Gold prices rebounded on Wednesday after the latest US inflation data showed consumer prices rose at a slower pace last month, easing fears that the Federal Reserve may taper its economic support sooner than expected.

Spot gold rose 1.2% to $1,749.62 per ounce by 11:45 EDT, recovering some ground after four straight sessions of declines. US gold futures gained 1.1%, trading at $1,751.30 per ounce in New York.

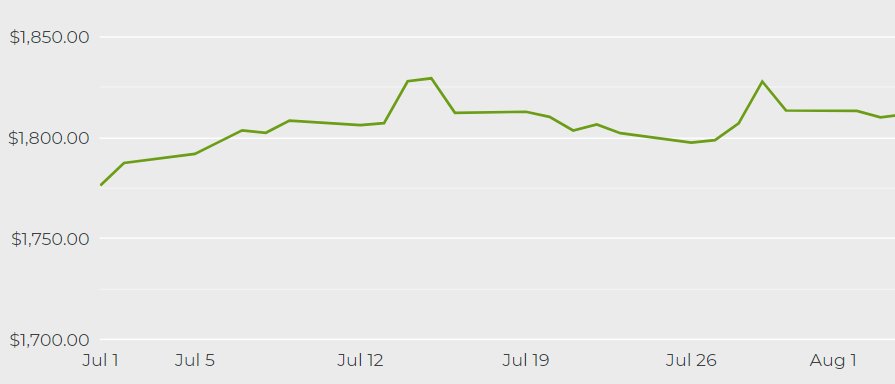

[Click here for an interactive chart of gold prices]

Earlier, the Labor Department stated that the US consumer price index rose 0.5% in July, after a 0.9% rise in June. This was the largest month-to-month drop in 15 months, a tentative sign that inflation may have peaked as supply chain disruptions work their way through the economy.

Additionally, core CPI, which excludes the volatile food and energy components, rose 0.3% last month after increasing 0.9% in June, which was weaker than expected.

Traditionally a hedge against inflation, bullion has been held back by concerns over central bank tapering, keeping it below the key $1,800 mark especially after a strong US employment report last week.

However, Phillip Streible, chief market strategist at Blue Line Futures in Chicago, told Reuters that Wednesday’s inflation data have helped ease those concerns, buoying gold even with inflation pressures waning.

“An inflation number that’s in line leaves the Fed scratching their heads and has them more on a wait-and-see-and-interpret-more-data type of approach,” Streible said. “The gold market is not going back up till $1,835, but I don’t think the bottom is going to fall out yet.”

Providing a further boost to gold, the dollar fell from a more than four-month high, and US Treasury yields too weakened, largely on the back of the new data.

(With files from Reuters)

No comments:

Post a Comment