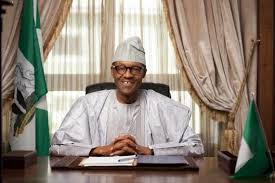

Nigerian President Muhammadu Buhari took power promising to tackle

the "mind-boggling" level of corruption in his country's oil industry. But can he succeed?

Although

oil is said to account for 75% of the Nigerian economy, no-one knows

how much the country actually produces or refines because hundreds of

thousands of barrels of oil are stolen every day, at each level of the

supply chain.

President Buhari has taken personal control of the

oil ministry and split the state-owned NNPC oil company into two

entities in a move aimed at reducing corruption.

Four experts talk to the BBC World Service

Inquiry programme about the challenge he faces.

Kolawole Banwo: Oil theft 'at industrial scale'

Kolawole Banwo is a senior programme officer at Nigeria's Civil Society Legislative Advocacy Centre.

"We do not have an independent metering facility to measure the quantity of oil that is extracted.

"We

are not able to know the figures, [but] as at 2014, Nigeria could have

been losing 300,000 barrels a day; about $12bn (£8bn) annually. That's a

sizeable part of our budget.

"We can hardly afford to pay basic

salaries and fund our budget because oil is being stolen. Considering

we have the highest number of out-of-school children all over the world;

the highest risk of maternal mortality; decaying infrastructure, and

about 60% of our population live in poverty, it's very shocking indeed.

"Some of these pipelines were built in the 60s and 70s, so they are not strong. They are on the surface, they are rusted.

"Breaking through them is not difficult. In the dead

of night in deep creeks where it's difficult to have proper security,

they are able to siphon the crude into smaller boats and ships with

drums and barrels to convey it further into the forest in the coastal

waters where they already have refineries.

"You have smaller

vessels that actually get these things to bigger vessels that can go on

the high seas. That is very sophisticated and can only happen when you

have high-powered individuals who can afford a crew and have the

connection to a buyer.

"You need some form of high-powered conspiracy to do that. We call it oil theft at industrial scale.

"The

very volatile nature of the Niger Delta came from an area of militancy

and effort has still been made to pacify the population and not to exact

too much force. But there are many who may benefit from the outputs and

so give cover to these people because in the end their interest is tied

to it."

Dauda Garuba: People need to benefit from oil revenues

Dauda Garuba is Nigeria officer at the Natural Resource Governance Institute.

"If oil is the cash cow of Nigeria, nothing will be too much a price to get the situation right.

"We need to have a multi-face meter that measures

the quantity of oil at the level of the well head, at the level of the

flow station, and at the level of export terminals.

"People have

an 'I don't care' attitude to what is happening, because if the oil is

taken by the community or by thieves, it doesn't matter to them, because

nothing comes to them in terms of development.

"They don't get

anything for the oil that is taken from their territories. To get oil

theft addressed, one of the things we might consider is getting the

community involved.

"Over the years, the refineries have not been

maintained. And a lot of persons have gotten rich through corruption on

the basis of this."

Idayat Hassan: Corruption in Nigeria is endemic

Idayat Hassan is director of the Centre for Democracy and Development in Abuja.

"Corruption

in the Nigerian context is endemic, because it permeates all stratas of

the society. You can find corruption everywhere you actually dig into

in the daily life activities of Nigerians.

"When building

hospitals and schools it's the norm that contractors in Nigeria get

contracts, and then either don't implement them all, or they do what we

call 'contract splitting', so people split the money and go away, and

the hospital or school doesn't get built at all.

"Who are the

key players in the oil industry? Most of them are also involved in other

parts of the economy. So you find somebody is actually in oil, but is

also in banking, at the same time he's in manufacturing, he is in

various parts of the economy of Nigeria.

"There is also a linkage to politics, because if

they are not in active politics, don't forget that they are the

financiers of the politicians.

"It's a very, very difficult task,

really, for President Buhari. He will also have to take on people that

are part of his political party, really.

"Most of the people

that have been accused of corruption are normally let off. So, for

instance, there are charges filed against somebody for stealing 10

billion Naira (US$100m, £65m) - a mindboggling amount. At the end of the

case, after five years, this accused person is let off the hook because

there is corruption in the judicial sector. One way or another, justice

is not dispensed.

"It will actually be impossible for President Buhari to do this. Saying he will end corruption itself is a mirage.

"It's

a long, long-term initiative. It's collectively Nigerians who will have

to deal with the issue of corruption, or else we may all end up

disappointed together."

Mansur Liman: Buhari could be the man to solve this

Mansur Liman is the head of the BBC Hausa service.

"I

think he's in a very good position to tackle what is happening. People

who remember him as the head of state of Nigeria when he toppled a

civilian government in the 1980s remember him as someone who didn't

tolerate any nonsense.

"It was a dictatorship. He arrested many politicians

that were accused of corruption and locked them up without any trial.

The musician Fela Kuti was arrested for criticising the military

government.

"He introduced something called 'War Against

Indiscipline'. People did not queue in Nigeria; Buhari made it law to

queue because that is the proper thing to do - first come, first served.

"The popular support that he enjoys at this moment was because

of what he did as the military then. If Nigerians are looking for

someone who is ready and willing and has the capacity to fight

corruption, I think the name of Buhari will be top.

"I think

it's the way he conducts himself, the way he insulates himself from all

the corruption that's been taking place in the country. He declared his

own assets recently and you could see he had about 30 million Naira

(US$145,000, £94,000) in his own bank account.

"This is not a lot

of money in the Nigerian context: there are many people who have held

posts that are much lower than he has held and who have much more money.

"When he was elected as the president, there were many rich

people who were trying to get an audience with him - carrying lots of

things to his house. And he turned them back. This is the kind of person

that you're talking about."