleum Reserve. The Bryan Mound Sour, imported by PetroChina's trading arm Chinaoil, arrived in Shandong province in July for independent refineries.

Meanwhile, Unipec, the top importer of US crude, plans to import more US crudes to run at Sinopec refineries, in an effort to blend them with other crudes and aim to optimize feedstock plans, said a source with the company on Tuesday. Unipec is the international trading arm of state-owned Sinopec.

Looking ahead to July, arrivals from the US are expected to take a breather because of relatively lower exports from the US in May for late June and July delivery. The US Census Bureau data showed that US crude exports to China in May reduced by more than half of April's level to 147,000 b/d.

OPEC LOSES MARKET SHARE

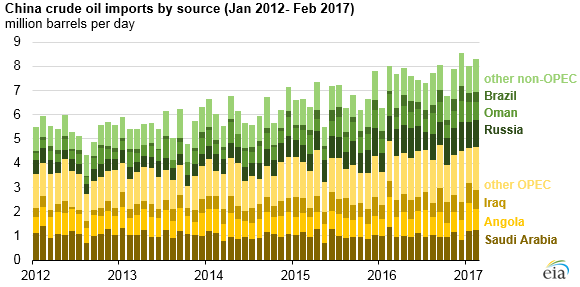

China's overall crude oil imports in June was up 17.9% year on year to 8.82 million b/d, from 7.48 million b/d, while its cumulative imports in the January-June period was up 14.5% year on year to 8.6 million b/d, from 7.51 million b/d.

Crude shipments from Saudi Arabia to China fell to a six-month low of 940,456 b/d in June, a drop of 15.7% year on year, which is also 13.2% lower than May's level. The previous low was recorded in December at 845,284 b/d.

Following the production cut deal, Saudi Arabia climbed down to the third place among China's top suppliers in June, behind Russia and Angola.

Saudi Arabia's energy minister Khalid al-Falih said on Monday that the country's oil exports would be capped at 6.6 million b/d in order to clear the global oil glut.

However, Saudi Arabia's deliveries to China is unlikely to fall further in H2 as some additional Saudi crude cargoes had been finalized following the start of new capacity at PetroChina and CNOOC.

Saudi Aramco has signed a one-year contract to supply one VLCC of Arab Medium crude oil per month to CNOOC's Phase 2 Huizhou refining project, which is scheduled to start in H2 2017. Chinaoil has also booked additional barrels from Saudi for PetroChina's greenfield Yunnan refinery.

In the January-June period, China's crude imports from OPEC countries grew 8.3% year on year to 4.69 million b/d, despite the production cut deal.

The increase was mainly contributed by Angolan crudes, supplies of which jumped 22% year on year to 1.1 million b/d. Angolan crudes were popular among independent refineries. But despite the volume growth, OPEC's share in China's crude imports fell to 54.6% in H1 from 57.7% a year ago.

--Oceana Zhou, oceana.zhou@spglobal.com

--Sambit Mohanty, sambit.mohanty@spglobal.com

--Edited by Arnab Banerjee, arnab.banerjee@spglobal.com

Crude shipments from Saudi Arabia to China fell to a six-month low of 940,456 b/d in June, a drop of 15.7% year on year, which is also 13.2% lower than May's level. The previous low was recorded in December at 845,284 b/d.

Following the production cut deal, Saudi Arabia climbed down to the third place among China's top suppliers in June, behind Russia and Angola.

Saudi Arabia's energy minister Khalid al-Falih said on Monday that the country's oil exports would be capped at 6.6 million b/d in order to clear the global oil glut.

However, Saudi Arabia's deliveries to China is unlikely to fall further in H2 as some additional Saudi crude cargoes had been finalized following the start of new capacity at PetroChina and CNOOC.

Saudi Aramco has signed a one-year contract to supply one VLCC of Arab Medium crude oil per month to CNOOC's Phase 2 Huizhou refining project, which is scheduled to start in H2 2017. Chinaoil has also booked additional barrels from Saudi for PetroChina's greenfield Yunnan refinery.

In the January-June period, China's crude imports from OPEC countries grew 8.3% year on year to 4.69 million b/d, despite the production cut deal.

The increase was mainly contributed by Angolan crudes, supplies of which jumped 22% year on year to 1.1 million b/d. Angolan crudes were popular among independent refineries. But despite the volume growth, OPEC's share in China's crude imports fell to 54.6% in H1 from 57.7% a year ago.

--Oceana Zhou, oceana.zhou@spglobal.com

--Sambit Mohanty, sambit.mohanty@spglobal.com

--Edited by Arnab Banerjee, arnab.banerjee@spglobal.com

free us import data Wow, cool post. I'd like to write like this too - taking time and real hard work to make a great article... but I put things off too much and never seem to get started. Thanks though.

ReplyDelete