National Bank of Serbia. Image courtesy of serzhile, Flickr Commons.

Gold prices climbed higher on Monday as it appears that central banks have regained their appetite for buying bullion after staying on the sidelines for the past year.

[Click here for an interactive chart of gold prices]

Gold has come under pressure this year as higher bond yields made the non-interest bearing haven seem less attractive to investors. After recovering in April and May, the yellow metal fell by the most in more than four years last month as the US Federal Reserve turned more hawkish and the dollar strengthened.

However, gold has recaptured some of its shine lately as central banks from Serbia to Thailand have been adding to their holdings.

“Long term, gold is the most significant guardian and guarantor of protection against inflationary and other forms of financial risks,” said the National Bank of Serbia.

Serbian President Aleksandar Vucic recently announced the central bank intends to boost holdings of the precious metal to 50 tonnes from 36.3 tonnes.

Ghana also recently announced plans for purchases, as the specter of accelerating inflation looms and a recovery in global trade provides the firepower to make purchases.

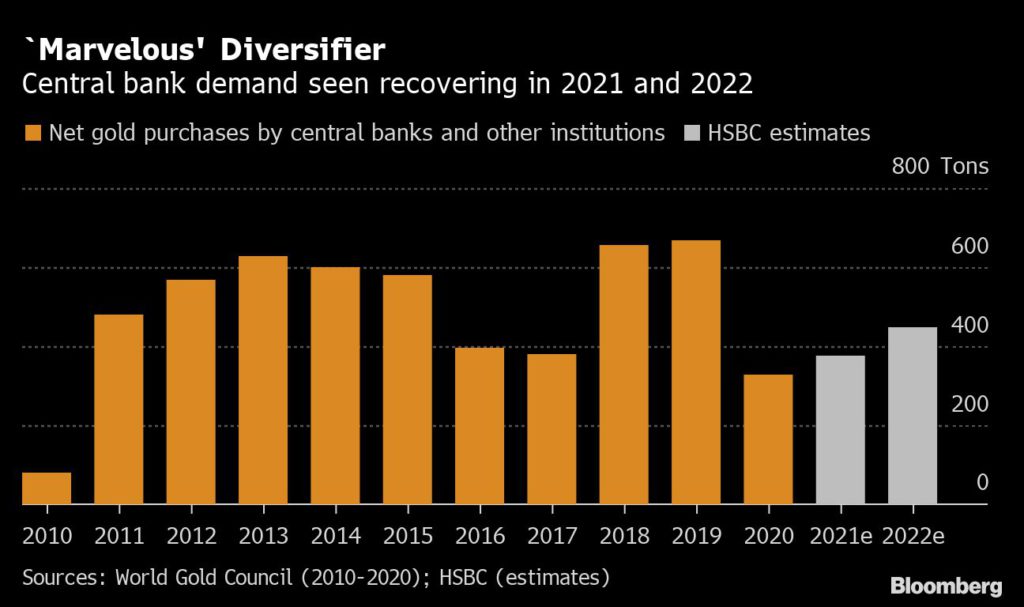

A rebound in central bank buying — which had dropped to the lowest in a decade — has bolstered the prospects for gold prices as some other sources of demand falter.

The recovery in global trade is bolstering the current accounts of emerging market nations, giving their central banks the option of buying more gold. Higher crude prices are also boosting bullion purchases by oil exporters, including Kazakhstan, according to James Steel, chief precious metals analyst at HSBC Holdings Plc.

That’s likely to continue, Steel said in a note to Bloomberg.

“If a central bank is looking at diversifying, gold is a marvelous way of moving out of the dollar without selecting another currency,” he added.

In a bullish scenario, as the global economy rebounds, central bank buying could reach about 1,000 tonnes, Aakash Doshi and other Citigroup Inc. analysts wrote in a report.

The bank’s forecast is for purchases to climb to 500 tonnes in 2021 and 540 tonnes next year. That is below the twin peaks above 600 tonnes in 2018 and 2019, but a significant advance on the 326.3 tonnes purchased last year, according to World Gold Council data.

(With files from Bloomberg)

No comments:

Post a Comment