Iron ore prices fell sharply on Wednesday amid more expectations for crude steel production curbs in China for the remainder of the year.

“The September delivery (of iron ore) remains wide contango,” analysts with SinoSteel Futures wrote in a report, noting that the price for the deliverable product Super Special Fine has been recently lowered to 723 yuan ($111.88) per tonne.

The September iron ore contract was traded around 880 yuan a tonne in the morning session.

While China has not relaxed steel production curbs as of yet, mills are not supported to increase inventories in the short term and that could affect price gain in a far-month contract, SinoSteel Futures added.

Benchmark iron ore futures on the Dalian Commodity Exchange for January delivery were down 8.1% at 763 yuan ($118.07) per tonne, as of 0255 GMT, the biggest percentage loss since July 30.

Steel prices on the Shanghai Futures Exchange were also undermined by a drop in raw materials and tepid economic data.

Earlier in the week, Baoshan Iron & Steel Co., the listed unit of China’s biggest producer, flagged the potential for renewed price declines in iron ore.

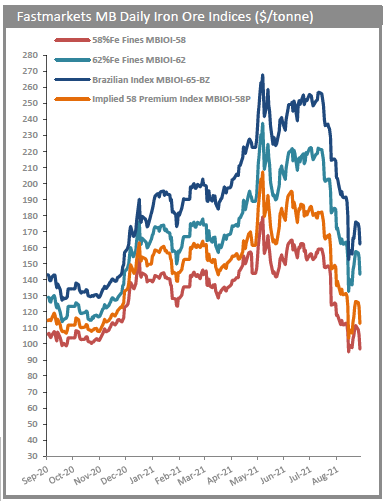

“We expect China’s steel curtailments to be targeted in 4Q when demand slows seasonally and air pollution is in focus (especially ahead of the Winter Olympics in Feb-22) and as a result we expect prices to stabilize in Sept/Oct before continuing to fall back below $100/tonne in 2022,” UBS analysts wrote in a recent note.

China’s factory activity slipped into contraction in August for the first time in nearly 1-1/2 years as covid-19 containment measures, supply bottlenecks and high raw material prices weighed on output in a blow to the economy.

Related read: Global iron ore production to accelerate until 2025 – report

(With files from Reuters and Bloomberg)

No comments:

Post a Comment